(This vol. 85 covers figures that are all refenece to vol. 84, text version.)

(1) 2012 was a year of global healing except in Japan, which fell behind in enacting reflationary policies

Figure 1: Equity indices in major countries

Figure 2: Exchange rates of major currencies against Japanese Yen after 2007

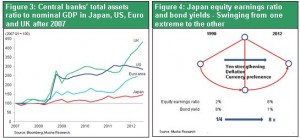

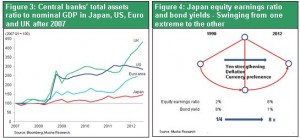

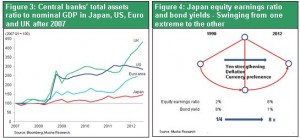

Figure 3: Central banks’ total assets ratio to nominal GDP in Japan, US, Euro and UK after 2007

Figure 4: Japan equity earnings ratio and bond yields - Swinging from one extreme to the other

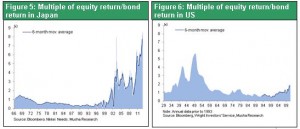

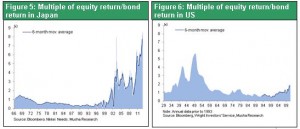

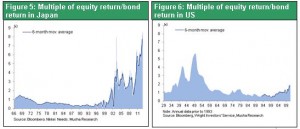

Figure 5: Multiple of equity return/bond return in Japan

Figure 6: Multiple of equity return/bond return in US

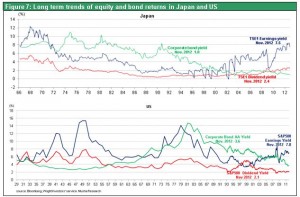

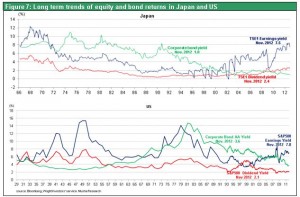

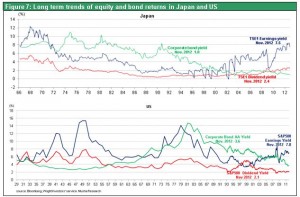

Figure 7: Long term trends of equity and bond returns in Japan and US

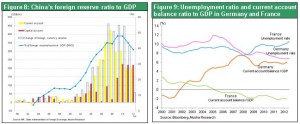

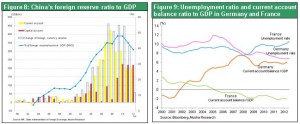

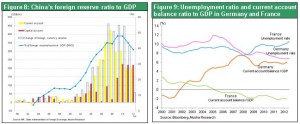

Figure 8: China’s foreign reserve ratio to GDP

Figure 9: Unemployment ratio and current account balance ratio to GDP in Germany and France

(2) 2013 - A year of accelerating risk-taking and the defeat of pessimism

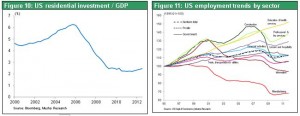

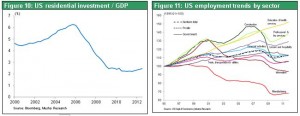

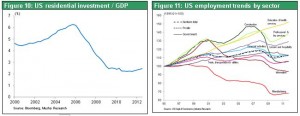

Figure 10: US residential investment ratio to GDP

Figure 11: US employment trends by sector

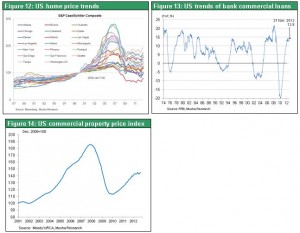

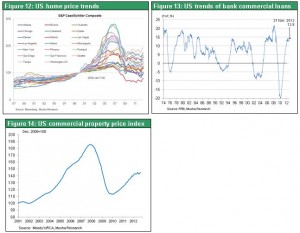

Figure 12: US home price trends - S&P Case/Schiller Composite

Figure 13: US trends of bank commercial loans

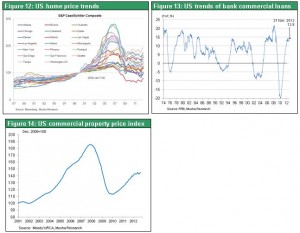

Figure 14: US commercial property price index

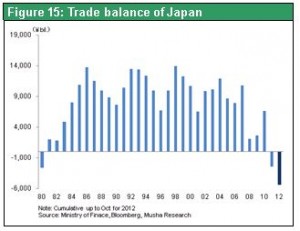

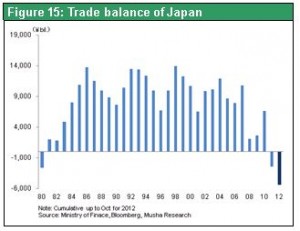

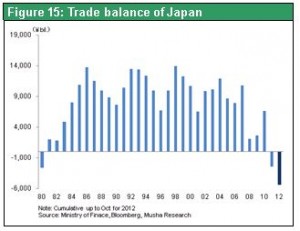

Figure 15: Trade balance of Japan

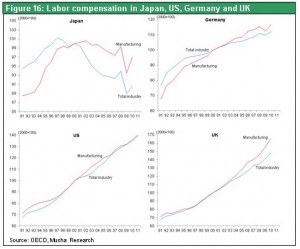

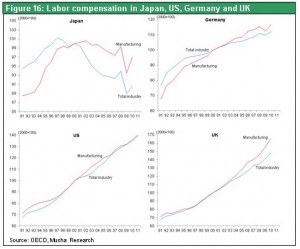

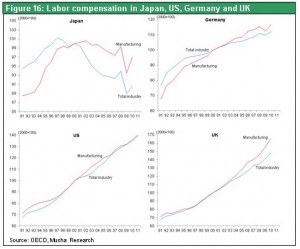

Figure 16: Labor compensation in Japan, US, Germany and UK

(3) A positive surprise in Japan from the government’s policy reversal

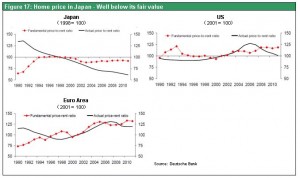

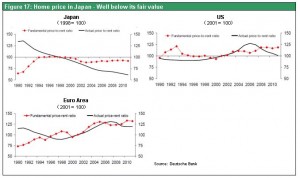

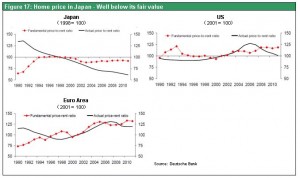

Figure 17: Home price in Japan - Well below its fair value

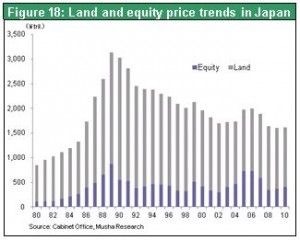

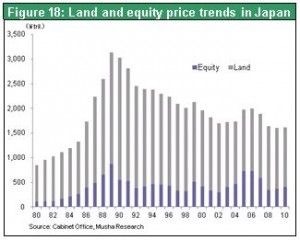

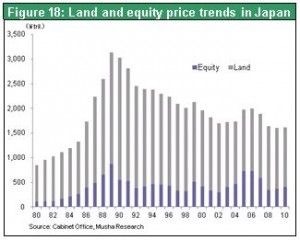

Figure 18: Property and equity price trends in Japan

Conclusions

- A full-scale upturn in Japanese stocks is likely to occur. Reasons include (1) the likelihood that a new administration in Japan will enact policies to stimulate economic growth and end deflation fueled by a strong yen as well as have the Bank of Japan implement more monetary easing; (2) a steady increase in the U.S. dollar’s value along with the rejuvenation of the U.S. economy; and (3) the inability of investors in Japan and overseas to ignore any longer the unprecedented undervaluation of Japanese stocks and favorable supply-demand dynamics. Consequently, the primary scenario is for a change of direction in Japan that will lift the Nikkei Average to JPY15,000-18,000, the yen/dollar exchange rate to JPY100-110 and the long-term interest rate to about 1.5%-2.0% over the next two years.

- The global economy is recovering from the Lehman shock, euro crisis and a downturn that brought the world to the brink of a depression. Progress continues with measures to deal with negative after-effects such as insufficient capital at financial institutions and burgeoning debt. Countries are switching to a focus on policies to spur economic growth and encourage risk-taking. As a result, we will probably see a favorable investment climate in 2013 with (1) steady global economic growth backed by the U.S. economic recovery, (2) aggressive monetary easing measures and ample funds for investments, and (3) downward pressure on inflation from the shale gas revolution and deflation exported from China. In this environment, risk-taking will probably increase worldwide and stock market rallies will gain momentum.

- Risk factors are slowing economic growth in China on a global scale and in Europe another euro crisis sparked by a downturn of the French economy. But the probability of these events occurring in 2013 is small. In Japan, there are fears about the possibility of a new administration failing to adopt a sufficiently aggressive stance for monetary easing. The primary reason for Japan’s strong-yen deflation since 2007 has been the gap between the easy-money policies of the Bank of Japan and overseas central banks. Consequently, we may see a significant correction in the yen’s strength due to a switch in the Bank of Japan’s posture. However, if the new administration in Japan fails to demand adequate easing measures due to pressure from conservative public opinion, this correction may not take place.