May 28, 2024

Strategy Bulletin Vol.354

Recommendation of Optimism

~Optimism is reasonable and makes people happy.~

Conviction that Japan's Economy is Entering a New Growth Era

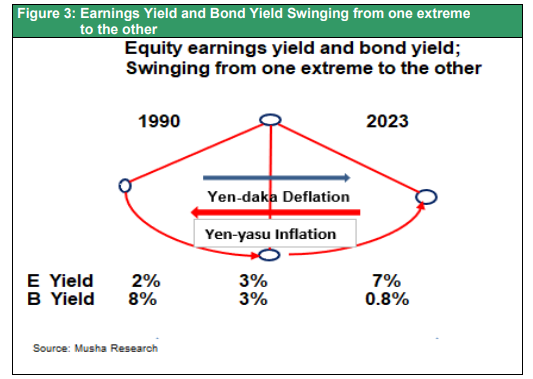

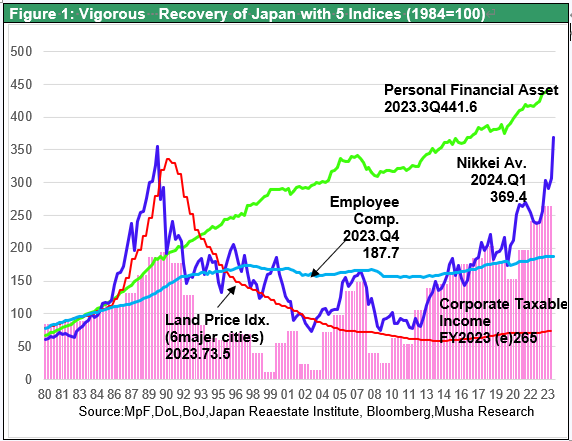

With the Nikkei 225 reaching a new all-time high, there is a growing sense that a new era is about to begin. A series of changes not seen in the past 30 years are taking place: a semiconductor investment boom led by Kumamoto, Kyushu; record-high capital investment growth; a surge in inbound travel; the highest wage increase in 30 years and an increasingly severe labor shortage; rising condominium prices; and the Bank of Japan's lifting of its extra-dimensional monetary easing policy. It is now clear to all citizens that Japan has finally emerged from the long-term stagnation suffered from the strong yen and deflation and is entering a new virtuous cycle.

I saw this coming 10 years ago, when Abenomics began, and published “The Great Revival of Japanese Stocks” in 2009 and every year since then, all of which have been about fighting pessimism and calling for a long-term rally in Japanese stocks. Because they were so far removed from the current trends of the time, they were ignored by the media and did not sell well, but I am proud to say that I have been able to keep burning the seed fire of my optimism.

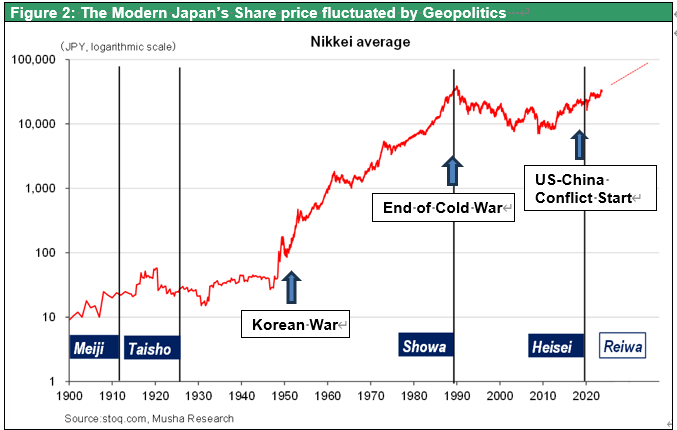

In “The Once-in-a-Century Wave of Japanese Stocks” released in April 2013, I wrote, “There are five reasons for the Nikkei Stock Average of 40,000 yen: 1) Japanese stocks are extremely undervalued, 2) Abenomics will end the long-term strong yen recession, 3) the US will change its policy toward China from engagement to containment and support a weaker yen to revive the Japanese economy, (4) Full-scale expansion of the U.S. economy will continue the recovery trend of the global economy, and (5) Japan's strength in quality and cost competitiveness will become apparent.

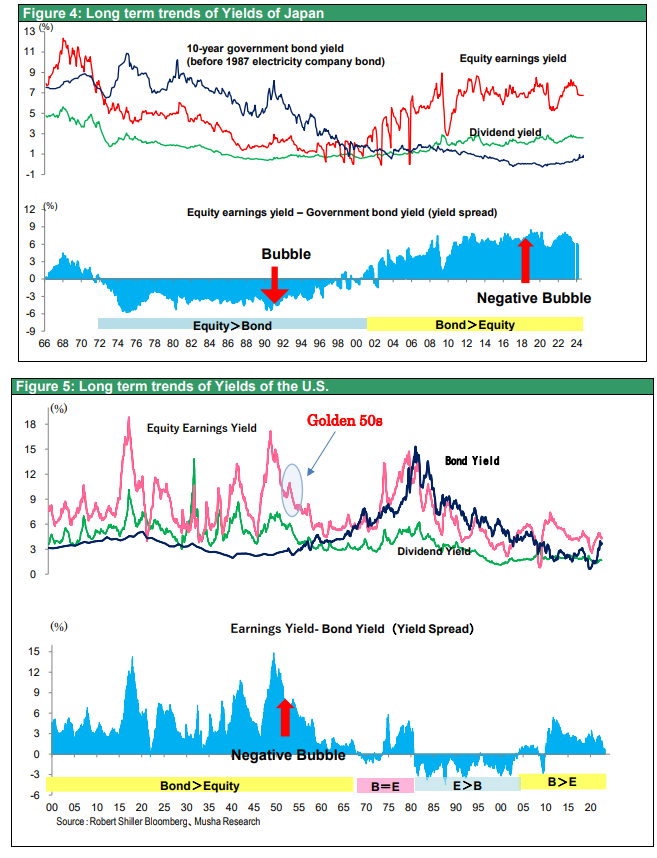

Geopolitics and the U.S.-China conflict will determine Japan's revival

In 2011, in “The End of the Lost 20 Years: The Japanese Economy in Geopolitics,” and in 2017, in “The U.S. Economy Continues to Win in the End and the Chinese Economy Loses Alone: Japan Gains the Fisherman's Advantage,” we argued that the U.S.-China hegemony struggle has begun and that the U.S., which needs Japan's support, will favor Japan and support the depreciation of the yen as though reversing previous actions. Amid the China boom, which was gaining momentum, such claims must have seemed like those of a right-winger who was hardened anti-Chinese.

Thirty years ago, in 1993, I authored a book entitled “America: Reviving Capitalism”. It was about the U.S. economy's resurgence and the difficulties that Japan, still basking in its bubble economy, was going through. This was at a time when the New York Dow was around 3,000 dollars and the Nikkei average was around 20,000 yen.

Although it is embarrassing for me to refer to my own experience in this way, I dared to share it with you because there are hints in it that can help us foresee the future correctly.

If you do not know the cause-and-effect relationship, you do not know anything.

The reason why the predictions of experts and many wise people in the world do not come true is because they do not take the necessary steps to predict the future. What is needed to make a prediction is to solve the riddle to find out the cause of why things happened the way they did. If we can understand the cause-and-effect relationship, we can predict what will happen in the future because of the current cause. The present is the result of the past, but the present is the cause of the future. If we consider everything in this flow, the accuracy of our future predictions will be enhanced.

During my examination, I noticed a phenomenon that could not be grasped only by economic theory a long time ago. That is the impact of geopolitics on the economy.

Japan's great postwar revival, its fall from the position of “Japan as Number 1,” the recent depreciation of the yen, and the fact that the Nikkei Stock Average has reached an all-time high of over 40,000 yen are all influenced by geopolitics. Specifically, it is because the U.S. has clarified its strategy to make Japan a “strong ally” in the face of the U.S.-China confrontation. Geopolitics is the analysis of human and national agendas backed by a long history. In other words, political mechanisms and economic dynamism have been inseparable from each other since ancient times. Geopolitics is the cause of the creation of new economic paradigms. In such a paradigm shift, it is essential to think in terms of dialectics: opposites are created and destabilized in a stable mechanism, and a new framework is created through the unification (sublation) of these opposites.

Analysis of the value creation mechanism is the key.

The seeds of future creation are in the details. Change does not start from the big picture, but from the specifics. If you look only at the macro, you will miss the changes. The most important detail is the value creation in a company. If companies cannot create value, they cannot pay salaries, they cannot invest, and the economy cannot move forward. Whether an economy rises or falls depends primarily on the health of value creation in the enterprise.

It is essential to have insight into the professional ethics and ethos that form our DNA.

We are also witnessing the greatest athlete in history, Otani, who is both a superb pitcher and a superb hitter, and why such a great man was born in Japan is also a useful insight. Why Japan and not the U.S., where there are so many more physically and materially gifted people? The spirit of pursuing the completion of his profession, without regard to money, reputation, or fame, seems to have come from the Japanese culture. And there are many young Japanese professionals who have the same mentality as Otani. Even though Japan's research funding has been cut and Japan is now behind the U.S. and China in research and development, everyone agrees that the work ethic and ethos (attitude toward life) of the Japanese people is among the best in the world. This spirit is the reason Japanese companies have been able to steadily change their business models even during the historic collapse of the bubble economy and the unusually prolonged period of economic stagnation.

Bright Future VS Super Cheap Stock Valuation

If we examine the above-mentioned checkpoints and construct a hypothesis, Japan’s future is incredibly bright. For the past decade or so, I have been saying that Japan's future is even brighter than the most optimistic think.

To make people aware of the importance of optimism now more than ever, we published “Japan's Historic Great Stock Market Has Begun! (WAC)on May 26. If you read this book, you will understand that the desired changes we are experiencing now are the signs of a great rebirth of Japan as a nation. I have no doubt that the Japanese stock market can reach 50,000 yen within this year, and unless the environment surrounding Japan changes drastically, it will reach 100,000 yen in five years at the earliest, or ten years at the latest.

Now if we agree that such a bright future awaits us, how should you, the reader, act? You should allocate a sizable portion of your funds to equities. By continuing to invest in an index of Japanese stocks, you will be able to multiply your wealth several times over the next 10 years.

On the other hand, if you are occupied by pessimism and invest your money in easy deposits, one dollar will remain one even after 5 or 10 years. There is an extreme difference in wealth formation. It is not an exaggeration to say that your destiny is divided by investing in stocks.

We hope that in these glorious times, you will achieve remarkable results in your investments and open a new chapter in your life.