Sep 20, 2024

Strategy Bulletin Vol.364

If Ms. Takaichi would become LDP President, She will revive the Abenomics bull market

Takaichi has a commanding lead in key economic policies

The LDP presidential election (September 27), which will effectively decide Japan's next prime minister, is just a week away. This is the first presidential election since the dissolution of the factions, and with nine candidates running, it is a very crowded race. Although the public does not have the right to vote, the election has triggered a national policy debate involving the Internet and social networking services.

It is almost certain that none of the candidates will win a majority of the first round of voting, and that it will be a runoff between the top two candidates. However, based on various polls, the field has been narrowed down to three candidates, Ishiba, Takaichi, and Koizumi, who will remain in the runoff. In that case, the winner will be decided by which of the top two will receive the votes of party members and Diet members who supported the candidate who did not make it to the runoff. The deciding vote will consist of 367 votes from Diet members and 47 votes from prefectural representatives, so the majority of votes will be decided by which Diet member supports which candidate. And since the next LDP president is expected to call for a general election by the end of this year, it will be crucial for LDP Diet members to set an agenda that will win the next election in order to choose the president. This means that the superiority of economic policy is likely to be the deciding factor.

When we asked Chat GPT which of the three candidates who might remain in the decisive race would have the most positive effect on stock prices, we were told, “The candidate most likely to have a positive effect on stock prices is considered to be Sanae Takaichi. Her aggressive monetary easing measures and fiscal stimulus are an extension of Abenomics and could provide short-term relief to investors and boost the stock market. Shinjiro Koizumi's promotion of green policies may have a positive impact on certain sectors, but the overall market reaction is uncertain due to the risk of tighter regulations. Shigeru Ishiba's emphasis on long-term structural reforms is unlikely to lead to a short-term rise in stock prices but may have a positive impact on local economies and specific industries,” was the response. This view is shared by the majority of experts, including the author.

How to transfer enhanced earning power to households

It is surprising that Mr. Ishiba and Mr. Koizumi do not have the right answer for economic policy at a time when the Japanese economy is at a critical juncture in overcoming deflation. It can be said that both men made a big mistake at the stage of setting economic policies. If left to their own devices, the risk of a shift from the new capitalism, proactive fiscal policy, and Abenomics line of the Kishida administration to an anti-Abenomics line that prioritizes neoliberalism, fiscal consolidation, and monetary discipline will increase.

Ten years after Abenomics in 2013, Japan's battered earning power has improved significantly. Total income earned by Japanese people (nominal GNI) expanded sharply to 647 trillion yen in2Q2024, up 2.7% from 630 trillion yen in the same period last year and up 9.1% from 593 trillion yen in the same period two years ago. This is supported by the ongoing depreciation of the yen and inflation, as well as a surge in overseas profits due to the globalization of Japanese companies. Corporate profits, which are linked to nominal economic growth, increased 2.2 times, stock market capitalization increased 3.3 times, and general account tax revenues increased 1.6 times.

On the other hand, however, personal life has been left behind. Real personal consumption expenditures peaked in the January-March 2014 period just prior to the March 2014 consumption tax hike (5➡8%) and have never exceeded it in the past 10 years. How to bridge the gap between this strong corporate earnings and stock prices and weak real consumption to ensure the end of deflation and to achieve a virtuous economic cycle in which prices and wages both rise is now a crucial point.

August's Crash Warns of Premature Tightening Policy

The interest rate hike at the end of July and BOJ Governor Ueda's forward-looking monetary tightening statement triggered a shocking 25%- or 10,500-yen plunge in the Nikkei Stock Average. The following week, Deputy Governor Uchida's statement to the effect that “we do not raise interest rates at a dangerous time on purpose” brought about a sharp recovery in stock prices, clearly indicating that the sharp drop in stock prices was a warning against premature policy changes. Nevertheless, during August, Governor Ueda and Council Members Takada, Nakagawa, and Tamura all made speeches with a bias toward raising interest rates, which has increased the market's skepticism.

Japan has a bitter experience of prematurely tightening monetary and fiscal policies, which resulted in a lost decade that turned into a lost 30 years. The total market value of Japan's national wealth, including land and stocks, peaked at 3,142 trillion yen at the end of 1989 and bottomed out at 1,723 trillion yen at the end of 2002, but fell further after the GFC to 1,512 trillion yen at the end of 2011 (and has recovered remarkably to 2,410 trillion yen at the end of 2023). This double-dip recession could have been avoided if the right policies had been taken.

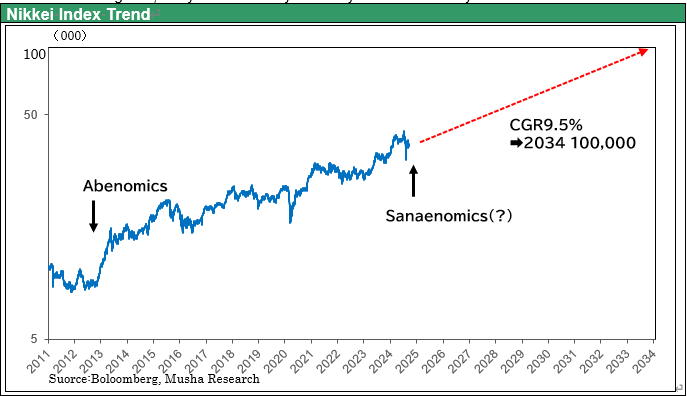

The possibility of a repeat of the Abenomics bull run, the Nikkei average of 100,000 yen in sight

If the Takaichi cabinet is formed, the BOJ will be asked to curb interest rate hikes and continue monetary easing. It will also launch an economic policy centered on a plan to support households, which are suffering from the adverse effects of real tax hikes due to inflation, and large-scale fiscal spending for growth and investment. The creation of a “high-pressure economy” in the U.S. style, where aggregate demand exceeds aggregate supply, has become Takaichi's catchphrase. This will lead to an increase in real wages through increased corporate investment and productivity growth. She will probably hold a general dissolution election before the end of the year with economic policy as the issue.

If the Takaichi cabinet is formed, the possibility of a stock price rise on a similar scale will increase. The dream of the Nikkei 225 reaching 100,000 yen in 5 to 10 years may become a reality.