Nov 13, 2024

Strategy Bulletin Vol.368

Trump's 2025, Heading to the Bubble

~ U.S. Capitalism Continues to Evolve ~

(1) What Trump's Victory Means

The Trump-led Republican Party have secured a triple-red presidential victory over the House and Senate. It was surprising that Trump beaten Clinton by a narrow margin after emerging as a frothy candidate in 2016, defying the expectations of most media and pundits. What does it tell us that eight years later, Trump, who has become even more damning image, won a landslide victory?

Rather than viewing this as a victory for conservatism in an ideological conflict, we need to look at it as part of the evolution of U.S. capitalism.

The 2024 Nobel Prize in Economics was awarded to Professor Daron Acemoglu of MIT and two others for bringing history and institutional analysis into the realm of economics. Professor Acemoglu said, “Countries with political and economic structures such as private property protection, equality of opportunity, and free market economies are the ones that can generate innovation and achieve prosperity. Authoritarian political systems are not conducive to long-term growth because they nip creative destruction in the bud. Societies with poor rules of law and systems that exploit the people continue to privilege the rulers and depress the people. Even if changes that appear to be reforms occur, the rulers will be replaced by another one and stagnation will continue,” he argues. This is why deregulation and the elimination of vested interests to maintain equal opportunity are essential. According to his theory, the ecosystem of U.S. capitalism has evolved through the unique DNA of the U.S. and tireless reforms. Trump's and Musk's insistence on deregulation and the elimination of vested interests can be seen as the reemergence of “anti-intellectualism (or anti-authoritarianism)” (Anri Morimoto), which is at the root of U.S. capitalism. A・ Jackson (1829-1837), the seventh president of the United States, whom Trump and Elon Musk respect, was the embodiment of anti-intellectualism (=authoritarianism), full of pioneering spirit and self-reliance. The slogan shared by Trump and Musk, “The majority opinion is created by the courageous one,” is also a quote from President Jackson.

In this context, we should consider the possibility that Mr. Trump's policies will possibly be successful. The words of Mr. Trump in his victory speech, “A golden age of the United States is coming,” cannot be dismissed as grandiose words.

(2) Similarities with 1995, high interest rates and animal spirits

President Trump, who won overwhelming confidence in the election and gained powerful executive power, may cultivate the soil for a new industrial revolution such as AI through deregulation and elimination of vested interests. If such expectations rise, 2025 will be a year of great upswing. Looking back at the past, the year 1995 bears a striking resemblance to today.

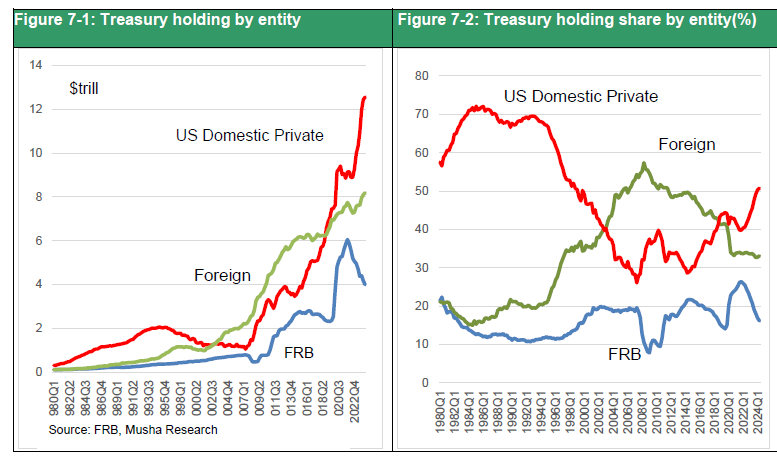

The SP500 index rose 13% in one year, 70% in two years, and 99% in three years from July 1995, when the first interest rate cut was implemented. Similarities between then and now include: 1) real interest rates remained high after the rate hikes ended, 2) long-term interest rates remained subdued and the yield curve flattened over time, 3) the dollar continued to appreciate, and 4) technological innovation (then the Internet revolution, now the AI revolution) drove strong investment. Figure 1.

Figure 1: SP500, U.S. Long- and Short-Term Interest Rates and Interest Rate Differentials

Why did the economy continue to boom despite the sharp rate hikes and high real interest rates? The reason may be that the economy's fundamental temperature (i.e., ground strength) was rising, and if the FF rate has not being kept high, asset prices and inflation would have risen sharply. In other words, the purpose of raising interest rates was a precautionary increase to prevent overheating.

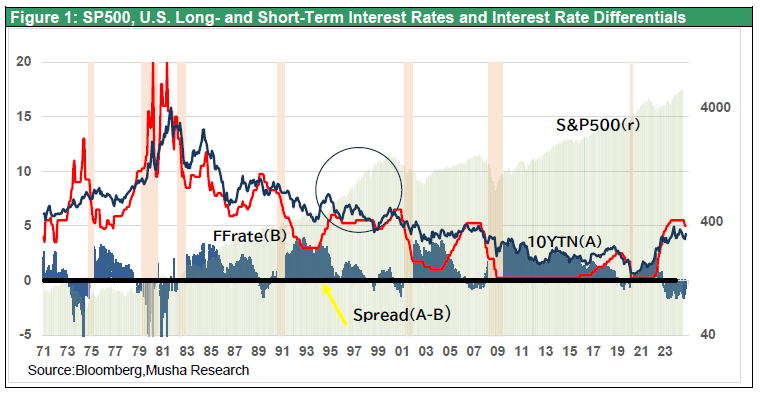

This situation can be observed through the rapid change in the natural rate of interest (the real neutral interest rate). The growth rate at which maximum employment can be achieved while inflation is controlled is the potential growth rate. The optimal rate at which this potential growth rate can be realized is called the natural rate of interest, and the Fed guides the level of interest rates toward this rate. If people become overly bullish and fears of asset bubbles and economic overheating increase, the Fed will need to raise the FF rate significantly to apply the brakes. In the past, the natural rate of interest, or the interest rate that the central bank should aim for, fluctuated widely. This is clearly observed in Figure 2, which shows the trend of the potential growth rate and the natural rate of interest as estimated by the New York Federal Reserve Bank. At that time, the U.S. was enjoying the dividends of peace after the end of the Cold War and reigned as the world's sole superpower, while the restructuring of the 1980s was over and the IT revolution was underway.

Figure 2: U.S. Natural Rate of Interest and Potential Growth Rate Trends (NY Fed calculations)

(3) Why high interest rates do not stall the economy

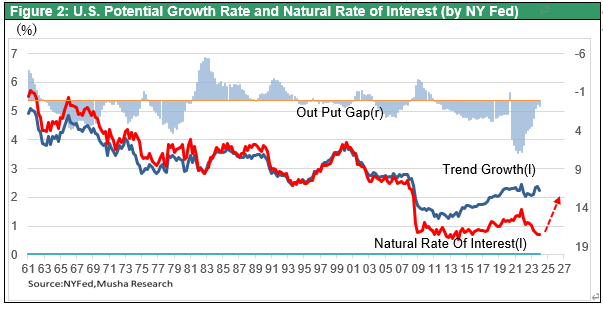

The U.S. natural rate of interest is rising as rapidly today as it did in 1995. Looking back at Figure3, the real FF rate, which serves as a rough guide to the natural rate of interest, it is noteworthy that it has risen sharply since around 1995. This real FF rate averaged 1.5% for 228 months from 1990 to 2008 but fell sharply to -1.25% for the 188-month period from 2009 to August 2024. The level of the real neutral interest rate changed dramatically after the GFC. This can be interpreted as the fact that risk-takers, having learned their lesson, no longer reacted at all no matter how much the FF rate was lowered. However, the situation has changed dramatically since 2023, and the real FF rate is once again significantly positive.

Figure 3: Trends in the U.S. real FF rate

Again, as in 1995, the sharp rate hike (525 bp in the first 18 months after 2022) did not cause an economic slowdown at all. There are three transmission channels through which an increase in interest rates can lead to a reduction in aggregate demand, which in turn leads to a slowdown in the economy and thus to subdued inflation: 1) banks curbing corporate lending, 2) banks curbing personal loans such as housing, and 3) an increase in the cost of funds and speculators' funds, which in turn leads to lower asset prices. However, 1) did not work because companies are now significantly less dependent on bank loans, and 2) the increase in borrowing costs was offset to some extent by the continued rise in rents and housing prices due to the tight housing supply-demand situation. 3), which should have had the greatest impact, was hardly affected by the interest rate hike. The rising animal spirits of investors offset the negative impact of the interest rate hike. Even if the cost of funds rises, if people become more bullish, they can maintain their investments at a reduced risk premium, and asset prices can rise. This rising animal spirit that offset higher interest rates was the main reason asset prices remained elevated and continued to support aggregate demand even under higher interest rates.

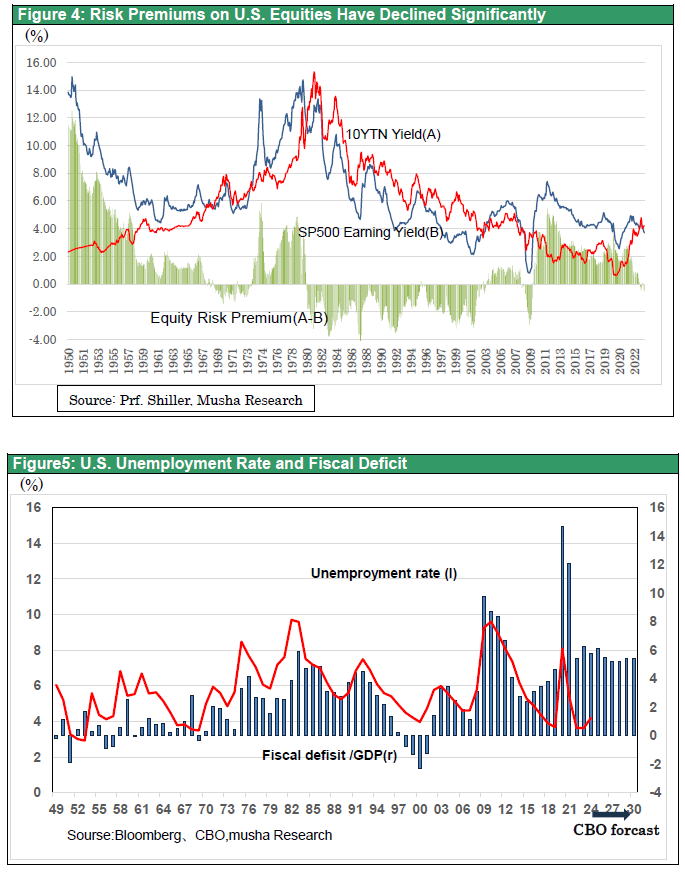

If interest rates had not been raised, inflation would have been much higher due to rising asset prices and an overheated economy. The fact that people have become more bullish is clearly reflected in the sharp decline in the equity risk premium (i.e., valuations have increased significantly) (see Figure 4).

The close correlation between the real FF interest rate and the equity risk premium, as mentioned above, can be seen in Figure 4.

Figure 4: Equity Risk Premium (≈Equity Yield - JGB Yield)

Four factors have been pointed out as contributing to people's growing bullish bias:

1) the AI/internet industrial revolution (innovation and higher profits),

2) the virtuous cycle of equity capitalism,

3) demand creation through fiscal stimulus, and

4) the internalization of (strengthening the U.S. economy through external debt and benefiting from the strong dollar).

The increase in people's confidence due to these structural factors seems to have much in common with the situation in 1995. As was the case then, the U.S. appears to be creating the conditions for a higher potential growth rate and higher long-term stock prices.

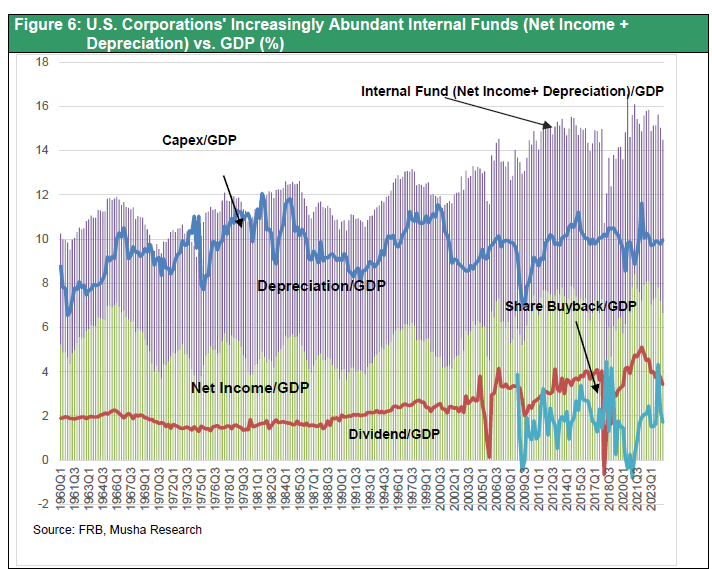

Figure 5: Fiscal Deficit (% of GDP) and Unemployment Rate

(4) Challenges and Risks for the U.S. Economy under the Trump Administration

The top economic priority for the U.S. today is the creation of new jobs. The AI revolution has increased corporate profits and accumulated savings (Figure 6). From the 1960s to the 1990s, corporate internal funds (net income plus depreciation) hovered between 10 and 12% of GDP. More recently, it has been hovering between 14% and 16%. There are three channels for redistributing this increased corporate surplus into new demand and employment: 1) income redistribution and demand creation by the government, 2) income return and demand creation by the stock market, and 3) raising the labor share.

Figure 6: U.S. Corporations' Increasingly Abundant Internal Funds (Net Income + Depreciation) vs. GDP

What is developing there is a high-pressure economic policy. By maintaining high demand pressure and tight labor supply and demand, employment and wages must be raised, and household income must be secured. This requires expansionary fiscal policy, rising stock prices, home prices, and other asset prices, and maintaining favorable terms of trade with a strong dollar. Trump's economic policies will be aligned with those objectives.

The risk would be that a spike in interest rates would derail growth and stock market appreciation. An overheated economy would lead to inflation and bubbles, which would lead to a market revolt called a spike in long-term interest rates. This will take away the demand-creating power of fiscal policy in the form of higher interest payment costs. Prudence is required in the management of monetary policy.

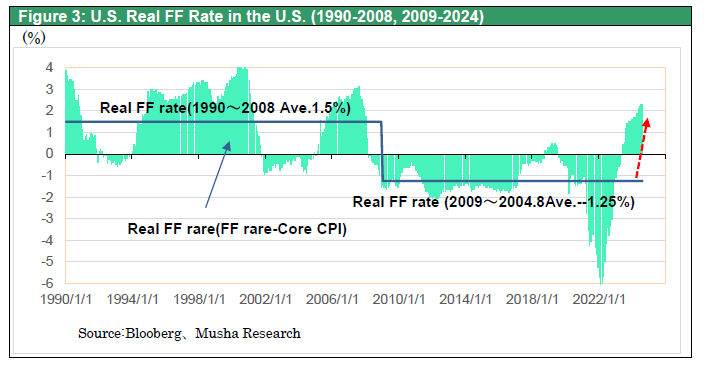

However, the good news is that long-term interest rates in the U.S. have not risen very much, despite a mountain of negative factors, including 1) a sharp increase in interest rates, 2) QT (quantitative tightening), 3) a large increase in the budget deficit, and 4) a large deficit in the external balance of payments. The first reason is that domestic investors are investing heavily in government bonds. As seen in Figure7 domestic private-sector investment is surging while the Fed and foreign investors, who have been the buyers to date, are selling. In addition to the increase in corporate savings, some of the funds enriched by the substantial rise in asset prices have shifted to U.S. Treasuries, which now carry higher interest rates. The second reason is that confidence in the Fed and in the U.S., dollar has been maintained. The Fed's ability to weather the pandemic and subsequent rate hikes without causing an economic recession has provided a sense of security to markets. Unless the Fed makes a mistake, a spike in U.S. interest rates in the near future can be avoided.

Figure 7: U.S. government bond holdings by entity