Aug 14, 2024

Strategy Bulletin Vol.361

Consider the possibility that the Ueda shock could be the start of a major bull market

Certain number of people were uncomfortable with the growing optimism in the U.S. and Japanese stock markets since early 2024.The sharp rise in the yen, the plunge in Japanese stocks, and the constant decline in U.S. stocks at the beginning of August served as a validation of this discomfort.

The discomfort was based on two points: (1) Japan's stock market rally was a bubble created by the Bank of Japan's mistakenly excessive monetary easing, and (2) the bubble would deflate if the BOJ stopped its excessive monetary easing policy.

However, the V-shaped recovery in stock prices (the Nikkei 225 fell 10,700-yen or25% from the peak but achieved a half-price reversal in 5 days - on a closing price basis) is revealing that the discomfort was not correct.

The selloff has made Japanese equities even more attractive. Strong corporate earnings and sharply more attractive stock valuations may provide a good buying opportunity for all investors who are feeling the risk of not owning Japanese stocks (FOMO). We would like to consider the possibility that this plunge could be the springboard for a stock price rally this fall and into next year.

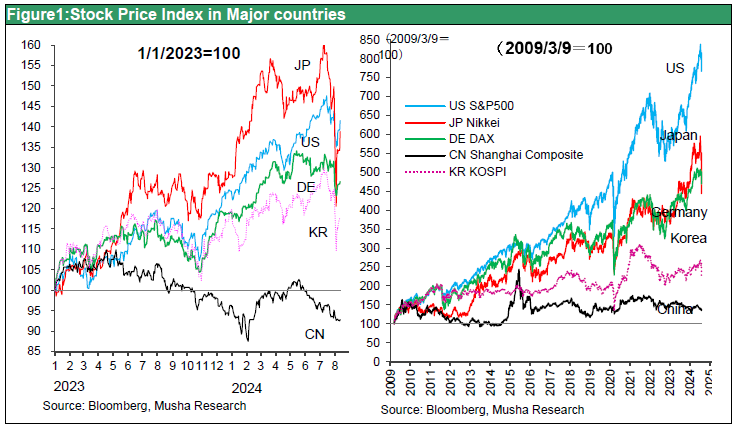

Figure 1: Stock Price Trends in Major Countries

(Ⅰ) Why is a major plunge considered to be the beginning of a bull market?

1) Premature rate hike to be sealed, The Abe-Kuroda risk-taking supportive policy maintained

The BOJ's hasty rate hike on July 31 and Governor Ueda's hawkish press conference took people by surprise and caused stock prices to plunge immediately afterward. The BOJ was reminded of the urgency of conducting market (i.e., stock price) oriented policy management. On August 7, BOJ Deputy Governor Uchida said, "We will not raise interest rates when markets are unstable. We can choose the right time (we are not in a behind the curve situation). We will not deliberately raise interest rates at a dangerous time. We can only find the neutral interest rate (the interest rate at a neutral level, neither tightening nor easing) by groping for it, and we can afford to continue seeking it over time," he said. The comments by Uchida, who is seen as the most influential person within the BOJ, made it almost certain that the BOJ will continue its supportive Abe-Kuroda risk-taking path. In the U.S., the "Greenspan put" and "Bernanke put" were frequent examples of central banks easing monetary policy to support the market when the market plunged, and Japan may be entering such an era.

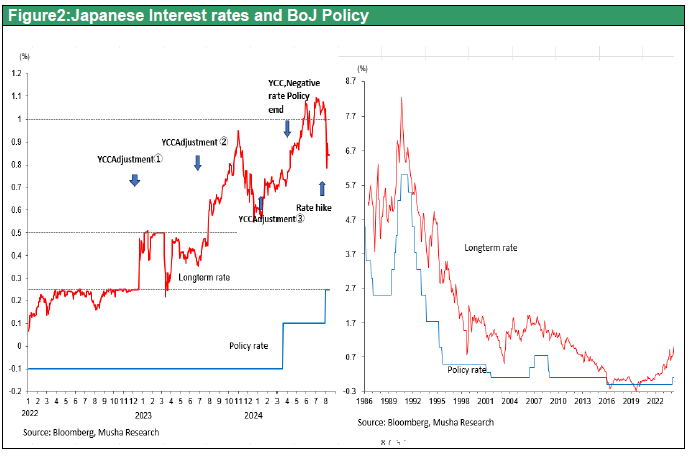

Figure 2: Changes in BOJ Policy and Long- and Short-Term Interest Rates

2) The stock market has begun to function as an umpire of policy management

The stock market plunge amidst a boom in stock investment due to the NISA program and the government-led "shift from savings to investment" program caused substantial losses for New Entry investors. Public criticism of the administration rose dramatically, and the administration suddenly found it urgent to correct the stock market decline. The Bank of Japan, the Ministry of Finance, and the Financial Services Agency held an urgent meeting on the afternoon of June 6, which led to a statement of policy revisions by BOJ Deputy Governor Uchida. In addition, it is assumed that requests for support of stock prices from the GPIF and other government-related institutional investors, coordination with the U.S. authorities, and media manipulation were conducted. This led to a V-shaped recovery in stock prices from August 6 onward.

From a historical viewpoint, we may be entering an era in which stock capitalism has finally penetrated Japan and economic policies that cause stock prices to fall will no longer be tolerated. The Ministry of Finance and the Bank of Japan, which until now have been able to implement their policies as they wish with the influence on the media and academia, can no longer defy the newly emerged referee, the market (especially the stock market).

Media, academics, and economists who are in the habit of surmising the intention of Ministry of Finance should take precautions.

3) The worst-case scenario for the U.S. economy (a marked slowdown) has been factored in

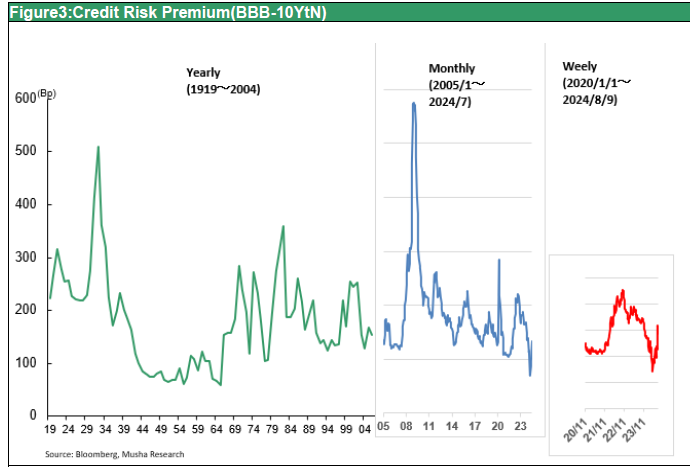

The U.S. unemployment rate is rising, stock prices are falling, and the yield on U.S. Treasuries remains below the short-term yield. However, the unemployment rate of 4.3% in July is still close to full employment, and the increase in the labor participation rate due to the increase in immigration and the hurricanes have had an impact, so the view that the economy is strong prevails. The decline in stock prices from their highs of 6.8% for the SP500 and 5.3% for the NY Dow is also in the realm of cyclical adjustment. A recession is unlikely unless there is a sudden deterioration in the sentiment of investors, consumers, employers, and other economic actors for various reason. Two factors that were assumed by the market to cause a deterioration in sentiment were the stock market slump and financial instability (Black Monday type) caused by Japan's interest rate hikes, but neither was serious (see below). The Atlanta Fed's 3QGDPnow is steady at 2.9%. The most closely watched credit risk premium rose last weekend, but its level is lower than in past crises, and financial market stress has not increased at all (see Figure 3). In this context, the stock market's VIX (Volatility Index) and the put-call ratio, a typical short-term bearish indicator, rose sharply. These market storms, which have no basis in fundamentals, can be viewed as tantrums associated with excessive deleveraging. If this is the case, the U.S. economy is strong and future U.S. interest rate cuts will be limited. The adjustment of excessive leverage has already made rapid progress, and the market turmoil is likely to subside.

Figure 3: Trends in U.S. Credit Risk Premium

4) The ceiling of the yen's appreciation has also been seen

The yen is unlikely to appreciate very much due to the following four factors. The yen will stabilize within the range of 160-145 yen.

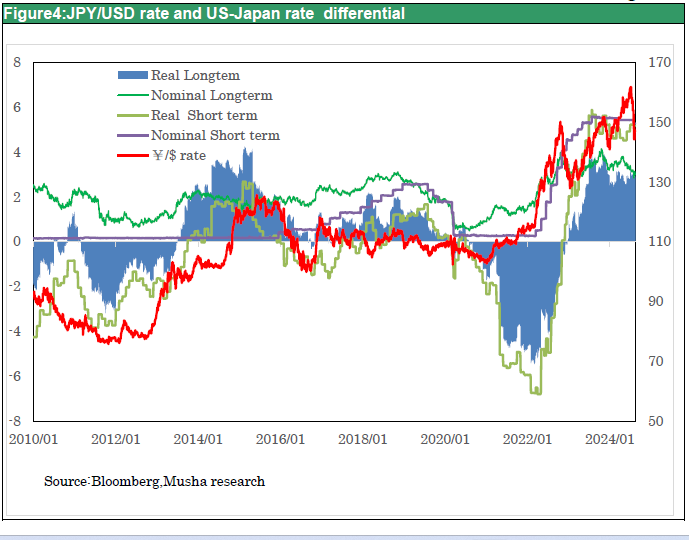

First, we do not see much of a narrowing in the Japan-U.S. interest rate differential going forward. If the BOJ is far from raising interest rates and the U.S. rate cuts are limited, the narrowing of the Japan-U.S. interest rate differential will be slow. Rather, Japan's long-term interest rates have fallen more than those in the U.S. due to Japan's falling stock prices and the BOJ's sealed interest rate hike. The narrowing of the interest rate differential has reached a lull. As shown in Figure 4, the narrowing of the interest rate differentials (in all aspects: long-term, short-term, nominal, and real) has already begun a year ago, and the Japan-U.S. interest rate differential as a factor in determining exchange rates will probably lose its importance.

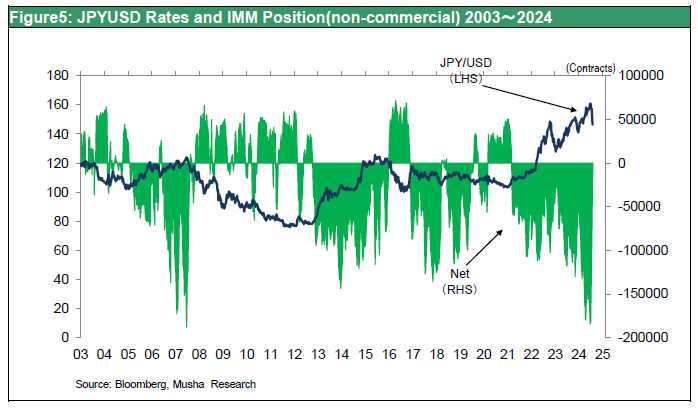

Second, speculative yen appreciation is also unlikely to continue. The IMM currency futures position on the Chicago Mercantile Exchange shows that the net short yen position, which had reached a record high of 184,000 contracts at the end of June, shrank to 11,000 contracts on August 9, less than one-tenth of its previous level, indicating that almost all speculative short yen positions have been eliminated in one month. As shown in Figure 5, net long yen positions have accumulated only during times of financial instability, such as the GFC and Greek currency crisis (2008-2012), the China Shock (2015-6), and the Corona Shock (2020). If the U.S. economy becomes firm, there may rather be a situation where short yen positions will be built up again.

Third, the contrasting policy mixes of Japan and the U.S. are clearly oriented toward a strong dollar and a weak yen. Based on the economic hypothesis (Mandel-Fleming model) that an expansionary fiscal policy and a tight monetary policy lead to a strong currency, while an austere fiscal policy and a loose monetary policy lead to a weak currency, the US has a typical strong currency policy mix and Japan has a typical weak currency policy mix. The government's tax revenues are inflated by the yen's depreciation and inflation. The government has compiled estimates that the primary balance will be in surplus in FY2025, a sharp recovery from -5.2% in 2023 (OECD, November 2023). That means that, viewed in reverse, public finances will depress private demand by 2.6% per year between 2024 and 2025. While the weak yen's inflation is depriving households of income in the form of lower real incomes, it is also generating huge income transfers to the government. For the Japanese government to achieve a surplus in the primary balance by stashing away higher tax revenues means that it will maintain intense pressure on the yen to weaken. Stopping the yen's depreciation will require a major reversal of the fiscal austerity program, and until this is initiated, the yen's weakening trend is not likely to change significantly.

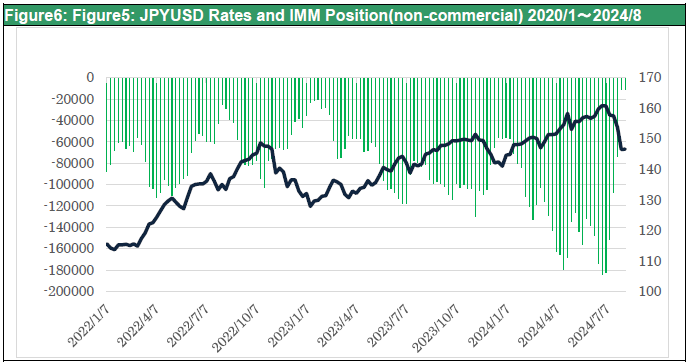

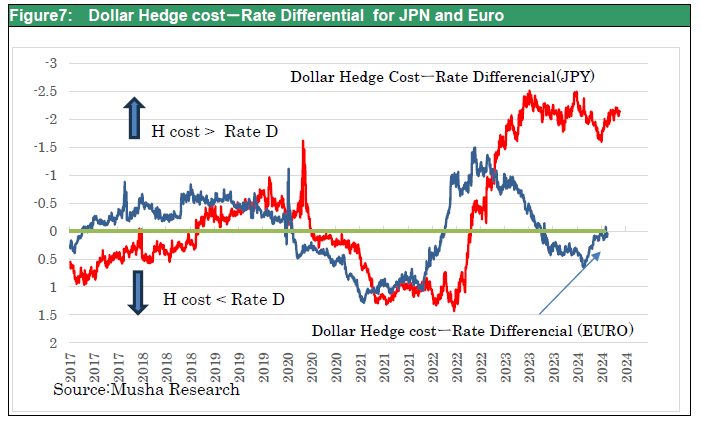

Fourth, the market's view of the yen's future depreciation has remained intact even during the yen's appreciation since July. The market's view of a weaker yen can be inferred from foreign exchange hedge costs, which exceed interest rate differentials, but as shown in Figure 6, the Japanese yen alone has remained sharply higher for almost two years and has not changed at all. Until the beginning of 2022, the hedging cost of the Japanese yen against the U.S. dollar was almost the same as that of other currencies such as the euro, in the 0% range, but at the end of 2022, the cost jumped to almost 5%, and is still at an abnormally high level of 5-6%. Since the cost of currency hedging has become abnormally high only against the Japanese yen, Japanese investors have been losing 2 to 2.5% if they hedge their currency exposure and invest in U.S. government bonds for more than two years. This hedging cost of the yen against the dollar, which exceeds the difference between Japanese and U.S. interest rates, has risen sharply in accordance with the rapid depreciation of the yen since the early spring of 2022 and has remained 2 to 2.5% above the interest rate differential since then. That can be understood as the market assuming a 2-2.5% annual depreciation of the yen.

Figure 4: Dollar/Yen Rate and Japan-U.S. Interest Rate Differential (Long-term, Short-term, Nominal, Real)

Figure 5Dollar/Yen Rates and IMM Position 2003~2024

Figire6 Dollar/Yen rate and IMM Posption 2020/1~2024/8

Figure7 Hedging Cost minus rate differential against the dollar in Yen and Euro

5) Valuations and supply-demand balance for Japanese equities have become more attractive. There is a favorable wind blowing on the Japanese economy and capital investment in the future. There is a headwind for consumption in the form of lower real income due to inflation, and a favorable wind brought about by asset effects. Moderate growth to be sustained.

(2) Pessimism that stirred anxiety at the bottom, Black Monday revisited?

In this sharp decline, speculators who sold off the market by stirring up fears of another Black Monday are believed to have played a dark role. In response, the usual opinion leaders who loudly asserted pessimism, "The bubble is about to burst," stirred up anxiety at the bottom.

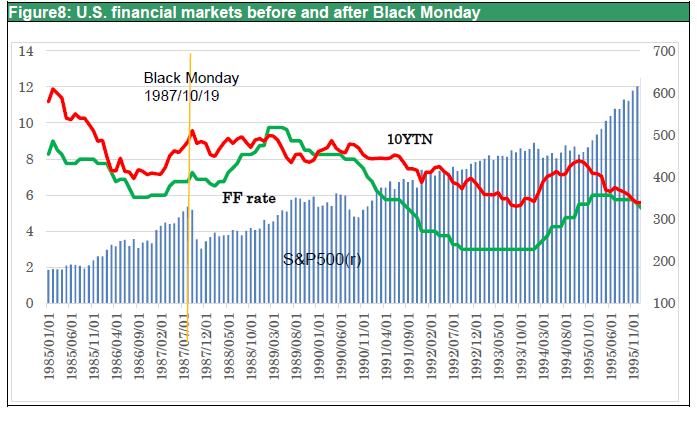

The crucial difference from the time of Black Monday, the difference in the dollar confidence, is more important

In 1987, the main focus of international cooperation was to rebuild confidence in the dollar, which was weakened by the twin deficits of the U.S. In February, an internationally coordinated ruble agreement was reached to restore confidence in the dollar. Fed Chair Greenspan, who had just taken office, was forced to raise interest rates to defend the dollar, but West German interest rate hikes against inflation made U.S. monetary management difficult, and international cooperation was cracked. In this environment, New York stocks had risen sharply in value by 30% from the beginning of the year through August, and a sense of discomfort was growing in the market. This was the background to Black Monday on October 19, 1987, when the Dow plunged 23% or 508 points in a single day.

In contrast, this time, confidence in the dollar is sufficiently high and U.S. domestic savings are plentiful, allowing the Fed to cut interest rates freely without worrying about the dollar's credibility. It is safe to say that there is no element of international financial instability that would result from a rate hike in Japan. The contrast between Japan's rate hike and the U.S. rate cut is certainly similar, but this does not mean that the scenario of "Black Monday coming back" to terrorize the market was reasonable.

Figure 8: U.S. financial markets before and after Black Monday

The theory of the bursting of the "bubble of a weak yen and high stock prices" that heightened market anxiety

On the other hand, in Japan, regular Abenomics critics and austerity advocates argued that "Abenomics and Kuroda's extreme monetary easing created a bubble with a weak yen and high stock prices, but the time has come for judgment. Economist A said, "There may be a strong aspect of the collapse of the bubble of a weak yen and high stock prices created by the Bank of Japan. ・・・・ believes that the collapse of the "bubble of a weak yen and high stock prices" created by the Bank of Japan's unprecedented monetary easing, which was maintained even amid soaring global prices, is behind the collapse.

Professor B also said, "The global stock market has had three "extra bubbles" since the Corona shock, which should have resulted in the complete collapse of the bubble. There was the "bonus bubble No. 1," the Corona subsidy bubble, the "bonus bubble No. 2," the monetary policy put option bubble, in which the FED to cut interest rates. The "bonus bubble No. 3" is the AI and semiconductor bubbles, or the "Magnificent 7” In other words, three encores of the bubble, in response to investors demanding "another round of bubbles." He asserted.

Furthermore, Chair C said, "The market is now in the final stage of an abnormal money glut, and stock prices could burst at any time. There will be a big crash soon. The new NISA started at such a time, further igniting the overheated market. and other such arguments.

We respect these courageous objections, but in the unlikely event that the hypothesis is incorrect, we would like to see a frank correction of logic.