Jun 24, 2024

Strategy Bulletin Vol.357

Analysis of “from Japan Decline,China Rise to Japan Rise ,China Decline"(2)

~The Japanese Revival from the Collapse of the Bubble Economy and Lessons for China

At the annual academic conference of the Center for Industrial Development and Environmental Governance Research (CIDEG) at Tsinghua University, I presented a keynote report on the theme of "Japan's Economic Revival and Lessons for China," and the following is a detailed explanation based on my report. In the previous issue, I reported that Japan's economy is on a long-term recovery track and analyzed two factors that prolonged the stagnation. In this issue, we would like to point out three similarities between Japan's past and China's present due to the accumulated U.S. debt, and four differences between Japan and China. A comparative analysis of Japan and China shows that the post-World War II development and setbacks of the two countries are linked by common circumstances. Such an understanding is essential when considering future policy choices and prospects for Japan and China.

(1) Japan's Entry into the Era of Great Growth (previous issue)

(2) Three Similarities between Japan and China that relates US Debt (this issue)

(3) Four differences between Japan and China: (this issue)

(4) Conclusion (this issue)

(2) Three Similarities Between Japan and China and Their Backgrounds: U.S. Debt Accumulation

There are three striking similarities between Japan's past and China's present. The first and most important similarity is that the U.S. debt accumulation and the resulting surge of current account surpluses in Japan and China were at the root of the remarkable economic development and bubble formation in Japan and China. Second, both Japan and China failed to channel this massive surplus into stimulating domestic demand, which led to real estate bubbles. Third, the U.S. suddenly took away this advantage in the international division of labor that Japan and China had enjoyed. In the same Japan bashing that has caused serious trade friction and a strong yen, the U.S. is raising tariffs on China and restricting exports of high-end technology products.

It is important to understand that the economic development of Japan and China and the creation of the bubble were not entirely independent but were fundamentally caused by the U.S.-led international monetary system. In other words, the Nixon Shock of 1971 extinguished the dollar's compatibility with gold, and the U.S. imported heavily, first from Japan and finally from China, causing its foreign debt to soar. This was the driving force behind the economic development of Japan and China, and it resulted in large external surpluses in Japan and China.

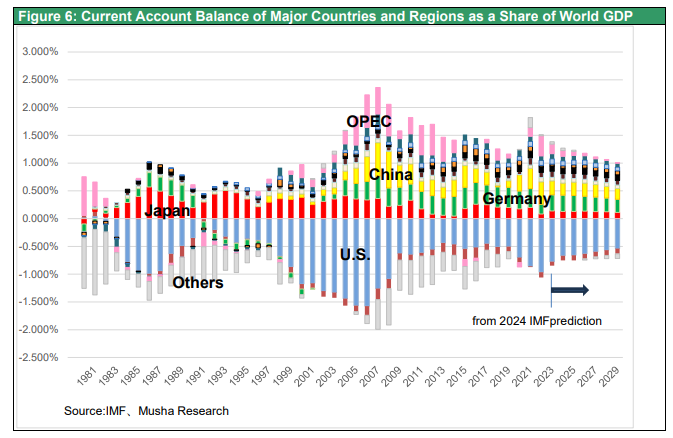

The Nixon Shock caused massive U.S. debt

The reserve currency, the dollar, lost its gold backing, and there were initial fears of a dollar plunge. However, the value of the dollar did not fall, even though dollar supply took place on a large scale. Figure 4 shows the ratio of current account balances of major countries to the world's GDP, and only the U.S., as the largest debtor nation, has been accumulating its external debt single-handedly. The U.S. pointed to Japan's huge trade surplus with the U.S. in the 1980s and 1990s and China's huge trade surplus with the U.S. since 2005 and blamed the undervaluation of its currency but made no efforts to reduce its own deficit. This tells us that the floating exchange rate system under the dollar reserve currency regime did not help the U.S. to correct its imbalance at all.

|

|

Privilege of U.S. hegemony, supply of growth currency = cumulative U.S.debt

Floating exchange system are believed to be fair because it has a mechanism for correcting imbalances. The theory is that a weaker currency for a deficit country will lead to higher import prices and lower imports, and a weaker currency will make the country more competitive and thus increase exports (the opposite is true for a surplus country).

On this basis, the U.S. has monitored and sometimes sanctioned major trading partners suspected of currency manipulation. In the past, Japan and China accumulated their holdings of U.S. government bonds through foreign currency intervention to avoid sharp currency appreciation, but U.S.-led international public opinion condemned this as currency manipulation and dirty float.

|

|

|

Historical facts over the past 40 years, however, show that this logic has not been applied to the United States. Normally, the U.S. dollar, the currency of the U.S., a country with a large deficit, should have plummeted, putting a stop to imports by causing U.S. import prices to soar, but the dollar's decline was limited and did not function as a brake on U.S. imports. As a result, the U.S. current account deficit continued to increase, and 50 years after the Nixon Shock, the world accumulated huge claims on the U.S. and huge U.S. foreign debt. This was the very supply of the dollar, the currency of growth, by the U.S. to the rest of the world.

Ample dollar issuance caused Asia's taking off through globalization

This increase in U.S. external debt has had a positive effect on the world economy: Japan's exports to the U.S. in the 1980s and 1990s led to an economic boom, Asian NIES such as South Korea, Taiwan, and Hong Kong took off in the 1990s and 2000s, and the Chinese economy achieved high growth in the 2000s and beyond, The starting point for all of this was the ample supply of the dollar. China's powerful presence in the world economy, with a little less than 40% of the world's manufacturing production and a high share of 80-60% in high-tech products such as PCs and smartphones, and clean energy products such as solar panels and EVs, was the result of the Nixon Shock. This dollar-driven system is the essence of modern globalization.

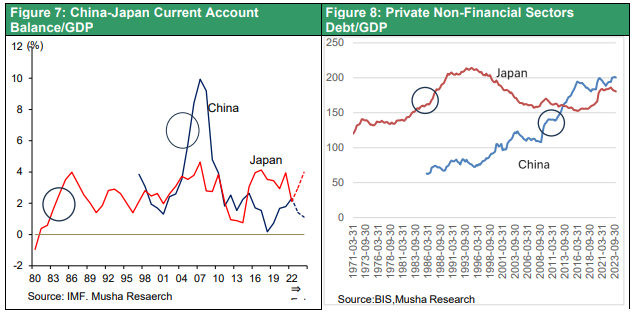

External surplus caused the formation of the Sino-Japanese bubble

The persistence of this external surplus and the permanent savings surplus caused a major distortion in the Japanese and Chinese economies. While the external imbalance should have been corrected by an increase in domestic demand, it was difficult to expand domestic demand in a brief period. It should also be noted that the accumulation of surpluses with the U.S. led to excessive issuance of currency in Japan and China, which subsequently led to the formation of real estate bubbles. A look at the external current account surplus (vs. GDP) and household debt (vs. GDP) in both Japan and China reveals a linkage between the two.

Dollar flood has boosted Americans' living standards

Dollar dissemination also worked within the U.S. The U.S. import dependency calculated by goods imports divided by goods domestic demand was only 10% until the Nixon Shock in the early 1970s but has reached 80-90% since 2010. The U.S. economy, which used to be self-sufficient, producing most of its clothing, TVs, and automobiles domestically, has been liberalized. This has led to the hollowing out of the manufacturing sector, but this has been compensated for by the emergence of new industries and employment, such as IT and services. From another perspective, the hollowing out of the U.S. manufacturing industry has promoted the upgrading of the industrial structure in the United States.

Regardless of who becomes president, it Is essential to maintain dollar hegemony

This has also increased U.S. consumption, which in the early 1970s accounted for 60% of GDP, but 50 years later, in 2023, it will account for 68% of GDP. This is because cheap imports have boosted the real purchasing power of U.S. consumers. The question is whether the growth of the U.S. economy and the improvement in living standards that accompanies this buildup of external debt will be healthy or sustainable, and it will depend on whether dollar hegemony can be maintained.

The U.S. has recorded a massive net foreign debt of $15 trillion by accumulated current account deficits and $18 trillion in net international investment position, which is reported in the balance of foreign assets and liabilities. If the U.S. were forced to immediately repay this debt, the dollar would plummet, and the U.S. would be plunged into a major inflationary crisis. However, if the U.S. is certain to maintain its dollar hegemony, creditors will not have to seek repayment of its claim to the U.S. because it holds the dollar as its currency. In other words, the logic holds that maintaining dollar hegemony is essential to protecting the standard of living of U.S. citizens.

(3) Four Differences between Japan and China・・Japan’s reform, China’s Postponement

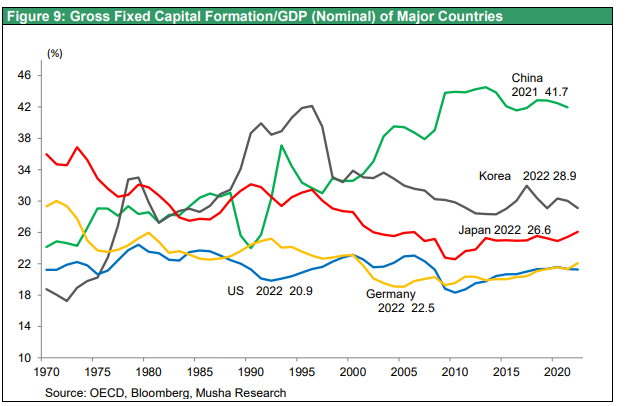

Japan's bubble is completed on the books, while China's bubble created excessive physical investment

Four differences can be noted between the economic development and the formation of bubbles of Japan and China. The biggest difference is that Japan's bubble was a book value bubble caused by excessive bank lending and the formation of non-performing loans, while China's bubble resulted in of massive overinvestment in real assets using purchasing power boosted by its real estate price hike. China may now face a significant decline in equipment, infrastructure, and real estate utilization rates. The second difference is that Japan's bubble was created solely by excess domestic savings, while China's massive capital inflows accelerated domestic investment. Third, both Japan and China have accumulated external assets because of large current account surpluses, but there are major differences in how these assets are managed. The fourth and most essential difference may be their attitude toward the United States. Japan, which is militarily subordinate to the U.S., has surrendered to the U.S. and accepted the U.S.-style business model. China appears to be increasing its opposition to the US.

Let us examine each of these differences below. Let us look at the first difference. China has been an investment-driven economy for 20 years with a fixed capital formation rate of over 40% of GDP, which is unprecedented in global history (Figure 5). The reality of this investment-led economy is the creation of demand by postponing costs. Investment is a risky act in that it is an accounting expenditure (i.e., demand creation) that is postponed by capitalizing the cost. If the constructed facilities and structures cannot be effectively utilized, they will continue to create a mountain of non-performing assets, which entails a great deal of risk.

|

|

|

|

The reason for continued economic growth through fixed asset investment has been the soaring land use rights prices. Local governments extremely became revenue-rich when they sold land use rights and the proceeds from such sales accounted for 40% of local government revenues. They were able to channel these ample funds into infrastructure investment and support for high-tech companies. This growth pattern would become unsustainable once the price of land use rights declines and revenues from the sale of land use rights by local governments ceased.

Contrary to investment, the ratio of private consumption to GDP has fallen 15% over the past 40 years, from 53% to 38%, making it unprecedented for consumption to continue to underperform investment. The decline in investment can only be compensated for by an increase in consumption, but the decline of land use prices is likely to lead to an increase in defensive savings by households, further depriving the economy of vitality.

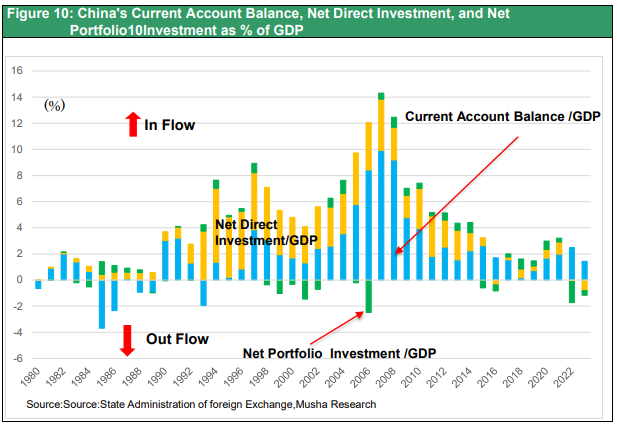

China's growth and asset price hike dependent on foreign capital inflows

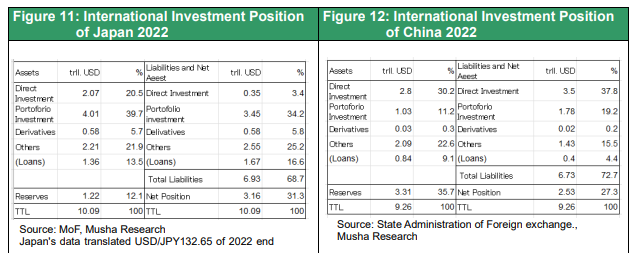

The second difference is that Japan's bubbles were created solely by excessive domestic savings, while China's huge capital inflows accelerated domestic investment. As a result, China is highly dependent on foreign capital such as direct investment (Figure 11,12).

In the case of Japan, there was no inflow of funds from abroad during the period of high economic growth and the creation and collapse of the bubble economy, while in the case of China, inward FDI surged since 1990s, in addition to a huge current account surplus became the sources of investment and economic growth as well as price hike of the land use rights. This period of foreign currency surpluses exceeding 5% of GDP continued for more than 25 years (Figure 10). Comparing the external balance sheets of Japan and China, their respective total assets approximate Japan's $10.1 trillion and China's $9.3 trillion, but China's inward FDI balance is $3.5 trillion, 10 times larger than Japan's $0.35 trillion.

|

|

|

|

Sharp decline in capital Inflows, signs of foreign currency insecurity

This situation of ample foreign currency is changing rapidly: inward foreign direct investment and portfolio investment have largely ceased since 2022, but outward direct investment continues to increase, and the capital and financial account balance is now significantly overdrawn. Although the trade surplus has remained high so far, it is expected to decline due to the offshore transfer of factories from China and the trade friction between the U.S. and China. China may experience foreign currency shortages and exchange rate instability that did not occur in Japan after the burst of the bubble economy. The risk of capital flight is inherent.

Foreign asset management, high returns in Japan, indifferent to returns in China

Third, both Japan and China have accumulated external assets because of large current account surpluses, but there are major differences in the management of these assets (Figure 9). Japan's external assets consist of corporate direct investment and investment in securities such as U.S. government bonds and U.S. stocks. Although we do not know the details, China seems to have a high weighting of support for emerging countries and infrastructure investment. This may lead to differences in the future returns from invested assets and the possibility of recovery. Comparing the asset side of the external balance sheets of Japan and China, 40% of Japan's investment is in securities, mainly U.S. government bonds and U.S. equities. China, on the other hand, has an overwhelming share of direct investment and foreign exchange reserves. The more significant difference is the destination of outward assets: according to the IMF's Direct Investment and Portfolio Investment Survey, Japan's direct investments at the end of 2022 is mainly in advanced economies such as the US, the UK, and the Netherlands, with the rest in manufacturing centers such as China and ASEAN countries, while China's share is overwhelmingly in emerging economies.

|

|

|

|

|

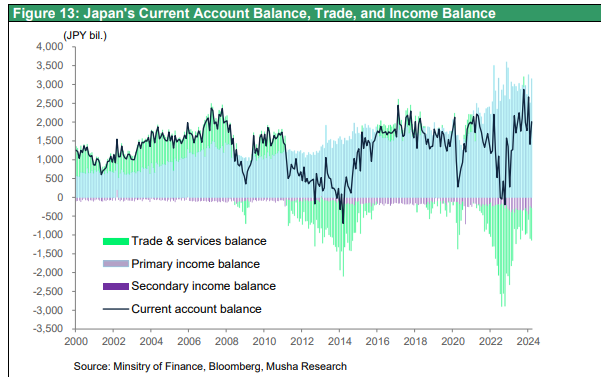

Japan's outward FDI outstanding has surged since the super-strong yen following the Global Financial crisis, rising sharply from 53 trillion yen in 2010 to 206 trillion yen in 2022. This outward investment has brought huge investment returns to Japanese companies. Japan's trade balance has been in the red since 2011, but its accumulated external assets have led to a significant increase in primary income, maintaining a large current account surplus overall. Japan is the only country with a trade deficit among those with large current account surpluses. In contrast, China has a larger foreign direct investment asset than Japan, but its income from it is significantly negative. (Chart 13).

|

|

|

|

Japan kowtowing to the U.S., China rivaling It

The fourth and most essential difference may be the attitude toward the United States. Japan, which is militarily subordinate to the U.S., has capitulated to the U.S. and embraced the U.S.-style business model. This concession to the U.S. has resulted in corporate governance reforms in Japan and appears to be preparing the way for higher Japanese stock prices and a prosperous equity capitalism. China, on the other hand, appears to be increasing its opposition to the US.

(4) Conclusion

Japan's future looks bright, but there is a risk of repeated policy mistakes and a risk that policy and the external environment could turn everything upside down. Premature fiscal balancing targets, such as zero primary balance, stealth tax hikes, and impatient monetary tightening may impede the virtuous cycle of the private economy, which has just begun to take off.

In China, on the other hand, the bubble has yet to burst.30 years ago Land prices in Japan have fallen 80% after quadrupling over the previous decade. During that period, real estate-related loans (to construction, real estate, and non-banks) increased by ¥80 trillion, almost all of which turned into nonperforming loans. However, China still has an artificially maintained elevated asset prices. The house price to annual income ratio in Shanghai is 41 times, in Beijing 32 times, in Shenzhen 30 times, and the house price to annual rent ratio is 60-70 times, the highest in the world, and has not collapsed. Thus, official statistics still show no problematic financial NPLs.

Several countermeasures have been taken in China, but they seem to be not sufficient and sustainable for long run. The first measure is continued overinvestment focusing on highly competitive high-tech products such as EVs batteries and clean energy products. This may produce trade friction against China. The second is to preserve elevated real estate prices, cover up bad loans and overinvestment, and postpone the problem. The third is a series of stopgap measures and the constant weakening of the economy.

In light of Japan's experience in recovering from the collapse of its bubble economy, China is now in a situation where (1) disposal of bad loans, force zombie companies to write of bad assets and inject public money to prevent financial crisis followed by reform of the financial system and (2) enhancement of social security and strengthening of the role of public finances to promote healthy consumption are desirable.