Feb 05, 2024

Strategy Bulletin Vol.349

FOMO on Japanese Stocks Causes Economic Virtuous Circle

People Fear the Risk of Not Owning Japanese Stocks

There is a Wall Street expression "FOMO," which stands for "Fear of Missing Out," meaning the fear of being left behind. The Japanese stock market is now entering just such a state. People have finally realized how ridiculously undervalued Japanese stocks are and are seriously considering the risk of not owning Japanese stocks: 1) Foreign investors are rushing to increase their weight of Japanese stocks (see Figure 1), which rose the most among the world's major markets last year; 2) Individual investors are experiencing an investment boom due to the start of NISA reform; 3) Corporations are buying back their own shares under pressure from the Financial Services Agency and the TSE, which are demanding that P/B ratios of less than 1x be corrected, and 4) Pension funds and other institutional investors are forced to reduce their investment ratios in JGBs and shift to stocks in the face of entrenchment of inflation and rising interest rates. The surge in stock prices since the beginning of the year has been a result of the rapid rise in the stock market. The sharp rise in stock prices since the beginning of the year is an indication that the equity-driven fund management system has begun in Japan as well.

Figure 1: Stock Price Indices of Major Countries (since the beginning of 2023, since 3.9.2009)

Results Show the Overwhelming Superiority of Stock Investments

Since 2013, when Abenomics started, the Nikkei Stock Average has quadrupled from 9,000 yen to 36,000 yen. In addition, in terms of income flow, while the interest rate on deposits is almost zero, stocks have an overwhelming advantage with a dividend yield of 2% and an earnings yield (profit/share price) of 6%. There is a huge disparity depending on whether one chooses to invest one's wealth in stocks or leave it in deposits. It appears that those who are beginning to feel impatient with the fact that they are falling far behind in wealth building are beginning to act.

U.S. households have become significantly richer through stock investments, and this has become a source of strong consumption.

For more than 30 years since the bursting of the bubble economy in Japan, extreme risk aversion has covered the financial markets, with investors willing to accept zero return as long as they can maintain their principal. This contrasts sharply with the U.S., where risk-taking and investment in equities have significantly increased wealth. Japanese households have 73% (¥1107 trillion) of their ¥1508 trillion in investable financial assets in bank deposits and cash, and only 21% in stocks and investment trusts. In contrast, U.S. households have allocated 72% of their $82 trillion in investable financial assets to stocks and investment trusts, with cash and deposits accounting for only 18% (Figure 2). This equity-dominated U.S. asset management has resulted in significant wealth formation, as U.S. equities have risen significantly, by a factor of 7, since the GFC. The net wealth held by U.S. households increased 2.6-fold from $59 trillion immediately after the GFC to $154 trillion in 2023. Over the past 13 years, households' net worth has increased by about $100 trillion-, or four-times GDP. This wealth formation due to rising stock prices has stimulated U.S. consumption and become a driving force for the economy (Figure 2).

Figure 2: Comparison of financial asset holdings between Japan and the U.S., with the U.S. as the shareholder and Japan as the depositor

What is preventing the U.S.-style virtuous cycle: (1) Withholding of profit by corporations

Can the U.S.-style virtuous cycle of rising stock prices leading to increased wealth effect ➡ increased consumption ➡ economic growth ➡ rising stock prices take root in Japan? If this were to happen, it would raise the Japanese economy and people's standard of living. The current boom in Japanese stocks is a glimpse of this possibility.

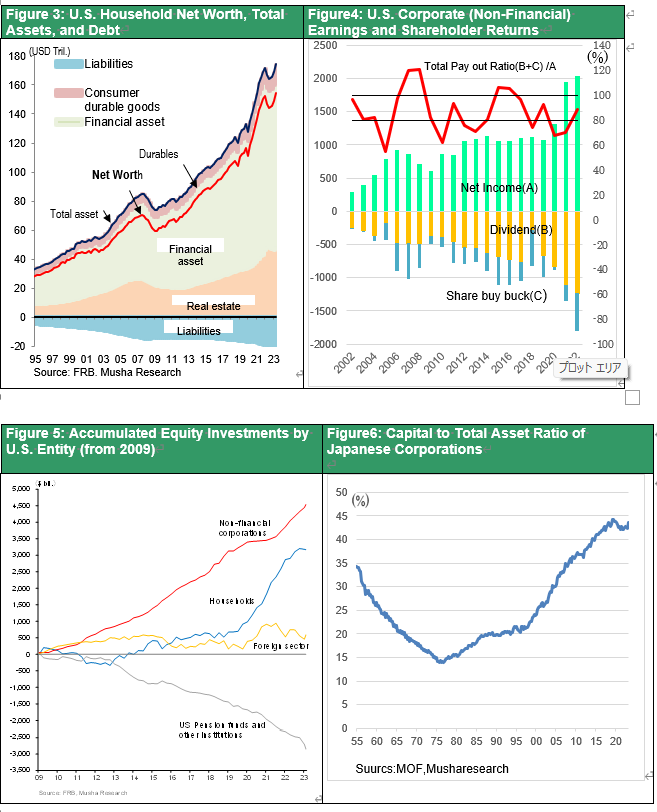

Until now, although companies in Japan have generated ample profits, low stock prices have not increased the wealth of households, and corporate profits have not been sufficiently linked to a virtuous cycle in the economy. The primary reason for this is that majority profits earned by Japanese companies have been stored within the companies and have not been linked to demand expansion and growth. In the U.S., almost 80% of corporate profits are returned to shareholders in the form of dividends and share buybacks (Figure 4). In the U.S., the only major source of investment in stocks during the 10 years until 2020, when households began to invest in stocks through social networking services, was share buybacks by corporations. The stock market rally after the GFC was solely the result of share buybacks (Figure 5). (Figure 5).

In contrast, the shareholder return ratio of Japanese companies is only 40%, half that of the U.S., through dividends and share buybacks, and companies invest most of their profits in financial assets and leave them idle. Part of this is strategic overseas investment, but the equity ratio is abnormally high (Figure 6). The demand by the FSA and TSE for corrective measures for companies with P/B ratios below 1x is a call for effective use of corporate retained earnings. We expect an increase in corporate share buybacks, a dramatic improvement in ROE and other capital efficiency, and a rise in P/B ratios.

Figure 3: U.S. Household Net Worth, Total Assets, and Debt

Figure 4: U.S. Corporate (Non-Financial) Earnings and Shareholder Returns

Figure 5: Accumulated Equity Investments by U.S. Entity (from 2029)

Figure 6: Japan's Capital Adequacy Ratio

What is preventing the U.S.-style virtuous cycle: (2) Extreme risk aversion

Second, because Japanese households have shied away from high-return equity investments, the benefits of rising stock prices have not been passed on to them, and household wealth formation has lagged far behind that of the United States. However, the NISA reforms and other measures are encouraging households to take on more risk. Households' income from financial assets will increase significantly because of stock investments.

FOMO will trigger a virtuous circle in Japan, and the Kishida administration's "new capitalism policy" will also contribute.

In this way, in Japan, as in the U.S., a trend toward the return of corporate profits to society and the creation of demand is beginning to take place, triggered by the rise in stock prices. As shown in Figures 7 and 8, Japanese firms have been holding excessive amounts of capital, resulting in extremely low ROE (return on equity = growth rate of shareholders' equity) and the lowest P/B ratios of all major countries. This is because corporations, like households, have been poisoned by the "Cash is King" mentality. This is where the Kishida administration's new capitalism policy is focusing. There is a great possibility that the U.S.-style virtuous cycle of rising stock prices for increased wealth ➡ increased consumption ➡ economic growth ➡ rising stock prices will take root in Japan.

Chart 7: ROE of Major Countries, Japan Stands Out as Low

Chart 8: P/B ratios of major economies, Japan's conspicuously low P/B ratios