Jun 06, 2012

Strategy Bulletin Vol.72

The abnormal decline in stocks only in Japan amid ultra-low interest rates

- BOJ policy shift may spark a powerful rally in Japan -

Ultra-low interest rates and falling stock prices make Japan abnormal

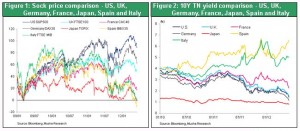

Japan’s TOPIX stock index just fell to a new post-bubble low. The global financial crisis that began after the Lehman Brothers collapse has jumped to Europe and is becoming increasingly severe. These events appear to support the beliefs of pessimists. But this view is wrong. From the lowest point after the Lehman shock, stock prices have bounced back 87% in the United States, 63% in Germany, 49% in Britain, 17% in France and 0% in Italy, as of June 4. But Japanese stocks conspicuously are down 4%. Falling stock prices are not a global phenomenon. The world’s markets are divided between strong and weak performers. An unprecedented drop in interest rates has occurred in the United States, Germany and Britain, where stock markets rallied. But interest rates are at historic highs (especially real interest rates) in Italy, Spain and Greece, where stock prices are down. In the problem countries of southern Europe, the flight of capital to other countries has brought down stock prices. This money has been channeled to the United States, Britain and Germany, where economies are sound. The result is low interest rates and high stock prices in these countries. In financial markets, the voice of God calls on “the United States, Britain and Germany to use ample capital for growth”.

The BOJ’s policy defeatism is the root of the problem

But Japan is attracting capital from around the world, has interest rates even lower than in the United States, Britain and Germany, and has an appreciating currency. Even so, Japan has the worst stock market performance. How should we interpret this abnormal situation? The financial market god is saying “Japan is not utilizing the low interest rates that are a condition for growth.” BOJ Governor Masaaki Shirakawa has done nothing more than repeatedly state that financial policies alone cannot end deflation and excessive easing will produce inflation. He has done nothing to use the “good fortune of low interest rates” bestowed by the financial market god in order to generate economic growth. Fed Chairman Ben Bernanke used financial policies with no end. In contrast, the BOJ adopted a defeatist stance about these policies. It is no exaggeration to say that this is the entire cause of slumping stock prices in Japan. Now that we have realized that Japan’s abnormal stock market downturn is linked to policy defeatism, it should not be difficult to achieve a big turnaround in the stock market. Pressure on the BOJ is climbing rapidly. As a result, there is an increasing likelihood that a policy shift in Japan will spark a major change of direction. Figure 1: Sock price comparison - US, UK, Germany, France, Japan, Spain and Italy Figure 2: 10Y TN yield comparison - US, UK, Germany, France, Japan, Spain and Italy  Haruhiko Kuroda, president of the Asian Development Bank (former Vice Minister of Finance for International Affairs of the Ministry of Finance), has an enormous influence on financial policy. Here are a few of his statements from an Asahi Shimbun article on June 4. “Consumption investments in Japan will not increase as long as long-term deflation continues.” “Like other countries, what Japan needs to do is to clearly define targets and bolster policies to achieve those objectives.” “1% (inflation goal) is far from enough to end deflation.” “The target must be more clearly defined. For example, if the goal is to end deflation in one to one and a half years, we should enact thorough monetary easing measures to achieve the goal.” An individual who played a central role in creating policies pointing out a specific error in a policy is itself abnormal. This indicates that the net encircling the BOJ is becoming tighter. As this net closes in on the BOJ, the bank will probably no longer be able to retain its stubborn stance of the past.

Haruhiko Kuroda, president of the Asian Development Bank (former Vice Minister of Finance for International Affairs of the Ministry of Finance), has an enormous influence on financial policy. Here are a few of his statements from an Asahi Shimbun article on June 4. “Consumption investments in Japan will not increase as long as long-term deflation continues.” “Like other countries, what Japan needs to do is to clearly define targets and bolster policies to achieve those objectives.” “1% (inflation goal) is far from enough to end deflation.” “The target must be more clearly defined. For example, if the goal is to end deflation in one to one and a half years, we should enact thorough monetary easing measures to achieve the goal.” An individual who played a central role in creating policies pointing out a specific error in a policy is itself abnormal. This indicates that the net encircling the BOJ is becoming tighter. As this net closes in on the BOJ, the bank will probably no longer be able to retain its stubborn stance of the past.

Destroy the thinking that the demise of financial capitalism = fatalistic pessimism = policy defeatism

The reappearance of the Lehman shock nightmare is reviving the scenario of the demise of financial capitalism. In other words, excessive leverage facilitated by financial capitalism is the reason for problems that began with the Lehman Brothers collapse and have now become the euro crisis. Since excessive leverage is alchemy with the same root, the belief that the resulting problems cannot be solved easily has been gaining support. The BOJ used this view of the world to forcefully proclaim “the limitations of financial policies.” According to this view, the unprecedented decline in long-term interest rates in the United States, Britain, Germany and Japan is the precursor of global deflation that is unavoidable. The trap of this pessimism is the inability to explain the enormous gap between profit margins and interest rates. No one can deny that long-term interest rates have fallen significantly. This decline occurred along with unprecedented monetary easing. Consequently, the view that emergency monetary easing produced excess capital with nowhere to go may appear to be the correct interpretation. However, profit margins are up sharply. For example, companies worldwide are reporting strong earnings and many U.S. companies had record earnings only one year after the Lehman shock. Excess capital was produced because these large profits could not be absorbed by investments. Furthermore, labor’s share of earnings fell and corporate profits rose significantly every time there was an economic crisis like the end of the IT bubble, the Lehman Brothers collapse and the euro crisis. Companies are now able to earn profits without using people or capital. This explains why there is an excess of both people and capital. Excesses of these two economic resources have no relationship whatsoever with financial capitalism or excessive monetary easing. This is because the ability to use less labor and capital is the product of the global industrial revolution (the worldwide increase in labor and capital productivity) that, in turn, is the result of today’s economic globalization and the Internet revolution. Excess capital and excess labor have been the source of progress for mankind throughout history. Therefore, we should not consider ourselves to be prisoners of the negative after-effect of this process. Instead, we should regard excess capital and labor as a means of achieving more progress in the future. The euro crisis itself is not the reason for weakness in financial markets. Selecting the wrong prescription to treat the problem the real cause. Today, the most serious disease in the world is inadequate demand, not government budget deficits or non-performing loans at banks. This explains why the world has unprecedented levels of idle people and money. Rather than making this problem better, government budget cuts, higher taxes, stronger currencies and deflation will make it even worse. People must understand that the thinking that the demise of financial capitalism = fatalistic pessimism = policy defeatism is the root of all evil. Figure 3: U.S. 10Y TN yield and ROE Figure 4: Returns for U.S. nonfinancial business and Interest rate