Jan 22, 2010

Strategy Bulletin Vol.3

Dark clouds loom for risk-takers

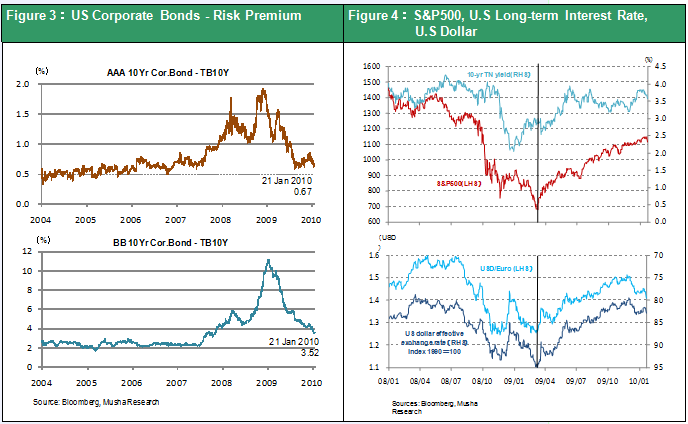

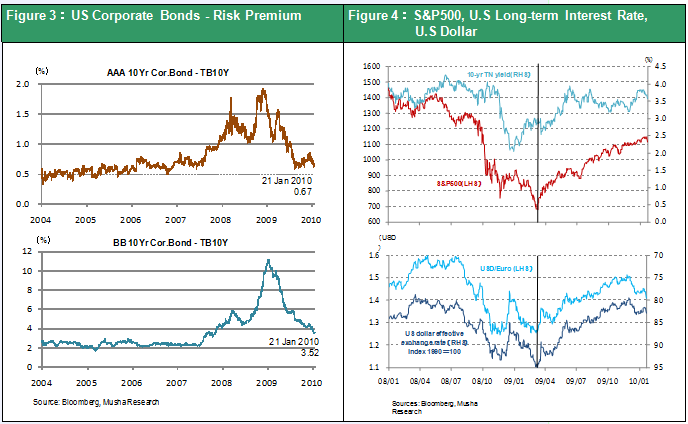

Criticism of financial institutions grows as possible revisions to the financial system emerge.

The breathtaking rally in global debt and stock markets that began last March is starting to encounter serious roadblocks. The UK is proposing a special tax on the large bonuses that have been doled out by financial institutions. The US is also considering a special tax on financial institutions. Yesterday we heard a US proposal for a law to reform the financial system that is nothing less than an effective restoration of the Glass-Steagall Act. All of these developments may signal the end of the recent period of risk-taking that drove prices of stocks and bonds higher month after month.

The Obama administration has announced reforms that, if enacted, would seriously impede investment banking operations on a global scale. Among the proposed reforms are measures to (1) prevent banks from proprietary trading, (2) prohibit banks from investing in or sponsoring a hedge fund or private equity fund; and (3) impose limits on the size of banks (10% limit on the share of deposits). Regulatory hawks clearly played a major role in coming up with these ideas. Collectively, these actions would fundamentally redefine the playing field for the financial sector. In this context, the defeat of the Democratic senate candidate in Massachusetts may be very significant. The reason is that the Obama administration could respond to this loss by urging the adoption of measures that punish banks in order to please the public.

In response to the financial crisis, central banks did everything possible to allow banks to return to profitability, bolster their equity and start adding risk to their balance sheets once again. What we are witnessing now is the end of this “benevolent period of protectionism.” The hike by China’s central bank in the deposit reserve ratio reinforced the growing negative sentiment about risk-taking by financial institutions. Many concerns remain: the direction of the debate about financial system reforms; how to bring an end to the current period of extreme monetary easing; and the outcome of widespread criticism about high bonuses and risk-taking at banks.

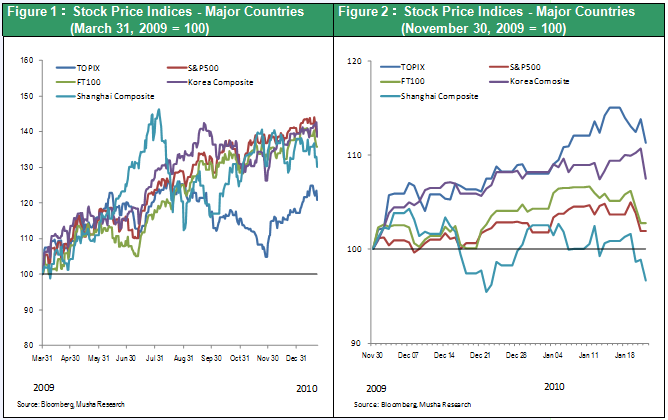

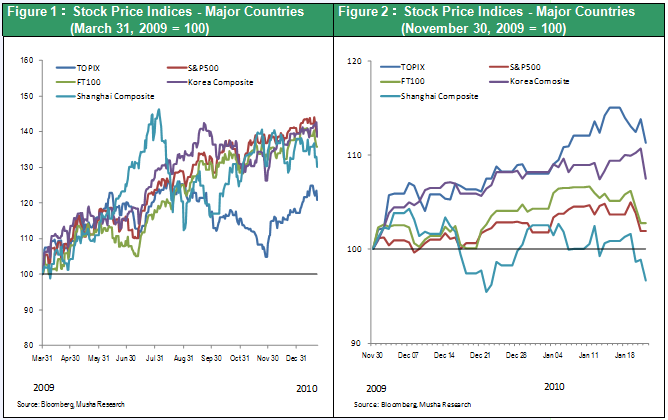

The worldwide stock rally fueled by low interest rates may be finally starting to wind down. On the positive side, both the US economy and earnings of US companies are improving steadily. Sooner or later, strong earnings may replace low interest rates as the force that pushes stock prices even higher. Moreover, Japanese stocks are likely to benefit from several factors. First, stocks in Japan have fallen behind the global easy-money rally more than in any other country. Second, stocks in Japan are extremely sensitive to the ups and downs of the global economy. That means Japanese stocks are well positioned to benefit from the upcoming earnings-driven rally. Third, if there is a continuation in the global trend toward more risk taking, the yen will most likely replace the dollar as the currency of choice for the carry trade. The result would be a decline in the yen’s value, which is good news for Japanese stocks. For these and other reasons, I believe that the performance of stocks in Japan will be comparatively strong from now on.

The worldwide stock rally fueled by low interest rates may be finally starting to wind down. On the positive side, both the US economy and earnings of US companies are improving steadily. Sooner or later, strong earnings may replace low interest rates as the force that pushes stock prices even higher. Moreover, Japanese stocks are likely to benefit from several factors. First, stocks in Japan have fallen behind the global easy-money rally more than in any other country. Second, stocks in Japan are extremely sensitive to the ups and downs of the global economy. That means Japanese stocks are well positioned to benefit from the upcoming earnings-driven rally. Third, if there is a continuation in the global trend toward more risk taking, the yen will most likely replace the dollar as the currency of choice for the carry trade. The result would be a decline in the yen’s value, which is good news for Japanese stocks. For these and other reasons, I believe that the performance of stocks in Japan will be comparatively strong from now on.

The worldwide stock rally fueled by low interest rates may be finally starting to wind down. On the positive side, both the US economy and earnings of US companies are improving steadily. Sooner or later, strong earnings may replace low interest rates as the force that pushes stock prices even higher. Moreover, Japanese stocks are likely to benefit from several factors. First, stocks in Japan have fallen behind the global easy-money rally more than in any other country. Second, stocks in Japan are extremely sensitive to the ups and downs of the global economy. That means Japanese stocks are well positioned to benefit from the upcoming earnings-driven rally. Third, if there is a continuation in the global trend toward more risk taking, the yen will most likely replace the dollar as the currency of choice for the carry trade. The result would be a decline in the yen’s value, which is good news for Japanese stocks. For these and other reasons, I believe that the performance of stocks in Japan will be comparatively strong from now on.

The worldwide stock rally fueled by low interest rates may be finally starting to wind down. On the positive side, both the US economy and earnings of US companies are improving steadily. Sooner or later, strong earnings may replace low interest rates as the force that pushes stock prices even higher. Moreover, Japanese stocks are likely to benefit from several factors. First, stocks in Japan have fallen behind the global easy-money rally more than in any other country. Second, stocks in Japan are extremely sensitive to the ups and downs of the global economy. That means Japanese stocks are well positioned to benefit from the upcoming earnings-driven rally. Third, if there is a continuation in the global trend toward more risk taking, the yen will most likely replace the dollar as the currency of choice for the carry trade. The result would be a decline in the yen’s value, which is good news for Japanese stocks. For these and other reasons, I believe that the performance of stocks in Japan will be comparatively strong from now on.