Jan 01, 2024

Strategy Bulletin Vol.347

2024 Why the U.S. and Japan Will Lead the World Economy?

We wish you a happy new year.

New Year's Day, 2024

Musha Research Co., Ltd.

The world economy has undergone astonishing changes over the past few years. However, the basic axis of the global economic situation has been set by 2023, and it is assumed that the year 2024 will be an extension of this axis. From a macroscopic viewpoint, the global economy will be developed around 1) geopolitics and the U.S.-China confrontation and 2) the new industrial revolution. The driving forces of the global economy will also be simple: the U.S. and Japan. This is because both are the beneficiaries of 1) and 2).

The reason the U.S.-China confrontation is so important is that the international division of labor, which has continued for the past decades, will fundamentally change. The U.S. and other liberal countries cannot stand to be dependent on China for supply, and they will make concerted efforts to build a supply system that is free from China. The biggest beneficiary of this effort will be Japan, which had been sinking due to the U.S.'s efforts to knock Japan out of the market. Japan and the U.S. will promote deep U.S.-Japan industrial cooperation in areas where the U.S. and Japan used to compete, such as semiconductors, automobiles, and iron and steel. The super depreciation of the yen is an essential and powerful means to achieve this. Japan is the only country that can build an industrial cluster of high-tech manufacturing industries that can replace China.

The largest growth area in the world will not be India, Africa, or the Global South, but the "Seventh Continent," cyberspace without borders. U.S. companies overwhelmingly dominate this "seventh continent. The "Seventh Continent," which was once thought to have entered a mature phase with the spread of smartphones, has entered the next stage of growth thanks to breakthrough innovative technologies such as chat GPT. The real strength of GAFAM+, the dominant player in the "Seventh Continent," is yet to be seen. The gatekeeper of the "Seventh Continent" is hardware, namely semiconductors and electronics. It is also an era in which cyber-physical interfaces, Japan's forte, will come into play.

The hegemonic currency, the dollar, will be further strengthened by its powerful technological advantages and corporate earning power. A strong dollar will bring the U.S. unjustified trade gains and seigniorage (debt that are not returned) by allowing the U.S. to buy cheaply from abroad and sell at high prices to other countries. Over time, the economic advantages of the U.S., multiplied by the strong dollar, are bound to overwhelm the tyrannies. The tragedy of tyranny is evident in Ukraine, and the world will welcome the strengthening of US hegemony through a strong dollar. As the largest military, economic, and industrial ally of the U.S., Japan is in a better position than ever before.

(1) The Rapidly Purifying Autocracies and Their Economic Decadence

The most important historical factor in the developments in 2022-2023, which have been full of upheavals and surprises, will be the rapid purification of despotic regimes and the economic decadence of these countries. With this, the West had a clear opponent to confront, and issues such as the environment, human rights, and inequality became subordinate factors.

Tyrannical States Strengthening Their Cohesion

In the war in Ukraine, the economy of the aggressor country, Russia, has shown surprising durability, and the war situation is in Russia's favor. China, which was cautious when the war began two years ago, is now overtly pursuing a course of Sino-Russian cooperation. Putin also revealed that during the Korean War, "the Soviet military, which was seen as sitting on the sidelines, had actually sent soldiers in Chinese People's Army uniforms into the war. The cohesion of the despotic group of states has become clear, as North Korea and Russia have grown closer through arms transfers and the provision of military technology.

In China, Xi Jinping's personal dictatorship has progressed at an alarming pace. The country is heading toward a dictatorship of fear, with the ousting of the Communist Youth League faction at the party congress, the sudden death of former Premier Li Keqiang, and the successive dismissals and disappearances of Foreign Minister Qin Gang and Defense Minister Li Shangfu. Putin, who is facing a snap election in April, has also become increasingly dictatorial, including the assassination of the rebel Mikhail Blighozin (WSJ observation), and both China and Russia have become more like North Korea, which is now seen as an abnormal state. The Israel-Hamas war has also benefited these rogue states.

China's Economic Difficulties, Dilemma of Economic Policies, and Coercive Intervention

However, China's real estate bubble has burst, and trade has declined, consumption has cooled, and deflation has set in, and the liquidity trap and monetary policy have become ineffective, making it almost clear that the country has entered a process of long-term decline. In China, policy dilemmas are occurring frequently. Monetary easing is essential to stop the bubble from bursting and to stimulate consumption, but this will lead to an outflow of funds from China and a plunge in the renminbi. The only way to deal with these dilemmas is to suppress them by force. To do so, economists who insist on economic rationality must be silenced, which has led to the authorities intervening in economic analysis. The structural problems of a declining population and a rapidly declining birthrate are also ongoing. There are positive factors such as a surge in investment in semiconductors due to policy measures, an increase in EV exports due to automobile measures, and an expansion of exports to Russia and an increase in the ratio of RMB settlements (expanding the RMB economic zone), but none of these factors will be sustainable.

Reexamination of economic and social mentality required

The world has thus entered an era of extreme danger, an era of aggression and war as it was until the first half of the 20th century. Japan and the world need to clean up the "taking peace-for granted mentality" that has persisted for the past 77 years since the end of World War II. A reexamination of this mentality is underway in the domestic politics and societies of each country as well. The intrinsic needs of the people have become stronger, and the era has come to a point where tokenism and idealism are seen as hypocrisy. The rightward turn of politics in each country, the so-called populism, has become a trend. The rhetoric of environmental responsiveness has also revealed its side effects and undercurrents. The adverse effects of humanitarian immigration have become extreme, and even in the Netherlands and Sweden, which are leaders on the liberal track, right-wing parties are on the rise. Criticism is growing for excessive protection of human rights, for example, CRT (Critical Race Theory), which calls for a reckoning with the history of past discriminatory persecution, and for the promotion of LGBT. While nationalism is returning to the political scene in many countries, there is an underlying desire for the restructuring of the world order and a new consensus on values. It can be said that this is an era in which the construction of a new order requires the strengthening of U.S. hegemony.

It is inevitable that the U.S. will become even more hostile toward China. No matter who becomes president, the top priority will remain victory in the Cold War against China, and building a supply chain that excludes China will remain the single most critical issue. The "big government" orientation will also remain unchanged. The development of a domestic industrial base and social insurance spending, as seen in the Corona subsidy, are essential. Although Trump is a Republican, he is not traditionally small government oriented. There is no significant difference in terms of achieving economic buoyancy through tax cuts and government spending.

Trump's popularity is because people are looking for a redefinition of values.

In 2024, there are two major events: the U.S. presidential election and the Taiwan presidential election, but regardless of the outcome of the elections, there will not be a broad range of policy choices. The Trump phenomenon is a sign of the ongoing redefinition of issues in the United States. The fact that support for Trump has not wavered despite his outspoken denial of the results of the previous presidential election is due to the strong public sentiment for a new order. If Trump is reelected, he will be expected to "impose 10% tariffs on imports, restrict and ban immigration (from Muslim countries), abolish MFN against China, increase production of anti-environmental oil and gas, reconsider the shift to EVs, strengthen his power (dictatorship) by intervening in the personnel system of public officials and making it easier to fire people, restore traditional values, leave NATO, rebuild alliances? There is a strong possibility that the U. S will further eliminate China.

In that case, the Japanese political situation may be such that the wind may blow in favor of Prime Minister Takaichi's candidacy. The European economy is stuck in a deadlock. Germany, its main ally, is amid a period of adjustment to its strategy since the Merkel administration of relying heavily on Russia for energy and China for trade, and it is unlikely to be able to shake off the stagnation it has been experiencing.

(2) The Secret of the Incredible Strength of the U.S. Economy, the New Industrial Revolution and MSSE

U.S. potential growth rate is likely to be on the rise

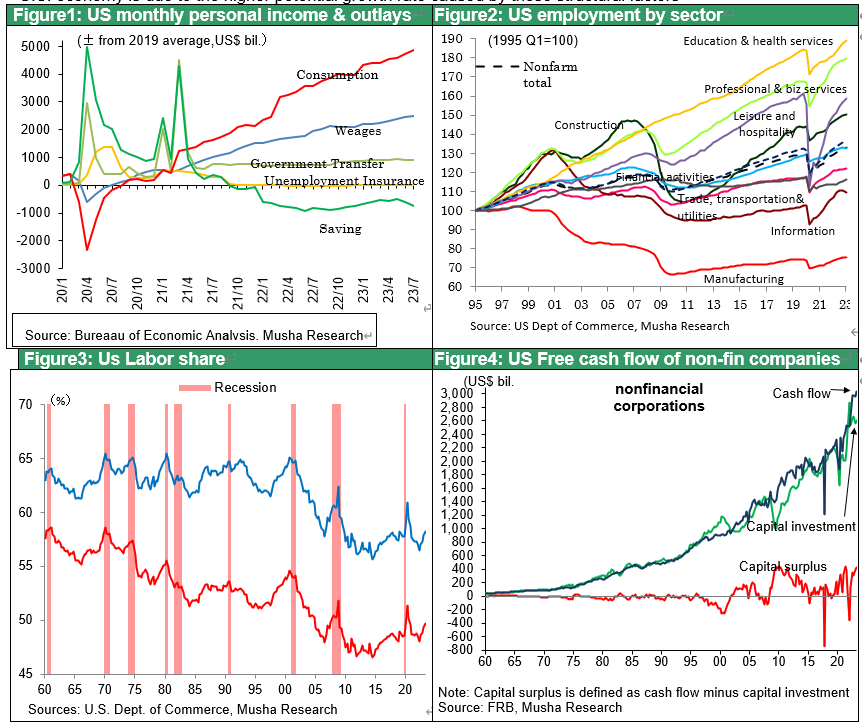

The U.S. economy is doing well and will grow 3% annually in 2023, a 2-percentage point improvement over the IMF's forecast a year ago and a stunning rejection of the consensus that a rate hike would inevitably lead to a slowdown. We may be forced to hypothesize that an industrial revolution and structural transformation of the U.S. economy, driven by the deepening of information technology, are raising the potential growth rate. Three characteristics of the current U.S. business climate can be pointed out. First, the virtuous cycle of consumption and employment is continuing. Consumption is driving the economy, and strong employment is supporting that consumption. Employment, which is a lagging indicator, is leading the economy. Second, strong employment is supported by strong value creation in the corporate sector. Even though productivity has increased and absorbed wage increases, the labor participation rate remains low, ensuring ample cash flow for companies. Third, the shift to "big government" and government spending is working. In addition to household social benefits under the Corona Disaster, industrial policies such as the CHIPS Act and IRAs have invested fiscal resources to promote industry. These three factors are structural factors. We should consider that the impressive performance of the U.S. economy is due to the higher potential growth rate caused by these structural factors.

Figure 1: U.S. Monthly Household Income and Expenditure (Change from 2019 Average)

Figure 2: Employment by Sector (19951Q=100)

Figure 3: U.S. Labor Share and the Economy

Figure 4: U.S. Corporate Cash Surplus (Free Cash Flow)

The New Industrial Revolution in the Cyber World

Historic technological revolution is taking place in the cyber world, including the Internet, AI, and robotics. This cyber world is a "seventh continent," without borders, a world of wisdom that anyone can instantly enter as a user or a company. US companies almost dominate the Seventh Continent. The biggest Bright Spot in the world is not India or the Global South, but the "Seventh Continent," and the U.S. almost single-handedly dominates that Bright Spot, The S&P 500 index is up 23% for the year through December 15, 2023, but the seven U.S. technology companies, the "Magnificent 7" (Google, Apple, Microsoft, Meta, Amazon, Tesla, and NVIDIA), are the most dominant with a combined share price up 75%, while the other 493 companies up 12% have a huge disparity. These stock price trends indicate that there are two economic areas in the United States. One is the cyber-growth economic area that is driving the new industrial revolution, and the other is the general economic area that, like the rest of the world, is hardly growing. Value creation in this "seventh continent" is changing the structure of the U.S. economy significantly.

Figure 5: Magnificent7, 493 Companies, S&P Stock Price Trends

(Since 1.1, 2023 WSJ12.18)

Figure 6: MSCIAC Index Composition (M7 and Major Markets)

(WSJ12.18)

Where did the high-tech restructuring at the beginning of last year go?

The high-tech revolution, which was thought to have ended with the finish of spreading smartphones in the second half of 2022, has begun to accelerate again. This restructuring appears to have accelerated the replacement of labor by innovative technologies in high-tech companies, further raising productivity and boosting corporate profits.

The fact that employment has declined only in the information industry (Chart 2), while employment growth has continued in all industries, tells us that the business model is evolving in high technology.

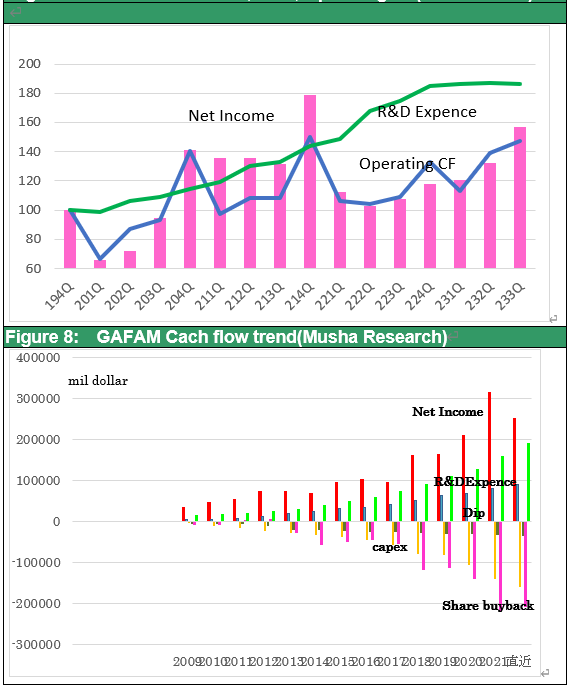

As shown in Figure 7, an examination of GAFAM's cash flow since before Corona Pandemic shows that 1) the decline in 2022 was merely a reaction to the special demand for the Corona Pandemic demand boosting , 2) the companies used this recession as an excuse to implement a major restructuring, 3) at the same time, R&D expenses increased significantly to reduce surface profit, and 4) the sharp increase in sales and profit from 4Q2022 onward.

Magnificent 7's robust stock price is made by the rebound from a sharp decline (almost 30%) in 2022, and by the strong profit recovery.

Double Benefit of Cost Reductions and Higher Sales Prices

High-tech companies are also using their monopoly positions to drive up selling prices: NVIDIA, which has a monopoly on GPUs, which are essential for generating AI, has overtaken TSMC and Intel to become the industry leader in semiconductor sales thanks to its high selling prices. Intellectual property rights create price dominance and value is determined by them. On the other hand, technological improvements increase productivity and reduce costs. The synergy of price dominance and cost reductions supports the unabated profit growth of Internet platformers and other high-tech companies, which are expected to generate $400 billion in after-tax profits by 2024, equivalent to the profits of all Japanese corporations. The M7's share of the MSCIAC Index, a global stock price index, is 17%, higher than the combined 15% of Japan, France, China, and the U.K. (WSJ 12.18.23), indicating the size of the M7's market capitalization. The fact that such a huge "seventh continent" is still growing exponentially should be taken more seriously.

Higher for longer, No major correction in the U.S. economy, no major interest rate cuts

A serious slowdown in the U.S. economy and a sharp drop in stock prices are unlikely in this situation. Since interest rates will start to fall from the current U.S. policy rate of 5.25-5.50%, a rate cut of as much as 2-3% is possible, which would inspire animal spirits and boost stock prices significantly. However, if there is no danger of a recession, there is no need to force a rate cut and push up stock prices excessively. In the past, rapid rate hikes have been followed by rapid rate cuts, and the market is rushing to discount rate cuts, assuming past will be repeated. However, the Fed has repeatedly stated that it is "Higher for Longer" to check the market's growing expectations for a rate cut.

Inflation, which was the impetus for the rate hike in the first place, has been quelled. It is now clear that the inflation that began in late 2021 was transitory, as Musha Research claims. Energy prices, supply chain disruptions, and food prices have completely subsided. Service prices and rents are still rising, but average hourly Earnings, the determinant of service prices, have fallen from a peak increase of 7% y/y to 2-3% y/y. In addition, imputed rents are a lagging calculation based on housing prices, and we see them coming down.

Inflation transitory that is falling sharply

Why does the Fed maintain a Higher for Longer stance? One can only assume that it is because the level of the so-called neutral interest rate, which is suitable for maintaining sustainable economic growth, has risen. However, since no one knows the correct level of the neutral interest rate, the Fed has been raising interest rates with gradual and cautious stance. Fed Chair Jerome Powell's famous remark at the Jackson Hole meeting last summer, "We are navigating by the stars under a cloudy sky," illustrates this.

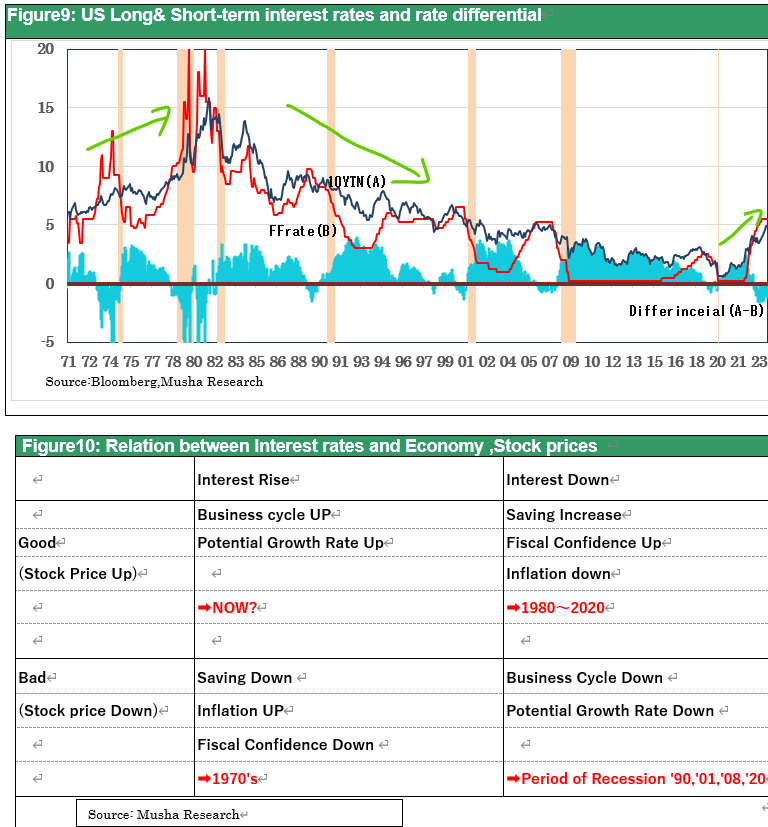

Figure 9: Long-term trends in U.S. long- and short-term interest rates and interest rate differentials

Time to change our view of interest rates over the past 50 years

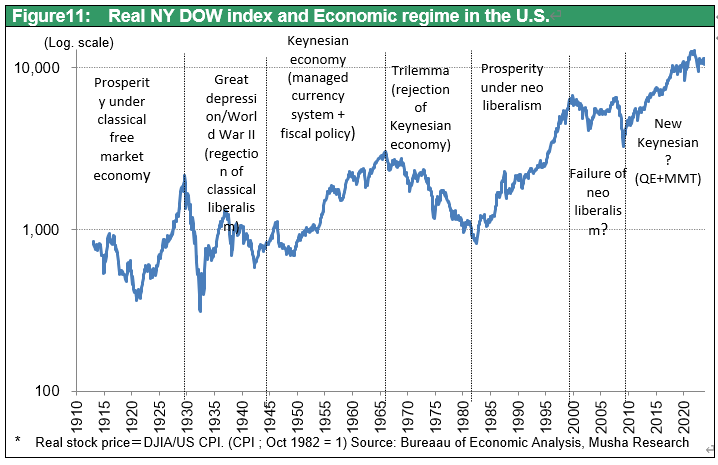

This perspective leads us to the conclusion that current lifted level of interest rate is a good thing. Looking back at interest rate trends over the past 50 years, it appears that the sense that rising interest rates are bad and falling interest rates are good has persisted: the interest rate hikes of the 1970s were bad, with inflation, declining government confidence, and dollar instability causing risk premiums to rise, interest rates to rise, and stock prices to remain depressed. Figure 11 shows the real NY Dow index deflated by the rate of price increases, which peaked in 1966, when interest rates began to rise, and fell 75% over a 17-year period to bottom in 1982, a decline comparable to the Great Depression. This was truly a bad interest rate rise.

Figure 10: Matrix of Interest Rates, Stock Prices, and the Economy

In contrast, the 40-year long-term decline in interest rates after 1981 was a good decline in interest rates due to lower inflation, a growing savings surplus, and the resulting lower risk premium. Real stock prices increased 32-fold (9.1% per annum) over the 40-year period from 1982 to 2022. However, one cannot simply assume that rising interest rates are bad and falling interest rates are good. As shown in Chart 10, if the current rise in interest rates is due to higher potential growth, it is a good interest rate increase. If the Fed continues to keep policy rates at low levels under rising growth potential and rising neutral interest rates, inflation and asset bubbles will increase eventually. Therefor the Fed will have to keep rates high even if inflation fears disappear for the time being. If this is the true meaning of the Fed's Higher for Longer, then the current high interest rates are a factor for higher stock prices.

Figure 11: Real Stock Prices (NY Dow) and the Rise and Fall of Economic Regimes (Musha Research)

The Essence of High Interest Rates, the "Convergence of Continuously Diverging Profit rates and Interest Rates"

More fundamentally, it is important to note that the "convergence of profit rats and interest rates, which have been diverging," is now rapidly progressing. Musha Research has been pointing out the anomaly of the continuous divergence between the profit rate and the interest rate for more than a decade. In both Japan and the U.S., interest rates have been falling since around 2000, while the profit rate has been rising, as if a crocodile had opened its mouth, and I pointed out this strange phenomenon in "The New Imperialism" (Toyo Keizai) published in 2007 (p. 108), but I did not understand the reason at that time. Shortly thereafter, the GFC caused the profit rate to decline, and the crocodile's mouth closed for a time, but since then the gap between the two subsequently widened even more significantly. The profit rate is measured by return on total capital, return on equity (ROE), and earnings yield (profit/share price), but the expansion of the crocodile's mouth is evident in all profit margin indices.

Figure 12: Profit rate (Return on Equity), Interest Rate (Yield on 10-Year Treasury Bond), and Fair Value Based on FED Model

Figure 12 shows the trends of earnings yield and 10-year Treasure yields, which were linked until around 2000 but have diverged significantly since then. The Fed once proposed the model of "expected earnings per share / 10-year JGB yield" as a fair value of stock prices. The model states that the appropriate stock price is the level at which the expected earnings yield (expected earnings per share/stock price) equals the yield on the 10-year Treasury note. Based on this model the stock price have been undervalued significantly, since the yield on equity have not declined over the past 20 years as interest rates foll This undervaluation of stock prices, have come much closer to fair value as interest rates have risen.

Why the crisis of capitalism was averted, the major contribution of high-pressure economic policies

Now, this divergence between the profit rate and the interest rate is a dangerous precursor to catastrophe. In capitalism, there is a struggle for funds because there are lucrative business opportunities and jobs, and interest rates rise as money is put to effective use. However, if companies make money but the money is idle and unused, the resulting interest rates fall means that capitalism is not functioning. I have argued that if the profits of corporations are not returned to the recirculation process of the economy, we are in trouble, and this is a dangerous signal that could lead to a Great Depression. A concept of this is shown in Figure 13.

Chart 13: The basic contradiction of modern capitalism, the divergence between the rate of profit and the rate of interest

There are several ways to return capital to the economic cycle. In the U.S. today, interest rates have risen because of the successful functioning of these methods, and idle funds have begun to be put to effective use. So, how did the idle funds start to move? One of them is fiscal policy. The government has begun to put the money it has been playing with to effective use. High-pressure economic policy (MSSE), led by Treasury Secretary Yellen, seems to have contributed admirably.

Monetary easing and rising asset prices have led to demand creation = job creation

The other is monetary policy. Monetary easing has started to put money to effective use. However, the process of monetary easing is different from the past. With conventional monetary easing, interest rates fell, bank lending increased, and idle money was returned to economic activity, but now there are no borrowers even if banks try to lend.

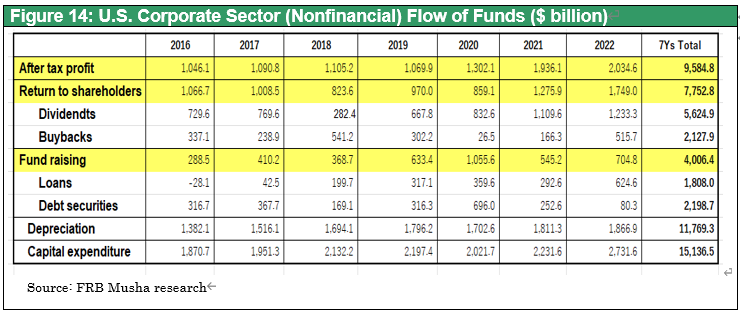

Figure 14: U.S. Corporate Sector (Nonfinancial) Flow of Funds ($ billions)

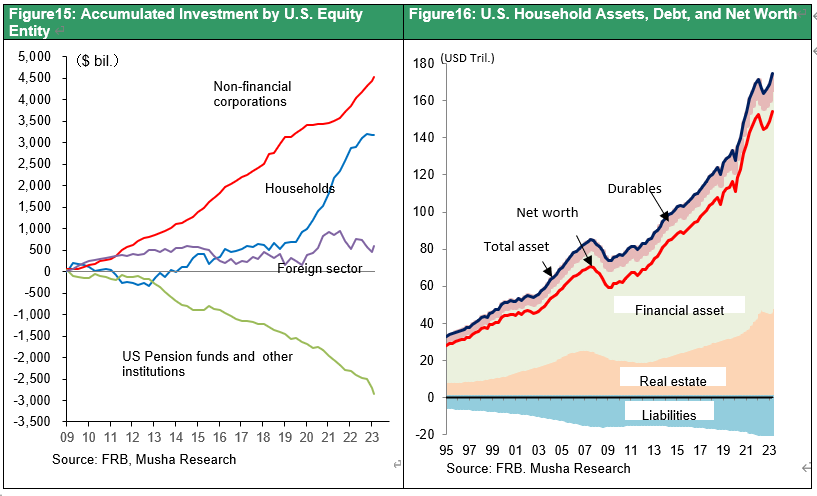

The way in which the money made by corporations during monetary easing was used this time around was through share buybacks and dividends. By returning the entire profits to shareholders, companies increased their stock prices, resulting in a virtuous economic cycle. Since more than half of U.S. household savings, including pensions, are effectively in stocks, higher stock prices increase savings, and the wealth effect boosts the economy. Almost 80% to 100% the free cash flow of the U.S. corporate sector has been returned to shareholders in the form of dividends and share buybacks, especially since the GFC. Even if households' wages have not increased much, the rise in the financial assets’ prices they own and increased dividends has provided energy for consumption. It can be said that the virtuous cycle of the U.S. economy has been supported by an unconventional mechanism. As a result, the divergence between the profit rate and the interest rate has entered a process of convergence, which has manifested itself in the form of the current rise in interest rates. Although the increase in the policy rate due to inflation was one of the triggers, there were underlying process such as shareholder return of corporations that caused interest rates to rise. Therefore, the Fed is not likely to cut interest rates easily even if inflation subsides.

Figure 15: Accumulated Investment by U.S. Equity Entity Figure 16: U.S. Household Assets, Debt, and Net Worth

strong dollar accompanied by high U.S. interest rates as the future trend

If the growth rate of the U.S. economy is higher than that of other countries due to the industrial revolution and technological innovation, the result will be high interest rates, and the dollar will appreciate. If the strength of U.S. innovation continues, the dollar will remain strong for some time.

In addition, there is another factor supporting the dollar's strength. After the Nixon Shock of 1971, the U.S. was able to issue bills without backing them with gold, and it printed more bills to buy goods from overseas. Japan was the first to benefit from this, followed by South Korea, Taiwan, and China. China became so strong because the U.S. bought more goods. It is important to note, however, that the U.S. has had enough, and there is no room left to increase imports any further. Until the Nixon Shock of 1971, the U.S. import dependence rate (how much of the goods that Americans need is imported) was around 10%, and at that time the U.S. made all its TV sets and clothes domestically. Now, however, the U.S. relies on imports for about 90% of its goods. Since there is no room for further increase in U.S. imports of goods, the trade deficit is likely to peaking. On the other hand, the U.S. invisible income from foreign trade will increase significantly in the future. These are services, intellectual property rights, and asset income. These are easy to understand if we think of them as income from the cyber world. Since the cyber world is the sole domain of U.S. companies, we are entering an era of ever-increasing income from it (see Strategy Bulletin No. 345, 11/24/2023).

(3) Japan's time has come

A rare situation has arisen: the greater the seeds of global unrest, the more Japan's brightness emerges. For the past 30 years, Japan has been the world's underdog. It was the only country in the world to suffer from long-term deflation, and its nominal GDP remained flat at just over 500 trillion yen for 30 long years. It was the only country in the world where wage growth stopped for 30 years and was overtaken by South Korea.

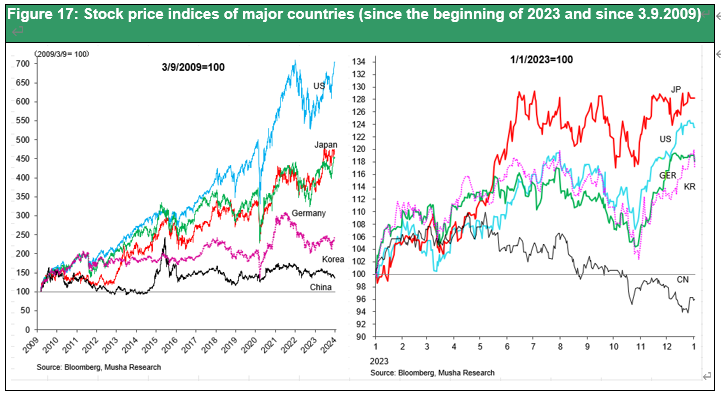

Japan's share of the MSCIAC Index, a basket of global equities, fell from over 40% to 5%, almost one-tenth. During this period, global investors continued to sell Japanese stocks, and by reducing the ratio of Japanese stocks, they were able to win the investment competition. Not only the Japanese, but also investors around the world have developed an attitude of disregard for Japan. Japan is suddenly becoming the world's brightest spot, with the Nikkei Stock Average rising +28% in 2023, the US SP500 +24%, Germany's DAX +19%, the UK FT100 +4%, China's Shanghai Composite -4%, and South Korea's Composite +19%, all of which stand out among major countries' stock markets.

Figure 17: Stock price indices of major countries (since the beginning of 2023 and since 3.9.2009)

Two Factors Behind Japan's Brightness, A. Subjective Change

What has happened to Japan? Two major changes should be noted. The first is a fundamental change: Japanese companies and the economy have improved during the Abenomics era since 2013. Through reforms and the creation of new business models, companies have doubled their profit margins and continue to post record profits. Public pension fund GPIF's investment income has quadrupled to 108 trillion yen. Tax revenues have increased 70% over the past 10 years. Wage growth, which had been lagging, has begun, and 2% inflation is on the horizon.

Many Japanese companies have developed creative business models that are not copycats, have made great strides in corporate governance reform, and are now profitable enough to meet the demands of their shareholders. The value created by these companies is currently being stored in the form of ample retained earnings. In order to promote the return of this retained corporate income, the Kishida administration is implementing a new capitalist policy that will trigger a virtuous cycle from savings to investment by: 1) promoting wage hikes; 2) requiring companies with P/B ratios below 1x to take corrective measures and induce profit returns through share buybacks and dividend increases; and 3) promoting investment through NISA reform and other measures. The supply-demand balance for Japanese equities is expected to improve significantly.

Two factors behind Japan's brightness, B. Major changes in the geopolitical environment

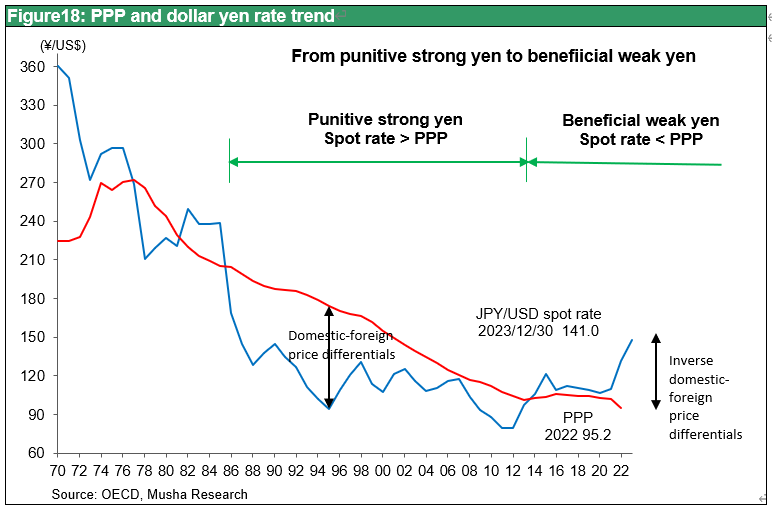

The second factor is the external environment. The U.S.-China confrontation has worsened, and the U.S., which once went crazy in its efforts to knock Japan, now needs a strong Japan to decouple from China and has come to accept a weaker yen to achieve this. The rise of China plus Asian NIES (South Korea, Taiwan, and Hong Kong) over the past 30 years has been remarkable, but it has been made possible by Japan's declining competitiveness. This one-victim Japan situation will be reversed. The significant depreciation of the yen has changed the major framework of the Japanese economy. The deflationary period caused by the strong yen is over, and 2023 was the brightest volume boom year for the Japanese economy since the burst of the bubble economy, and 2024 will see an acceleration of this trend. Factories, capital, business opportunities, and employment that fled Japan overseas due to the strong yen are returning to Japan due to the weak yen. Corporate earnings and capital investment are skyrocketing. The semiconductor boom is progressing further, and TSMC Kumamoto has decided on a third phase of expansion. The weak yen has also increased inbound tourism, and foreign tourists are stimulating local domestic demand in every corner of Japan.

Figure 18: Purchasing Power Parity and the Yen/US Dollar Rate

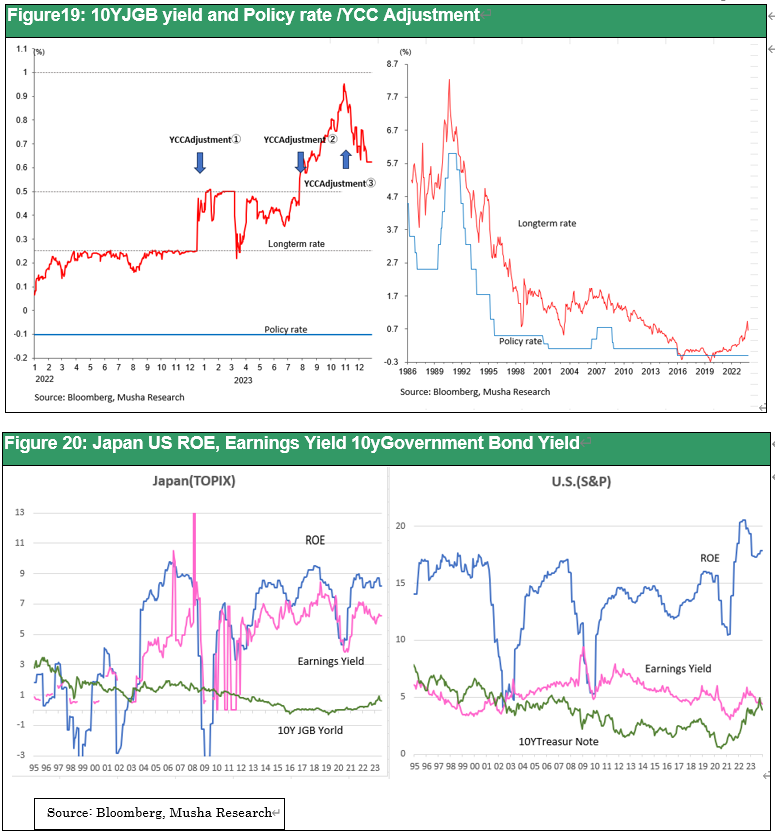

Just before the completion of the 2% inflation target, the BOJ has a good chance to win by proceeding cautiously

Former BOJ Governor Kuroda laid the groundwork for the end of deflation by withstanding criticism from many quarters. In December 2022, just before stepping down, Kuroda announced an adjustment to the YCC (shifting the long-term interest rate ceiling from 0.25% to 0.5%), clearly taking a step toward exit. New BOJ Governor Ueda further adjusted the YCC and allowed long-term interest rates to exceed 1% to a certain degree, leaving long-term interest rates largely to the market. QE (= balance sheet expansion) has also reached its peak at 750 trillion yen over the past few years. The outlook for achieving the 2% inflation target has also improved, when foreign hedge funds speculated on selling JGBs and dollars during the YCC correction in December 2022, these speculations did not last, and the market did not budge at all (Figure 19). The opponents of reflation policies, who assumed that the exit from monetary easing would be chaotic because the extreme monetary easing was forbidden measure, were completely off base.

As Japan's economic growth potential increases and 2% inflation comes into view, the BOJ, like the Fed, will modify its ultra-easy monetary policy and long-term interest rates will rise. However, as in the U.S., the rise in interest rates that is occurring in Japan is also a good interest rate hike and a factor for stock market rally. In fact, the divergence between the profit rate and the interest rate is much larger in Japan than in the US. As shown in Figure 20, In the U.S., the gap between the two shrank sharply in 2023 as interest rates rose, and Japan is expected to follow suit. The expected rise in interest rates in Japan, as we have seen in the U.S., can be seen as a sign that capitalism is back in action and will be understood as a factor for higher stock prices. There is no need to be skeptical about the BOJ's policy changes. The BOJ will continue to exit in an orderly fashion without problems, and the stock market will appreciate it.

Opponents of Abenomics have disappeared

Opposition to Abenomics has disappeared from the scholarly media discourse. There is no longer any objection to the argument that we should be patient and aim to achieve the end of deflation, which is just around the corner. The anti-Abenomics camp's unreflective change of stance is not graceful, but it is good news for the market, and we can expect an all-participant stock market rally in 2024.