● Twenty years ago, Japan had the world’s most powerful semiconductor industry. But now the industry is almost entirely gone and this crisis is spreading to other industries. Once a country loses industrial clusters, regaining those clusters is almost impossible.

● One cause of this loss is that Japanese corporate management and governance are mired in cronyism. But the central cause of this crisis is improper financial and economic policies that resulted in an extremely strong yen, deflation and other problems.

● The BOJ and Japanese government must take responsibility for the collapse of industrial clusters in Japan.

The demise of Japan’s industrial cluster has started!

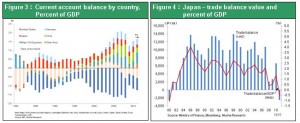

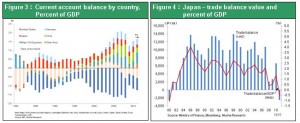

The noisy collapse of Japan’s industrial cluster is beginning. The nation’s full-set industrial structure has long been a key strength and defining characteristic of Japan. These industries cover almost all sectors, extending from basic materials to electronics, machinery and automobiles. Success of the automobile and electronics industries, which generate massive synergies, supported the formation of a vast industry encompassing parts, basic materials, devices and other items. Japan became the world’s leading industrial powerhouse as a result. From the mid-1980s to about 2000, Japan’s industries were far ahead of those of other countries, enabling Japan to consistently maintain the largest trade surpluses.

But this era has come to an end. No one can deny that Japanese industries are declining. Even the semiconductor industry, which was once called “the rice of industry,” is in a fateful crisis. Due to regrets about excessive competition in the past, Japan’s semiconductor industry has been consolidated into two large companies: DRAM manufacturer Elpida Memory and Renesas Electronics, which makes primarily logic ICs. Now, these companies are about to become foreign owned. Elpida Memory went under despite an infusion of public funds and will be acquired by Micron Technology of the United States. Renesas Electronics is to be acquired by the U.S. buyout fund KKR. These transactions signal the demise of Japan’s semiconductor industry, which was the most powerful in the world 20 years ago.

Figure 1:Semiconductor revenue share for four regions

Figure 2:Exchange rates vs. JPY by currency

The crisis of the semiconductor industry collapse and fate of the electronics sector

At one time, Japan dominated global markets for televisions, video cassette recorders, audio equipment and other consumer electronics. But Japan has relinquished flat-screen television leadership to Samsung and LG. Furthermore, Japan has fallen far behind South Korea in the field of next-generation technology of organic EL displays. Moreover, Japanese companies are virtually invisible in the booming markets for smartphones and tablet computers. Sony, Panasonic and other Japanese consumer electronics companies are reporting enormous losses and must implement drastic restructuring programs. Even Sharp has been forced to ask for an investment from Hon Hai Precision Industry of Taiwan, an OEM supplier of electronics products.

High-tech materials, parts and devices are not immune from this problem

Some people believed Japanese industry still had a future. The country was losing in markets for finished products like DRAMs, flat-screen televisions and other products that have become commodities. But a case could be made for Japanese manufacturers to retain their dominance as suppliers of the parts and materials used in these products as well as the machinery and devices needed to manufacture these products. In fact, Japan had large trade surpluses with South Korea and Taiwan with regard to these parts, materials and devices. However, dark clouds are gathering in these categories, too. For semiconductor manufacturing equipment, the pinnacle of high-tech machinery, Japan’s leadership ended around 2000. Japan’s Canon and Nikon dominated the market for steppers, a key device used to make semiconductor chips. But the Dutch company ASML developed a next-generation stepper and is now the world’s leading supplier of these devices by a wide margin. Furthermore, Intel has become an ASML shareholder and is supplying funds for R&D programs. Participants also include Samsung and Taiwan Semiconductor Manufacturing Company, the largest Taiwanese semiconductor manufacturer, creating an enormous consortium for the development of next-generation equipment. Japanese manufacturers are completely out of the loop. There are also concerns about outflows of technology from Renesas Electronics, which has a 42% share of the global market for automotive microcontrollers. Events like these are causing synergies within Japan to disappear.

Similar declines are occurring in Japan’s solar cell, steel, ethylene and shipbuilding industries. Furthermore, Japan has started posting large trade deficits because of higher imports of fossil fuels resulting from the shutdown of nuclear power plants.

Critical policy mistakes that caused a strong yen, deflation and other problems and a corporate culture centered on cronyism

There are two major causes of Japan’s decline. One is macroeconomic problems. Japan has lost its competitive edge because of the yen’s extreme strength. Deflation is creating challenges for companies. Japan’s industrial policies are producing an improper allocation of resources within the country and ignoring national interests. Deflation and the extremely strong yen have destroyed the vitality of Japanese companies. In other countries, governments and central banks have been working in concert to avoid strong currencies and deflation by using monetary and foreign exchange initiatives to the fullest extent. This is happening in the United States, United Kingdom, the Eurozone, South Korea, China, Switzerland and other countries. But in Japan, we hear statements like “there is nothing more we can do” and “that problem is not in our domain.” Financial authorities in Japan have become extremely insensitive and irresponsible.

The other cause is cronyism that prevents Japanese companies from competing based on the global standard. A fatal flaw exists in Japan’s corporate governance and management judgments. Resources are not channeled to young and energetic business sectors. This is true within companies and across different industries. As a result there is no change in Japan’s practice of allowing giant, old trees to block the growth of sprouting trees. Funds of savers who are focused solely on avoiding risk are used to buy government bonds and extend loans to companies with problems. Indirect financing is revitalizing electric power and other mature industries through bank loans.

Early in the 19th century, England was the world’s greatest industrial power. But this power was quickly lost because of a strengthening currency and deflation. Today, Japan is in the midst of repeating these mistakes. Waking up from the unrealistic memories by both Japanese companies and the government is crucial for turning around the situation.