May 08, 2023

Strategy Bulletin Vol.331

Both sides of the Atlantic, GAFAM and LVMH thrive

- Demand for Luxury Goods as a Guide

(1) Prosperity on both sides of the Atlantic, GAFAM and LVMH

Remarkable rebound in high-tech stock prices

The major miscalculation of the U.S. stock market in 2023, which began with general pessimism, will be the resurgence of GAFAM and the recovery of high-tech stocks. GAFAM, which had led the era with its outstanding technological innovations and rising stock prices since the outbreak of Corona pandemic, saw its stock price plummet in 2022 due to the end of special demand under the pandemic and the slowdown in smartphone demand in addition to the rapid rise in interest rates, and it seemed as if the boom period was over. However, this is not the case, and stocks have been recovering at a rapid pace once again. Looking at U.S. stock prices since the beginning of this year, the NY Dow index is up only 1.5%, while the tech-driven NASDAQ is up 17% since the beginning of the year, a significant difference.

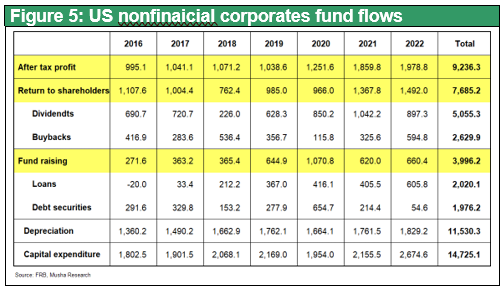

The stock price of NVIDIA, which supplies the semiconductor GPUs used in AI such as Chat GPT, plunged 66% from its all-time high a year ago to October of last year, but has since recovered 2.4 times in the six months since then.

The Breakthrough of European Brand Conglomerates

Turning our attention to Europe, however, we find that brand conglomerates in completely different categories are making remarkable strides. LVMH is the world's largest French brand company, employing 200,000 people worldwide, with sales of 79.2 billion euros (11.1 trillion yen) in fiscal year 2022, and a market capitalization of 436.3 billion dollars (65 trillion yen), making it the largest company in Europe. The company, which began with the merger of Moët Hennessy and Louis Vuitton in 1987, now owns numerous brands in a wide range of categories, including fashion, jewelry, perfume, and liquor, such as Louis Vuitton, Fendi, Gipandsy, Kenzo, and Loewe, etc. Bernard Arnault, CEO and largest shareholder of the company was ranked number one in the 2023 edition of the World's wealthiest people ranking , surpassing Tesla founder Elon Musk with an estimated $210 billion in assets (Forbes magazine). The world's three major conglomerates in the fashion brand industry, including Kering of France, which owns Gucci and Saint Laurent, and Richemont of Switzerland, which owns Cartier, Dunhill, and Chloe, are also doing well.

How should we look at the seemingly contrasting progress of U.S. high-tech companies and European brand companies on both sides of the Atlantic? In fact, the two are fundamentally linked. The vast amount of value created by the new industrial revolution is being redistributed to European companies in the form of demand for brand-name products. In his book "Love, Luxury, and Capitalism," the German historian economist Werner Sombart argued that luxury has been the catalyst for the creation of demand and the development of capitalism. The economist's emphasis on demand-side analysis suggests that the flourishing of European brand industries is significant as a marker of the strength of the current capitalist economy.

Cross-Atlantic Firms Connected at the Roots

On the East Atlantic coast, the new industrial revolution in the United States, including Internet and AI, is underway, bringing unprecedented productivity gains and significantly reducing the need for labor input. Technological innovation has also led to rapid price declines for digital equipment and other capital equipment and systems, eliminating the need for companies to reinvest all of their depreciation; GAFAM is generating huge revenues, but the amount of reinvestment required to stay in business is surprisingly small. The increase in value created by the corporate sector is directly linked to an increase in capital surpluses. It is becoming clear that this fertility of value creation has been largely unimpaired by the Corona pandemic, the surge in prices due to resource price and supply chain disruptions, and the fastest monetary tightening in recent history.

This abundant value creation is causing a virtuous cycle in the U.S., stimulating strong consumption and providing broad employment opportunities. The employment boom is continuing, with the unemployment rate at 3.4% in April, the lowest level in the post-war period. On the other hand, however, income accumulated by the wealthy is driving global demand for different and more expensive goods. This trend toward higher consumption has led to a significant increase in tourism demand from abroad in Japan.

Last year, there was growing criticism that the extreme monetary easing under the Corona pandemic had triggered speculation in real estate, luxury brand goods, and stocks. Based on these observations, many experts warned that monetary tightening would lead to a widespread bubble burst. However, despite the fastest interest rate hike in the U.S. unemployment rate remain at a 50-year low, and global demand for high-tech and high-value consumption such as luxury goods and tourism remain strong.

(2) Demand for luxuries has become a merkmal

Earned enterprises do not necessarily create demand

The new industrial revolution has two aspects: increased supply and increased demand. Technological evolution (i.e., productivity growth) increases the capacity to supply goods, but if it is not accompanied by an increase in demand, the increased capacity to supply goods will not only not be utilized but will also increase the deflationary gap and cause the economy to contract. The problem is that the companies leading technological evolution are not necessarily the ones responsible for demand creation. The income earned by companies must be transferred to other sectors, where a virtuous cycle of increased demand must begin.

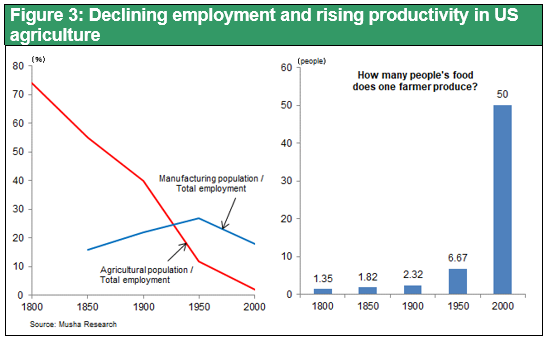

The results of improved agricultural productivity have been transferred to other sectors, triggering new demand

Over the past 200 years, labor productivity in U.S. agriculture has increased 50-fold. As a result, the number of agricultural workers has plummeted from 74 out of 100 to 2 over the past 200 years. The fruits of agricultural labor productivity gains were transferred to other sectors, where entirely new demands were created, creating new jobs for the 72 people who had been unemployed from agriculture. Workers freed from agriculture were placed in industries that did not exist at all before, including the manufacturing industries; the energy, utilities, and infrastructure industries; the education, health care, entertainment, and professional services industries; and the financial and real estate industries. These new jobs dramatically increased people's standard of living, which in turn greatly expanded the size of the economy.

High Tech Compresses Agriculture's 200-Year Development into 10 Years

If we apply Moore's law, which states productivity in high-tech industries doubles every two years, to predict for future the same change that took 200 years in agriculture will occur in 10 years in high-tech industries. The rapid pace of creation of new demand and new employment will be crucial in the high-tech sector. If not, we will soon find ourselves in a Great Depression of excess supply.

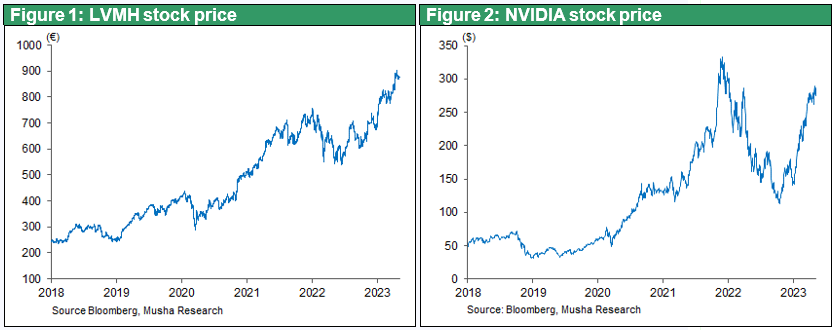

The virtuous cycle of value creation and demand creation maintained in the U.S.

The added value earned by companies must be linked to demand creation through various channels: (1) to households through higher wages, (2) to shareholders through dividends and share buybacks, or (3) to the national budget through higher tax revenues. And in the U.S. today, these three engines seem to be functioning. In 2022, the total shareholder return ratio (dividends and share buybacks/market value) was 4.6% for S&P500, and the amount of dividends and share buyback of U.S. corporation was $1.48 trillion, a massive 6% of the U.S.GDP. This has boosted stock prices, lowered long-term interest rates, and supported consumption. Strong consumption itself is supporting households by keeping employment strong and wages rising at a reasonable rate. In addition, the Chips Act and the IRA (Inflation-Reduction Act) passed last year have begun to set in motion government spending to support industry. In his other book, "War and Capitalism," Werner Sombart also argues that wars have developed capitalism by promoting the creation of massive demand and a disciplined supply system. Support for the war in Ukraine and the U.S.-China conflict are also factors supporting aggregate demand in the United States.

Thus, robust consumption and employment trends in the U.S. and the strength of the European luxury goods industry suggest that the global economic virtuous cycle remains intact even after significant monetary tightening.