Nov 15, 2024

Strategy Bulletin Vol.369

The Overlooked Historical and Economic Significance of Trump's Appearance

The U.S. presidential election was decided with a lot of question marks. Trump won in the second-highest turnout in the postwar era. The victory of the Trump-led Republican Party in both the Senate and House of Representatives elections, as well as in the vote count, gave Trump a significant policy platform.

The fact that Trump, who emerged eight years ago as a frothy candidate, defied the expectations of most media and pundits and narrowly defeated Clinton was a surprise, but in the eight years that followed, the damage to Trump’s image became even more severe.

He is mired in scandal, has ongoing four criminal prosecutions, and until a year ago was considered unlikely to even run for president. In the last presidential election in 2020, he refused to acknowledge Biden's victory as “stolen” and was the instigator of disturbance that angry crowds invaded Capitol Hill resulted in a fatality. The Democrats' claim that “Trump is the enemy of democracy, and if Trump wins, it will be the end of democracy” seemed convincing enough. What did voters give credence to in this maligned Trump?

The American electorate chose Trump even though his character and democratic manners were highly questionable. It is hard not to think that they saw such great merit in him. That is nothing other than policy. People overwhelmingly supported Trump’s policy. It must be because they hoped that his promise of “MAGA, making America great again” and his vision of “a golden age for America” in his victory speech were not big words, but something that could be realized. In fact, stock prices have continued to reach all-time highs since the election.

Trump nominated Elon Musk to head the Department of Government Efficiency (DOGE), which has no organization or building, but Musk will take charge of the existing government agency, the Office of Management and Budget (OMB), to make the government more efficient and cut its budget. Mr. Mask says he can cut $2 trillion, but it is unlikely that he will go that far.

What cannot be ignored is that Mr. Mask has a record: He bought Twitter in 2021 and cut 80% of its workforce. He did this not by prolonging the working hours, but by streamlining operations and using new technology. He may believe that the same can be done in the government sector.

Certainly, the advances in AI are astounding, and if we equip ourselves with the latest technology, incredible efficiency will be possible. What stands in the way are vested interests and old practices. These vested interests include human rights, protection of minorities, and other entities that wear liberal garb, recognizing that the very pretext of DEI (Diversity, Equality, and Inclusion) is an impediment to economic development.

Such restructuring will not only reduce costs but will also increase the efficiency and speed of operations and will be the most key factor in determining competitiveness.

If the U.S., the least regulated, the most innovative, with the most fluid labor and capital even at present, becomes more efficient, it will be a frightening prospect for competitors. There is ample technical and economic justification for Trump and Musk's insistence on deregulation and overthrowing vested interests.

The thoroughly anti-authoritarian, self-reliant, pioneering spirit shared by Mr. Trump and Mr. Musk has appeared many times in U.S. history to steer the economic and social course, such as President A. Jackson in the 1820s and President Ronald Reagan in 1980. They were realists and believers in power. The slogan shared by Mr. Trump and Mr. Musk, “The majority opinion is created by one person with courage,” is also a quote from President Jackson.

Nikkei commentator Atsushi Nakayama notes that Trump and Musk share the ideology of Ayn Rand, a leading advocate of libertarianism, which is thoroughly averse to regulation. Ayn Rand was an exile from the former Soviet Union during the turbulent times, and her message was that “regulations and mediocrity kill talented people,” writing a novel Atlas Shrugged in which “a handful of talented people can sustain the world and bring prosperity and happiness to the people.” It is said that there is a surprising amount of businesspeople in the United States, including Greenspan, who was chairman of the Federal Reserve Board (FRB), who support her worldview. The idea at the bottom of the novel is libertarianism, which thoroughly abhors regulation. (Nikkei 11.14.24)

The 2024 Nobel Prize in Economics was awarded to Professor Daron Acemoglu MIT and two others for bringing history and institutional analysis into the realm of economics. Professor Acemoglu said, “Countries with a political economy system that includes protection of private property, equality of opportunity, and a free-market economy are the ones that can generate innovation and achieve prosperity. Authoritarian political systems are not conducive to long-term growth because they nip creative destruction in the bud. Societies with poor rule of law and systems that exploit the people continue to privilege the rulers and enslave the people. Even if changes that appear to be reforms occur, the rulers are replaced and stagnation continues,” he argues. This is why deregulation and the elimination of vested interests to maintain equal opportunity are essential. According to his theory, the ecosystem of U.S. capitalism has evolved through the unique DNA of the U.S. and tireless reforms. Trump's and Mask's advocacy of deregulation and the elimination of vested interests is rooted in the origins of U.S. capitalism. In this light, the prospect of “MAGA, making America great again” and “America's golden age” becomes a reality.

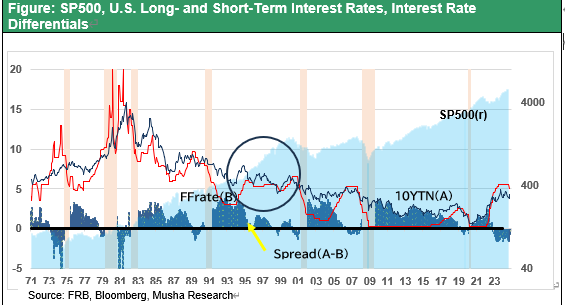

Turning to the stock market, the current situation resembles 1995 in many respects: 1995 was the starting point of the upswing that led to the IT bubble of 2000, after the irrational exuberance of December 1996 (Chairman Greenspan). Similarities include: 1) high real interest rates were maintained after the end of interest rate hikes, 2) long-term interest rates were also suppressed and the yield curve flattened for a prolonged period, 3) the dollar continued to appreciate, and 4) technological innovation (then the Internet revolution, now the AI revolution) drove vigorous investment. We would like to note the upside potential for U.S. equities in 2025.