Apr 09, 2025

Strategy Bulletin Vol.377

The Great Trump Tariff and the Stock Market Crash with Shigenobu Kawada

~The Trump administration's side of the story is the only way to understand the market~

We had a discussion with Shigenobu Kawada, a legend in U.S. equity investment (April 8).

Q1) Mr. Trump's announcement of a tariff tax hike that far exceeded prior expectations has caused a major upheaval in the market and a global stock market plunge. Public opinion and markets are all pessimistic.

Market panic, but not a total collapse, and there is a good chance of a generous treatment of Japan

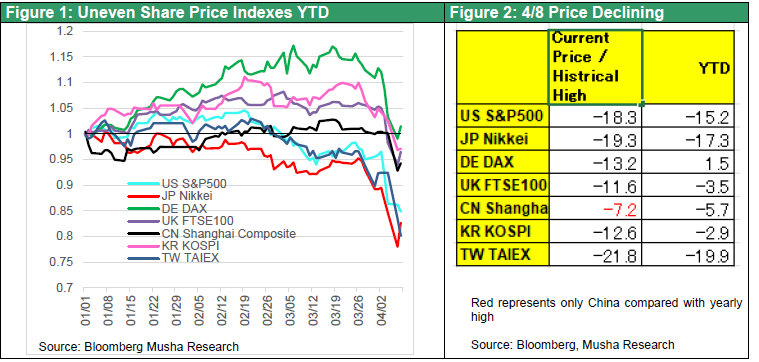

Musha) It is true that the tariff hikes are significantly larger than expected, especially for allied countries, the announcement was abrupt, and the rationale for the tariffs was muddled and unconvincing, turning the entire world public opinion against Japan. The exchange of retaliatory tariffs has begun, and fears of a recession have increased. There also emerged an extreme pessimistic opinion that the U.S. century was over. Even though stock prices have become undervalued, it is hard to see where the bottom is.

This policy uncertainty is what the market dislikes the most, and it is the condition under which speculative selling, mainly of futures, can disturb the market as much as possible. The notoriously high tariffs since the 1930s and the beginning of the tariff-hike race are enough to evoke nightmares of the Great Depression. But a closer look reveals a clue in the plunge. There are also positive factors: German and other European stocks are holding at the levels they were at the beginning of the year, and the bond market is calm, a sign of a recession, and risk premiums are not rising at all. It is not a total collapse.

We are beginning to see the tactics of the Trump administration. While imposing extraordinarily high tariffs on China, it has shown room to negotiate lower tariff rates with allies such as Japan, South Korea, and the EU. The possibility of a takeover of US Steel by Nippon Steel Corporation is also in sight. There is a strong possibility of a generous tariff with Japan, which is the key to building a de-China supply chain.

Figure 1: Stock prices of major countries since the beginning of the year (1/1=100)

Figure2: Major Stock Indices at Beginning of Year, Record Highs

Q2) Mr. Kawada, a legendary investor in U.S. stocks for 40 years, would you give us your opinion on whether the current situation in the U.S. market is optimistic, hopeless, or somewhere in between?

No need for pessimism, a decline of this magnitude? It has happened in the past.

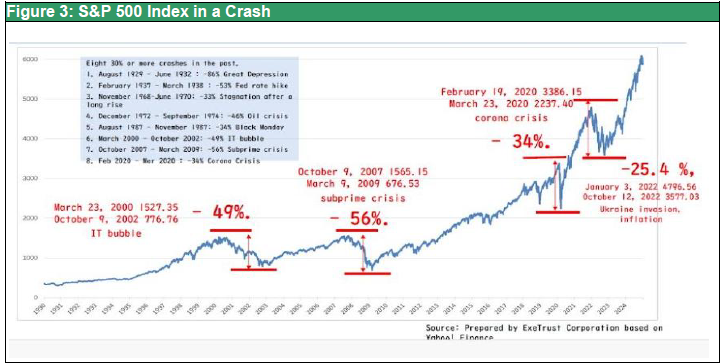

Kawata) Basically, I think we can be optimistic: The S&P 500 index fell 18.3% from its all-time high on February 19 to its most recent high on Tuesday, April 8. The Nasdaq 100 is also down a significant -23.9% during that time. However, even though President Trump's series of economic policies may seem absurd at first glance, there is a good reason for them. Namely, for long-term U.S. prosperity, bold initiatives are needed to correct the U.S. current account deficit and to encourage manufacturers to return to the domestic market. That is why it is particularly important to do “rough treatment” here and now.

This year marks the 21st year since I started asset management while keeping records in 2005. As shown in Figure 3, there have been a number of declines of this magnitude during that time. For example, just four years ago, during the Corona disaster, the S&P 500 index fell 34% in a brief period. Incidentally, I made an unwise trade at that time that I later greatly regretted.

This is how volatile the market can be when the basic market scenario changes or when there are fears of a recession. My perspective has always been asset building through equity investments. And the stock market is always volatile. So, if you want to build assets through long-term investment, I think it is a good idea to be “insensitive” to those turbulent fluctuations.

Figure3: S&P 500 Index in a Crash

Markets are trying to factor in the risk of a recession

The current market is trying to factor in the risk of a recession occurring: since 1950, there have been 56 occasions when stocks have fallen more than 10% from their highs (the most recent being 18.3%). In 49 of these adjustment phases (i.e., declines of more than 10%), stock prices rose 12 months later. Six of the seven times that there was no rebound were in the recessionary phase of the economy.

Is rising fear a sign that a bottom is nearby?

Markets may be even more pessimistic. In the event of a recession, the median stock market decline is 24%, so the market appears to see a 70% chance of a recession. However, it is a good sign that the market is showing signs of panic: The Chicago Board Options Exchange (CBOE) Volatility Index (VIX index), which quantifies the status of options on the S&P 500 index, jumped to over 45 on the 4th. This is more than double the normal level and the largest in the past several months. The put-call ratio (the ratio of open interest in put options to open interest in call options) also reached its highest level in a year. This does not mean that the market is declaring a bottom, as it means that fear is coming out a bit. Still, it is true that the market bottoms when fear rises.

Q3) The key question is still whether this massive tariff hike will lead the U.S. and other world economies into a major recession. What is Musha Research's view on this point?

It will not be a tariff war, which is completely different from the Great Depression

Musha) If it leads to an exchange of tariff hikes and a global economic bloc, it could be a replay of the nightmare of the 1930s. However, I believe that the possibility of this happening is small. First, unlike the 1930s, when there was a global shortage of demand, today we are in an environment of excess demand and inflation; second, the main purpose of the tariffs is not to deprivation of the neighborhood by enclosing its own demand, but the true goal is the confrontation between the US and China (see below); third, the Trump administration will likely make a big difference in the outcome after negotiations between China and its allies (Canada and the EU will also understand the U.S. situation and seek a compromise.) (Canada and the EU will also understand the U.S. situation and seek a compromise.) Each country will compensate for the lack of demand due to reduced exports to the U.S. by promoting domestic demand. Fourth, positive policy factors are expected to emerge over time, including tax cuts in the U.S. to fund the massive tax revenues from tariffs, the effect of increased production in the U.S., and the effect of deregulation in the U.S. The probability of recession by economists has jumped to 60% from 30% before the tariffs were announced, but Musha Research still believes that recession fears are small, as there is still a large room for interest rate cuts.

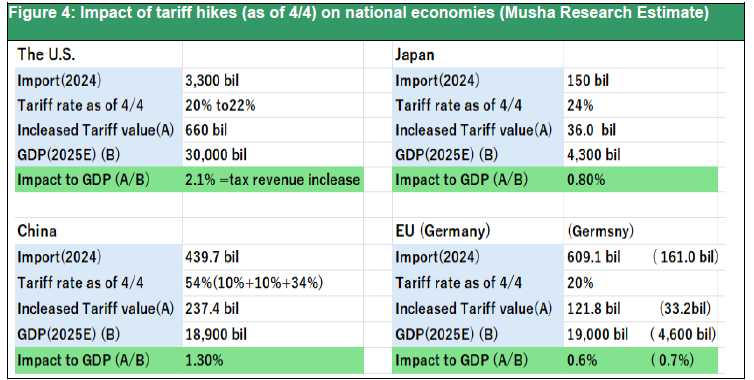

The impact of the tariff hikes (as of April 4) on the economy is shown in figure 4. If all of the tariff increases are passed on to the selling prices of imported goods, U.S. GDP will be reduced by 2.1%. However, if the same amount of increased tax revenue is used to reduce taxes and provide public support, the impact on the economy will be kept to a minimum (the negative impact on GDP is calculated to be 1.3% for China, 0.8% for Japan, 0.6% for the EU, and 0.7% for Germany). Therefore, the U.S. economy is unlikely to fall into recession as long as (1) tariff hikes do not become a battle and (2) a self-fulfilling contraction of demand due to worsening sentiment is avoided.

Figure 4: Impact of tariff hikes (as of 4/4) on national economies (U.S. import tariffs/GDP)

Q4) What do you think of Musha Research's optimistic view? Please point out any discrepancies from the perspective of a market participant.

Midterm elections are important for a great president

Kawata) President Trump is the person who is “number one in the world” anyway. So naturally, he is aware of a great president who will leave his mark on history. Whether or not he will be in office for a third term, in order to be named that great president, he must win the midterm elections next November.

The Trump administration's policies are in line with MAGA (Make America Great Again). Tax cuts and deregulation will probably be put forth later, but before that, foreign policy issues such as mutual tariffs, a ceasefire in the Russian-Ukrainian war, the Hamas-Israeli conflict, and even immigration repatriation are prioritized. In this case, these “reciprocal tariffs” have greatly affected the market. The decision was made that now is the only time to make a big move, even if it is painful, which can be compared to “surgery.” For this reason, even if stock prices fall a little (?), the economy will be set back. The president is willing to put up with the upheaval, including an economic recession, even if stock prices fall.

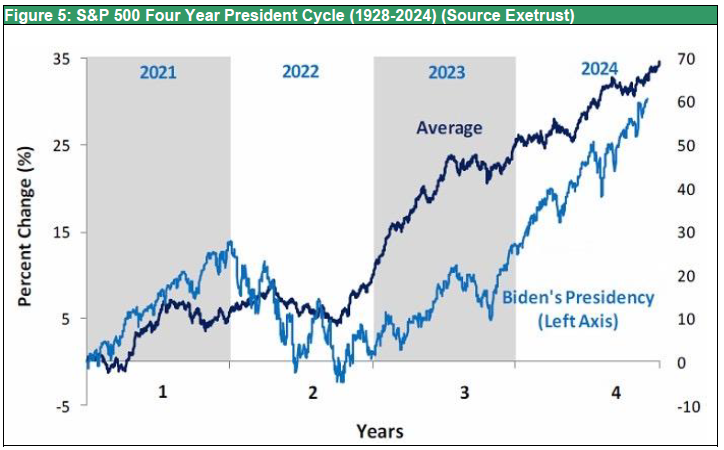

Stock prices in the second year of the presidential term are uncertain

To get through the midterm elections, we will have to be aware of what the presidential cycle suggests: that stock prices will soften in 2026. To do so, they may be aware that this year they dare to build up the upward energy in stock prices. That is, a policy that would make stock valuations undervalued going forward, assuming corporate earnings and interest rate levels next year and the year after. However, if the economy enters a recession and the market remains sluggish, it will be especially difficult to retain investors and public support until the midterm elections next fall. Somewhere along the way, a massive stimulus and stock price action plan will be launched.

We believe in the resilience of U.S. equities

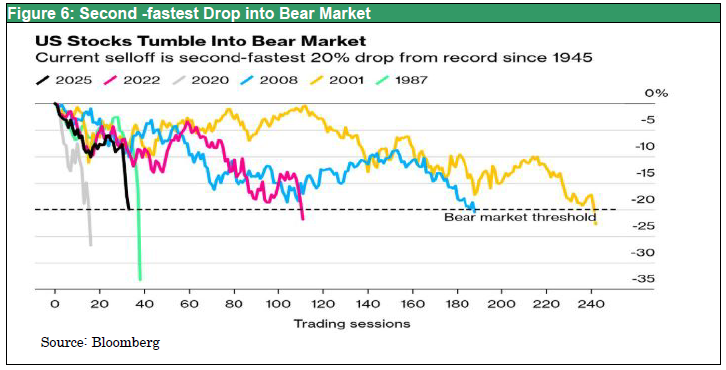

The S&P 500 briefly entered a bear market this time, falling at the second-fastest pace on record, falling 3.5% during the day and 20% from its highest level recorded almost two months ago. That's only 33 business days, making it the second-fastest bear market entry out of 14 bear markets since 1945. However, when I bought after a 20% decline in the past, three years later, without exception, I have emerged into positive territory. In my mind, the belief that “there is no sell-off in U.S. stocks” has been imprinted in my mind by experiencing these types of situations repeatedly. On this basis, U.S. stocks have been rising at 10% per year (including dividends). Therefore, it is more difficult for me to tell people to be bearish on this decline.

Figure 5: Presidential Cycle of the PS500 Index 1928-2024

Figure 6: PS500 Index enters the bear market (20% decline) at second fastest rate on record

Q5) Even so, I do not get the true meaning of the Trump administration's policies at all. Why is this? Do you think support for Trump's policies will increase in the future and will they be successful?

Crisis awareness that the threat of Chinese industrial power cannot be left unchecked

Musha) The most important reason for the incomprehensibility of Trump's policies is probably the lack of shared sense of crisis that the Trump administration feels (that it will lose the battle for U.S.-China hegemony if it continues). Musha Research believes that Trump's sense of crisis is correct. In fact, the gap will narrow as people understand that the U.S. economy is in such a perilous state. In fact, Musha Research believes that Trump is not wrong when he says that China's rise is surprisingly strong and that the U.S. can only win if it is prepared to go to war and even take extrajudicial measures.

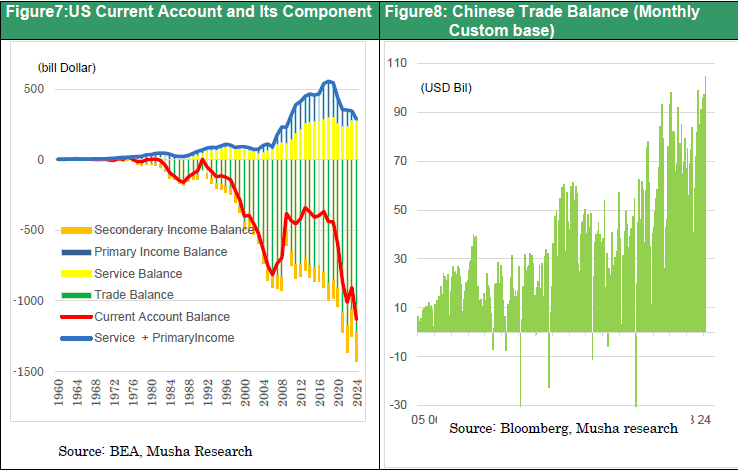

The U.S. current account deficit continues to widen. As seen in Chart 8, the pace of increase is gaining momentum with a 2.5-fold increase from $441.7 billion in 2019, just before the coronal pandemic, to $1.133 trillion in 2024.

In contrast, China's trade surplus has continued to increase in 2024, exports totaled $3,577.2 billion (up 5.9% from the previous year) and imports totaled $2,585 billion (up 1.1%), for a trade surplus of $992.2 billion (up 20.5%). China's trade surplus was $351 billion in 2018, the year the U.S.-China conflict erupted, so it has increased 2.8-fold over the past six years (Figure 9). By partner country, there has been a noticeable increase in exports to ASEAN and emerging economies, as the country has moved away from its former dependence on the U.S. and Europe. ASEAN has become the largest partner for both exports and imports, and it can be assumed that a supply chain is being formed within the emerging economies with China at its core.

China's presence in global manufacturing has increased significantly in the six years following the imposition of sanctions against China in 2018. With 17% of the world's population, China has become the dominant industrial power. China's share of global manufacturing rose to just under 40%, making it three times larger than the United States and five times than Japan. Not only does it have an overwhelming share of the heavy industry, with a 50% share of crude steel production (2024) and a 70% share of shipbuilding orders (2023), but it has also conquered the world with its advanced green energy. It has secured a dominant global share of 60-90% in solar power generation, wind power generation equipment, drones, EVs, and batteries. In addition, Chinese companies has secured rare metal concessions in resource-rich countries for use in batteries and other products and holds a majority share of the global market for most rare metal refineries. In semiconductors, the only area in which it has lagged behind, it is expected to significantly increase its share of production through major investments in existing (legacy) areas that were not subject to export restrictions.

See Strategy Bulletin No. 376 (4/1/2025) for details: https://www.musha.co.jp/short_comment/detail/376.

It can be seen that completely different measures are needed now, and that more intense tariffs and trade restrictions are needed to reduce China's presence.

Figure 7: Growing U.S. Current Account Deficit

Figure 8: China's Trade Surplus Soaring

Q6) As a U.S. watcher with access to many investors and information, do you think that support for Trump's policies will spread, and do you think that Trump's policies will succeed and that Trump's claim that “America's golden age is about to begin” will come true?

The key is whether support for Trump's policies will spread

Kawata) I believe that whether or not his support will spread depends on the success of his economic policies. The public has already become accustomed to his “bias in words and actions” and “erratic remarks. Still, they elected him, thinking that “he is the one” who can break out of the current economic predicament. Therefore, the success of his policies is the most important thing and this is true for any administration.

Can Trump's U.S. “golden age” be realized?

I believe it is very likely. I would like to consider this from the viewpoint of the constitution of the U.S. as a country. First, “respect for hard work. What I have observed in the U.S. over the years is that, after all, they are hard workers. I do not know whether the history of the founding of the U.S. makes them so or not, but anyway, the impression of “hard workers” is very strong in my mind. Next is “creative destruction. There are many leaders in that country who are “creative destructionists” to the core. Whether it is Mr. Trump or Mr. Elon Musk, they may be heretics, but the energy they put into their work (which could be replaced by “mission”) is tremendous.

Thirdly, there is “ownership.” The culture is deeply rooted in the idea that the shares belong to the “owner,” so there is a keen sense of the owner's rights. This is one of the strengths of the U.S., as it clarifies where responsibility lies.

The U.S. remains the dominant power in terms of economic, military, and soft power. (Specifically, the elite class is rational, diligent, and ascetic; they have tolerance and incentive to promote the collective wisdom of people at home and abroad; they have a sense of mission to reform the existing order = they believe in the “progress” of mankind; they know that business is a “battlefield” and are willing to bring spoils from all over the world; they make unceasing efforts to communicate with others; and they have a sense of values that they believe to be “universal”. (e.g., a sense of mission to reform the existing order = belief in the “progress” of humankind; a sense of mission to reform the existing order = belief in the “progress” of humankind; a sense of business as a “battlefield” = loot from around the world; unrelenting efforts to communicate with others; a keen interest in promoting values that he believes are “universal”)

Even in the past, when we have seen steep declines, media information alone can make us feel hopeless. Such a phase has happened many times in the past. However, without exception, these were investment opportunities.

Q7) Even so, I cannot help but be disappointed in the Japanese stock market and the Japanese government's response. Why are Japanese stocks falling so sharply? Also, it is surprising that tariff rates in Japan, which is supposed to be the closest to the U.S., are not taken into account at all.

Japanese stocks at the mercy of political mismanagement and foreign speculators

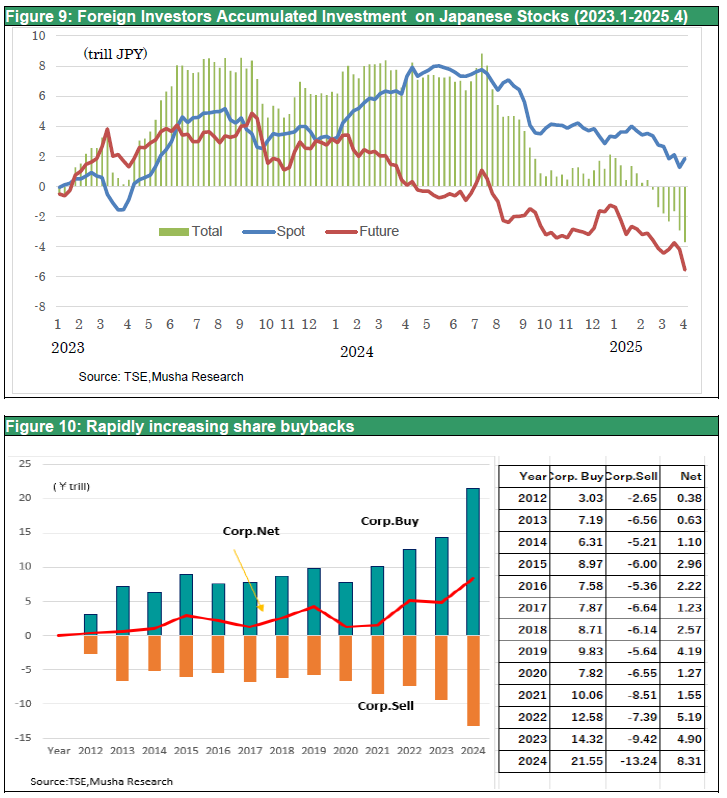

Musha) The reality of the Japanese market being dominated by hedge fund speculators was truly demonstrated. Foreign selling of Japanese stocks is intense, and disappointment with Japan's policies since last year has made Japanese stocks even more vulnerable. Chart 10 shows the cumulative trading trends of foreign investors, who account for 70% of the TSE's trading share, and shows that almost all the decline during this period was due to sales by foreign investors. This is the reason for the sharp weakness in Japanese equities shown in Chart 2. On the other hand, as shown in Chart 11, the rapid increase in share buybacks has outpaced the selling by foreigners. This will bring about a favorable supply-demand balance for Japanese equities in the second half of the year due to the undervaluation and overselling of Japanese equities. The Trump administration's respect for Japan, the most important and dependable country for containment against China, is great. The generous treatment of Japan will eventually become clear. In the unlikely event of a change of administration and a policy shift toward fundamental reflationary measures, Japanese stocks will soar toward the 50,000-yen mark.

Figure 9: Accumulated Investment by Foreign Investors (Futures + Cash) from Jan. 2023 to Mar. 2025

Figure 10: Rapidly Increasing Share Buybacks (trillions of yen)

Q8) How do you evaluate Japanese stocks from a global perspective, including the U.S.?

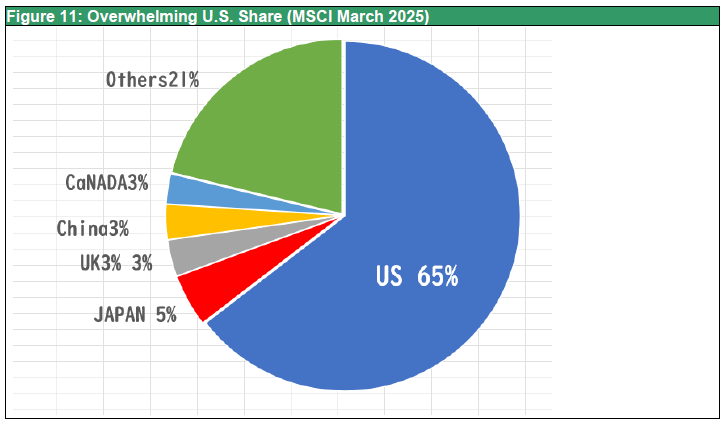

Kawata) The U.S. accounts for 65% of the world's stock market capitalization, while Japan accounts for 5%. I believe that Japan is making effective use of the stock market as a mechanism for the “creation, proliferation, and distribution” of wealth. Therefore, I always regret that Japan could be an even more attractive investment target with just a little ingenuity.

Figure 11: Overwhelming U.S. Share (MSCI March 2025)

Thank you very much.