Dec 18, 2023

Strategy Bulletin Vol.346

Abe faction ousted, what will happen to Abenomics?

Sudden Mini Political Change

While the NY Dow hit an all-time high in the U.S. on December 13, there was a sudden political upheaval in Japan. Kickbacks from party ticket sales were not listed as political funds on the income and expenditure report. The amount is too small to be a charge of tax evasion. The amount is not malicious, such as bribery or election bribery. Although it must be off-the -book funds, it is not clear whether it is a crime to be prosecuted. It is also rumored that the misreporting of political funds is widespread outside of Abe's faction. The public prosecutor's office has deployed 50 investigators to the case, which is the same level as the investigations into major scandals in the past.

While the facts have yet to be determined, Prime Minister Kishida has ousted all Abe cabinet ministers, deputy ministers, and LDP executive officials, and has steered the LDP away from the Abe faction. The ouster of the Abe faction, the largest faction in the LDP, could be seen as a move to destroy the Abe faction, which has been at the center of the policy debate to date. It is also rumored that the Ministry of Finance, which former Prime Minister Abe has criticized relentlessly, is fighting back behind this move.

The question is whether this political change will lead to a change in policy and a revision of Abenomics, which Kishida has basically inherited. Abenomics is based on three pillars: bold monetary policy, flexible fiscal policy, and a growth strategy to stimulate private investment. However, if there is a possibility of a hasty change in policy, this is something to watch out for.

Will there be a shift from aggressive fiscal policy to an emphasis on fiscal discipline?

The most notable change that could be expected is in fiscal policy. Following in the footsteps of the late Abe, the spearhead of the aggressive fiscal policy argument was Abe faction policy chief Hagiuda and LDP Upper House Secretary-General Seko. Although the ruling party's tax reform plan for FY2024 is not expected to specify a tax hike to finance the defense budget increase, the possibility of a return to fiscal discipline in the next fiscal year and beyond has increased. If a shift from Abenomics to a course of fiscal discipline and tax hikes were to occur, it would be a major cause for concern for the Japanese economy and stocks.

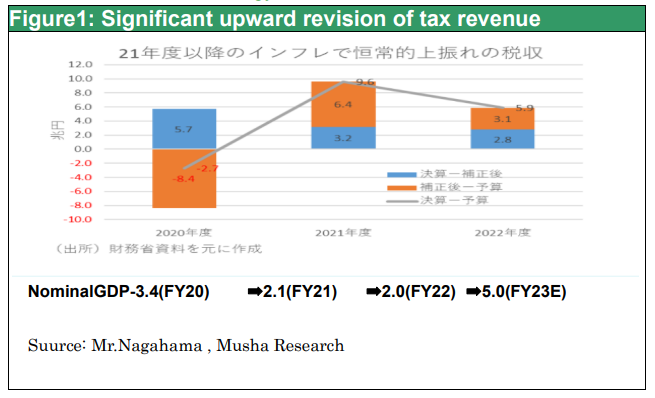

Prime Minister Kishida's position is delicate. Perhaps in reaction to being derided as a "tax-hike glasses," he has quickly decided to cut taxes. He has decided to cut taxes by a fixed amount, deducting ¥40,000 per capita, consisting of ¥30,000 for income tax and ¥10,000 for inhabitant tax, in order to "appropriately return the increased tax revenue, which is the result of growth, to the people. Households exempt from inhabitant tax will receive 70,000 yen. Although there are criticisms as follows, it is better than nothing. The following are some of the criticisms of the government: 1) June is too late, by which time inflation will have already declined; 2) The tax will be increased in the next fiscal year because it is not a permanent tax cut; 3) The government should go ahead with a permanent tax cut because a substantial increase in tax revenues can be expected. According to Toshihiro Nagahama of the Dai-ichi Institute of Life Economics, tax revenues settlement increased by 9.6 trillion yen compare to budget in FY2021(nominal GDP growth 2.1%) and by 5.9 trillion yen in FY2022 (nominal GDP growth 2.0%) (Figure 1). However, nominal economic growth in FY2023 is expected to be 5%, the highest in 30 years, and tax revenues could exceed the budgeted amount by as much as 10 trillion yen. With this as a source of funds, large-scale demand stimulus measures, such as eliminating the consumption tax on foodstuffs, are also possible.

Former Prime Minister Abe wary of the Treasury line, sophistry of the Ministry of Finance

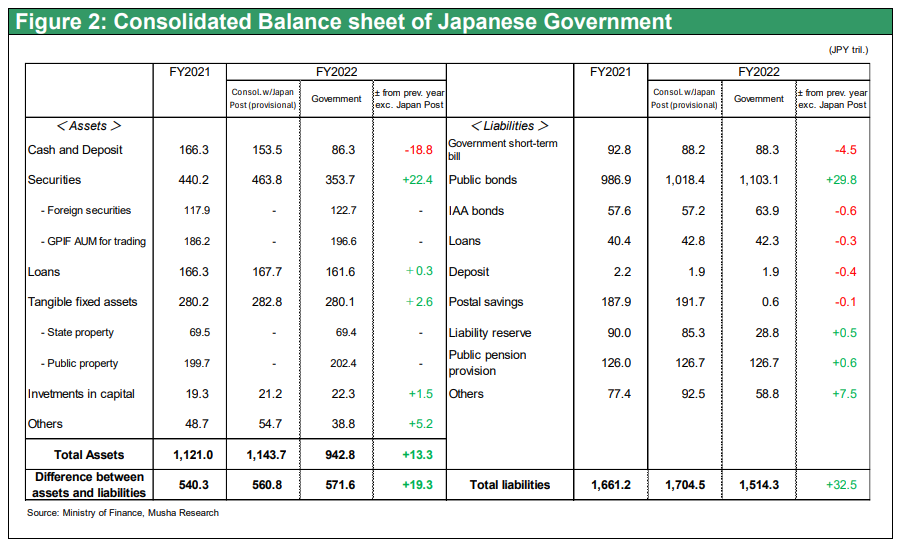

Musha Research has long argued that the fact that the Ministry of Finance and many media and economists have pointed out the problem with the huge budget deficit is extreme exaggeration. Please look at the Japanese government's consolidated balance sheet in Figure 2. Japan's government debt, excluding Japan Post, is 1,514 trillion yen, or 258% of GDP, the largest in the world, and is considered problematic only in terms of the absolute amount of debt. However, a significant portion of this debt has assets on the other side. For example, the Japanese government holds more than 120 trillion yen in U.S. government bonds, which are not needed for policy operations. Pension funds also have assets of about 200 trillion yen, including investment income from the GPIF, compared to the 120 trillion yen deposited by the Japanese people. In addition, Japan's expressways are assets that generate stable income through tolls, but the debt for their construction is also included in the debt. After subtracting the ample assets held by the government, Japan's net debt is 571 trillion yen, or less than 100% of GDP, which is not a very high level even by global standards. The Ministry of Finance's claim that Japan's government debt dependence ratio is 31.1%, the worst among major countries, is also an exaggeration (see Figures 3 and 4). Of the 35.6 trillion yen in debt (=JGB issuance), 16.7 trillion yen is for debt repayment (JGB redemption), and the remaining 18.9 trillion yen is true debt, making the new debt dependence rate 19.4%.The ratio of net new issuance of JGB to GDP is 3.4% which is far less than the US.

Japan has a huge savings surplus in the household and corporate sectors, so the government borrows to create demand, barely keeping the economy in circulation. Without the fiscal contribution, demand would have been insufficient, and deflation would have been even worse. The world-wide reputation of the Japanese government debt as the world's worst is as unfairly damaging to Japan as the "comfort women and conscription issues. Mr. Abe was highly alarmed by this austerity bias of the Ministry of Finance (see Hideo Tamura and Fumito Ishibashi, "Shinzo Abe vs. the Ministry of Finance" (Ikuho-sha, 2023) for details). The Ministry of Finance would like to cut off the influence of those who have inherited Mr. Abe's will.

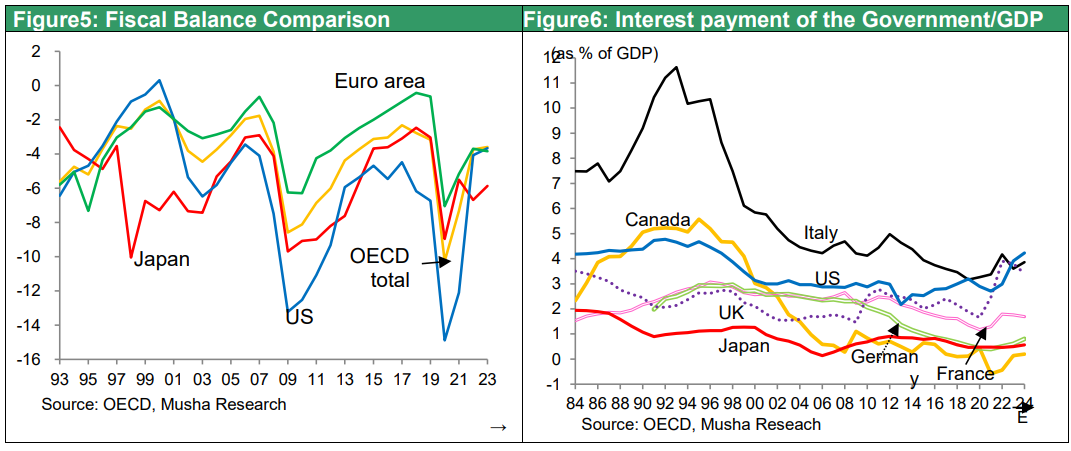

Increasing positive view toward Fiscal policy in the world

In the world, there has been a recent increase in positive opinions about fiscal stimulus. In the U.S., the high-pressure economic theory advocated by Treasury Secretary Janet Yellen (MSSE Modern Supply-Side Economics) is being put into practice, and the U.S. economy is enjoying a robust performance thanks to massive fiscal spending that is more generous than that of other major economies. On the other hand, in Germany, the Federal Constitutional Court has restricted fiscal spending based on the constitutional provision that the budget deficit must be kept below 0.35% of GDP. Japan needs to be careful not to follow Germany's example. The ratio of government interest payments to GDP (Chart 6), which more accurately represents the government's fiscal spending capacity, is among the lowest in the world, and further fiscal spending or tax cuts would be appropriate in Japan.

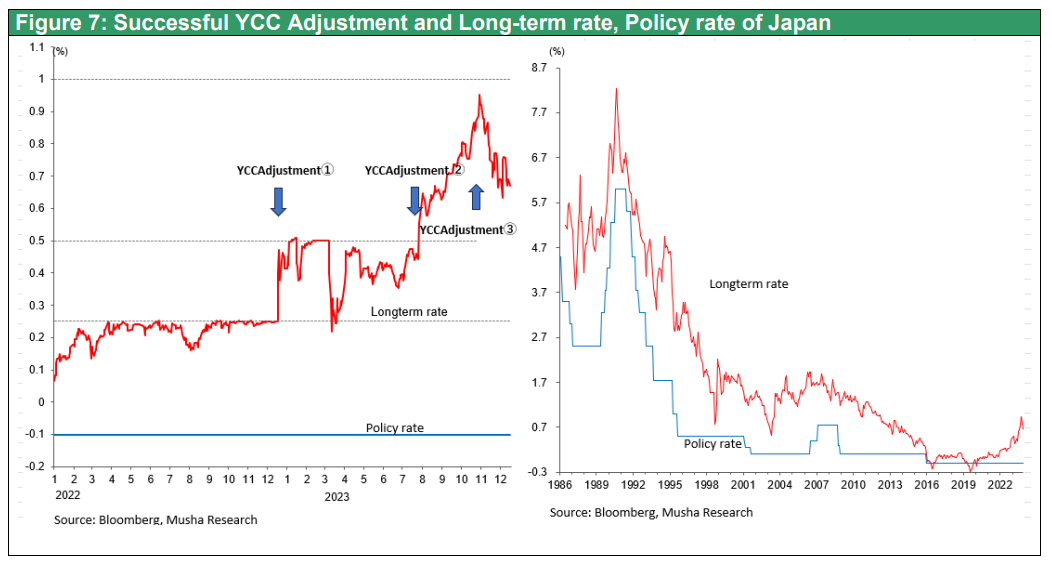

Super Monetary Accommodation Heading for an Orderly Exit

Next, what will be the impact of this political change on monetary policy? Former BOJ Governor Kuroda laid the groundwork for the end of deflation by withstanding criticism from many quarters. Kuroda took a clear step toward exit in December 2022 by putting forward a YCC adjustment (shifting the long-term interest rate ceiling from 0.25% to 0.5%). New BOJ Governor Ueda further adjusted the YCC and allowed long-term interest rates to exceed 1% to a certain degree, leaving long-term interest rates largely to the market. QE (= balance sheet expansion) has also reached its peak at 750 trillion yen over the past few years. Japan's extraordinary monetary easing program is effectively more than half over. Nevertheless, the market has not run disorderly because the BOJ is ready to come out at a moment's notice, and the prospects for achieving the 2% inflation target have opened up. From here, the BOJ can tighten in an orderly fashion if inflation exceeds the target excessively or the yen depreciates to an extreme level.

During the YCC adjustment last December, foreign hedge funds speculated by selling JGBs and dollars, but this did not persist, and the market did not move at all (Chart 7). The reflation policy opponents who assumed that the exit from monetary easing of a different dimension would be chaotic because it is forbidden means, were completely wrong. The BOJ will continue to proceed with an orderly exit without problems, and the stock market will appreciate it.

The sharp rise in the yen at the end of the year is a tailwind for the BOJ's "prudent course of unwinding monetary easing

The yen surged toward the end of the year. The reasons for this were 1) Governor Ueda's statement that "things will become even more challenging from the end of the year through next year," which led to the belief that policy changes would be made at the December monetary policy meeting, and 2) the December 13 FOMC meeting in the US, where the assumption of three rate cuts in 2024 was discussed due to falling inflation and economic slowdown. However, neither of these factors is a major change from the market's previous assumptions. In some respects, this was seen as an excuse to adjust positions.

The strong yen will be a tailwind for the BOJ, which is trying to proceed cautiously with the lifting of monetary easing. The BOJ was able to fend off criticism from the Keidanren and others that it should respond to the sharp depreciation of the yen that has occurred over the past few weeks. Rather, it was a reminder that a hasty policy shift toward tightening could accelerate the undesirable appreciation of the yen.

In this light, the recent political upheaval is not likely to have a major impact on economic policy management in the near term.