May 14, 2024

Strategy Bulletin Vol.353

The disadvantages of a weak yen, essentially none

~ The unacceptable bad yen argument~

The Stirring Bad Yen Weakness Theory

While confidence in the economic recovery, rising stock prices, and Japan's resurgence story is growing thanks to the weak yen, the usual suspects are once again stirring up bad arguments against the weak yen. The Nikkei newspaper has been running a series of special features on the weak yen and has been championing the argument that there is a limit to the weak yen., while on TV, for example, TBS has been running a self-deprecating campaign on the weak yen as a symbol of Japan's decline, etc. The argument that the yen will weaken as capital flees Japan's weak growth potential, such as NISA investments being shifted overseas, is being interpreted as a sign that the yen will weaken.

However, Japan's low growth potential is not a new story; since 2010, when the yen appreciated, massive amounts of capital have flowed out of Japan to other countries with higher growth rates, yet the yen remained strong. The argument that the yen is weakening because Japan is failing does not hold water. All citizens, not just investors, must be made aware of the obvious fact that the major reversal of the yen's appreciation, which destroyed and weakened Japan's industrial base, is the baseline for all matters.

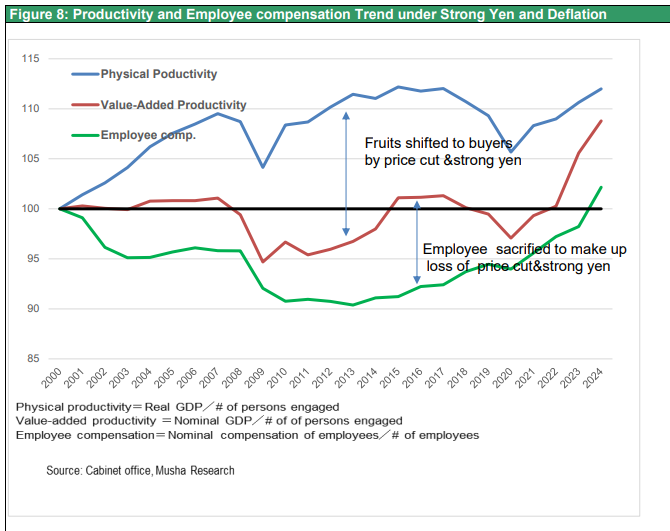

Interest Rate Differences, Trade Balance Cannot Explain Yen Weakness

Along with the sharp rise in U.S. equities at the beginning of the year, the U.S. financial markets have become increasingly speculative. The price of gold surged 14% since the beginning of the year, reaching an all-time high. The gold price surge has been cited as follows: U.S. price indexes have exceeded market expectations, renewed fears of inflation, central banks in emerging countries such as China, Russia, and Turkey are buying gold, and investors are hedging their bets against a possible stock market bubble burst. Some believe that “Chinese investors, lacking effective options, are buying gold” due to the slump in stock prices and deterioration in the real estate market.

|

Figure 1: US-Japan Interest rate differential and JPY/USD rate |

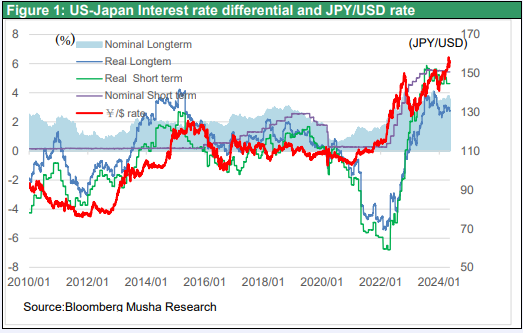

Figure 2: Japanese Current Account balance and it’s Component

Geopolitics and U.S. national interests are what drive the yen's depreciation

Why is the yen persistently weak? The yen's hedging costs against the U.S. dollar have skyrocketed since early spring 2022, and Japanese investors dollar hedged return have been negative 1to 2% for two years. It is because only the dollar hedging cost of the yen has been significantly exceeding the interest rate differentials, despite the dollar hedging cost of euro become below interest rate differential.

Since the hedging cost is considered as the market's perception of future prices, the market suddenly has formed an anticipation of the yen's future depreciation. Where did this perception of yen depreciation come from? It can only be attributed to geopolitics and the will of the U.S. authorities. In June and November of last year, Japan, which has the fifth largest trade surplus with the US, was removed from the US Treasury Department's foreign exchange watch list (China, Germany, Malaysia, Singapore, Taiwan, and Vietnam). One cannot help but think that the super depreciation of the yen is the backbone of the U.S. national strategy of the hegemonic U.S., which has no choice but to relocate its industrial clusters of high-tech manufacturing industries concentrated in the geopolitical danger zones of China, Taiwan, and South Korea to the safety of Japan.

Figure 3: JPY and Euro’s Dollar Hedge Cost minus Interest Rate differential

Exchange Rates are Causes, Not Results

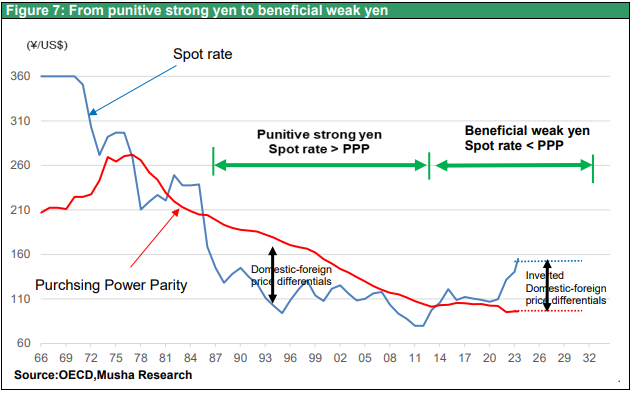

Market participants and economists should reverse the cause-and-effect relationship regarding exchange rates. While exchange rates may move in the short term as a projection of economic reality, in the longer term they are driven by policy intentions. In other words, we must know that the exchange rate is not the result but the cause. In the past, a strong yen was the most potent tool to attack Japan. At the time, many economists argued that Japan should accept the reality of a strong yen because deflation had strengthened the purchasing power of the yen. However, the appreciation of the yen has eroded Japan's competitiveness, encouraging the outflow of companies, business opportunities, jobs, and capital overseas, and has hurt Japan's domestic demand, which in turn has caused further deflation. The vicious cycle of a strong yen and deflation was broken by Abenomics and Kuroda's extraordinal monetary easing, which attempted to achieve reflation by inducing a weak yen as a starting point.

Japan's Great Revival Can Be Seen Beyond a Weakening Yen

Exchange rates are the most important determinant of the future economy. The U.S., eager for Japan's industrial revival, is inducing the yen to weaken. While South Korea dramatically increased its competitiveness and knocked out Japanese high-tech firms during the remarkable depreciation of the won from 2008 to 2013, the entrenchment of a weaker yen will prepare Japan for a dramatic re-emergence. On this trajectory, we see Japan re-emerging as a manufacturing powerhouse and a services (tourism) powerhouse. The weak yen is concentrating global demand in Japan, causing a boom in capital investment at record levels. In addition, high profits and the wage gap between Japan and other countries are motivating companies to raise wages and end deflation. This will revive Japan's strong yen over the long term. Japan should take advantage of the fortuitous depreciation of the yen and should not waste its time in trying to induce the yen to appreciate.

As Japan is the world's largest creditor nation, yen selling has no chance to win

The market may be repeatedly speculating to find a place to settle down. First, geopolitical reasons led to the formation of the market view that the yen would weaken for a prolonged period. We believe that the market is repeatedly speculating to find the bottom of the yen.

Is yen depreciation speculation in its final stages?

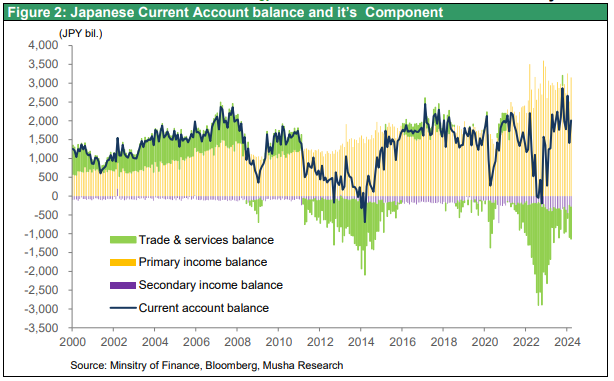

The BOJ and the government need not panic over yen selling speculation. Unlike Turkey and other countries with weak currencies, Japan is the world's largest net foreign investor with $3.1 trillion and the world's largest holder of assets against the US with $1.2 trillion in US government bonds. The foreign exchange gains from this huge amount of foreign assets are enormous, and the total amount of foreign exchange gains from the public and private sectors together is well over 100 trillion yen. Speculators are also aware of the depth of Japan's pocketbook. Speculation about selling the yen may be in its final stages.

|

Figure4: Us Treasury Bond Holding by Countries

|

Figure5: Net International Investment Position |

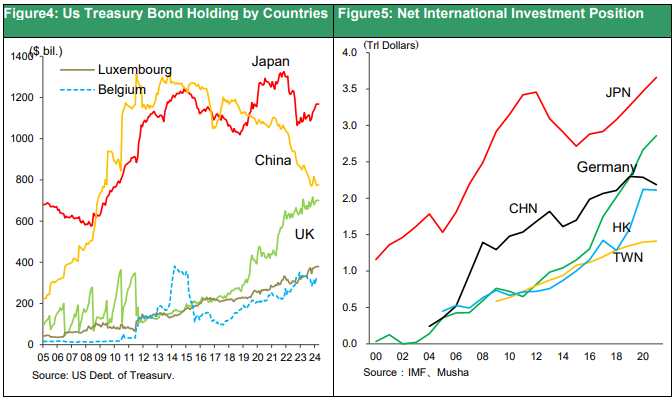

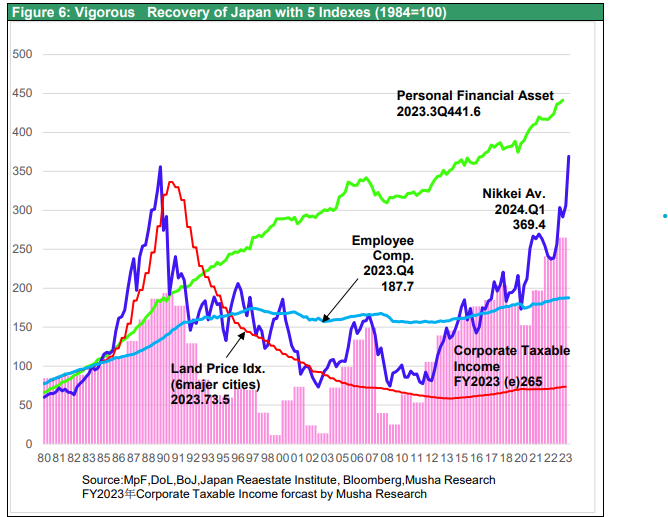

The weak yen is preparing Japanese strong recovery. This fact is illustrated in the charts below.

|

Figure 6: Vigorous Recovery of Japan with 5 Indexes (1984=100) |

|

Figure 7: From punitive strong yen to beneficial weak yen

|

|

Figure 8: Productivity and Employee compensation Trend under Strong Yen and Deflation |