Apr 13, 2023

Strategy Bulletin Vol.329

Vectors aligned for investing in Japanese stocks Spring 2023

- A virtuous cycle of New Capitalism will begin!

With the cherry blossoms blooming, there is a growing sense that a Japanese stock boom is about to arrive. After Japan as Number One in the 1980s, Japan Bashing in the 1990s, Japan Passing in the 2000s, and Japan Nothing (ignoring Japan) in the 2010s, there are signs that the world's enthusiasm for Japan is returning once again. Although Japan did not make it to the Olympics because of Corona pandemic, this year's Hiroshima Summit may set the stage for renewed enthusiasm toward Japan.

(1) A remarkable increase in the number of visitors and respect for Japan

Signs of the coming of the "Ten Thousand Guests" are appearing everywhere. Leaders of countries that have kept their distance from Japan, such as President Yun of South Korea and Chancellor Scholz of Germany, are visiting Japan one after another. Japan is the most powerful ally of the U.S., which confronts tyranny, and is located on the border of tyranny; Japan maintains the world's highest level of high-tech industrial strength and technology, including materials, components, and equipment, and is an essential link in the global high-tech supply chain; Japan is the only non-white country in the G7 that advocates diversity and has contacts with the global south; Japan is a country of extreme pacifism, and a country that maintains unique strategic reciprocity with rogue states Russia, China, and Iran. There has never been a time when the world needed Japan's rare standing as much as it does now.

It is a sign of the coming of a thousand visitors.

The World's Biggest Hot Tourist Spot

Japan is crowded with foreign tourists, and the country is full of advantages: Japan was ranked No. 1 in the WEF's 2021 Tourism Development Power Ranking. This is based on its infrastructure, cultural heritage, abundant nature and four seasons, and more. Add to this the delicious food (the number of Michelin ranked restaurants by city is overwhelming: Tokyo #1 with 201, Paris #2 with 118, Kyoto #3 with 107, Osaka #4 with 94, Hong Kong #5 with 71, London #6 with 70, and New York #7 with 65) and the subsequent depreciation of the yen, the competitiveness of Japan's tourism industry is overwhelming. Chinese visitors will increase rapidly as the Corona restrictions lifted, and by 2023 the number of foreign visitors will surpass the previous peak of 31.89 million in 2019, and will eventually approach the world's largest, France's 90 million.

High-Tech Investment Rush in Japan Begins

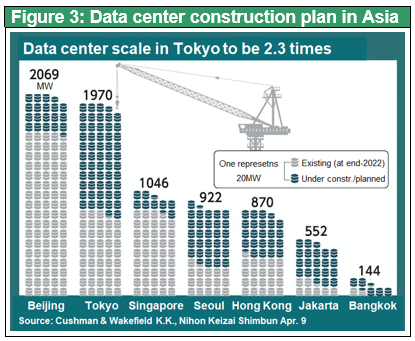

In addition to the second phase of TSMC's Kumamoto Plant and the 5 trillion yen project for Rapidus Chitose Plant, South Korean semiconductor companies such as Samsung and SK Hynix, which accompanied South Korean President Yun on his visit to Japan, are also expected to consider investing in Japan. Back-end processes will become more important with the shift to 3D, the key to next-generation semiconductor technology, and Japan may become a hub for back-end process technology, as TSMC has established a development base in Japan. In addition, Sam Altman, founder of Open AI, visited Japan on his first overseas trip after the launch of Chat GPT and met with Prime Minister Kishida. The Nikkei also reported that in terms of data center processing capacity, Tokyo, which is currently only half of Beijing's, will reach the largest level in Asia, rivaling Beijing, in 3-5 years as investment based on economic security surges. All of these reports indicate a growing respect for Japan. Companies are also returning to investment in Japan, including Kyocera, Yaskawa Electric, Canon, Fujifilm, Rohm, Renesas, Hitachi, Panasonic, Shiseido, Unicharm, Lion, and Iris Okayama, to name just a few.

(2) Policies (PM Kishida, FSA, TSE) to steer stock prices in the right direction, hot on the heels of foreigners'

Respect for Japan by Warren Buffet

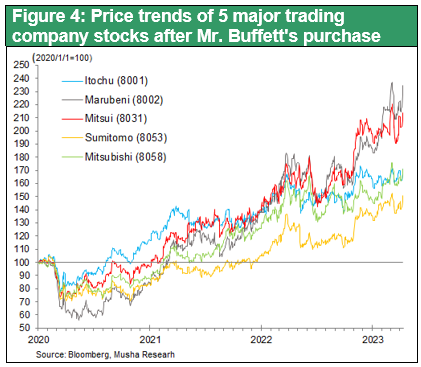

These growing respect for Japan has already factored into the stock market. Warren Buffett, an admired investment became the largest shareholder in 2020 with 5% of the five largest trading company investments, and this year he added to 7.4% of each companies share outstanding. After passing over Japan for the past 70 years, Mr. Buffett now has the largest weighting in Japanese equities outside of the United States. During his current visit to Japan, Buffett expressed his interest in Japanese stocks, saying, "From now on, I will be watching all the major Japanese companies. Not only that, but he also told the Itochu chairman Mr. Okafuji, "I would rather be a business partner than an investor. This is the utmost respect for the Japanese business model and the company itself.

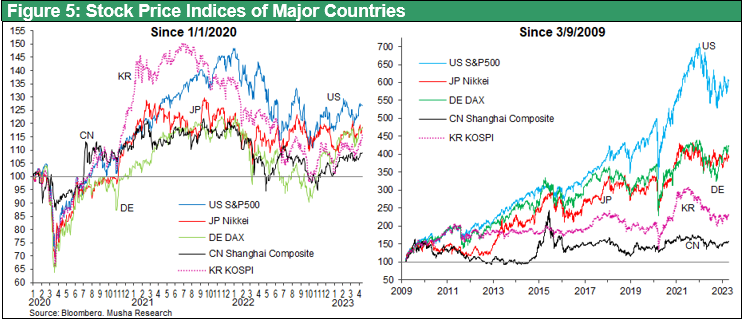

The Stock Market is Factoring in Japan's Revival

Despite the widespread pessimism and downbeat sentiment about Japan, the stock market, which is the leading indicator of all events, has already factored in Japan's resurgence 10 years ago. Japanese stocks were at their worst at the end of 2012 under the Democratic Party of Japan (DPJ) administration, long before Buffett's attention, and since then, Japanese stocks have had the world's highest performance after the US, Contrary to the observations of the media, academics, and experts looking in the rearview mirror, the stock market has been factoring in Japan's major turnaround extremely quickly and accurately.

TSE and FSA are sympathetic to the vulture's claim that "stock prices are the absolute measure of corporate valuation

A column titled "Japan goes capitalist" appeared in the FT's electronic edition (3/31). The column states that Japanese companies are shifting their focus to maximizing shareholder value and that expectations are rising for share price rises. The article stated, "Japanese companies have accomplished the difficult task of increasing profitability amidst the difficulties (of a strong yen and deflation), but they are struggling with the easy stuff, like returning those profits to shareholders. Many Japanese companies have been sitting on mountains of cash and have done little in the way of wage increases or share buybacks," but that may change dramatically, according to the column.

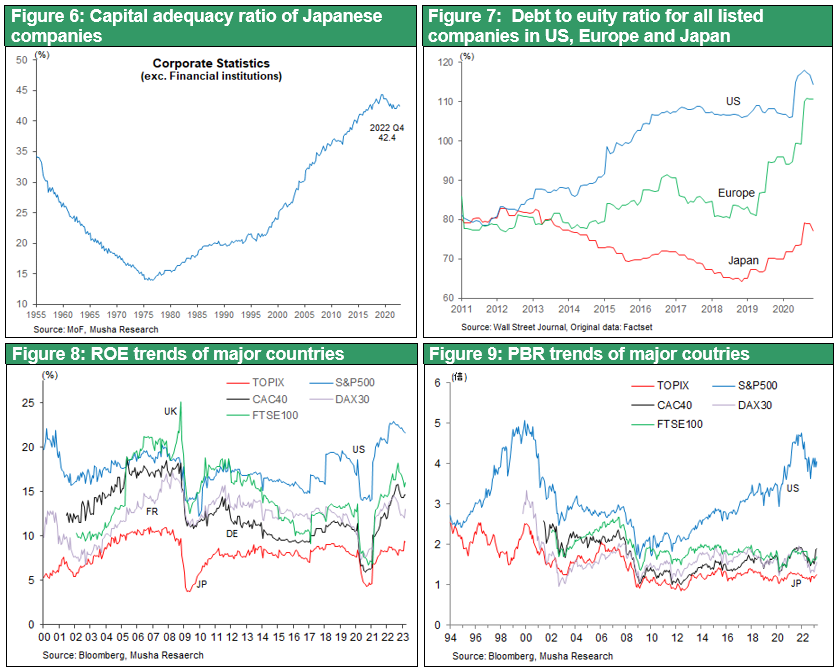

Indeed, Japanese companies have been hoarding too much of their profits, and their inefficient use of capital due to excessive savings has been the cause of Japan's stock market weakness. While the P/B ratios of U.S. stocks have risen to around 4x, Japanese companies are languishing at around 1x, the lowest in the world. Activists have criticized Japanese stock prices for being undervalued because management has not met shareholder expectations and have launched numerous TOBs (takeover bids). In fact, the equity ratio of TSE-listed companies is almost 50%, which is higher than the average ratio in Europe and the United States (around 30%). If this equity capital is returned to shareholders through share buybacks, return on equity (ROE) will soar and share prices will rise. This alone would increase shareholder value.

DNP and Citizen Watch, pressured by activist, Elliott Management, announced large-scale buybacks of their own shares, and their share prices soared by more than 30%. Investors around the world are excited to see which company will be the next to announce a share buyback.

The TSE and the Financial Services Agency (FSA) agreed with this activist approach to corporate management using stock prices as a yardstick. TSE asked listed companies to take measures to realize management with an awareness of cost of capital and stock prices and demanded corrective measures for companies with P/B ratios of less than 1x. Minister Suzuki also announced on 4/6 that the FSA intends to seek improvement plans from companies with low stock price valuations.

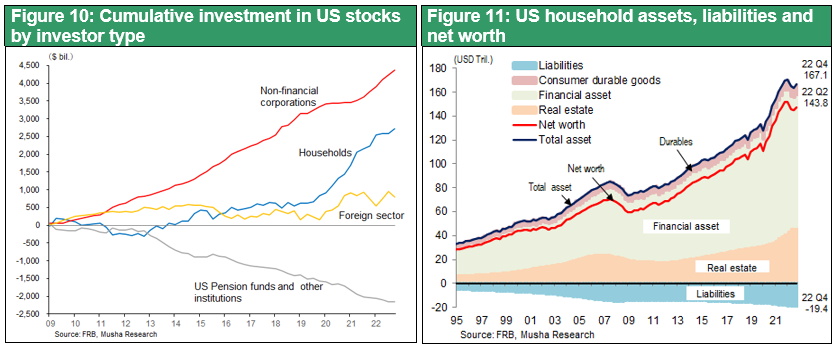

The U.S., where the stock market plays a key role in the flow of funds, and Japan is following suit

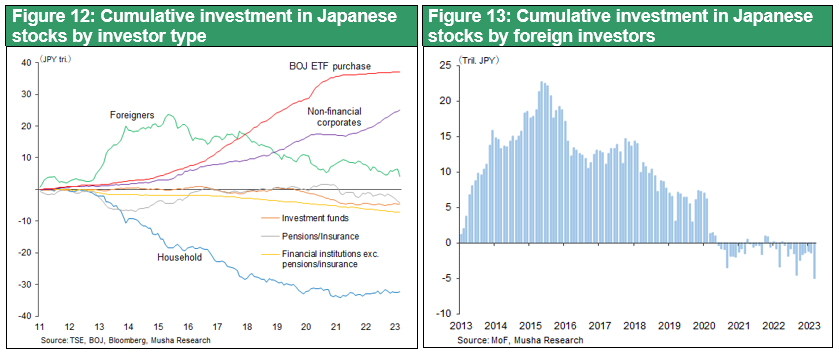

Thus, momentum for redirecting surplus funds to share buybacks is rapidly increasing. In 2021, share buybacks amounted to 8 trillion yen, and in 2022 they are estimated to have reached 10 trillion yen, and by 2023 they may leap to 15 trillion yen, making them the largest buyers of Japanese stocks. In the U.S., stock prices have surged sevenfold in the 12 years since the GFC, and the sole driver of this stock surge has been corporate share buybacks totaling $4.5 trillion. U.S. companies have been returning all their profits to shareholders through dividends and share buybacks, and the resulting large gains in stock prices have increased the net wealth of U.S. households by $90 trillion (more than four times the GDP), which has supported robust consumption in the United States. The possibility of a virtuous cycle occurring in Japan, as in the U.S., is becoming increasingly likely.

Anticipation of an investment boom in which everyone participates

The Kishida administration's asset-income doubling plan and reform of the "NISA" has started a major shift of individual funds from deposits to stocks. With companies buying back their own shares, households investing in long-term accumulations, and institutional investors shifting from bonds to stocks, the Japanese are on the eve of an all-participant investment in stocks. For a long time, the volume of Japanese stocks trading has been occupied 70% by foreigners and 30% Japanese. If the absence of domestic player were to change, it is only natural that foreign investors would be excited.

(3) Launching "New Capitalism", building on the achievements of Abenomics

Full revival of earning power

The reason why the virtuous cycle described above can be expected now is that Abenomics has fully restored earning power. Corporate profit doubled to 84 trillion yen since the introduction of Abenomics. On top of this earning power, two consumption tax hikes were made possible, resulting in a marked increase in tax revenues: Japan's general account tax revenues were 44 trillion yen in FY2012, but will be 65 trillion yen in the FY2022 budget, a 50% increase from 10 years ago.

The next challenge is to return corporate income to the economy; this is where "new capitalism" comes in

The Cabinet Secretariat's document on the Council for the Realization of New Capitalism states, "In the new capitalism, we will thoroughly pursue growth. However, unless the fruits of growth are properly distributed and used to invest in the next stage of growth, further growth will not occur. Distribution is not a cost, but an investment in sustainable growth. In Japan, the fruits of growth are not appropriately distributed to local regions and business partners and are not being fully channeled. Also not delivered to the next round of R&D, capital investment, and employee salaries. These "blockages" are preventing the next stage of growth. Waiting will not bring about trickle-down. It is necessary to eliminate the "blockages" through active policy involvement. The paper is proposing concrete measures such as (1) increasing wages, (2) facilitating labor mobility by improving skills, promoting side jobs and dual employment, and (3) formulating an "asset income doubling plan" to shift from savings to investment.

Why is emphasis on stock prices the right thing to do?

The way to resolve this "blockages" is to shift economic policy to emphasize stock prices. Mr. Kishida has reverted his original plan “new capitalism” which emphasize distribution to the Abenomics line of "a virtuous cycle of growth and distribution" by re-contextualizing. Simply put, he has made a major shift from a stance of disregarding and ignoring stock prices to one of emphasizing stock prices without any hesitation. In May 2022, Prime Minister Kishida urged investors in London to invest in Japanese stocks with the words "Invest in Kishida. This shift is a major corrective and the key to Kishida's long term government.

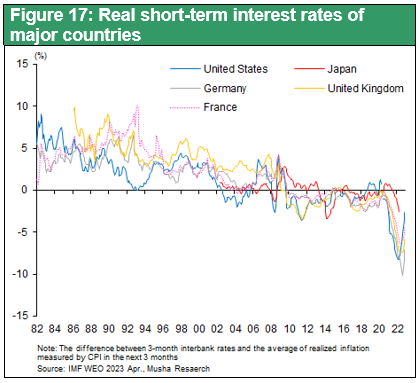

Fifty years ago, the leading companies in the U.S. were GM and GE, and when these companies became profitable, they expanded their factories and increased employment, triggering the next cycle of economic expansion. However, today's leading companies, such as Apple and Google, do not invest in facilities and do not increase employment much even if they make money. Their huge corporate profits do not lead to demand creation and the expansionary cycle of the economy. As a result, corporate surpluses are stuck in the financial markets, causing extremely low interest rates. The trend of low interest rates due to excess corporate profits and savings surpluses will not change even if inflation increased and monetary policy tightened, according to the IMF in its latest World Economic Outlook (April 2023, Chapter 2).

Shareholder Returns, an Essential Channel for Excess Profit Returns

The most desirable solution is to raise labor wages above productivity and sustainably increase household consumption. This requires moderate inflation, which is what is happening in the U.S. right now: the labor share has been rising since bottoming out in 2015 or so, and unit labor costs have also begun to rise. These trends are desirable from the perspective of increasing consumption through higher wages, narrowing inequality, and eliminating capital retrenchment. Herein lies the need for a high-pressure economy. However, this huge gap will not be filled unless wages continue to rise for a considerable period of time.

Therefore, for the time being, there is no other way but to return excess profits of corporations to the real economy through shareholder returns. The U.S. economy is the strongest among developed countries because the mechanism of returning excess corporate profits through the stock market is functioning well.

The Kishida administration's shift to a policy emphasizing stock prices is precisely the kind of policy that encourages the return of excess corporate profits to the economy in the U.S. style, and the result should be entirely satisfactory.