Apr 15, 2019

Strategy Bulletin Vol.223

Soaring Stock Prices in China and the US - Causes and Sustainability

-Monetary Easing + Competition for High Stock Prices Triggered by the US-China Confrontation

(1) Unpredictable US and Chinese Stock Prices

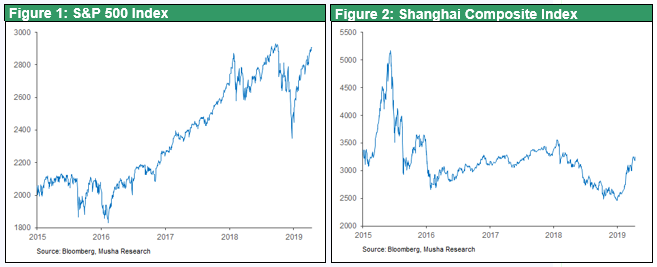

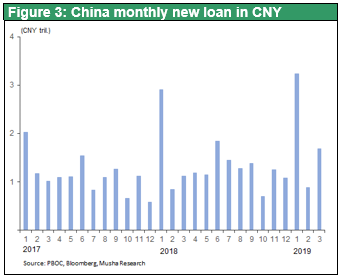

At Christmastime last year, no one could have foreseen stock prices soaring in the first three months of this year. The US S&P index had fallen at Christmas by 20% from its historic high level at the end of September, but by last weekend (April 12) it had now soared 24% and recovered to just 1% short of its all-time high. It now looks very likely that setting a new historic high price will be just a matter of time. The dramatic upswing in Chinese share prices was even more intense, with the Shanghai Composite Index hitting 3,247 points on April 4, up 32% from the bottom recorded on January 2. The Shanghai Composite Index has clearly already recovered the level it was at before the outbreak of the US-China Trade War, since it was in a 3,200-3,300-point range back in early March last year when the outbreak of the US-China Trade War became clear evident. So even before the conclusion of a US-China agreement on settling the US-China Trade War, the stock prices of China and the United States, the two nations now embroiled in the trade war, will fully recover and will lead the world!!

Right up to the end of last year, most market participants were concerned that the US-China Trade War would cause the global economy to stall and trigger a decline in stock prices. On October 4 last year, when stock prices plunged, US Vice President Pence made a very harsh speech criticizing China at the Hudson Institute. In his speech, he censured China's unfairness in its stance on political, military, information and technology-related issues, and in all aspects went far beyond the bounds of previous criticism which had formerly been limited to trade and economic considerations. The WSJ published an editorial (by Mr. Walter Russell Mead) stating that Vice President Pence has declared the start of a Second Cold War and conveyed his assessment that the stance of the United States has transformed into a full-scale policy of Chinese containment. "The United States and China have finally entered an era of fundamental conflict. Economic and market participants are underestimating the fact that national security has now entered an era of prioritizing the economy" asserted the editorial. Resign yourselves to the fact that the economy and stock prices are to be the victims of trade wars was the underlying message. But why then are stock prices now continuing to rise in a manner that is the direct opposite of this widely shared concern?

(2) Monetary Easing is Progressing with a Sense of Resolve and Preparedness between the US and China

Monetary Easing => High Stock Prices Boosting National Presence

The biggest reason is that both the United States and China are developing monetary easing with a considerable degree of resolve and preparedness. President Trump has relentlessly put pressure on the Fed to promote monetary easing since the middle of last year, with one of the reasons seemingly having been the need to offset the expected economic deterioration effect of the US-China trade war. As discussed later, since the end of last year the Fed has implemented a major shift from monetary tightening to easing, and this development has been the biggest driver of the appreciation in US stock prices.

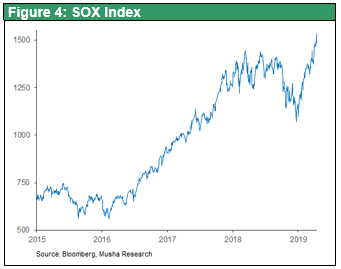

On the other hand, with the intention of curbing shadow banking by the spring of last year, China adopted a policy of tightening involving measures such as raising the reserve ratio and curbing loans, thereby causing a sharp slowdown in domestic demand in areas such as fixed-asset investment and triggering a drop in stock prices. However, in response to the intensification of the US-China trade war, China is now making a major shift in monetary policy. The deposit reserve ratio fell from 16.25% in 2016 - mid 2018 to 13.5%, bank lending expanded sharply, and the total amount of RMB-denominated lending from January to March greatly increased to a total of some 5.8 trillion RMB (= about 864.1 billion dollars), jumped by 19.5% by comparison with the previous year. It is estimated that such funds are being channeled into investment in stocks, real estate, and commodities, etc.

In this way, as the US and China have become more involved in fiercely contesting the trade war and striving to achieve supremacy, they are also simultaneously moving towards raising their own stock prices, thereby creating credit and expanding demand, and as a result, increasing their presence in the global economy. This is the reason why the stock prices of the United States and China have risen conspicuously and significantly.

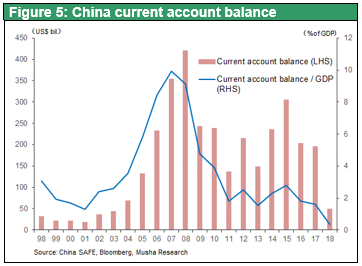

In addition to a full recovery in stock prices, if US-China trade talks are finally agreed upon, there may also be a positive effect on demand. Unpredictability around the trade war briefly halted capital investment in China at the end of last year, but there is almost no possibility that final demand will decline in the US and China. If this is the case, the suspension of investment would bring about a slowdown in future supply capacity and increase the possibility of tight supply and demand situation in the future. The surge in US semiconductor stocks, which have risen by 40% from a bottom at Christmas last year, can be viewed as having taken that possibility fully into account. If the economies of the US and China become more buoyant, the economies of Japan, Germany, and Korea, etc., which export into them, will also receive a boost as a result.

Given this background, the consequences of the US-China Trade War now seem to be linking up with a strong boost to stock prices and to the economy rather than to the deterioration of the global economy and a decline in asset prices. The underlying reason for this development is that it is possible to boost demand without any cost at all being incurred because there is no inflation. Thanks to monetary easing, stock prices boost purchasing power and power the economy, and this mechanism also holds true for China.

It may well be the case that we are now entering an era in which appreciation in stock prices, with the support of monetary easing, and thereby leading to the superiority of the nation’s own economy, is becoming a model that would be appropriate worldwide.

Increase in the Weighting of China Shares in MSCI Accelerating Investment in Chinese Stocks

The increase in the weighting of Chinese stocks in the MSCI Emerging Markets Index is also a factor contributing to the rise in Chinese stock prices. On February 28, the MSCI announced that it would gradually increase the inclusion factor for mainland China-listed RMB-denominated shares (A shares) (the discount rate against the actual Chinese market share weighting (estimated at 16.2%)). The factor for China's A shares in the Emerging Markets Index will be raised from 5% to 10% in May, to 11.5% in August, and the factor will be raised to 20% in November. Therefore, it appears that the actual incorporation ratio of 0.8% (16.2% x 0.05) so far) is expected to eventually rise to 3.3% (16.2% × 0.2). In addition, FTSE Russell, a member of the London Stock Exchange Group, announced at the end of September last year that China's A-shares will be included in its Global Index, and that they will be included in three stages from June this year on. These developments increase China's importance in the global stock market, forcing global investors to be aware of the risk(s) of not holding Chinese stocks. It is believed that buying of Chinese stocks by global investors since the beginning of the year has largely been driven by these changes.

In response to the trade friction, the Chinese government has also promulgated a Foreign Investment Law to amend the trading practices that are disadvantageous to foreign companies. In addition, it has raised the investment limit from the previous $150 billion to $300 billion by means of the Qualified Foreign Institutional Investor (QFII) system, and has been actively calling for investment, rather than just greatly relaxing its restrictions on foreign investment. China's current account surplus fell sharply from $195.1 billion in 2017 (1.6% to GDP) to $49.1 billion in 2018 (0.4% to GDP) The adoption of measures to stimulate capital inflows is also a pressing issue.

(3) Has the Stock Price Standard Begun?

As we have seen above, the policy of pushing up asset prices, such as stock prices, by implementing aggressive monetary easing in both the US and China, and thereby promoting demand and enhancing the national presence, has become an essential feature of today's economic policy. This may be something that should be understood as being a new financial regime, so to speak, the Stock Price Standard.

Changes in the stance of the US Federal Reserve since the sharp decline in stock prices last fall may go down in history as being seen as the central banks "giving in to" the stock market. This means that they have been getting gradually further away from a QE (quantitative monetary easing) exit, such as stopping rate hikes and halting balance sheet compression. According to the general opinion that QE is a dubious way of making big money, an “alchemy” of emergency evacuation, the Fed's policy shift in the direction of market friendliness has delayed its normalization and has taken the “demonic whisper” a step further.

However, in the absence of inflation (= existence of excess supply capacity), there is a great risk of falling into a major recession from the vicious cycle of a credit crunch if stock market plunges are neglected. As far as the Fed is concerned, it has no choice but to shift to market-friendly policies. The mission of economic policy is to aim for maximum growth in a sustainable range, which is to be achieved by the central banks controlling total credit (total purchasing power). So how does one control the amount of credit? In the past, bank loans were ordered and directed by interest rate policy. Nowadays, however, credit creation is directed and carried out not by the banking system but mainly by rises in asset prices (especially stock prices). Therefore, as a policy to exert influence on asset prices, QE has emerged to enable and facilitate the printing of additional huge volumes of money.

If this is the case, QE can only be considered as a gold standard, a system of unconvertible paper money (fiat money) issuance, a continuation of the paper dollar system and a new phase of a money-issuance regime. Central banks will target the highest stock price levels within the inflation allowance as a policy target. This is, so to speak, the Stock Price Standard. The central banks have emerged as the ultimate guardians of the equity and asset markets, and the positive effect of this on stock prices will be enormous.

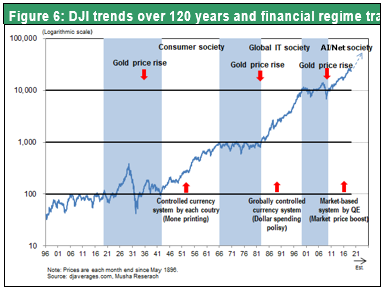

Looking back over the 120-year history of US stock prices, it is clear that the rise and fall of the US economy and the trend in the NY Dow Industrial Stocks have been transformed by the financial regime (= the banknote printing mechanism). The real NY Dow (the NY Dow divided by the price index) shows the stock value in terms of purchasing power, but there have been three significant rising waves in the past 120 years, and we are now right in the midst of the fourth rise. The three waves were:

1) 1910s-1920s (the rise under the classical liberal system under the gold standard)

2) 1950s-1960s (the rise under the Keynesian economic system governed by each nation's managed-currency system > additional-domestic-banknote-printing system)

3) 1980-1990s (the rise under a globally-managed currency system > Dollar-dispersal system, or the global neoliberal system).

And now:

4) A new rise has started since 2010. This can be thought of as being a market- (stock price)-based system that uses QE (quantitative monetary easing), as a mechanism for issuing new banknotes, and a means for issuing currency that conforms to market tolerance-risk criteria, such as stock prices, etc. This is a system that can perhaps best be described as being a new, global, Keynesian system that is driven by demand creation by the government sector. The time has now come for an essential and appropriate process of demand creation powered by the two engines of monetary easing and fiscal policy.

(4) Japan Stocks’ Turn is Getting Closer

Japan appears to be struggling with measures such as its policy of increasing the rate of the Consumption Tax, as opposed to the US and China attempting to carry out a monetary policy targeting stock prices, and this contrast is creating obstacles to global investors directing investment into Japan’s markets. Another aspect is the fact that Japanese stocks were sold off to increase China's portfolio weighting. But if the world economy really starts to soar, then surely the biggest upswing should happen in Japan? This is because the capital goods and production goods that Japan specializes in also have the largest global swing factors, so the declines and the rise will both be amplified as a result. Japanese stocks, which have been laggards to date, are therefore highly likely to register a significant upswing if global production stages a recovery.

Musha Research has pointed out that a major bottom for Japanese stocks (which significantly breaks through fair value) is formed when foreign speculators sell, and that this is also consistent with the bottom for the unsettled buying position of arbitrage trading. In the previous Bulletin I noted "Unsettled buying position of arbitrage trading 500-billion-yen level, unsettled buying position of arbitrage trading and TSE partial market capitalization ratio 0.2%, is proof that speculative selling has reached its limit. This pattern was formed four times in the past, namely in 1998, 2003, 2009 and 2016, but all achieved a share price increase of more than 60% between 1 and 1.5 years thereafter. The unsettled buying position of arbitrage trading reached this level in December 2018, and so the Nikkei Average may well reach the 30,000-yen level by the middle of 2020."

Furthermore, we also hope to see the launch of measures to promote equity investment. The top story on the front page of the Sankei Shimbun on March 10 reported that "the Financial Services Agency aims to create a Guidebook to Asset Management for Individual Investors by summer this year". By comparison with the US, this issue is significantly inferior in terms of the asset formation of Japanese households. The reason for this is that almost all their valuable assets are “sleeping” in cash deposits that do not produce any wealth. It is the aim of the Guidebook to promote asset formation by means of undertaking an appropriate degree of risk taking. The Abe administration, which has already addressed various issues relating to the National Security Law, improvements in ways of working, and reforms in the Immigration Control and Refugee Recognition Act, is surely now likely to place emphasis on diversifying the management of individuals’ funds. Policies may well be implemented that, from now on, actively support equity investment as a pillar of this strategy.

With the rise in global stock prices and the change in spirit and mood ushered in by the advent of the new Reiwa era in Japan, it may well be that a spectacular rally in Japanese stocks could also appear.