Mar 13, 2023

Strategy Bulletin Vol.328

Monetary tightening without rationality nears end

- SVB failure could be the starting point for a U.S. stock market rally

(1) Implications of the SVB failure ⇒ Side effects of monetary tightening have become apparent

The side effects of the strong monetary tightening have become apparent with the collapse of SVB. SVB (Silicon Valley Banking Group), a medium-sized bank ranked 16th in the U.S. with total assets of $209 billion (¥28 trillion), failed and was placed under public (FDIC) control. Although SVB is a core company in the Silicon Valley financial ecosystem and the largest bank failure since the Lehman Brothers collapse, the general view is that it will not be widespread. If this is the case, then this sharp decline in the stock price is a good time to buy.

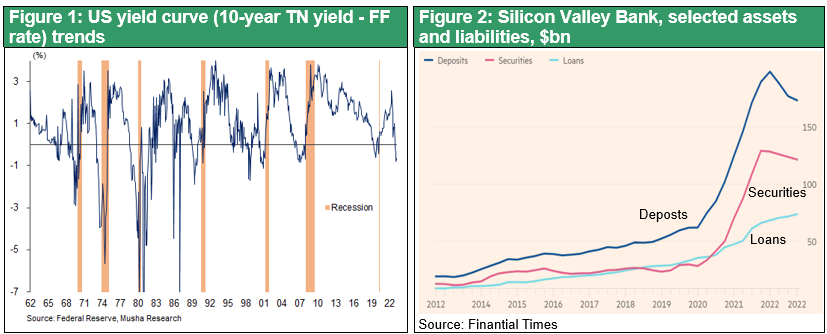

The traditional business model of commercial banks is to accept deposits at short-term interest rates, and then invest them in higher-interest loans and long-term bonds to earn interest. However, the sharp rise in interest rates in 2022 caused a reversal of long- and short-term interest rates(inverted yield), making the traditional banking business the largest reverse yield in the past 20 years.

SVBs have grown rapidly as a temporary holding place for funds raised by Silicon Valley start-ups from venture capital firms, etc., and have earned interest by investing these funds in long-term securities such as U.S. treasuries. Therefor, the reversal of long- and short-term interest rates and the drop in the prices of long-term bonds such as treasuries have resulted in potential losses, causing depositors to withdraw their funds (bank run) and bringing the bank under FDIC control. However, it is generally observed that SVB is unique and will not catch fire from other banks. This is due to the following reasons: (1) while 90% of SVB's funding comes from deposits, JP Morgan, BankAmerica, and other financial institutions depends 60-70% on deposits, so the impact of higher funding costs will be minor; (2) SVC invests most of its assets in long-term bonds with fixed interest rates, while other banks have a wider diversification.

Nevertheless, if the inverted yield continues, the bank's earnings and asset values will be damaged and financial stability will eventually be undermined. The business model of depository institutions, which provide loans by accepting deposits, will no longer be viable, and their earnings will be severely damaged. The Fed must be deeply aware of the risks of raising interest rates too quickly.

(2) Monetary tightening of unknown significance

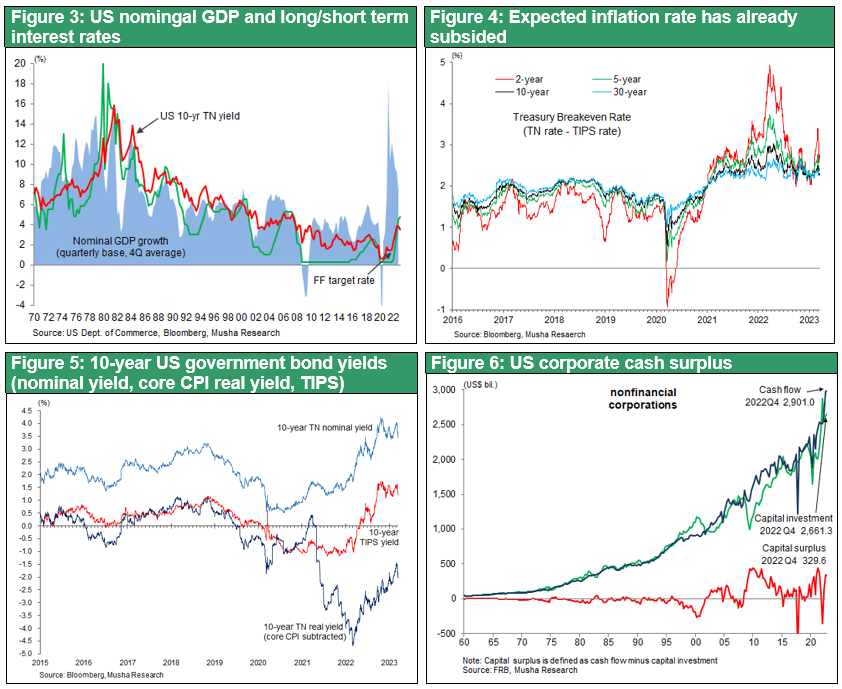

The adverse effects of raising interest rates have become apparent, but what about the effects of monetary tightening? This raises serious question that long-term interest rates have peaked out despite the rate hikes, and the cost of funds for the economy as a whole has not risen, thus not acting as a brake on the economy. The Financial Condition Index has been improving since early fall of 2022. This is precisely the phenomenon that Chairman Greenspan described as a "conundrum" in 2005, and it is still continuing.

Why are long-term interest rates not rising? The only answer is that (1) markets view inflation as transitory and (2) structural factors, such as a permanent surplus of funds due to excess corporate profits, are at work.

TIPS (yield on inflation-linked bonds = real interest rate) rose through mid-2022, but it is highly likely that this was influenced by the Fed's rate hikes, not by inflation fears. As shown in Figure 4, the expected inflation rate has already subsided, but real interest rates (TIPS) have remained high. This strongly suggests that natural rate of interest (i.e., the real interest rate that is neutral to the economy) is declining. This may be due to the technological revolution brought about by IT, NET, and AI. In other words, the prices of goods and services have fallen sharply due to technological evolution, and capital productivity has increased. This is the exact opposite of the decline in productivity and potential growth that is generally pointed out as a reason for lower natural rate of interest.

Under these conditions, if interest rates are raised further by Fed, financial system instability will increase and long-term interest rates will fall further. The justification for raising interest rates is now strongly in doubt.

The same is true of the labor market, which has been blind to the effects of interest rate hikes. The rate of increase in wages has clearly peaked out, even though the process of economic slowdown and easing of labor supply and demand has not occurred because of the interest rate hike. The February 2023 employment report shows the brisk result such as the number of jobs added was 311,000 and the unemployment rate was 3.6%, but average hourly earnings peaked at 0.7% in January 2022 and 0.6% in March 2022, and then declined to 0.3% in August , September (0.3%), October (0.4%), November (0.3%), December (0.3%), January 2023 (0.3%), and February (0.2%). The average duration of unemployment has also shortened from 9.3 weeks in 2019 16.1 weeks in 2021, 8.7 weeks in 2022, and then to 8.3 weeks in February 2023.

As we reported earlier in our analysis (Strategy Bulletin No. 325, February 14), we believe that the labor market is elastic and is orchestrating the allocation of resources. More specifically, the NAIRU (non-accelerating inflation rate of unemployment) may be declining. In the labor market, the Internet has made it possible to instantly match job openings and job seekers. It has also enabled fairer wage determination. If the NAIRU is declining, it may mean that there is a surplus of labor supply, which may be an environment in which wages are suppressed while production increases.

In other words, there may no longer be a need to slow the economy by raising interest rates.

(3) What is happening now, the decline in the NAIRU and the natural rate of interest, both factors for higher stock prices

Thus, the "wonder" is that the goal of the policy is being realized without the Fed envisioned macroeconomic transmission mechanism : rate hikes ⇒ suppression of aggregate demand and economic slowdown ⇒ decline in job openings and demand for funds ⇒ decline in wage growth rate ⇒ decline in interest rates.

If this is the case, then what is the purpose of raising interest rates? If the side effects of raising interest rates have become apparent and the policy goal is being realized through channels other than rate hikes, then there is no longer a need to raise interest rates. The conclusion is that inflation, which occurred under temporary supply constraints, is subsiding due to improvements on the supply side, and there was no need to restrain aggregate demand.

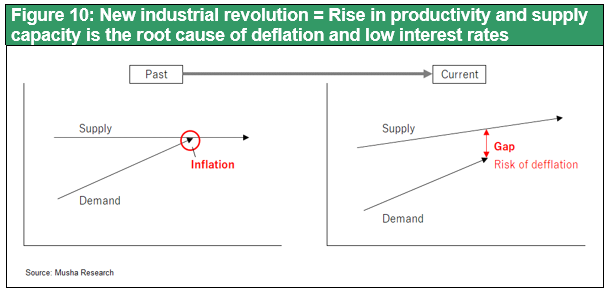

Behind this "wonder" lies the persistence of the long-term trend from before the Corona pandemic of a decline in the natural rate of unemployment (≈NAIRU) and a decline in the natural rate of interest. The decline in the natural rate of unemployment and the natural rate of interest has been brought about by technological evolution (i.e., an increase in supply capacity), which, if left unchecked, will cause deflation and a decline in the growth rate. This is Japanification itself, and the U.S. economy is still at risk of deflation. Figure 10 illustrates this relationship. Therefore, it is desirable to take appropriate demand-creation policy measures to activate the surplus (slack), under which risk assets can be expected to rise.