Sentiment of London investors split in two directions

We may have finally reached a major turning point. Investors may very well be witnessing the start of a surge in stock prices on a scale that has never been seen in our lifetimes. This massive stock market rally will probably sweep away pessimistic views without a trace. Surging stock prices cannot be explained or justified in any way by using these views. As prices climb, people will come to realize that an enormous volume of pent-up energy had been accumulating.

However, current changes in expectations differ among investors. Will the reflationary policies of Prime Minister Shinzo Abe succeed or fail? There are two sources of concern. First is the possibility that Abe’s reflationary initiatives will end up as nothing more than talk because of opposition from people in his inner circle. Second is doubt about whether or not financial initiatives alone can end Japan’s strong-yen deflation. As a result, we cannot reject the possibility of these worries leading to disappointment. Deputy Prime Minister Taro Aso has made many statements that pull back from Abe’s position. “It is impossible to end deflation with monetary easing alone.” “There is no need for an accord with the Bank of Japan.” “The next Bank of Japan governor cannot come from the academic sector. We will not exclude bureaucrats as candidates.” Even Bank of Japan Governor Masaaki Shirakawa said that he is more worried about inflation than deflation.

When I was in London last week, I noticed that the sentiment of investors there is also divided between two beliefs. Hedge fund investors are the primary group that is not retreating from a cautious stance regarding Japan. They are traumatized by the occurrence of “false dawns” in financial markets again and again. Investors who were successful as Japanese stocks declined over the past two decades made extensive use of the hedging method of shorting indexes and picking individual stocks. But this method is no longer working. Due in part to foreign exchange losses caused by the yen’s weakness, the survival investment approach is not viable any more. Has the prolonged period of a strong yen, deflation and weak stock prices really come to an end? If so, investors will have to abandon the methods that were successful in the past. But investors have not yet decided whether or not to take this action.

In contrast to this stance, expectations are mounting among many long-term investors that “this time is different.” They say that money has started flowing into Japanese equity funds.

Figure 1:BOJ lagging in easing (Total assets of central banks/GDP)

Figure 2: Exchange rate of major currencies against the yen

Figure 3:Japanese stocks lagging behind extremely

Make stock prices the indicator of success or failure

The most critical point is whether or not Prime Minister Abe can carry through with his initiatives. He should learn a lesson from Fed Chairman Ben Bernanke. The prime minister hopes to raise expectations and lower the risk premium. In other words, the goal is to push up prices of assets. And stocks are at the center of this goal. The world is in an age of market finance. Managing market prices is now the primary element of the policies of central banks. In this environment, firstly the safety net of central bank must be preventing a collapse in market prices to unreasonable levels by direct intervening. Secondly increasing purchasing power by boosting prices of assets is major transmission channel of supplying liquidity. Bernanke’s quantitative easing and creative financial initiatives are in step with the demands of today’s financial environment. Japan must create actions that produce results, even if those actions aren’t in any textbooks.

A sustained stock market rally will be the decisive factor regarding success or failure. Japan must establish the mentality that “higher stock prices are justified.” An inflation target is needed, too. Furthermore, Japan should have a stock price target in mind even if financial authorities do not announce a target. But can Japan unleash one initiative after another that will underpin stock prices? We are finally seeing the emergence of risk-taking. Japan must be careful not to pull out the ladder from under these risk-takers. Japanese financial authorities should confidently use stock price measures as the primary tool for ending strong-yen deflation. Stocks in Japan have an unprecedented undervaluation along with favorable supply-demand dynamics on an unprecedented scale. Theoretically, everything is in place for a major upward correction. Rising stock prices will produce a huge wealth effect. As the United States demonstrated, there is a very close link between changes in asset prices and the savings rate. The savings rate falls as stock prices climb, which stimulates consumption.

The stock yield/corporate bond yield multiple is an indicator of investors’ appetite for risk. As you can see in Figure 5, this multiple fell to 0.25 at the peak of Japan’s asset bubble in 1990 and 0.5 at the peak of the U.S. IT bubble in 1999. Today, these multiples are 8 and 2, respectively. In the United States, the all-time high since the 1930s was 5 in 1949. Japan’s current multiple clearly shows the extremely high level of risk aversion that exists in the country. Japanese stocks have reached this degree of undervaluation because Japanese stocks have been completely sold off by all investor segments: individuals, pension funds, insurers, mutual funds, banks and foreigners. This undervaluation is the mirror image of the remarkable underweighting of Japanese stocks. Supply-demand dynamics for Japanese stocks have never been more favorable. The market is like a field of dry grass soaked in gasoline. All that is needed is a spark to start an enormous conflagration.

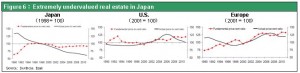

With assets in Japan extremely undervalued, an upward correction in asset prices has the potential of generating massive capital gains. If the PBR of Japanese stocks simply increases from the current 1 to the world average of 1.7, stock prices would approximately double. This would raise Japan’s stock market capitalization by more than \200 trillion. There is substantial room on the upside for real estate prices, too.

Figure 4:Pendulum of risk appetite

Figure 5:Bond return / stock return in Japan and U.S.

Figure 6:Extremely undervalued real estate in Japan