Aug 19, 2024

Strategy Bulletin Vol.362

Why High Stock Prices Can Diverge from Real-Life Experiences and Still Be Justified

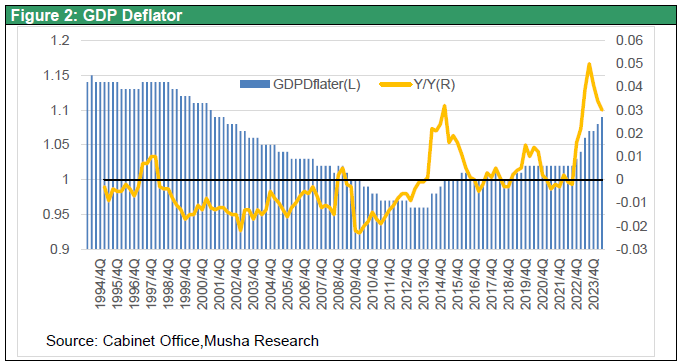

~The J-Curve Effect of a Weakening Yen Leads to an Increase in Economic Volume ~

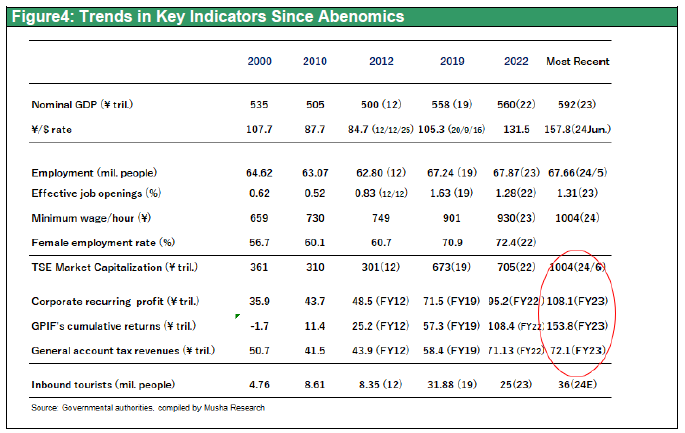

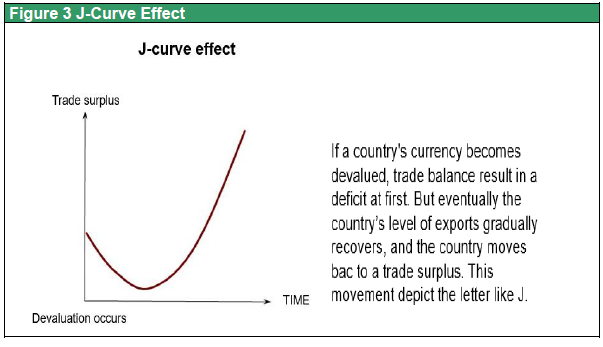

The unprecedented Nikkei 225 plunge of 7,600 yen, or 20%, in three days triggered by the Bank of Japan's interest rate hike on July 31 was followed by a sharp rise of 6,500 yen, or 20%, over the next seven days, recovering 85% of the decline. This V-shaped recovery suggests that the stock price decline was not based on fundamentals. But it is not surprising that people have been swept away by pessimism. This is because there has been trivial improvement in the living standard of the Japanese people. Figure 1 shows that real personal consumption expenditures peaked at ¥310 trillion in the January-March 2014 period, just before the consumption tax hike (5➡8%) in March 2014, and have never exceeded that level in the past 10 years. It began to recover from the ¥272 trillion in the April-June 2020 period during the pandemic, and although it rose at an annualized rate of 4.0% y-o-y in the most recent April-June 2024 period, it remains at a level 4% lower than its peak 10 years ago. During this period, corporate profits have increased 2.2-fold, stock market capitalization has increased 3.3-fold, and general account tax revenues have increased 1.6-fold, which shows how much individual life has been left behind.

Figure 1: Japan's Diverging Nominal Gross Income (GNI) and Nominal GDP vs. Real GDP and Real Consumption

According to the GDP statistics released on August 15 for the April-June period, total income earned by the Japanese people (nominal GNI) was 647 trillion yen, up 2.7% from 630 trillion yen in the same period last year and up 9.1% from 593 trillion yen in the same period two years ago, indicating a continued sharp increase. Why has nominal GNI grown so rapidly while real GDP has remained at 550 trillion yen for the past two years? First, nominal GDP expanded due to rising prices. The second reason is that the income balance surplus from abroad has increased significantly. Since corporate profits, stock prices, and tax revenues are all linked to nominal income, it is only logical that they are performing well.

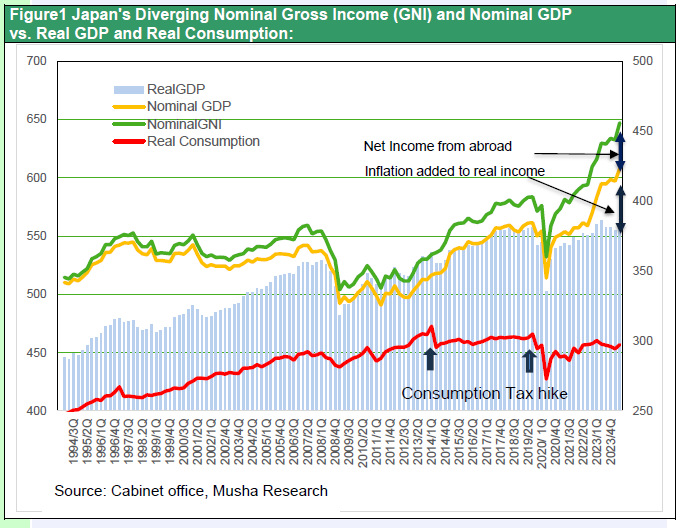

Figure 2: GDP Deflator

What will happen to the gap between these strong earnings and stock prices and weak real consumption in the future? Musha Research expects real GDP and consumption to grow at a faster rate and catch up with nominal growth.

The first reason is that Japan's economy will experience a pronounced volume boom in the second half of 2024 and beyond. The weak yen has strengthened Japan's price competitiveness, and industrial production are starting to increase. In addition, substitution of domestic production for imports, which have become expensive, has begun to occur. The weak yen has also increased inbound tourism, and foreign tourists are stimulating local domestic demand in every corner of Japan. Global demand is concentrated through various channels toward cheap Japan, stimulating the domestic economy. Companies' appetite for capital investment in Japan is growing rapidly. According to DBJ (Development Bank of Japan) survey of capital investment by large corporations in FY2024 capital investment in the manufacturing sector will increase by 24.7% and in all industries by 21.6%, the highest levels of growth ever recorded. In addition to the effect of the weak yen, the Japanese government's support for semiconductors, totaling 4 trillion yen, is entering a critical phase, and investment is booming in Kumamoto, Hokkaido, Kitakami, Hiroshima, and other areas.EV investment, which had been lagging in Japan, is rising as well. Once the yen's depreciation is firmly established, companies will be more willing to invest in the domestic market.

Figure 3 J-Curve Effect

Second, household real incomes, which were hit in the initial stages of the J-curve effect, have begun to recover. In addition to the first significant wage growth rate of 5% in 30 years, inflation has subsided. International inflation (due to energy prices and supply chain disruptions) since 2022 has completely ended and the rapid depreciation of the yen has almost run its course. In accordance with GDP deflator falling to 3.0% in April-June 2024 after rising to 5% y/y in January-March 2023 real employment compensation rose 0.8% y/y in April-June 2024, the first growth in 11 quarters since July-September 2021. Household consumption is likely to gain strength.

What Japan is experiencing today is a typical J-curve effect, in which the initial phase of the yen's depreciation has the negative effect of depriving the economy of real income due to higher import prices, but once this has run its course, the yen's depreciation makes the economy more competitive, leading to an increase in production volume, which in turn continues to boost economic growth. Japan’s relative strength will continue, as real GDP grew at an annualized rate of 3.1% in the April-June 2024 period, the highest among the G7 countries.

Figure 4: Trends in Key Indicators Since Abenomics