Nov 18, 2010

Strategy Bulletin Vol.35

Four reasons that the U.S. will not see Japanese-style deflation

Determining whether or not the U.S. will become mired in deflation is the decisive factor for investment decisions. The conviction that deflation will be avoided would prompt investors to abandon the “cash-is-king” mentality and start taking on risk. We believe that circumstances in Japan and the U.S. are completely different due to the following four facts. Now is the time for investors to give up on the “cash-is-king” mindset. These same facts explain why we should expect the yen to start weakening.

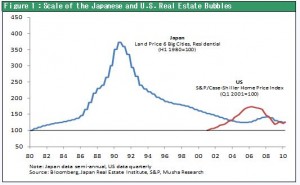

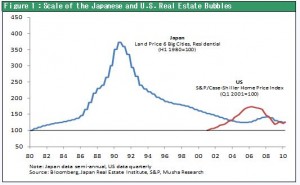

(1) A decisive gap in the scale of the bubble ⇒ Like the difference between Mt. Fuji and a small hill

Japan’s real estate bubble caused a four fold increase in prices over 10 years. After the bubble burst, prices required 15 years to hit bottom. But the U.S. housing bubble pushed up prices 70% over a five-year period. Housing prices then hit bottom only three years later. Furthermore, Japan’s real estate bubble was accompanied by a stock market bubble in which stock prices surged fivefold. Clearly, there is an enormous difference in the scale of the bubbles in Japan and the U.S. The gap is almost like the difference between Mt. Fuji and a small hill. Moreover, this massive gap is also an indication of the magnitude of the difference between potential non-performing loans at Japanese and U.S. banks.

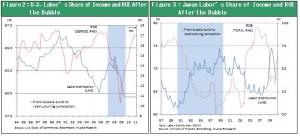

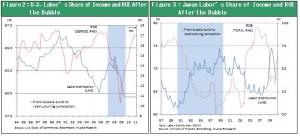

(2) Corporate restructuring and the speed of the rebound in earnings ⇒ The decisive difference in the appeal of U.S. and Japanese stocks

U.S. companies finished restructuring initiatives only two years after the bubble burst. Restructuring caused labor’s share of income to plunge while listing corporate earnings to almost a record-high level. But in Japan, companies needed more than10 years to restructure their operations following the end of the bubble.

(3) Stance of central banks ⇒ The Fed backs up asset prices

The Bank of Japan decided on its own that quashing the bubble should be the objective of its policies. As a result, high real interest rates caused deflation to take hold as the bank’s monetary easing measures lagged behind deflation. In the United States, though, real interest rates remained negative because monetary easing was enacted ahead of deflation. In addition, the Fed has announced QE2 as a measure to push asset prices higher. QE2 will end up raising the stock prices of companies since companies have already completed restructuring programs.(4) Contribution of asset income to households ⇒ Rising stock prices are supporting household income and consumption

Asset income such as interest, dividends and rental income accounts for a significant share of U.S. household income. In the third quarter of 2010, wages (pure wages excluding fringe benefits) totaled $6.2 trillion while asset income (interest, dividends and rent) was $2.2 trillion. The large volume of asset income means that the U.S. has an effective channel for translating growth in corporate earnings into higher consumer spending. This is because rising stock prices and dividends backed by recovering corporate earnings contribute to growth in household income. In Japan, asset income is an extremely low 4% of household income. Consequently, unlike in the U.S., there is no effective channel for corporate earnings to fuel growth in consumer spending.