Sep 16, 2024

Strategy Bulletin Vol.363

Rising U.S. real interest rates are a factor in higher stock prices and a stronger U.S. dollar

~ Expectations of interest rate cuts have gone too far~

Return to the era of high real interest rates

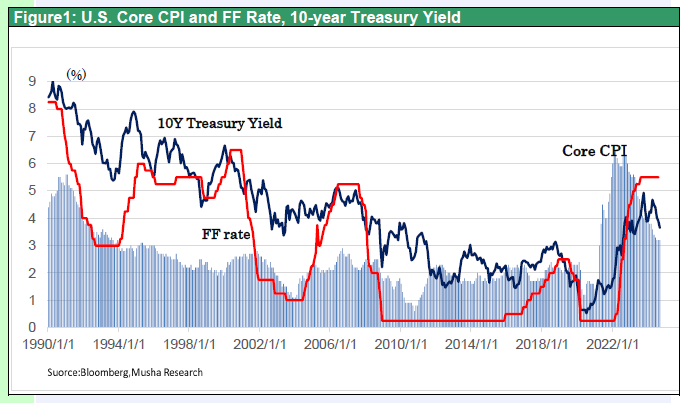

The level of interest rates, the yardstick for the U.S. economy, has undergone a dramatic shift that continues to mystify market participants. Contrary to conventional economic wisdom, neither the extreme interest rate hike of 5.25% in 18 months nor the longest and largest inversion of short- and long-term yields in the past 50 years has caused a recession.

In addition, inflation has been subdued during this period. As a result, real interest rates are remarkably high. If left unchecked, these high real interest rates could trigger a serious economic slowdown or even a financial crisis. Fears that a major interest rate cut is inevitable and that this will cause the yen to appreciate, which will hurt Japanese equities even more seriously, justify the sell-off in Japanese equities.

Figure 1: U.S. Core CPI and Long- and Short-Term Interest Rates (FF Rate, 10-year Treasury Yield)

Market Interest Rates Ahead of a Large Rate Cut

Under such an outlook, U.S. market interest rates have fallen sharply in anticipation of a rate cut: as of September 13, the 12-month FF rate futures are at 2.92%, the 2-year Treasury yield is at 3.57%, and the 10-year Treasury yield is at 3.66%. Over the course of a year, a rate cut of 250 basis points from the current 5.5% to 3% has been factored in. Such a sharp rate cut is comparable to the financial crises that occurred when the IT bubble burst (from 6.5% in December 2000 to 1.75% in December 2001) and when the GFC (from 5.25% in August 2007 to 0.25% in December 2008). The only economic rationale that could justify such a sharp interest rate cut would be a severe recession, but economists are still mostly in favor of a soft landing for the U.S. economy. If this is the case, then a large divergence exists between the economic outlook of market participants and the outlook for interest rates. Are economists overly optimistic about the economic outlook, or is the market overly confident about the prospect of interest rate cuts?

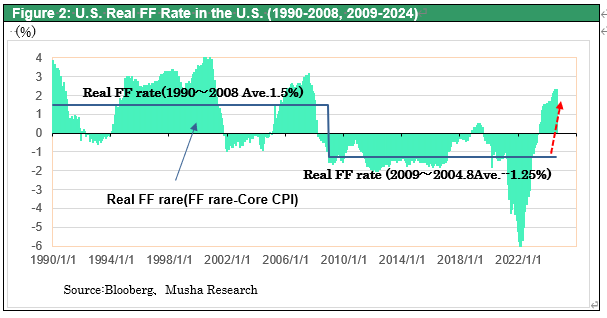

Musha Research believes that market expectations for a rate cut are overblown. The key will depend on whether the high real interest rates now reached are viewed as dangerous or not. Looking at the 188-month average since the GFC, the nominal FF rate is 1.23%, the core CPI is 2.48%, and the real FF rate is -1.25%. Considering the -1.25% real Fed rate as the neutral interest rate, we can conclude that the current situation is extremely tight monetary policy and that an immediate interest rate cut is crucial.

The Fed is beginning to expect a rise in the neutral interest rate, but it is still not enough.

The Fed is increasingly convinced that the neutral interest rate is rising and that a sharp rate cut is not necessary. According to the Summery of Economic Projections (SEP) released quarterly by FOMC members, the FF rate's terminal rate was raised from 2.5% in December 2023 to 2.6% in March 2024, and 2.8% in June 2024.

Since the inflation forecast has remained unchanged at 2.0% over this period, the terminal real FF rate has increased from 0.5% to 0.8%. Fed seems to intend to increase terminal rate further and if it is raised to 1.3%, as current real FF rate is 2.3%, which means that a 100bp rate cut would be sufficient.

Figure2: U.S. Real FF Rate in the U.S.

(1990-2008, 2009-2024)

Why has the neutral interest rate declined since the GFC?

What is the current level of real terminal FF rate, the benchmark for the neutral interest rate? Figure 2 shows that the average real FF rate for the 228-month period from 1990 to 2008 was 1.5%. However, for the 188 months from 2009 to August 2024, the average was -1.25%, a significant decline. The level of the neutral interest rate changed dramatically after the GFC. And now the real FF rate is again significantly positive.

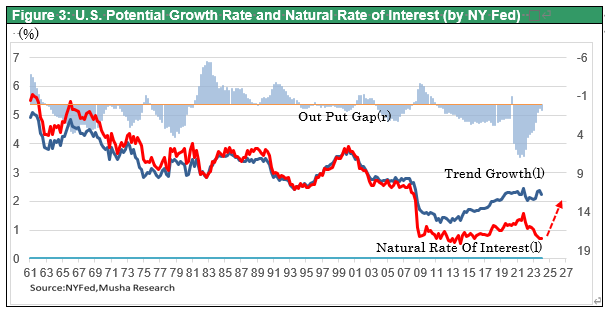

This shift in the real FF rate is consistent with the movement of the natural rate of interest, as estimated by the New York Federal Reserve Bank. Figure 3 shows that the previously perfectly consistent potential growth rate and the natural rate of interest have diverged significantly since 2009, and the natural rate of interest has remained far below the potential growth rate (≒full employment growth rate). In other words, for more than a decade, a substantial reduction in the level of interest rates was necessary to achieve full employment. Why did the natural rate of interest (≒ real neutral interest rate) decline? Many factors have been pointed out, but Musha Research believes that the following three factors are important. (1) People have become overly pessimistic and have turned backward on risk-taking, (2) uncertainty about the future has increased and demand for a high risk premium (term premium) has risen, and (3) both firms and households have reduced their demand for debt resulted in declining interest rate sensitivity .Firms have become more self-financing and households have become more reluctant to borrow money due to the aftereffects of the GFC. In addition to the above three points, the decline in the natural rate of interest is also attributed to the global decline in real interest rates due to global

saving glut, and the decline in aggregate demand due to the ag

ng of society and the decline in productivity.

Under these circumstances, QE (Quantitative Monetary Easing) was launched, asset prices were boosted, and measures to stimulate demand through channels other than interest rates were introduced.

Figure 3: U.S. Potential Growth Rate and Natural Rate of Interest (by NY Fed)

Neutral interest rates entered a dramatic upward phase.

However, it is now clear that the low-interest rate environment after the GFC has changed dramatically. First, the breakthrough of technology spread of the Internet and smartphones was followed by the AI revolution, and furthermore, people have survived the Corona pandemic without much trouble, and inflation has steadily subsided since then, which has strengthened people's optimism.

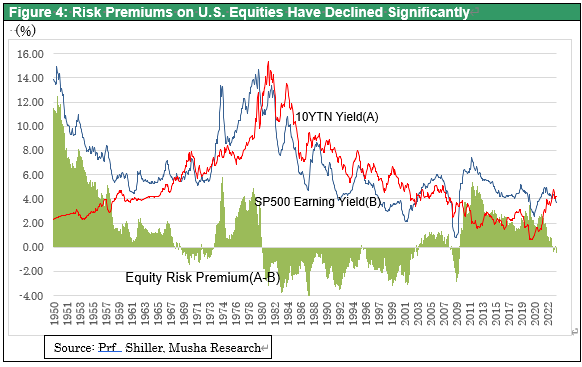

The increase in optimism can be observed with three aspects, firstly the strong appetite for capital investment, including AI-related investment, despite the large interest rate hike, secondly the increased appetite for equity investment and the sharp decline in equity risk premiums (= significantly higher valuations) (see Figure 4),

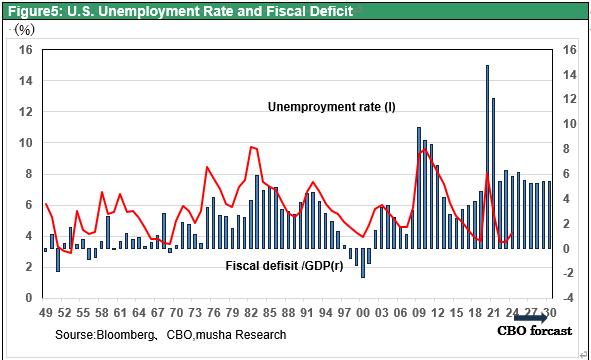

Thirdly, the economy has become established with a budget deficit as a given, with fiscal spending consistently exceeding 5% of GDP (see Figure 5) due to the 2017 Trump tax cuts, the American Rescue Plan Act ($1.9 trillion, 2021), the Chip-S Act, industrial policy by IRAs, etc.

Figure4: Risk Premiums on U.S. Equities Have Declined Significantly

Figure 5: U.S. Unemployment Rate and Fiscal Deficit

If we view the U.S. natural rate of interest (= real neutral interest rate) as having risen significantly, the Fed's interest rate cuts are likely to be limited, and interest rates are likely to remain high for an extended period. The Fed's rate cut in July 1995 after the Tequila crisis created a favorable investment environment with rising stock prices and shrinking term premiums, which is similar to the current situation.

If the cause of high real interest rates is strong fundamentals, the strong stock market and strong dollar are consistent

Nothing has happened to cause us to doubt the soft landing of the U.S. economy. First, the footsteps toward 2% inflation are solid. Also, the 4.2% unemployment rate in August remains close to full employment and does not change the view that the economy is fundamentally strong.

A recession is unlikely unless, for some reason, sentiment among investors, consumers, employers, and other economic actors deteriorates sharply. Two factors that were assumed by the market to be responsible for the deterioration in sentiment were the stock market collapse and financial instability (Black Monday-type) triggered by the Japanese interest rate hike, but neither of these was serious.

The Atlanta Fed's 3QGDPnow is steady at 2.5%. The closely watched credit risk premium rose in early August, but its level is lower than in past crises, and financial market stress has not increased at all. The stock market's volatility index (VIX) and the put-call ratio, a leading short-term bearish indicator, rose sharply in early August, but they have subsided. These fundamentally unfounded market storms can be viewed as tantrums associated with excessive deleveraging. The adjustment of overleveraging is already underway and market uncertainty is likely to improve.

Despite the uncertainty of the presidential election, the baseline remains the same, with U.S. neutral interest rates jumping significantly regardless of whether it is Ms. Harris or Mr. Trump. The U.S. 2-year and 10-year yields of 3.58% and 3.66%, respectively, factor in a 100-bp rate cut. Market interest rates in the U.S. are already considered to be in the cyclical bottom zone. If this is the case, the yen is unlikely to appreciate beyond ¥140, which is assumed based on the Japan-U.S. interest rate different