Feb 17, 2025

Strategy Bulletin Vol.373

Disagreement with the Commentaries on BOJ’s” Review of Large-Scale Monetary Easing”

Strategy Bulletin (No. 373)

Disagreement with the Commentaries on BOJ’s” Review of Large-Scale Monetary Easing”

A Chorus of Critics of Large-Scale Monetary Easing

At the end of last year, the Bank of Japan published “Review of Monetary Policy from a Broad Perspective” and many economists have been discussing the issue based on this review. The Nikkei Shimbun, Asahi Shimbun, and other media outlets also covered the review in major articles. The main point of contention was the criticism that the 2% inflation target was not only unachievable, but also produced too many side effects (e.g., crowding out of market functions and loosening of fiscal discipline).

The Key to Judgment is How to Evaluate the Adverse Effects of Deflation

However, as Tsutomu Watanabe, a professor at the University of Tokyo, points out, it is meaningless to discuss only prescriptions without analyzing the extent of the adverse effects of chronic deflation. In fact, Hiroshi Yoshikawa, Professor Emeritus of the University of Tokyo, dismisses “all large-scale easing as a mistake,” but his rationale is that mild deflation is not a threat. Based on the premise that “Mild deflation has no noticeable adverse effect on the real economy, as seen in 19th century Britain” (Asahi Shimbun, 1/11), his straightforward conclusion that the current monetary easing will cause only harm, not benefit, appears to be a clean one.

In 2011, Japanese capitalism was on the verge of collapse

From the point of view of the author, who has been analyzing the historic experiment of Large-Scale Monetary Easing as a living witness, the argument that deflation is acceptable, like Mr. Kikkawa's, is contrary to historical facts. In the process from the GFC to the Great East Japan Earthquake, Japan was facing the crisis of capitalism's collapse. Deflation progressed along with the appreciation of the yen, and the earning power of companies fell to the ground, tormented by the so-called six-fold crisis (appreciation of the yen, high corporate taxes, high electricity prices, labor regulations, environmental regulations, and EPA delays), resulting in a dramatic decline in competitiveness. The ability of companies to create value was in a catastrophic state. The electronics industry, once Japan's flourishing industry, went bankrupt one after another. In 2012, Japan's remaining semiconductor industry ally, Elpida Memory, collapsed and was acquired by U.S.-based Micron Technology. Had this trend continued, Japan's high-tech manufacturing industry would have been destroyed a little more than a decade later. Today, however, Japan's high-tech manufacturing industry is undergoing a dramatic revival. This is because the U.S., which has been in a frenzy to attack Japan, has sought semiconductor cooperation with Japan as part of its strategy to suppress China. The great headwind has turned into a great tailwind, all the gears are turning in the right direction, and we are entering a virtuous cycle of semiconductor industry investment in Kumamoto, Chitose Hokkaido and others.

The Japan-US semiconductor cooperation statement at the Suga-Biden meeting in April 2021 have initiated all following developments. The following month, Abe, Aso, and Amari called for the establishment of the LDP's semiconductor parliamentary group. In October 2021 TSMC, the most advanced semiconductor company in the world, decided

the entry into Kumamoto, and Japanese government promised 470-billion-yen subsidy on the project. The cutting-edge semiconductor manufacturing company Rapidus was also established with the provision of IBM technology.

Extraordinary monetary easing has rebuilt the earning power of Japanese companies

In the ten years between despair in 2011 and the US request for semiconductor cooperation in 2021, Japan's industrial environment changed radically, and the foundations for Japan's revival were being laid. This was led by Abenomics and the extraordinary monetary easing. If Japanese economy had continued its decline during last decade Japan would have been unable to respond to any U.S. requests when the U.S. asked U.S.-Japan semiconductor cooperation, since Japan's high-tech industrial base would have been destroyed.

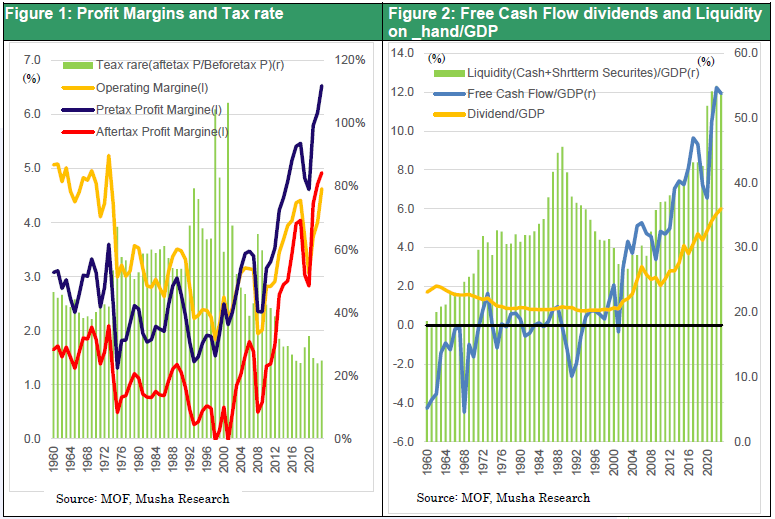

Dramatic Improvement in Profitability

I would like to share with you a couple of facts about how things have changed in Japan over the past decade. First, corporate profitability has dramatically improved. While the operating profit margin has not changed much, the recurring profit margin has improved significantly due to the contribution of overseas earnings and financial income, and the after-tax profit margin has improved markedly due to a significant decrease in the effective tax rate. The after-tax return on sales of corporate enterprises has risen sharply, from less than 1% in 2010 to 5%. This rapid increase in the ability of corporations to create value was the result of Abenomics and the extraordinary monetary easing.

Figure 1: Return on Sales and Effective Tax Rate

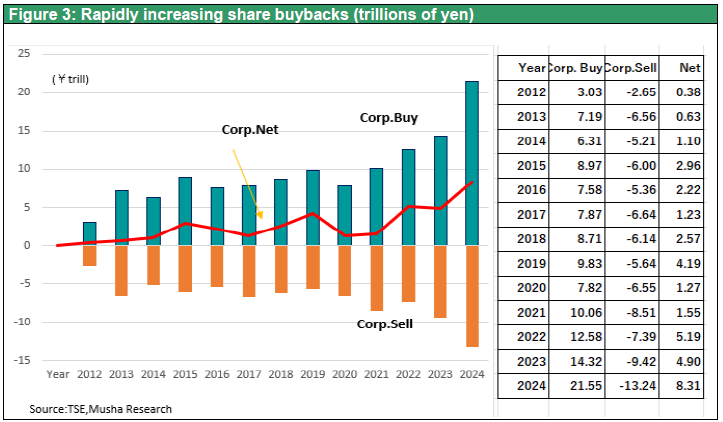

Figure 2: Free Cash Flows, Dividends, and Liquidity on Hand Ratio of Corporations (excluding financial) to GDP

Corporate Surplus Unprecedented

Second, corporate cash surpluses have increased significantly: corporate free cash flow (net income + depreciation - capital expenditures) as a percentage of GDP was almost zero until 2000, but has risen sharply since then, reaching an elevated level of 12% in 2023. Liquidity on hand (cash + short-term debt securities) in the corporate sector rose from 160 trillion yen, or 30% of GDP, in 2000 to 321 trillion yen, or 54% of GDP, in 2023.

Surge in Payouts from Corporations

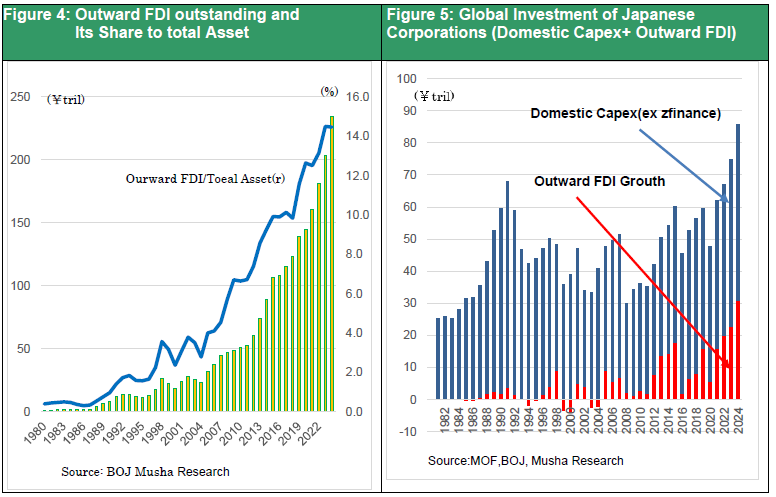

Third, payouts from corporations have increased significantly. The ratio of dividends to nominal GDP in the corporate statistics jumped from 0.9% in 2000 to 6% in 2023. Share buybacks also surged. Stock purchases by corporations are growing rapidly: 12.6 trillion yen in 2022, 14.3 trillion yen in 2023, and 21.6 trillion yen (3.5% of GDP) in 2024.

Figure 3: Rapidly Increasing Share Buybacks (trillions of yen)

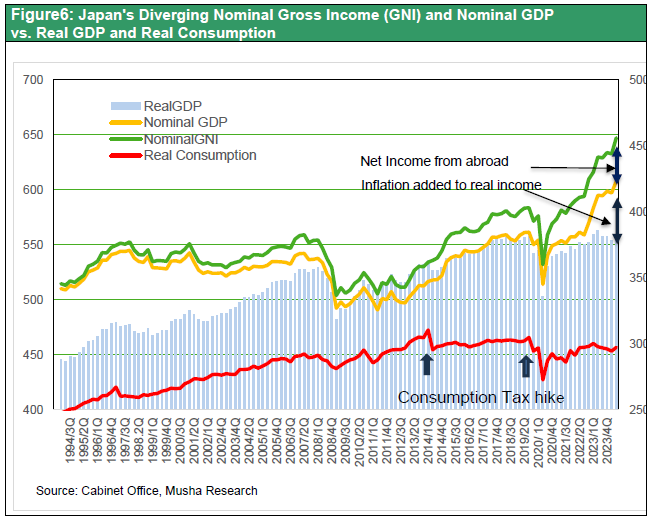

Japanese Corporations Enter the Era of Great Global Investment

Fourth, Japanese companies are experiencing a global investment boom. Outstanding of outward direct investment by Japanese firms has surged from 18 trillion yen in 2000 and 51 trillion yen in 2010 to 234 trillion yen by the end of 2024. The increase during this period has been rapid: 16 trillion yen in 2021, 20 trillion yen in 2022, 23 trillion yen in 2023, and 31 trillion yen in 2024. Adding corporate capex from the MOF’s corporate business statistics to this growth of outward direct investment, it is clear that we are entering an era of great global investment.(Figure 5) This is the reason why Prime Minister Ishiba promised President Trump to raise investment in the U.S. from 780 billion dollars in 2023 to 1 trillion dollars over the years.

Figure 4: Rapidly Growing Outstanding Direct Investment abroad and Overseas Direct Investment to Total Assets Ratio

Figure 5: Global Investment by Japanese Firms (Domestic Capital Investment +Increase in Overseas Direct Investment)

Household Consumption Left Behind

Fifth, household consumption has been sacrificed. Looking back at real personal consumption expenditure, it peaked at ¥310 trillion in the January-March 2014 period just before the consumption tax hike (5➡8%) in March 2014 and has never exceeded that level since. Personal consumption has been hit hard by 1) wage restraint under the strong yen and deflation, 2) consumption tax hikes and social insurance premium hikes, and 3) real income declines due to inflation.

Figure 6: Japan's GNI, nominal GDP, real GDP, and real consumption

The key to stimulating households' willingness to consume

Fortunately, Japan's industrial decline has been stopped just short of a crisis, but household consumption continues to weaken, and an inflationary virtuous cycle has not yet been achieved. The BOJ should focus its efforts on policies that will return corporate surpluses to the households left behind.

We do not believe there is any validity to the argument made by some BOJ staff that higher interest rates are necessary to deal with the decline in real income caused by inflation. A rate hike would clearly be counterproductive to raising wages for two reasons: (1) it would suppress aggregate demand, and (2) a stronger yen would increase relative Japanese wages in the international perspective and reduce the pressure to raise wages.

A repeat of last year's Ueda shock is unacceptable.