Jan 16, 2024

Strategy Bulletin Vol.348

Geopolitics will be the decisive factor of 2024

~Why will the outstanding strength of Japanese equities continue?~

(1) Geopolitics will make the difference in stock performance

Outstanding Japan's stock market rally, U.S. firms, China's setback

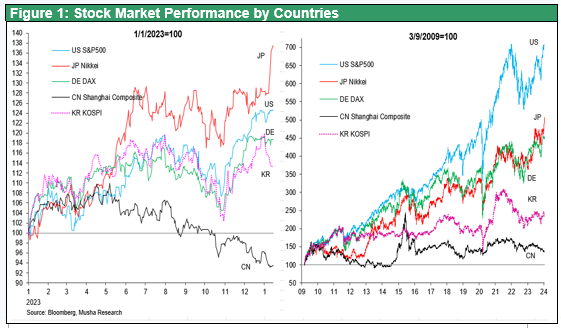

The year 2024 opened with an outstandingly impressive performance of Japanese stocks. In the first seven business days, the Nikkei 225 rose 8%, or 2,700 yen, and U.S. stocks were also strong, with the NY Dow already reaching an all-time high at the end of last year and the SP500 rising 14% from November to December last year, close to its all-time high. However, on the other hand, Chinese stocks have continued their decline since last year. Comparing the performance of stocks since the beginning of 2023, the Nikkei 225 +36%, the US SP500 +25%, the German DAX +19%, the UK FT100 +2%, the Chinese Shanghai Composite -7%, the Korean Composite +13%, and the Taiwan TAIEX +24%, among major country stock markets Japanese stocks stand out. This performance gap can be explained by geopolitics.

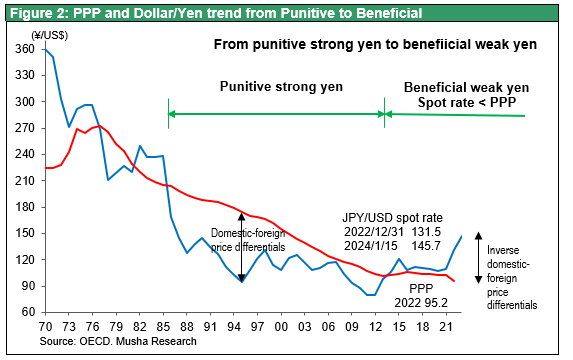

U.S. National Interests Supporting Japanese Stocks

The powerful performance of Japanese equities is backed by U.S. support for Japan. As the U.S.-China confrontation has worsened, the U.S., which once went crazy in its efforts to knock Japan, now needs a strong Japan to decouple from China and is willing to accept a weaker yen to achieve this. The remarkable rise of China plus Asian NIES (South Korea, Taiwan, and Hong Kong) over the past 30 years has been made possible by Japan's declining competitiveness. This one-victim Japan situation will be reversed. The establishment of a significantly weaker yen has changed the major framework of the Japanese economy. The era of deflation caused by the strong yen is over, and the Japanese economy in 2023 was the brightest volume growth economy year since the collapse of the bubble economy, and this will accelerate in 2024. Factories, capital, business opportunities, and employment that fled Japan overseas due to the strong yen are returning to Japan due to the weak yen. Corporate earnings and capital investment are at unprecedented levels. The U.S.-China conflict has brought the semiconductor investment boom to a climax, and TSMC Kumamoto has decided on a third phase of expansion.

In addition to unprecedented corporate profits, the yen's depreciation (Japanese salaries are now 40% lower than the global average) is expected to ensure a 5% wage increase, and the long-awaited end to deflation and 2% inflation are in sight. The weak yen is also increasing inbound tourism, which is stimulating local domestic demand in all regions of Japan.

China's Outflow of Funds Becoming Severe, Buying Up the Yuan

Meanwhile, China is experiencing serious economic difficulties. In the country, the bursting of the bubble economy and a drop in consumption have led to ongoing deflation. Until 2022, influential investors in Wall Street ignore the Washington's warnings and piling up investments in China. However, Panda huggers are forced to shift their investment policies against China due to the establishment of China's dictatorship of fear, the enactment of anti-spying laws, the bursting of China's bubble and economic difficulties. This is the cause of the single largest decline in Chinese equities.

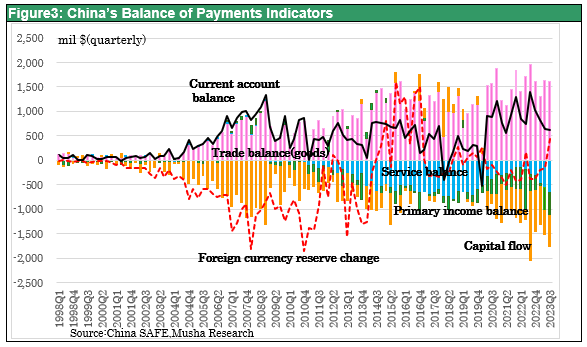

As shown in Chart 3, in addition to large deficits in the balance of services and primary income balance, China has experienced significant capital outflows despite capital controls.

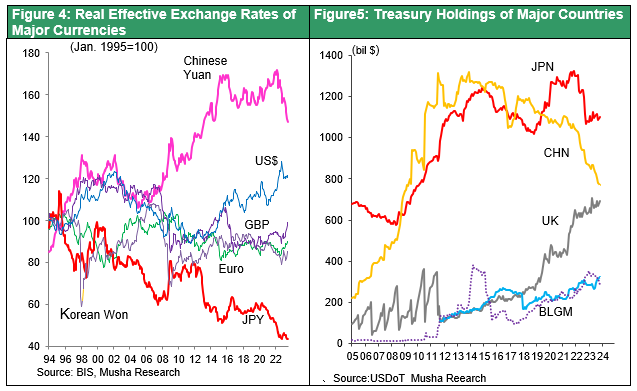

The foreign currency situation is in a lull, with foreign exchange reserves building up in 3Q2023. However, China's wages are the highest among emerging Asian economies, and U.S. import restrictions on China will cause its trade surplus to decline significantly. Despite the superficial stability, China's holdings of U.S. government bonds have declined sharply, suggesting that support for yuan purchases is underway. The foreign currency situation will worsen and pressure for yuan depreciation will continue to mount as China reschedules and revalues its massive loans to emerging economies and further withdraws the foreign capital on which it has been relying.

The ongoing trend toward yuan settlement and de-dollarization with Russia is a desperate measure by the two countries excluded from the dollar international settlement system, and it does not mean that confidence in the yuan is growing stronger. As shown in Chart 4, the real effective exchange rate of the Chinese yuan is at a historically elevated level. For China, which has reached the highest wage level in Asia, the current yuan exchange rate is extremely unfavorable, but it must be maintained at this unfavorable rate to cope with the uncertainty over foreign currencies.

High-Pressure Economic Environment in the U.S. under the U.S.-China Conflict

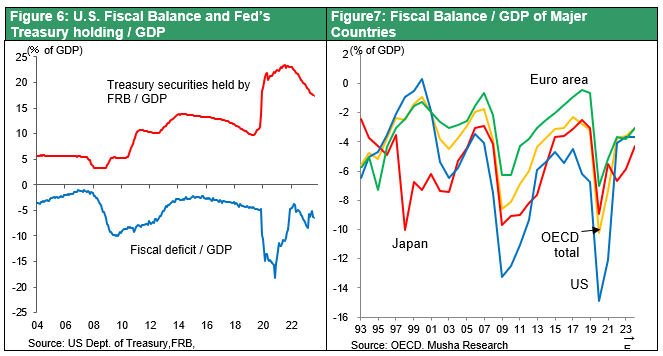

The soft landing of the U.S. economy is almost certain, and corporate earnings have begun to recover after bottoming out in 2Q2023. Behind this is the functioning of high-pressure economic policies in the U.S. to maintain high demand and avoid a Great Depression-type situation of excess supply and insufficient demand. In addition to the aggressive fiscal policy shown in Figure 6, the new industrial revolution, innovation using AI and robots, and the resulting increase in corporate productivity and high profits played significant role. Profits are returned to society through dividends and share buybacks, and new demand and job creation are being promoted through households’ asset income. Consequently, the potential growth rate is rising, and the natural rate of interest is increasing. They indicate that the economy is becoming more self-sustaining and that there is a growing fear that the low interest rates of the past will lead to inflation, bubbles, and other overheating. Stock prices, which have been undervalued for a long time according to the FED model presented in our previous report, are now at appropriate levels when viewed at current interest rate levels, and the risk of bubbles is increasing.

The Fed will be wary of an excessive rise in stock prices. This outstanding economic strength of the U.S. and high interest rates will cause the dollar to appreciate. The hegemonic currency, the dollar, will be further strengthened by its powerful technological advantages and corporate earning power. A strong dollar will bring the U.S. unjustified trade gains and seigniorage (debt that cannot be repaid) by allowing the U.S. to buy cheaply from abroad and sell at higher prices abroad. The economic advantages of the US, multiplied by the strong dollar, will over time overwhelm the tyrannical powers. Looking at the contrast with China's currency woes as it stakes against the U.S. the economic consequences of the struggle for supremacy are almost obvious.

(2) No worries about the geopolitical developments and Trump's reelection

Although the economy and the financial markets are looking at 2024 as a bright year, people's sentiments are gloomy. The postwar international order based on democracy and international law has been shaken by the U.S.-China confrontation and the growing possibility of a Chinese invasion of Taiwan, the Russian invasion of Ukraine in which Russia has the upper hand, the Israeli attack by Hamas and Israel's counterattack, and the conflicts in the Middle East. The decline of the U.S. presence is significant. The Obama administration said that the U.S. could not stand to be the world's policeman, and the Trump administration has increased its disregard for alliances by advocating MAGA. As China continues its military buildup at an exceptionally rapid pace, the U.S. defense budget has fallen from 7.7% of GDP in the Reagan era at the end of the Cold War between the U.S. and the Soviet Union to 3.7% of GDP in 2022.The root cause of the geopolitical turmoil is the weakening of U.S. hegemony, as if Pandora's box had been opened.

The tragedy of the tyranny of a despotic state is evident in Ukraine, and the world is demanding the strengthening of U.S. hegemony as the world's policeman, but this is not happening. The victory of the DPP candidate in Taiwan's presidential election is a good sign, and the fact that the Taiwanese people rejected the idea of Taiwan becoming Hong Kong is extremely significant.

The root of the pessimism that persists, however, lies in whether the U.S. has the will to maintain its global hegemony. There is a whiff of isolationism in Mr. Trump, whose approval rating is rising and who is considered the most likely to become the next president of the United States. The political will of the U.S. will not be confirmed until the end of 2024, and uncertainty persists. Indeed, Trump's reported election agenda includes "10% import tariffs, immigration restrictions & bans (from Muslim countries), elimination of MFN against China, increased anti-environmental oil and gas production, rethinking the shift to EVs, strengthening his power (dictatorial color) by intervening in the civil service personnel system and making it easier to fire people, restoring traditional values, withdrawal from NATO, alliance relations Restructuring? The report also states that "the United States will rebuild a more radical international order based on the national interests of the United States, including the acceptance of nuclear proliferation. The trend toward isolationism is undeniable.

U.S. Abandonment of Taiwan is Unlikely

Trump insists on withdrawing from Ukraine. If that is the case, how far will he go in committing to the defense of Taiwan, where greater sacrifices are expected?

Musha Research would like to emphasize that the next U.S. president, whoever he or she may be, does not have the option of abandoning Taiwan. If China's annexation of Taiwan succeeds and China controls the sea lanes of Japan and South Korea, Japan and South Korea will inevitably become under China's military influence. This would mean the U.S. withdrawal from Asia, the world's growth center, and the end of U.S. hegemony. Dollar hegemony will be severely damaged, and the yuan economic zone will prevail.

This will cause the U.S., the world's largest debtor nation, to face serious debt withdrawal from other nations, leading to a major plunge in the dollar. Intense import inflation will occur in the U.S., and the U.S. economy's presence in the world will shrink sharply. A sharp deterioration in the living standards of the American people is inevitable.

MAGA's number one priority is to maintain dollar hegemony

As shown in Charts 8 and 9, the U.S. has accumulated a huge amount of foreign debt, but its creditors are not worried at all about its ability to meet its obligations because it is the reserve currency. However, once the dollar's hegemony ends, the amount of debt repayment will be enormous. The inability of the U.S. to relinquish the privilege of this massive debt, which it has no obligation to repay, is forcing the U.S. to commit to Taiwan at any cost. We would like to emphasize that maintaining dollar hegemony is a lifeline for Trump's MAGA (Make America Great Again).