Aug 04, 2024

Strategy Bulletin Vol.360

The " weak yen is bad "theory is killing stock prices

-How to view the Midsummer Nightmare?-

A Midsummer Nightmare

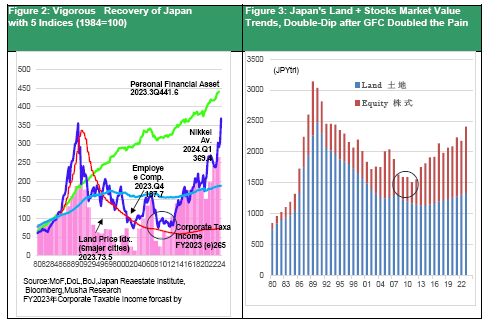

The Nikkei Stock Average hit an all-time high of 42224 yen on July 11, and then began to fall, plunging 15% in a little more than half a month to 35909 yen on August 2. Three factors have been pointed out as the background. The first is the global stock price correction. U.S. stocks (SP500) have fallen 6% in the last 3weeks after rising 20% since the beginning of the year, and the NASDAQ has fallen 10% in the same period after rising 26% since the beginning of the year, which is within the range of cyclical adjustments. The timing of the shooting of Mr. Trump, Trump's nomination for president at the Republican convention, and Biden's withdrawal from the presidential race changed the leader in U.S. equities, causing major tech stocks to sell off, while small-cap and energy stocks that benefit from Trump's policies such as tax cuts and deregulation attracted funds.

The U.S. economy is slowing as the Fed had hoped, and a rate cut in September is on the horizon, but this was also perceived as a negative factor by the market. The hard landing scenario for the U.S. economy began to be discussed, even though we believe, the likelihood of this happening is negligible.

Second, the rapid appreciation of the yen forced hedge funds that had been betting on a weaker yen and higher Japanese stock prices to unwind their positions. Intervention by the BOJ and a series of statements by politicians that interest rates should be raised to prevent the yen from weakening turned the tide in the foreign exchange market.

Why the BOJ has changed the stance

Third, the BOJ's surprise interest rate hike has quickly spread uncertainty about Japan's macroeconomic policy. The Nikkei 225 plunged 8% in the two days following the rate hike, and the Nikkei 225 fell another 3% to 34,800 yen in overnight futures trading on August 2, underscoring the outstanding weakness of Japanese equities. The Nikkei 225's 26% gain since the beginning of the year to its all-time high on July 11 was quickly reduced to a 5% gain at the close of overnight futures trading last Friday.

Of the above three factors, the prominent decline in Japanese equities was triggered by the BOJ's interest rate hike. The market's confusion centered on the sudden change in Governor Ueda's stance. Based on his previous explanations, a rate hike in July was unlikely. Real wages fell -1.3% y/y in May, the 26th consecutive month in which wages have been below water. Although there is a possibility of a positive turnaround in early fall, some observers believe that it will not emerge until next year. Real consumption expenditures (y/y) were -6.3% in January, -0.5% in February, -1.2% in March, 0.5% in April, and -1.8% in May, remaining on a negative trend. Given this, the BOJ lowered its outlook for real GDP growth in FY2024 from 0.8% to 0.6% in its July Outlook Report. While Governor Ueda has said that he is data-driven, he decided to raise interest rates before the data became clear, which shows that he is in front of the curve.

Furthermore, his tone on the yen's depreciation has changed substantially; in April, he had indicated that the impact of the yen's depreciation on prices would be negligible. However, at the press conference held at the end of July, he changed his stance, saying that he had taken early action (raising interest rates) because there was a risk that the upward pressure on prices due to a weaker yen would push prices above the 2% target, even though the dollar/yen exchange rate had not changed from around 155-yen level.

The market was convinced by the conventional explanation that "the main cause of price hikes is cost-push factors originating overseas, which leads to a decline in real household incomes and an increase in the burden on corporate profits. tightening monetary policy to curb these factors will worsen the economic and employment environment,"

Yet, at its July meeting, the BOJ shifted its stance to the need to raise interest rates because of the large negative impact of the exchange rate on prices.

Markets try to discount the BOJ's change in thinking to the maximum extent

There are two reasons for the change of BOJ policy stance: (1) political pressure and (2) the BOJ's rate hike bias. The government and the ruling party have made a series of statements calling for the BOJ to take action to deal with the weak yen. Prime Minister Kishida stated on July 19 that "normalization of monetary policy will support the transition of the economic stage," and furthermore, Digital Minister Kono and LDP Secretary-General Mogi followed with statements calling for an interest rate hike. It is possible that the Bank succumbed to this pressure. Second, the BOJ may have been preoccupied with its innate desire to "normalize monetary policy" and is now impatient for rate hike. It is said that there is a common perception among BOJ officials that real interest rates are too low: the CPI for June was 2.8% and the yield on JGBs was 0.9, so the real interest rate was a substantial -1.9%, and "borrowing benefit " are still high. BOJ officials think this negative real interest rate situation to provide room for interest rate hikes. This is a desire to secure a margin to cut interest rates if the economy deteriorates in the future. Negative real interest rates have been maintained to promote risk-taking and increase demand, but the tone may shift to the side effect of causing moral hazard.

If the market begins to suspect that the BOJ has shifted its stance from promoting risk-taking, which has continued for a decade since the Abe-Kuroda regime, to curbing risk-taking, it will cause a landslide deterioration in investment sentiment. Governor Ueda brushed off fears of an economic stall, saying, "Since the adjustment is at a very low interest rate level, there will be no major negative impact on the economy. However, there is no guarantee that the nightmare of 2000 and 2007, when a premature rate hike coincided with the U.S. recession and rate cut cycle and caused the yen to appreciate, will not repeat itself.

Do not repeat the root cause of the lost 3 decades, premature monetary and fiscal tightening.

Another concern is the fiscal drag on the economy. The government's tax revenues have been inflated by the weak yen and inflation. The government has compiled estimates that the primary balance will be in surplus in FY2025, a sharp recovery from -5.2% in 2023 (OECD, November 2023). That means that, viewed in reverse, public finances will depress private demand by 2.6% per year between 2024 and 2025. While the weak yen's inflation is depriving households of income in the form of lower real incomes, it is also generating huge income transfers to the government. If this massive income in the form of higher government tax revenues is left untouched, private consumption will suffer a major blow. At this point, it is necessary to bail out individuals who continue to suffer the disadvantages of the weak yen and have not yet entered the wave of prosperity, but the prescription is clear. The public finances, enriched by inflation, should return the money to the people whose income has been stolen by inflation in the form of permanent tax cuts.

Twice in the past, in 2000 and 2007, Japan's premature fiscal and monetary tightening exacerbated the recession and the lost era, which should have ended in 10 years, continued for 20 or 30 years. The sharp decline in Japanese stock prices may be a reminder not to repeat the mistakes of the past this time around.

Sharp Rebound Expected

Nevertheless, the BOJ should be extremely reluctant to be seen That the BOJ's decade-long promotion of risk-taking have shifted all at once to a restraint of risk-taking. Also, the slowdown in the U.S. economy should be seen as a factor that will promote interest rate cuts and thus boost stock prices. The Japanese government has already sent out a message that it will be watching the decline in stock prices closely, and the BOJ may well set a tone of relief for the market. If the market's sharp selloff is based on the exaggerated paradigm shift it is likely to be an excellent buying opportunity. Strong corporate earnings and sharply more attractive stock valuations may provide a good buying opportunity for all investors who are feeling the risk of not owning Japanese stocks (FOMO).

《Reference:》

Premature shift to monetary and fiscal tightening brought about the double-dip weakness in the Japanese economy.

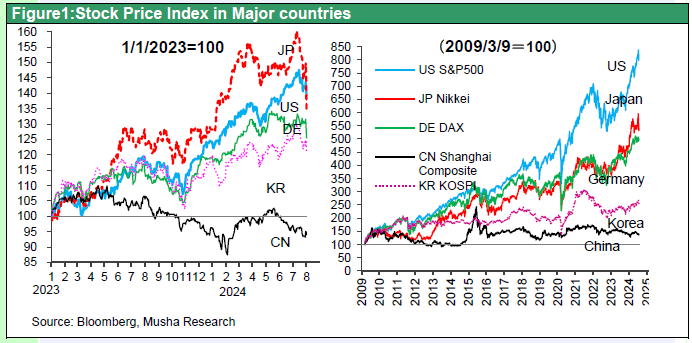

The GFC was a financial crisis in the U.S. and other countries. However, Japan, which was the furthest away from the epicenter of the crisis, suffered the greatest economic impact, and its stock prices slumped the longest. The premature tightening of policy caused the yen to appreciate, pushing stock and real estate prices down beyond their intrinsic values and imposing additional costs on companies, plunging Japan's economy and stock prices, which had been recovering, into a double-dip recession. The total market value of Japan's national wealth, including land and stocks, peaked at 3,142 trillion yen at the end of 1989 and bottomed out at 1,723 trillion yen at the end of 2002.But fell further after the GFC to 1,512 trillion yen at the end of 2011 (and has recovered remarkably to 2,410 trillion yen at the end of 2023). This double-dip recession could have been avoided if the correct policies had been taken.

Figure 2: Vigorous Recovery of Japanwith 5 Indices (1984=100)

Figure 3: Japan's Land + Stocks Market Value Trends,Double-Dip after GFC Doubled the Pain