Jan 20, 2025

Strategy Bulletin Vol.372

Japanese Stock Outlook for 2025

~M&A Boom and Share Buybacks to Take Center Stage

More Promising despite growing hesitant

The Nikkei Stock Average soared 27% in the first half of 2024 but then plunged 20% in three days due to the Ueda shock in August. Since then, the market has continued to dull in a range between 38,000 yen and 40,000 yen, and the temporarily heightened expectations of a long-term rally have been peeled off. However, the outlook is rather bright because people are cautious.

In the U.S., expectations are rising for Trump's second term as U.S. president, who prioritizes economic growth and a strong preference for high stock prices. 2017 tax cuts will continue and corporate tax cuts, as well as increased energy production and deregulation, will make it easier for companies to make more money. While some are wary that the economy will not slow down and interest rates will remain high, the strong fundamentals will rather lead to a further rise in U.S. stock prices.

A virtuous cycle in the Japanese economy is in sight

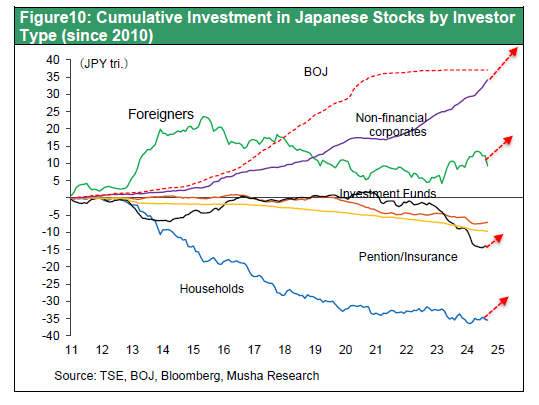

Of particular interest in 2025 will be Japanese equities. The Nikkei 225 is expected to rise 25% to ¥50,000, and the yen has weakened to around ¥150 per dollar, indicating that deflation could completely break out of its grip. The potential growth rate of Japan, which has been in a long-term slump, is likely to turn up from now on. The construction industry is booming for the first time in many years due to capital investment and a boom in condominiums and hotels. A surge in foreign tourists is enriching local economies in every corner of the country. Companies that have given up on China are returning to Japan, and investment in Japan by foreign companies will be in full swing following the construction of advanced semiconductor plants at TSMC Kumamoto and Lapidus Chitose.

Figure 1: Stocks of Major Countries (after 2023.1)

Figure 2: Major Country Stocks (2009 - Jan. 2025)

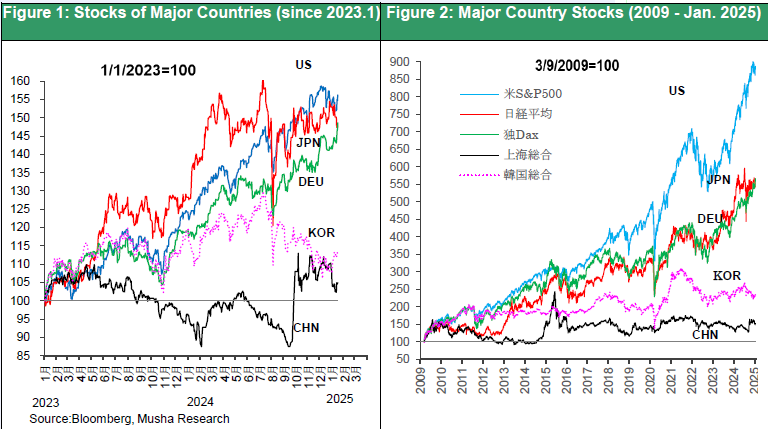

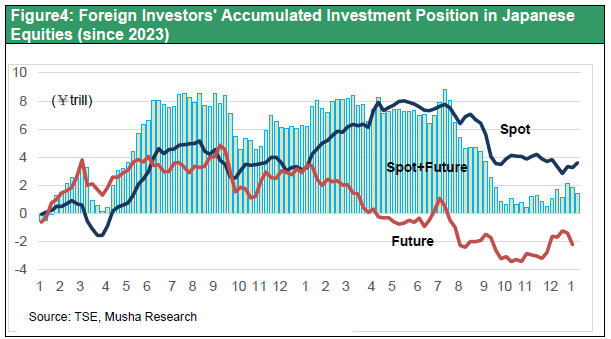

Arrival of the leading actor: Share Buybacks by Corporations

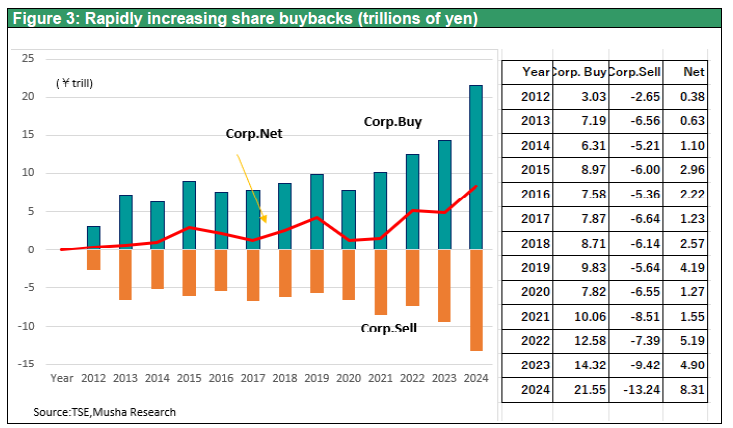

This favorable environment has triggered a major boom in corporate share buybacks. According to TSE data, corporate stock purchases (the majority of which were share buybacks) surged from 12.6 trillion yen in 2022 to 14.3 trillion yen in 2023 and 21.6 trillion yen in 2024, and are expected to approach 30 trillion yen by 2025. During this period, cross-shareholding dissolution sales and corporate equity issuance at market value have increased, diluting the impact of share buybacks, but corporate share sales are expected to decline and net corporate purchases will accelerate. We believe that share buybacks on this scale will fundamentally improve the supply-demand balance for Japanese equities. Incidentally, foreign net buying that led the Japanese stock boom since 2023 totaled 8 trillion yen in futures and cash, but foreigners sold 7 trillion yen during last fall's wild swings. Despite this foreign selling, Japanese stocks were able to maintain their elevated levels because of continued strong corporate buybacks.

Figure 3: Rapidly increasing share buybacks (trillions of yen)

Figure 4: Foreign investors' cumulative position in Japanese equities (2 years of investment almost sold off)

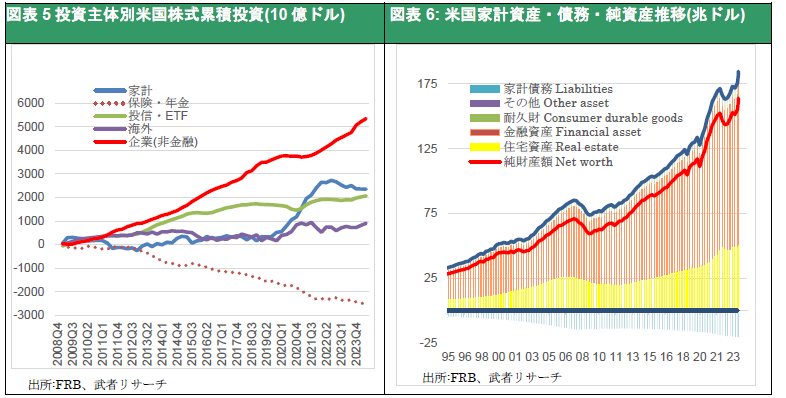

Share buybacks are the main driver of the U.S. stock market rally

In fact, buybacks have been the main driver behind the U.S. economic growth and the U.S. stock market rally. U.S. stocks have surged eightfold (15% annualized) in the 15 years since the bottom after the GFC, boosting household net worth by $105 trillion (3.6 times GDP) from $59 trillion to $164 trillion and driving robust consumption in the United States. Who drove up stock prices? During this period, corporations purchased a total of $5.4 trillion worth of stocks, absorbing the massive sales of pension funds and insurance companies.

Figure 5: Cumulative Investment in U.S. Stocks by Investor Type ($ billions)

Figure 6: Trends in U.S. Household Assets, Debt, and Net Worth (trillion dollars)

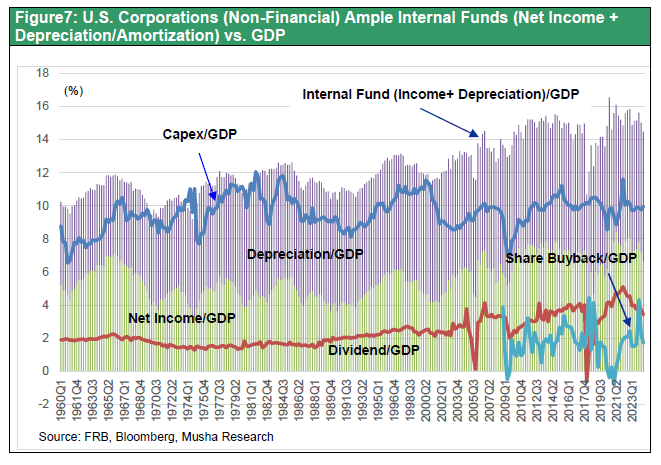

“Equity capitalism,” in which corporate surpluses are returned to shareholders through stock market

In this era of historical technological development, such as the AI revolution, corporate profits have increased, and excess saving have accumulated in the corporate sector. Share buybacks have played a key role in returning these corporate profits to the economic system. This flow of funds has created an ecosystem that attracts massive amounts of investment funds to venture businesses through the stock market and has been the driving force behind the world dominance of high-tech of the United States. The U.S. is now amid an era of “equity capitalism,” in which the stock market oversees allocating resources through the return of profits to people. And the incoming Trump administration, unlike Biden Harris's Democratic Party line, intends to strengthen “equity capitalism” as a policy platform.

Figure 7: U.S. (non-financial) corporations' growing internal capital (net income + amortization) and payouts (% of GDP)

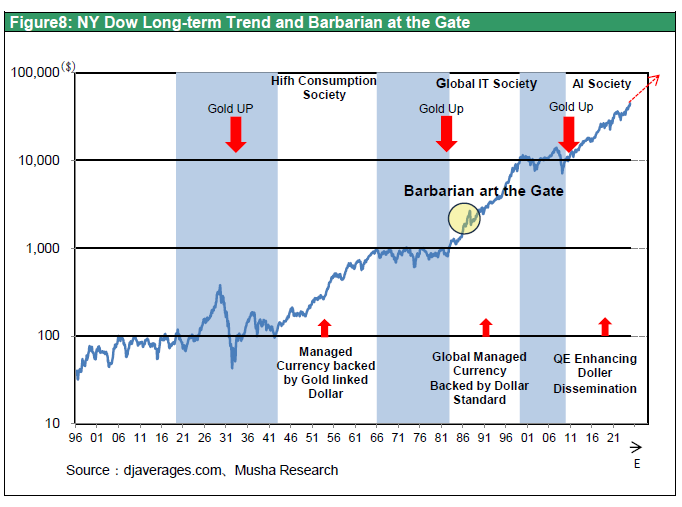

When and why did such “equity capitalism” take place? It is the U.S. takeover boom in ‘80s through ‘90s. symbolized by KKR's 1988 purchase of RJR Nabisco that has been turned into a novel and a movie called “barbarian at the gate”. To avoid becoming takeover targets, companies returned excess cash to shareholders through share buybacks and dividends to boost share prices and improve capital efficiency.

Thus, the foundation for the current prosperity was prepared.

Figure 8: NY Dow Jones Industrial Average and Barbarian at the Gate

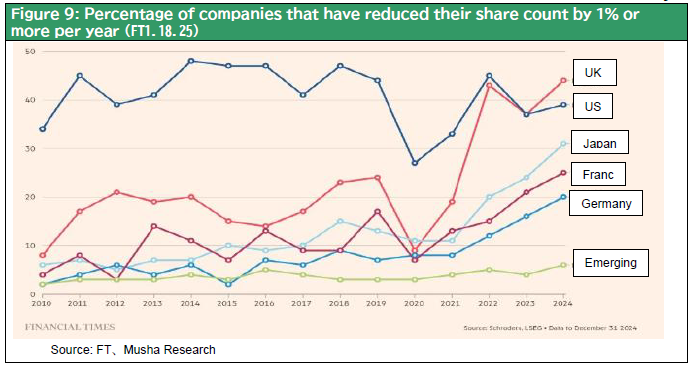

A boom in Acquisitions and Share Buybacks began to take place in Japan

A similar trend is occurring in Japan today. From the TSE and FSA demanding that companies with P/B ratios below 1x be corrected to the appearance of KKR founder Henry Kravis (who was considered a barbarian even in the U.S.) in the Nikkei's “My Biography” for 30 days Japanese policy and corporate society have undergone a surprising attitude shift toward M&A acceptance. The proposed acquisition of Seven & I Holdings by the Canadian firm Alimentation Couche-Tard (ACT) was a major rebuke to the Japanese listed corporation, which had neglected capital efficiency and allowed low stock prices to persist. The Nissan-Honda business integration was also foreshadowed by Taiwanese manufacturer Hon Hai's intention to acquire Nissan. Nidec Corporation announced a TOB for Makino Milling Machine, a long-established machine tool manufacturer, and Nidec's founder, Mr. Nagamori, stated in his press interview that “we cannot take time in the face of the Chinese threat.

Even Toyota, Japan's largest company with a market capitalization of 44 trillion yen, could be a takeover target. Tesla, which is one-sixth of Toyota in terms of unit sales, but with a market capitalization of $1.38 trillion (¥210 trillion), 4.7 times larger than Toyota, could be able to challenge acquiring Toyota. Late last month, Toyota surprised the market by announcing that it would raise its return on equity (ROE) from the current 11% to 20%, but it can no longer rest on its laurels with a huge amount of cash. The Nikkei reported that Toyota “raised its share buyback limit to 1.2 trillion yen in September 2024 through April 2013, up 20% from the previous one. The total dividend for the previous fiscal year exceeded 1 trillion yen, and the total return ratio, including dividends and share buybacks, may well exceed more than 50% of profit in the current fiscal year,”.

Thus, Japan is rapidly shifting to the “equity capitalism” similar to the U.S., and a major share buyback boom is beginning to take place. Figure 9 shows the percentage of companies (MSCI included companies) that have reduced their share count by 1% or more per year by the FT. Although the increase in the number of Japanese companies over the past three years is remarkable, the most noticeable change is probably yet to come.

Figure 9: Percentage of companies that have reduced their share count by 1% or more per year (FT1.18.25)

Japanese stocks are significantly undervalued relative to government bonds, yielding 6% and 1%, respectively, but this undervaluation will be corrected by the purchase of all type of investors. First corporate share buybacks and dividend increases will trigger a stock market rally that should increase the willingness to purchase. Households have begun to increase their asset management through NISA, foreigners who have sold off their Japanese stock will again need to purchase, and public pension funds that are required by the government to actively manage their assets in the same manner as the GPIF will be forced to buy Japanese equity.

The concern is that the Bank of Japan's accelerated interest rate hikes and the Ministry of Finance's tax hikes may become more apparent, and as with the Kishida shock in 2022 and the Ueda shock in 2024, a hasty tightening of policy may well limit the upward movement of stock prices.

Figure 10: Cumulative Investment in Japanese Stocks by Investor Type (since 2010)