The collapse of gold signals the demise of two beliefs: inflation is coming and the black swan theory

The price of gold is plummeting. All indications point to the end of the third gold boom that has occurred during the century of modern capitalism. Moreover, there is no consensus among investors about the proper value of gold. Cost, supply and demand, and other conventional methods of analyzing the price of goods are useless for gold. The reason is obvious. Long-term movements in the gold market have been determined by a tug-of-war between two factors. One is economic fundmentals: economic crises occur, become more severe and are followed by a recovery. Second is the emergence and establishment of a new currency regime in response to a crisis. Looking back at these two factors over the years leads to the conclusion that a drop in the price of gold is the precursor of economic prosperity and a long-term upturn in stock prices.

Gold’s plunge most likely signifies the destruction of two positions held by pessimists. The first is that inflation is coming. However, the price of gold has declined against a backdrop of slower economic growth in China and lower prices of resources. There is also a link with the downturn in long-term interest rates. As a result, the position that inflation is coming is no longer convincing. Furthermore, people who made investments based on this belief (such as John Paulson) have incurred enormous losses. The second is the black swan mentality, which also makes people want to use any event as an excuse for adopting a pessimistic view of the future. PIMCO’s Mohamed El-Erian is one example. People who embrace this thinking believe that the falling price of gold proves the validity of the view that deflation worries are increasing and economic problems are becoming more severe.

I have been pointing out contradictions in the thinking of pessimists for some time. I believe that cheaper gold shows that confidence in currencies is rising. The gold market’s drop also proves that pessimists were wrong to think that inflation is coming and to embrace the black swan theory. The most persuasive position today is that all necessary conditions for a stock market rally are in place because of money supply growth and increasing confidence in currency. The result is an environment in which risk-takers will prevail.

The clear cause-and-effect relationship among gold, currency regimes, stock prices and the real economy

Observations of gold price movements over the years support the following three hypotheses (a pattern for cause-and-effect).

(1) The price of gold has increased when a new currency regime emerged and the money supply grew (or expectations for growth increased). This time as well, the steady increase in the price of gold mirrored the use of quantitative easing.

(2) Upturns in the price of gold have occurred while gold served as a temporary place for money to stay as purchasing power increased due to money supply growth. Subsequently, faith in the new currency regime increases and people have a more positive outlook. Once this happens, purchasing power that had accumulated in gold first shifts to high-risk financial assets. Next, these funds move on to investments and consumption, which causes the price of gold to plunge. Consequently, a drop in the price of gold is collateral evidence of the formation of a base for sustained economic growth.

(3) Stock prices have been unstable (sharp drops and stagnation) when a crisis deepens up to the point that a new financial regime is established. In other words, when gold is moving up stock prices have been weak. But once a new financial regime begins to function, a prolonged stock market rally starts as purchasing power migrates from gold to stocks.

The significant similarities between today and 1982

There are several similarities between 1982 and 2013 from the standpoint of the three hypotheses. First, gold began to drop sharply after reaching a peak two years earlier. Second, stock indexes rose to new highs after an extended period of lackluster performance. Third, there were declines in both the consumer price index and long-term interest rates. 1982 was the start of an upturn that lifted the Dow Jones Industrial Average from the $1,000 level to the $10,000 level. Today, we may very well be on the verge of a similar long-term upturn in stock prices.

For more information about the analysis of past data, please read Strategy Bulletin Vol. 56 “What is the meaning of upturns in the price of gold during shifts in currency regimes?” (October 12, 2011). (The following text is from Vol. 56 but the graphs have been updated.)

Strategy Bulletin Vol.56 (Released on Oct 12, 2011)

Debt-based Historical View vs. Productivity-based Historical View (Part 3)

What is the meaning of upturns in the price of gold during shifts in currency regimes?

In part 3 of my series on debt-based vs. productivity-based historical views, I will examine the current historic surge in the price of gold. No one can deny that the surge in the price of gold has been accompanied by extreme monetary easing in reaction to serious economic problems. Nevertheless, it is a mistake to embrace the conventional wisdom that a sharp increase in the price of gold is a sign of an economic downturn. Instead, more costly gold may be the precursor of a stronger economy and stock market rally over the long term.

Gold price surge signals a shift in the currency regime and long-term upswing in stock prices

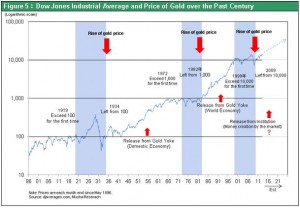

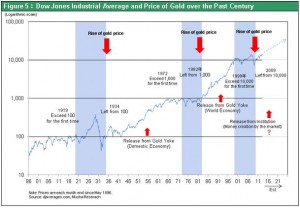

The price of gold has always increased in tandem with financial turmoil. The powerful rally in the gold market that began in 2007 is the third major upswing in the price of gold during the modern age of capitalism that began about 100 years ago. Gold staged its first increase in 1934. At that time, the United States had abandoned the gold standard and shifted to the managed currency system. One ounce of gold rose from $20 to $35 as a result. The second major rally started in the late 1970s and ended in 1980 and pushed gold to $850 per ounce. These two past upturns also coincided with the turning points in the currency system. In 1934, the gold rally was backed by the demise of the gold standard. In 1980, the gold rally was linked to the end of the dollar’s gold conversion with the 1971 Nixon Shock (termination of the gold standard for international transactions that had existed until then) and the subsequent establishment of the paper dollar standard. Obviously, both of these gold market rallies occurred during major historic turning points in the currency regime. Furthermore, as you can see in Figure 5, these major upturns in the price of gold have coincided with the starting points of long-term increases in stock prices. It may be possible to assume that a higher price of gold leads to the establishment of a new currency regime that in turn triggers a prolonged upswing in stock prices. If this is true, shouldn’t we expect to see a significant shift in the global currency system after the current gold market rally? Furthermore, does costly gold raise the possibility of a renewed long-term bull stock market?

Money growth explains why investors bid up the price gold

There is a different mechanism behind each upswing in the gold market. However, all gold market rallies are closely linked to the money supply. Figure 1 shows the U.S. monetary base divided by nominal GDP. During the past 100 years, this ratio has increased rapidly only twice: in the early 1930s and starting in 2009. Clearly, both upturns coincide with gold market rallies. There was no increase in the monetary base/GDP ratio during the sharp upturn in the price of gold that ended in 1980. But growth in credit was also a factor behind the 1980 rally. Figure 2 shows the real debt growth ratio (domestic non-financial sector) in the United States. A steep increase of an unprecedented scale occurred in the first half of the 1980s. Figure 3 shows the sharp increase in CPI and nominal GDP of the U.S. in late 1970s, which were accompanied by rapid growth of monetary stocks. However, the CPI plunged in the early 1980s, resulting in a significant amount of excess credit. Despite the big drop in the nominal GDP growth rate triggered by the plunge in inflation, there was no immediate contraction in the growth rate for the creation of money or credit. As a result, there was a comparative excess of money caused by the rapid slowdown in inflation.

Figure 1:U.S. Monetary Base/Nominal GDP and the Price of Gold

Figure 2:U.S. Real Debt (Non-financial sector) Growth Rate and the Price of Gold

By pooling purchasing power, does a higher price for gold signal the starting point for prosperity and higher stock prices?

Exactly how does a hike in the price of gold lead to economic growth and a stock market rally? I think the most persuasive hypothesis is the “Higher gold price = Purchasing power pool” theory. Even though demand for gold is supported by the industrial and jewelry sectors, most of the demand comes from speculators who want gold as part of their investment portfolios. Industrial and jewelry demand is stable. That means speculation is the decisive factor behind fluctuations in gold demand and its price. Since gold is purchased as part of an investment portfolio, demand for gold increases when other types of investments lose their appeal. Around 1980, investors escaped to gold when inflation eroded the value of currencies and higher interest rates caused prices of securities to fall. Uncertainty about the economic outlook is the reason that investors have turned to gold since 2007. The need for hedges has increased along with the magnitude of risk factors. Investors are worried about rising prices of crude oil and other natural resources. There are also worries about a plunge in prices of financial assets and real estate if the financial crisis worsens. A decline in faith in the dollar is another source of concern. Gold’s role as a hedge against risk became even greater since about 2005 when the volume of investments in the gold ETF (GLD*) began to increase rapidly to reach a massive scale.

* This ETF is currently the world’s largest private owner of gold with holdings totaling $65 billion.

These events demonstrate that gold functions as a type of pool that can store excess purchasing power. In other words, an upturn in the price of gold signifies that there is excess credit and that purchasing power is being stored. Consequently, this pooled purchasing power is released when the price of gold falls (when gold’s role as a risk hedge declines because uncertainty ends). Can’t we then draw the conclusion that this release will fuel economic growth and a powerful stock market rally? In 1980, ample liquidity that matched inflation became excessive when inflation was brought under control. This excess liquidity eventually led to economic growth and a stock market rally. In both the 1930s and today, a clogged financial system triggered a rapid decline in the velocity of money. To fix the problem, the only course of reaction was rapid growth in the monetary base. Measures to rebuild the global financial system may lead to a recovery in the velocity of money. If this happens, we could see the excess money fuel economic growth and higher stock prices. The price of gold would drop in this environment.

Gold and inflation

Many people believe there is a close link between the price of gold and inflation. Oil shocks occurred twice during the 1970s: 1973 and 1979. Between these two shocks, the prices of gold and commodities moved together as gold, crude oil and silver climbed with mounting U.S. inflation. However, precisely the opposite events took place when the price of gold surged in the 1930s and today. The price of gold increased amid a financial crisis, raising fears of deflation and falling long-term interest rates. That means we should probably conclude that there is no clear cause-and-effect relationship between the price of gold and inflation.

The doubtful relationship between gold and faith in the dollar ? Supply and demand determine the dollar’s value

Many people rush to the conclusion that more costly gold means people are worried about the dollar. I cannot deny that this is true to some extent. But after both the Lehman shock and the outbreak of fear about Greece and European currencies, the dollar became stronger and gold was sold off as the liquidity crisis deepened. Clearly the dollar rather than gold is widely viewed as a safe haven during a crisis. This is irrefutable proof that investors prefer the dollar as the last resort to ensure liquidity. The belief that gold is a currency with no issuer is why people believe there is no risk of insolvency (no sovereign risk). However, gold is no longer a currency. Many investors remember the plunge in the price of gold during the 1980s. Consequently, the view that “gold is a currency with no risk of insolvency” can be justified only if people have expectations (fantasies) of the end of the dollar and restoration of the gold standard.

At times, the dollar’s value has plunged due to supply-demand dynamics following significant growth in the U.S. monetary base. But as a crisis deepens, (1) investors increasingly turn to the dollar as the currency of last resort and (2) the interest rate on dollar-denominated investments declines. Therefore, can’t we conclude that there is no relationship between a gold price hike and faith in the dollar?

Figure 3:U.S. CPI and Long/ST Interest Rates

Figure 4:Price of Gold and DJIA

As I have explained, the usual explanations of inflation or worries about the dollar are not responsible for the current gold market rally. Costly gold is nothing more than the result of growth in the U.S. base money . But we cannot easily reach a conclusion about what the larger base money will cause next. Only past experience has shown that a higher price of gold accompanied by money growth leads to the creation of credit, economic prosperity and a long-term upturn in stock prices. The first signs of a new money supply mechanism may emerge from this process. I think this mechanism will probably be a “market standard system” in which markets play the central role in creating money. Another possibility is that the dollar is positioned at the center of currency markets that have greater transparency and efficiency. This would result in a new and stronger dollar standard system. (1) Under the gold standard system, gold was used to back the supply of currencies. (2) Under the managed currency system, government bonds (sovereign debt) were used to back the supply of currency. Next, (3) assets that generate cash flows will be used to back the supply of currency. Shouldn’t we regard quantitative easing as the first sign that this new age of currencies is about to start?

Figure 5:Dow Jones Industrial Average and Price of Gold over the Past Century

As I have explained, the usual explanations of inflation or worries about the dollar are not responsible for the current gold market rally. Costly gold is nothing more than the result of growth in the U.S. base money . But we cannot easily reach a conclusion about what the larger base money will cause next. Only past experience has shown that a higher price of gold accompanied by money growth leads to the creation of credit, economic prosperity and a long-term upturn in stock prices. The first signs of a new money supply mechanism may emerge from this process. I think this mechanism will probably be a “market standard system” in which markets play the central role in creating money. Another possibility is that the dollar is positioned at the center of currency markets that have greater transparency and efficiency. This would result in a new and stronger dollar standard system. (1) Under the gold standard system, gold was used to back the supply of currencies. (2) Under the managed currency system, government bonds (sovereign debt) were used to back the supply of currency. Next, (3) assets that generate cash flows will be used to back the supply of currency. Shouldn’t we regard quantitative easing as the first sign that this new age of currencies is about to start?

Figure 5:Dow Jones Industrial Average and Price of Gold over the Past Century

As I have explained, the usual explanations of inflation or worries about the dollar are not responsible for the current gold market rally. Costly gold is nothing more than the result of growth in the U.S. base money . But we cannot easily reach a conclusion about what the larger base money will cause next. Only past experience has shown that a higher price of gold accompanied by money growth leads to the creation of credit, economic prosperity and a long-term upturn in stock prices. The first signs of a new money supply mechanism may emerge from this process. I think this mechanism will probably be a “market standard system” in which markets play the central role in creating money. Another possibility is that the dollar is positioned at the center of currency markets that have greater transparency and efficiency. This would result in a new and stronger dollar standard system. (1) Under the gold standard system, gold was used to back the supply of currencies. (2) Under the managed currency system, government bonds (sovereign debt) were used to back the supply of currency. Next, (3) assets that generate cash flows will be used to back the supply of currency. Shouldn’t we regard quantitative easing as the first sign that this new age of currencies is about to start?

Figure 5:Dow Jones Industrial Average and Price of Gold over the Past Century