The cause of strengthening emerging country currencies is the exact opposite of the cause of the yen’s appreciation

Both the yen and currencies of emerging countries have become stronger as the U.S. dollar weakened. But yen and emerging country currencies are appreciating for completely different reasons. People are buying the yen due to a growing desire to avoid risk based on the outlook for global deflation. On the other hand, emerging country currencies are gaining value due to the increasing desire to take on risk based on the outlook for global economic growth. However, the yen and emerging country currencies are climbing simultaneously because there is confusion as these two outlooks coexist during the current transitional period. Once QE2 eliminates deflation fears and prompts investors to take on risk aggressively, the upward pressure on the yen will most likely dissipate very quickly.

QE2 will further increase investments in emerging countries

The Fed has started executing QE2. The result will probably be a further increase in investments in emerging countries due to the growth of a carry trade with the dollar used as the funding currency. Momentum for interest rate hikes is growing in India, Australia and other emerging countries. But higher interest rates will merely make investments in these countries even more attractive. Capital that is flowing to emerging countries is primarily long-term investments that aim to benefit from the high economic growth rates and returns on capital in these countries. In addition, this situation has been severely distorted by capital barriers in China, a country with the world’s largest trade surplus and a high economic growth rate. Capital originally destined for China that was blocked by the country’s capital restrictions has been flowing instead to the other BRICS countries and Asian countries. Inflows of this “hot money” are fueling fears in these countries about overheated economies, excessive speculation and the creation of a bubble.

QE2 will spark emerging country investments from Japan that will cause the yen to weaken

Will QE2 lead to a stronger yen because of this same mechanism? We believe this is highly unlikely. There is no reason for capital to flow into Japan, which has lower interest rates and returns on capital than in the United States. In contrast to the appreciation of emerging country currencies, the appreciation of the yen thus far is not a product of investors seeking higher returns. Instead, the yen has strengthened due to a self-fulfilling process driven by the desire for earning short-term speculative gains from the yen’s appreciation (profits from spreads based on the outlook for a near-term increase in the yen’s value). As a result, the yen’s strength is rooted in the growth of dollar short positions. That means the yen’s run-up can be easily retracted by short-term funds. We believe that the unwinding of these short positions may begin following the completion of a number of events (QE2, G20 summit, U.S. midterm elections, hedge fund settlement month). This leads to the question of whether or not another upturn in the yen will happen once the yen’s reversal period ends. Apparently, the vast majority of people think that the probability of another upturn is high. But Webelieve there is only a small possibility of another surge in the yen’s value.

The demise of the deflation scenario will deflate the yen’s value

QE2 has two objectives: encourage investors to take on risk and wipe out once and for all expectations for deflation. Under Ben Bernanke’s leadership, the Fed has made its resolve regarding these goals crystal clear. Consequently, we can conclude that the global deflation scenario has been eliminated. This conclusion holds true even if excessive monetary easing leads to inflation and problems involving the moral hazard. Investors worldwide will be forced to make a big shift in their portfolios, which are now structured to avoid risk (with large holdings of cash and national government bonds). Naturally, investors will move their money to assets with higher risk and higher potential returns. If this shift takes hold in Japan, it will trigger a surge in overseas investments by Japanese investors. U.S. investors have responded to the country’s zero interest rates and quantitative easing by making substantial investments in countries with emerging economies and countries with high interest rates. Investors in Japan as well should respond to zero interest rates by making large investments targeting emerging economies and high interest rates. This is why investors should view the upswing in risk-taking prompted by QE2 as an event that is very likely to bring down the yen as capital flows out of Japan. With the yen/dollar exchange rate almost at the \80 level, individual investors in Japan are already increasing their dollar long positions. We are therefore seeing the emergence of signs that investments from Japan in emerging countries are about to grow. As Figure 4 shows, in the past, growth in overseas securities investments by individuals in Japan has coincided with stock market rallies (risk-taking). I believe that Japan may be on the verge of another simultaneous upturn in stock prices and overseas investments (which causes the yen to weaken, which is what happened between 2005 and 2007.

Why the yen appreciated as the global crisis deepened

Movements of capital can have positive or negative ramifications. Positive capital movements cause money to flow to areas that have higher returns, a process that maximizes economic efficiency. With negative capital movements, investors have given up on seeking higher returns. Protecting principal is the only priority. This is why these capital flows block economic growth. Movements of capital that pushed up the yen following the 2008 outbreak of the financial crisis were not the result of positive forces seeking higher returns. Investors were doing nothing more than looking for ways to effectively utilize the large volume of funds to invest as the demand for investments contracted. Money did not flow to Japan, which had the world’s highest long-term deflation and lowest long-term interest rates, for legitimate reasons. Because of investors’ expectations for deflation, money that was channeled to Japan came from investors who had no hope for earning any income from their investments. These investments were based on the self-fulfilling stance of “buying the yen because the yen is climbing because everyone is buying it.” But exactly why is everyone buying the yen? The first reason is a negative cycle that begins with higher real interest rates caused by deflation. As interest rates rise, the economy weakens and deflation is reinforced. This makes the yen even stronger, which in turn makes the economy even weaker. The second reason is the belief among currency regulatory agencies that deflation should be welcomed (this is about to change with the current quantitative easing by the Bank of Japan). The third reason is inertia rooted in the fact that yen speculators have been constantly rewarded because the yen has consistently been the world’s strongest currency during the past two decades. For these reasons, investors worldwide have developed a conditioned response in which they react to a global financial crisis by turning to the yen.

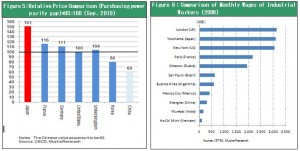

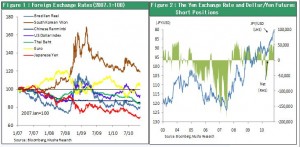

These negative movements of capital will probably disappear as QE2 causes investors to abandon the global deflation scenario. As you can see in Figures 5 and 6, the yen is way overvalued in relation to its purchasing power parity. This overvaluation means that the cost of labor in Japan is far higher than the international standard. Once global currency markets become sound again (by abandoning the deflation scenario), I expect to see a naturally occurring correction that eliminates Japan’s unjustifiably high currency and wages.