An unmistakable shift in the direction of the market

Stock markets in major countries have completed the correction that took place in January and February. The FT100 has reached a new high following the plunge sparked by the financial crisis. And in the United States, the S&P500 is only 1% below its post-crash high. A powerful rally is beginning. Let’s take a look at the facts pointing to this shift in the market’s direction.

First is the big jump in Japanese stock prices last Friday (March 5) that took place without waiting for an important announcement. In the United States, which is the center of attention, the announcement of February employment statistics was a little more than ten hours away. But stock prices in Japan surged as investors were unwilling to wait for this news. Apparently, investors now take for granted a recovery in U.S. employment. The rally shows that investors are no longer looking at only data for a single month.

Media companies have stopped sitting on the fence

Second is a change in the media, which until now has not been able to reach a consensus about the economic outlook. Major media companies that have been consistently pessimistic are no longer able to retain a negative stance. For example, a Financial Times article (March 5, The Short View) stated that snow storms may cause a big increase in U.S. unemployment in February, but this no reason to become pessimistic. The article told readers that there is a steady recovery in the U.S. job market. Such articles have started to appear in the media. The Nikkei Shimbun is also adopting a similar view. For some time, we have seen media reports that interpreted good news as only temporary and superficial. Finally, media companies are forced to discard their bad habit of interpreting data from a pessimistic perspective. Many people still have a significantly negative bias about the economy. However, this is because they have been following the lead of the media. This noteworthy shift in the stance of leading media companies will probably result in a major change in market sentiment.

Anglo-Saxons are showing the way

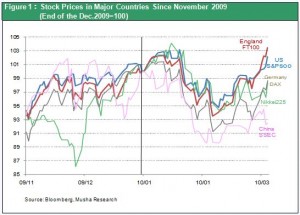

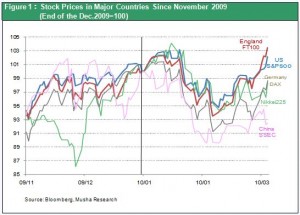

Third, Anglo-Saxons are taking the lead in this rally. Since the beginning of 2010, British and U.S. stock markets have been at the forefront of the rally as markets in Continental Europe, Japan and emerging countries follow. In fact, the recovery in stock prices in China and other emerging countries, which people have been expecting to save the global economy, has fallen far behind (Figure 1).

Anglo-Saxon-style principles of liberalism and free markets have been widely criticized as the source of the financial crisis. If this is true, then what does the U.S.-British leadership of this recovery tell us? It is now readily apparent that the United States, which is firmly committed to market principles, is playing a leading role in the global economic recovery. The United States was able to respond to the financial crisis with great flexibility and speed. In 2009, the U.S. economy contracted by 2.4% while the euro zone was down 3.9% and Japan’s economy shrank by 5.1%. In addition to having the smallest negative growth rate, the United States made much greater progress in eliminating jobs. In 2009, the U.S. unemployment rate skyrocketed by 3.5% while unemployment was up by only 1.9% in the euro zone and 1.1% in Japan. The result was a big improvement in U.S. labor productivity and a drop in labor’s share at companies to a record low (Figures 2 and 3). Unprecedented progress in streamlining U.S. companies took place behind the scenes (no reports of this improvement at all in the media) because this news was overshadowed by rising unemployment. From now on, though, these lean U.S. companies will be the driving force behind a broad-based U.S. economic recovery. This is why Anglo-Saxon stocks are doing so well.

So why do I think that this new direction in stock markets will trigger a powerful rally in Japanese stocks? For the answer, please read my three-part series of perspectives on deflation in Japan (Key Strategy Issues 287, 288 and 289).

Anglo-Saxon-style principles of liberalism and free markets have been widely criticized as the source of the financial crisis. If this is true, then what does the U.S.-British leadership of this recovery tell us? It is now readily apparent that the United States, which is firmly committed to market principles, is playing a leading role in the global economic recovery. The United States was able to respond to the financial crisis with great flexibility and speed. In 2009, the U.S. economy contracted by 2.4% while the euro zone was down 3.9% and Japan’s economy shrank by 5.1%. In addition to having the smallest negative growth rate, the United States made much greater progress in eliminating jobs. In 2009, the U.S. unemployment rate skyrocketed by 3.5% while unemployment was up by only 1.9% in the euro zone and 1.1% in Japan. The result was a big improvement in U.S. labor productivity and a drop in labor’s share at companies to a record low (Figures 2 and 3). Unprecedented progress in streamlining U.S. companies took place behind the scenes (no reports of this improvement at all in the media) because this news was overshadowed by rising unemployment. From now on, though, these lean U.S. companies will be the driving force behind a broad-based U.S. economic recovery. This is why Anglo-Saxon stocks are doing so well.

So why do I think that this new direction in stock markets will trigger a powerful rally in Japanese stocks? For the answer, please read my three-part series of perspectives on deflation in Japan (Key Strategy Issues 287, 288 and 289).

Anglo-Saxon-style principles of liberalism and free markets have been widely criticized as the source of the financial crisis. If this is true, then what does the U.S.-British leadership of this recovery tell us? It is now readily apparent that the United States, which is firmly committed to market principles, is playing a leading role in the global economic recovery. The United States was able to respond to the financial crisis with great flexibility and speed. In 2009, the U.S. economy contracted by 2.4% while the euro zone was down 3.9% and Japan’s economy shrank by 5.1%. In addition to having the smallest negative growth rate, the United States made much greater progress in eliminating jobs. In 2009, the U.S. unemployment rate skyrocketed by 3.5% while unemployment was up by only 1.9% in the euro zone and 1.1% in Japan. The result was a big improvement in U.S. labor productivity and a drop in labor’s share at companies to a record low (Figures 2 and 3). Unprecedented progress in streamlining U.S. companies took place behind the scenes (no reports of this improvement at all in the media) because this news was overshadowed by rising unemployment. From now on, though, these lean U.S. companies will be the driving force behind a broad-based U.S. economic recovery. This is why Anglo-Saxon stocks are doing so well.

So why do I think that this new direction in stock markets will trigger a powerful rally in Japanese stocks? For the answer, please read my three-part series of perspectives on deflation in Japan (Key Strategy Issues 287, 288 and 289).