Apr 15, 2024

Strategy Bulletin Vol.352

U.S. Rate Cut Delayed, Fed to Curb Resk Taking

“Good news is bad news bad news is good news” is a simple statement about the current U.S. economic situation. The robust performance, which has not slowed down, is causing expectations of an interest rate cut to fade away, which is causing stocks to fall.

Why no slowdown? There are three factors that are accelerating the economy. The first is the vigorous value creation by companies due to the new industrial revolution, the second is fiscal expansion, and the third is the asset effect of rising stock prices. The Fed will be forced to delay interest rate cuts. We should assume that its goal is to adjust asset prices by curbing the appetite for risk-taking. The Fed may be forced to delay rate cuts. U.S. equities, which surged at the beginning of the year, are likely to experience a period of adjustment.

(1) Business confidence is not in the doldrums

The U.S. economy is at full employment, inflation is subsiding, and the possibility of a soft landing is increasing. Employment is strong, but so far wage growth has not accelerated: the March employment report showed that nonfarm payrolls rose by 303,000 month-over-month, well above market expectations (+200,000). Employment increased in all industries. Average hourly earnings rose 4.1% y/y, down from 4.3% in February. Increased immigration and an improved labor participation rate have also contributed to the increase in supply.

However, the best-case scenario so far of a resilient economy may turn into a risk scenario in the future. If this pace of growth continues, prices are likely to accelerate eventually. The rosy scenario also creates the seeds for a bubble: 2.5% GDP in 2023 followed by a strong 2.7% in 1Q2024, according to GDP Now by the Atlanta Fed. District Fed presidents, one after another, have begun to stress that there is no rush to cut interest rates, referring to high inflation and favorable labor supply and demand.

In fact, the CPI rose 3.5% y/y in March, accelerating from 3.2% in February and beating market expectations of 3.4%. While higher gasoline and housing costs were the main reasons for the increase, the rate of increase in core service prices, which the Fed is concerned about, has increased as wages remain lower, reinforcing expectations of a rate cut delay. The market has been increasingly speculating that the Fed will hold off on cutting interest rates until September.

(2) Increasingly speculative financial markets

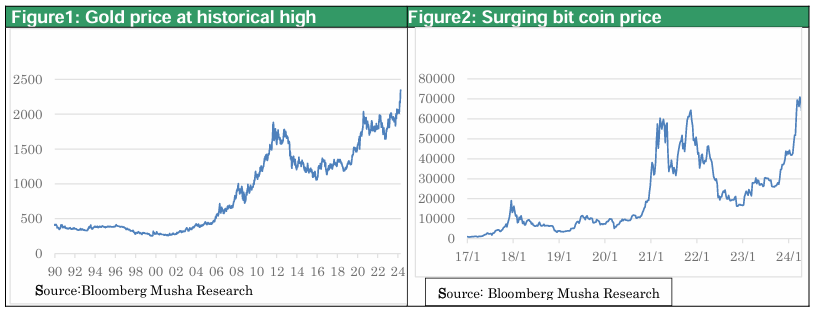

Along with the sharp rise in U.S. equities at the beginning of the year, the U.S. financial markets have become increasingly speculative. The price of gold surged 14% since the beginning of the year, reaching an all-time high. The gold price surge has been cited as follows: U.S. price indexes have exceeded market expectations, renewed fears of inflation, central banks in emerging countries such as China, Russia, and Turkey are buying gold, and investors are hedging their bets against a possible stock market bubble burst. Some believe that “Chinese investors, lacking effective options, are buying gold” due to the slump in stock prices and deterioration in the real estate market.

Bitcoin, which last year hovered between $32,000 and less than $40,000, began to soar after the new year, doubling in six months to $70,000 by the end of March, breaking the previous peak reached in November 2021. The sharp rise in the prices of gold and bitcoin, assets that generate no cash at all, can be taken as a signal that the market is becoming speculative.

In addition, investment funds are plentiful, and households' abundant savings are flowing into U.S. Treasuries through MMFs.

Expectations of three rate cuts this year, which were announced by the Fed at the January FOMC meeting, have been revised down significantly in the market. The market now expects one rate cut, and the dollar is strengthening in parallel.

Good news is bad news, bad news is good news,” and the Fed is pondering how to slow down the U.S. economy, which is likely to overheat and lead to inflation and asset bubbles if the economy continues at this rate. There are three factors that are accelerating the economy. The first is the vigorous value creation by companies due to the new industrial revolution, the second is fiscal expansion, and the third is the asset effect of rising stock prices. Of these factors, the economic accelerators from the new industrial revolution and fiscal expansion will remain unchanged for the time being.

The Fed is likely to be forced to delay interest rate cuts, but its aim may be to adjust the appetite for risk-taking by restraining stock prices and other asset prices. U.S. stocks, which surged at the beginning of the year, are likely to face a period of adjustment.

(3) Equity capitalism, a circumstance that will force a delay in interest rate hikes

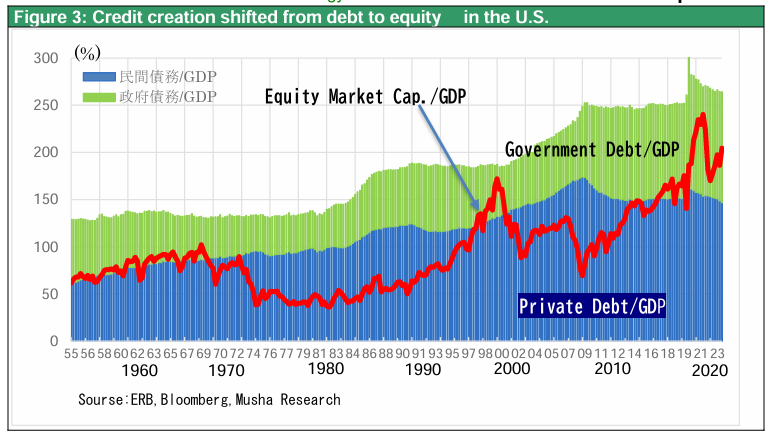

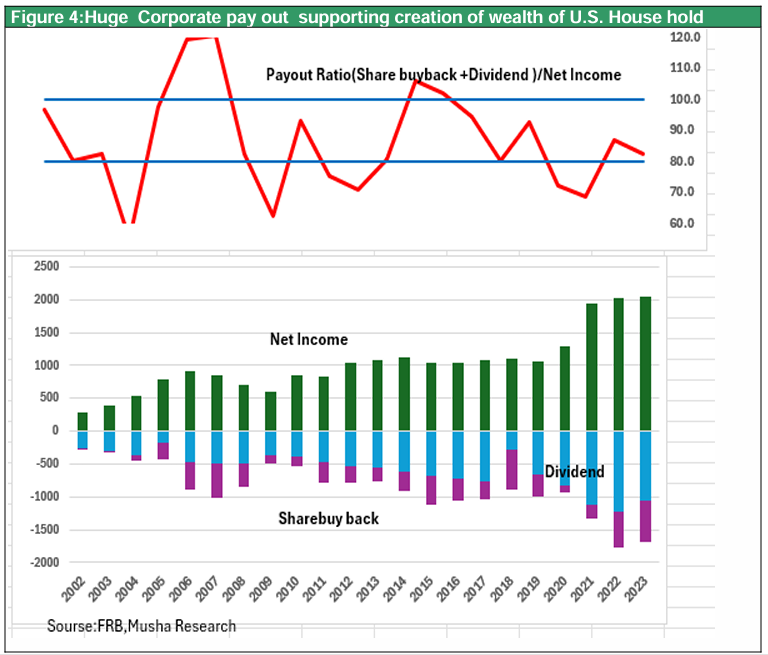

The reason why asset prices such as stocks are essential for the Fed's control of aggregate demand is that the current U.S. economic cycle is centered on the stock market. In other words, it is stock capitalism. Chart 5 shows the evolution of credit creation (credit outstanding/GDP) in the U.S. over the past 70 years. The era of private-sector debt driven credit expansion that lasted until the GFC of 2008 is over, government debt driven credit is limited, and the market capitalization of stocks has expanded from 69% to 240% of GDP over the past 14 years, which has led to the creation of demand driven by stocks.

This increase in equity credit (= higher stock prices) is justified by the entrenched money flow, where almost 80% of corporate profits are returned to the stock market (see Figure 6). Since there are no borrowers beyond the banks, the former monetary adjustment by the Central Bank, which controlled aggregate demand by controlling bank lending, has lost its power. Instead, asset prices have come to affect aggregate demand, and the Fed introduced QE as a means to achieve this. In other words, this is the era of equity capitalism.

As stocks have come to occupy a central position in the financial markets, a significant drop in stock prices causes far more damage to the economy than in the past. The Fed needs to focus on avoiding bubbles and maintaining appropriate stock prices.

As seen in Chart 7, even if stock price is not in a bubble right now when compared to interest rates (as seen in the FED model), it is no longer undervalued at all. For the past 20 years, the gap between interest rates and stock returns has been so large that stocks were significantly undervalued, but that era is over. While the actual April 12 S&P 500 index was 5123 points the fair value calculated by the Fed model was 5352, so the two were identical.

If the Fed's ability to control inflation becomes increasingly questionable in the future, or if long-term interest rates soar due to concerns over the U.S. budget deficit, stock prices are approaching the danger zone of being immediately judged to be in a bubble.

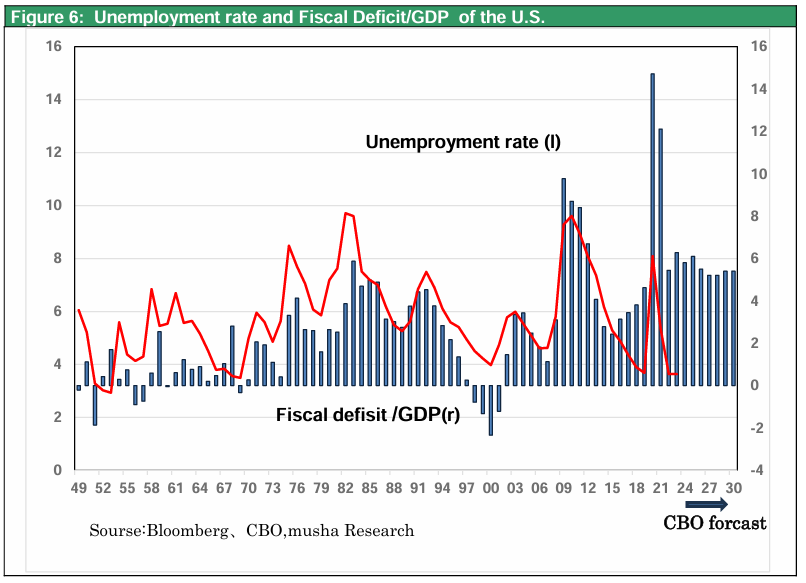

(4) Steady Fiscal Deficit and High-Pressure Economic Policy Management

It is necessary to take a glance at one more factor causing overheated demand in the U.S.: public finances. Chart 8 shows the evolution of the unemployment rate and the budget deficit (as a percentage of GDP) in the postwar period, but it should be noted that since the Corona pandemic, there is no longer any correlation between the two. In the past, the two were perfectly linked, as budget deficits were rolled out as a demand creation tool when unemployment rose. However, there is no sign that the budget deficit is decreasing, even though full employment has been in place since 2021. The Congressional Budget Office (CBO) projects that the budget deficit, at 5-6% of GDP, will remain entrenched at the highest level of any major country through 2034.

Big government is likely to take hold, with increased spending for the elderly such as Medicare, industry support such as the Chips Act and IRAs, and GX/DX measures.

The new industrial revolution will lead to higher productivity and increased supply capacity. Thus, relative demand shortages are expected, and creative fiscal policies are required as a response. The recent expansion of the U.S. budget deficit confirms this historical change in the role of fiscal policy. The high-pressure economic environment advocated by Treasury Secretary Janet Yellen will continue, but this will be accompanied by risks such as higher interest payments due to higher interest rates. In addition, with economic fundamentals in excess of demand, there is a risk that the economy could easily slip into an inflationary or bubble economy. Since we may have entered a situation where policy management requires caution, risk-taking in the U.S. financial markets also need to be careful.