Jun 02, 2024

Strategy Bulletin Vol.355

A Consideration of “What if Trump win”

~Is Trump's Challenge a Factor in Higher Stocks and Dollar?~

The outcome of the election cannot be predicted. However, since there have been so many inquiries about “what if Trump win,” we have summarized the points of contention as follows.

(1) The Mystery of Trump's Prevailing Position

The U.S. presidential election, the world's biggest political and economic event, is fast approaching in six months. The surprising thing is that Mr. Trump, who has a strong impression of uncooperative and egoistic person is reported to have a strong possibility of being reelected. Four criminal charges have been filed against him, and on May 30 he was found guilty for the first time as a former president, but the negative impact on the presidential election is seen as limited. Trump, who has refused to acknowledge Biden's victory in the last presidential election as stolen at all and continues to deny the legitimacy of the current president, was even viewed as a dead man until a year ago. Once the criminal prosecutions began, his campaign of political persecution was successful, and his approval ratings increased. In the seven close battleground states (Arizona, Georgia, Nevada, Michigan, North Carolina, Pennsylvania, and Wisconsin), where Biden won six last time, surveys show Trump ahead in all states this time. This is a major reversal of media and pundit predictions. Why is this?

Major Changes in the Structure of Employment

We must assume that major structural changes are occurring at the base of the U.S. economy and society, and that Trump's bold challenge to these changes is beginning to mesh with the voters. Two changes are occurring in the U.S. economy and society. The first is the change in the structure of employment and the disappearance of the middle class due to advances in technology and the international division of labor.

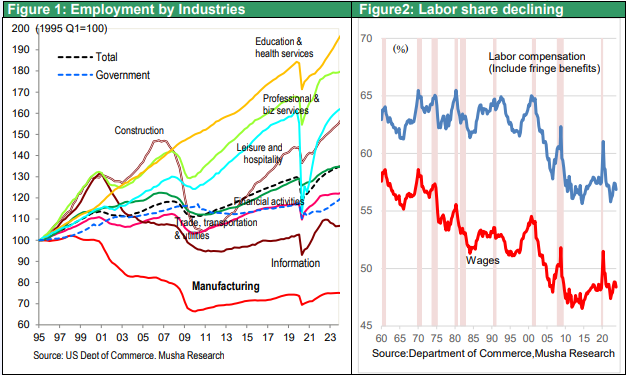

Figure 1: Manufacturing employment has declined significantly Figure 2: Labor's share of income has been declining for a long time

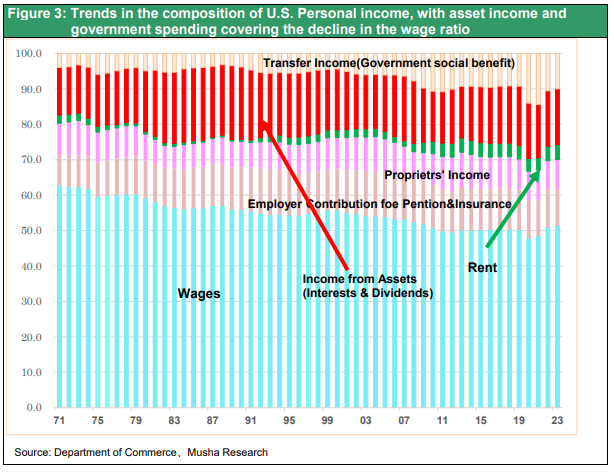

The manufacturing industry, which once supported the middle class, has become dramatically more dependent on foreign countries because of globalization, and employment has declined. 50 years ago, in the 1970s, the U.S. was the world's largest manufacturer in almost all fields, from light industries such as clothing and toys to heavy industries such as steel, shipbuilding and chemicals, electronics, communications and semiconductors, machinery and automobiles. The U.S. used to be only 10% dependent on imports of manufacturing products (goods), but now it is 80-90% dependent on imports, resulting in an overwhelming loss of jobs. The new jobs that filled the gap were in the high-wage business services, financial, and information and communications industries, and the low-skilled and low-wage personal services, food services, entertainment, and medical and long-term care industries, which are diverse and disparate. As a result, the labor share fell from just under 60% to just under 50%, putting a brake on wage growth and making households dependent on social insurance, public assistance, and asset income such as dividends and interests for much of their income rather than wages. This has widened the gap between asset holders and have-nots.

Figure 3: Trends in the composition of U.S. household income, with asset income and government spending covering the decline in the wage ratio

Backlash Against Excessive Minority Favoritism

The second change is the spread and radicalization of diversity and inclusion. The pursuit of human rights, protection of the vulnerable, fairness, and the movement to create an environment where diverse members can share job satisfaction by having their differences respected, ideals that are also common to the SDGs and ESG, has become radicalized and left leaning.

Critical Race Theory (CRA) that whites are born with the original sin of discrimination, the BLM (Black Lives Matter) movement, excessive concern for the weak such as different passing scores based on race, and anti-history such as denying the Founding Fathers as slave owners, etc., are all harmful effects of leftward leaning. The victimhood of reverse discrimination caused by this is also growing among the less-educated white population, which is on the verge of falling into minority status (the percentage of whites has plummeted from 84% in 1965 to 58% in 2020 and is certain to fall below 50% by 2060). This resonates with the backlash against radical de-fossilization.

Disparities are shrinking

The gap between whites and blacks, Hispanics, and other minorities has narrowed markedly in recent years, both in terms of unemployment and average wages. In addition, since the Corona pandemic, there has been a tightening of labor supply and demand in low-wage, less-than-college-educated occupations that do not require much skill, such as truck drivers, waiters, and waitresses, and the wage gap has narrowed overall. In this context, there are growing calls for preferential treatment of minority groups.

(2) Clarifying his position by identifying his enemies

By envisioning his enemies, Trump is clarifying his stance in answering these national grievances head-on. The first enemy is globalization and China, which have eliminated manufacturing jobs in the U.S. The second enemy is the dismantling of the “deep state,” a group of vested interests and bureaucracy that promotes excessive favoritism toward the weak, reverse discrimination, and historical denialism. Although this assumption of the enemy is wild and not necessarily rational, as an election slogan, it must have struck a chord with the public sentiment.

Existing Political Parties Failing to Respond to Public Sentiment

Both Republicans and Democrats, the existing political forces, have failed to respond to such public discontent. In the past, the Republican Party versus the Democratic Party had clear partisan lines of opposition, such as wealthy versus working people, white versus colored, conservative versus liberal, small government versus big government, and liberalism versus protectionism, but these lines have largely been lost and the situation is now chaotic. At a time when both the Democratic and Republican parties are in need of redefinition, Trump is the first leader to jump out and advocate for redefinition. While Trump enjoys overwhelming support within the Republican Party, many of his arguments are far removed from traditional Republican values. It could be said that Trump has remade the backbone of the Republican Party.

It is hard to understand that a millionaire and beneficiary of the capitalist system is advocating anti-Washington and anti-establishment on behalf of the interests of the weak who have been left behind and claiming that power will be reclaimed from the “deep state,” but that is what Trumpism is all about. Is it reactionary, as in simple white revolution and restorationism, or is it about bringing about further development through reform? The anti-Trumpers say the former and the pan-Trumpers take the latter position, but this is a phase in which both sides have a point.

(3) Policies that Trump is likely to launch if reelected

Push forward the fight against two enemies: China and the Deep State

It is too early to say, but let us consider what kind of policies Trump will propose if he is elected president. We need to make a distinction between campaign rhetoric and the policies that will be truly pursued. First, the fight against two enemies will be conducted. The U.S. will take a stronger stance against China, which seeks not only to steal U.S. jobs but also U.S. hegemony.

Policies such as raising import tariffs from China to 60% and eliminating China's most-favored-nation status will further accelerate decoupling from China. The high fence previously limited to a few advanced and military technologies, such as advanced semiconductors, will be extended to more fields, and the level of dependence on China will decline even more rapidly. It is also likely to “eliminate bad bureaucrats and bring democracy back to corrupt Washington. The scope of the political appointment system, which has been limited to about 4,000 people, has been expanded to 50,000, suggesting a major reshuffling of the mid-level bureaucrats. This may trigger a fierce confrontation involving the media and academia as criticism of a witch hunt of bureaucrats who do not agree with Trump's wishes grows. The fierce criticism of Trump that is occurring now may be a prelude to such a confrontation. The U.S. has a history of persecuting radical ideas, such as McCarthyism and the Red Purge.

It is also certain that Trump will reverse the environmental policies promoted by the Biden administration, such as withdrawing from the Paris Agreement, reducing, or suspending EV subsidies, and promoting pipeline construction. Furthermore, the government will also strengthen border controls and take stronger measures against illegal immigration.

Clarify pro-wall street and pro-capitalism

On the other hand, some policies are changing their electoral rhetoric. The tone of the prohibition of abortion and opposition to support for the war in Ukraine has begun to loosen considerably. It is also likely that he will continue to represent the interests of Wall Street and adopt stock price friendly policies while verbally calling himself anti-international capitalist, which will be no different from the first term of the Trump administration. Last time, he implemented the Dot-Frank amendment, the Volcker rule, and other financial deregulation measures, but he may also retract some of his anti-market policies, such as the elimination of the tax on stock buybacks introduced by the Biden administration. In the end, Trump will make his position on behalf of finance capital and Wall Street interests and in defense of capitalism clear.

He will not pursue a weak dollar policy

Although Trump is thought to favor a weaker dollar because of his focus on the trade deficit and his reference to a weaker currency during his last presidency, he may rather adopt a position of accepting a stronger dollar. The Trump administration has been putting forward high tariffs as a means of protectionism. The administration has already proposed a 10% flat tariff on imports and a 60% tariff on imports from China, and if import tariffs are added to a weaker dollar, it is inevitable that U.S. import prices will rise sharply, but this is unlikely. Rather, it is likely that they will use a combination of high tariffs and a strong dollar policy. The rational choice would be to allocate tariff policies to defend U.S. industries and to use the strong dollar to intensify the offensive in the fields of AI and digital technology, where the U.S. has an overwhelmingly strong monopoly.

In addition to the market-friendly policies envisioned above, former USTR representative Robert Lighthizer, former presidential adviser Peter Navarro, and former National Economic Council (NEC) Chairman Larry Kudlow, who served in the first Trump administration, are participating in policy preparations, and the consistency of economic and trade policies is almost certain to be maintained.

As in 2016, contrary to prior concerns, the stock market is likely to welcome the “What if-Trump win”.