The domino-effect of Middle East turmoil is very unlikely to halt the ongoing global economic recovery

Geopolitical risk has abruptly become a serious source of concern. The world is witnessing anti-government, pro-democracy uprisings with a domino-effect that has spread unrest from Tunisia to Egypt, Libya and Bahrain. Although improbable, this domino effect could eventually reach Saudi Arabia, the world’s largest oil producer, and China, the world’s largest manufacturer. There would be a severe impact on the global economy if this happened. Obviously, financial markets would react negatively to higher crude oil prices and mounting uncertainty about the future. Investors have resumed risk-taking by channeling their funds to Japanese and U.S. stocks since the end of 2010. However, the current Middle East turmoil gives investors a perfect excuse to retreat from their current stance of buying stocks and selling government bonds. For the reasons outlined below, I believe that prospects are excellent for a continuation in global economic growth as the present unrest quiets down. If indeed more growth lies ahead, investors should view the current stock market dip as an excellent opportunity to buy stocks at low prices.

The cautious view: A decline in the clout of the United States

We need to examine this domino effect to determine if it will be beneficial or harmful to our lives and the world’s future. No decision is possible at this time. but we do need to carefully analyze current events. There are two opposing viewpoints. The first is the cautious outlook for a long-term decline in U.S. global influence and increase in worries about the supply of crude oil. Pessimists foresee the end of globalization as pro-democracy unrest sweeps across the Middle East. They believe that persistently high prices for crude oil will bring about long-term erosion in the growth potential of the global economy.

In Egypt, the fall of the pro-American Mubarak regime is creating uncertainty about a possible shift in the balance of power among Middle Eastern countries. Anti-government demonstrations in Bahrain are also worrisome. This country is home to the largest U.S. military base in the Middle East as the home port for the U.S. Navy’s Fifth Fleet. Bahrain is a constitutional monarchy while Saudi Arabia is an absolute monarchy. Nevertheless, these two countries are similar because both are ruled by Sunni-controlled governments that are U.S. allies. Anti-government demonstrations may eventually reach Saudi Arabia, which tightly controls information. If this happens, the resulting limitations on the supply of crude oil would create an enormous shock. As a result, we cannot overlook the possibility that the situation in the Middle East may erode the global clout of the United States. These events may also increase the influence of anti-American countries of the Middle East. But King Abdullah of Saudi Arabia, who had left the country for long-term medical treatment, rushed home to announce conciliatory actions like more funds for housing loans and a 15% pay raise for government workers. For the time being, the risk of unrest spreading to Saudi Arabia appears to be very small.

The positive view: The pro-democracy movement will give globalization even more momentum

The second view is that Middle East unrest is simply part of the worldwide move toward democratic governments. The domino-like spread of pro-democracy uprisings is occurring as part of the global economic expansion process. Middle East turmoil is thus the evidence of worldwide economic growth. Economic activity around the world has been completely unified and the Internet makes information readily available to anyone. Typically, social unrest like student and worker demonstrations has occurred at the beginning of a period of rapid economic growth. This is certainly true of Japan. Just as the country’s economy was taking off, the nation was rocked by demonstrations protesting the U.S.-Japan security treaty, student demonstrations and worker protests as companies' streamlined operations. In the Middle East today, the economies of many nations are just now starting to take off. Demonstrations are thus nothing more than a rite of passage that happens as the gap between rich and poor widens at the beginning of a period of rapid economic growth.

I believe that the positive view is more likely to be on target for the time being. There are fears that new Middle East governments will reject globalization by embracing reactionary policies and Islamic fundamentalism. But few people expect this to happen. The populace of a country that is becoming affluent cannot turn back the clock. The only way to sustain economic growth and improve living standards is for all countries to benefit as much as possible from prosperity created by globalization. Egypt’s new military rulers who took over after President Mubarak’s resignation stated that the country “is committed to all regional and international obligations and treaties.” Making this statement clearly shows that Egypt will remain a U.S. ally and continue to abide by the peace agreement with Israel. There is no need for any concerns about the new government making any change in Egypt’s geopolitical position. Egypt is the keystone of the Middle East. A stable Egypt should thus be regarded as a sign that the series of anti-government protests that began in Tunisia will produce governments that are democratic and welcome globalization. Prospects for maintaining a stable supply of crude oil will improve as a result. Shocks affecting the supply of crude oil will always cause the price of oil to rise briefly. For instance, the price of crude oil surged 150% over a three-month period when Iraq invaded Kuwait in 1990. But the price soon returned to the original level once the crisis ended.

An investment strategy centered on industrialized country stocks is the best course of action

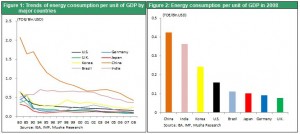

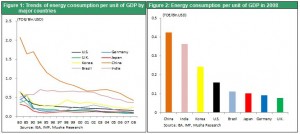

I have just explained why I expect the Middle East domino effect to wind down quickly in a manner that is good news for globalization. This leads to the question of how this will affect global investments. The answer is that events in the Middle East will probably negatively impact investments in emerging countries and prompt investors to return their focus to industrialized countries. First, the higher cost of crude oil will hold down economic growth in emerging countries. Unit energy consumption is high in these countries. But industrialized countries have greatly cut unit energy consumption in recent years as the service sector expanded and energy conservation initiatives produced benefits. Moreover, the angel coefficient in emerging countries is more than twice the level in industrialized countries. That means higher food prices will be a much greater impediment to economic growth in emerging countries. Second, investors can no longer ignore the mounting geopolitical instability in emerging countries, particularly in the Middle East and China. We will probably see demands for an even greater geopolitical premium than before for investments in emerging countries. I believe these two factors will make industrialized countries comparatively more appealing to investors.

What could stop the economic recovery in industrialized countries? The most likely cause is an excessive upturn in long-term interest rates. A sharp upturn could happen if fears about inflation emerge and investors decide that the Fed is behind the curve in hiking rates. If investors view this as a negative interest rate increase, the higher rates would provide an excuse for a downward stock market correction. But the present situation is precisely the opposite of what I have just described. The view that the increasing cost of crude oil is having the effect of deflation will probably bring down long-term interest rates. Furthermore, central banks of the world now have ample resources to take actions as required. This is why the investors should continue to use risk-on trades in the current economic climate.