Mar 06, 2023

Strategy Bulletin Vol.327

Kishida Administration's Execution Capability to be Commended

- 2023 could be the year of Japanese stocks

The Kishida Administration Pushing for a Historic Turnaround

Prime Minister Kishida's motto was "the ability to listen," but his start was marked by a lackadaisical approach, and his ability to execute was also questionable. In opposition to the growth-oriented policies of former Prime Minister Suga, who succeeded Abenomics, Kishida took a distribution-oriented approach under the slogan "new capitalism," and immediately after assuming office, he proposed a stronger taxation of income from financial assets. In response, the stock market was subjected to a merciless baptism, plunging almost 3,000 points, or 10%, from its previous high.

However, the development of the Kishida administration over the past year and a half has defied expectations in a positive sense, and, not surprisingly, a number of pending issues have been put to rest. Although the administration's performance on the surface has been lackluster, with resignations due to ministerial misconduct, the Unification Church controversy, and a declining approval rating, the fact that it has launched a series of policies that are groundbreaking for the times should be given due credit.

The most significant of these is the formulation of the Three Security Documents. This documents marks a historic shift in Japan's policy toward a more offensive defense system, which has long been at the core of its pacifism, and a move toward an enemy base attack capability. It also set a goal of raising defense spending to 2% of GDP and took the first step toward lifting the ban on defense equipment and arms exports. In addition, in order to increase energy self-sufficiency, the government overcame many objections to promote the restart of nuclear power plants and consider building new plants, extend the service life of nuclear power plants to 60 years, and develop new nuclear power plant technologies. The Administration has accelerated its efforts to promote the semiconductor industry, which is a pillar of economic security, with the first phase of the 1 trillion yen project at the TSMC Kumamoto plant, the second phase of the plant now taking shape. In addition, the creation of "LAPITAS," a cutting-edge national semiconductor company, and the announcement of a huge investment plan estimated at 5 trillion yen (Nikkei report) have brought about spectacular changes. The Prime Minister emphasized his desire to revise the Constitution, saying, "I feel that the times call for an early revision of the Constitution. With the help of the opposition parties, I will be even more active in the debate in the Diet.” He has steered a course toward a fundamental shift of pacifism, which had been the core ideology of his home faction, the Kochikai.

The "Mysterious Strength" of the Kishida Administration

Yoshiko Sakurai a leading conservative journalist commented this shift by Prime Minister Kishida as follows: "Mr. Kishida's decision on the three Security Treaty documents is exactly the same as former Prime Minister Abe has insisted on. However, no matter how correct Mr. Abe's claims were, the media, led by the Asahi Shimbun, slammed him for his righteous arguments. Mr. Kishida has not been accused by the media. This is the strength of Mr. Kishida. It is a strange strength. Kishida will be able to turn it into a force to promote his policies." (Shukan Shincho, December 29, 2022). The reality of Russia's invasion of Ukraine, the dictatorship of China's Xi Jinping administration, and the U.S.-China confrontation have undeniably shown the limits of postwar fantasy pacifism. The soft-spoken Mr. Kishida is in a fortunate position to encourage a change of stance by the obstinate fantasy pacifists and to promote national policy with a united front.

The first bitter pill of Kishida's administration, a shift to a policy of prioritize high stock prices, has worked

In economic policy, too, Kishida has followed the broad outlines of the Abe administration. He has reverted to the Abenomics line of "a virtuous cycle of growth and distribution," by re-contextualizing the content of the "new capitalism" emphasis on distribution, which appears to be a criticism of Abenomics, his original advocacy. Simply put, he has made a major shift from a stance of disregarding and ignoring stock prices to one of emphasizing stock prices, and he has done so without hesitation. In 2013, former Prime Minister Abe declared "Buy my Abenomics" in front of foreign investors in New York, inviting Japanese stock investment. Prime Minister Kishida followed suit in May 2022, calling for investors in London to invest in Japanese stocks with the words "Invest in Kishida.

The Cabinet Secretariat's document on the Council for the Realization of New Capitalism states, "In the new capitalism, we will thoroughly pursue growth. However, further growth will not occur unless the fruits of growth are appropriately distributed and used to invest in the next stage of growth. Distribution is not a cost, but an investment in sustainable growth. In Japan, the fruits of growth are not being appropriately distributed to local regions and business partners, and are not being fully channeled to the next round of R&D, capital investment, and employee salaries. These "bottlenecks" are preventing the next stage of growth. Waiting will not bring about trickle-down. It is necessary to eliminate the "blockages" through active policy involvement. The "blockage" will not be solved by waiting, but by active policy engagement." As such, the administration proposed concrete measures such as (1) increasing wages, (2) facilitating labor mobility by improving skills, promoting side jobs and dual employment, and (3) formulating an "asset income doubling plan" to shift from savings to investment. These measures almost overlap with the third arrow of Abenomics, the "growth strategy to stimulate private-sector investment through deregulation.

Acceleration of Individual Stock Investment and Corporate Stock Buybacks

A series of changes starting here will alter the supply-demand balance for Japanese equities. First, the reform of NISA, the preferential taxation system for individual investors (increase of the tax exemption limit to 18 million yen, indefinite tax-free holding period, etc.), will create a large flow of funds from deposits to stocks. The amount of money purchased through the monthly investing NISA account has been growing at a pace of 50%, reaching just under 1.3 yen in 2022. When combined with the ¥3.9 trillion in purchases by the general NISA, individuals already invested ¥5.2 trillion per year in stocks last year.

The breakdown of Japanese households' financial assets (excluding pension insurance reserves) is irrational, with 74% in cash and deposits, which pay next to zero interest, and 20% in stocks and investment trusts, which pay almost 2.5% in dividends. Within a few years, households' stock investments may exceed 10 trillion yen per year and become a major investment entity. At present, the majority of this investment is in the U.S. and other foreign stocks, but this ratio will improve by 2023, when the relative performance of Japanese stocks will turn around.

In addition, companies have been stashing away too much of their profits, and the inefficient use of capital due to excessive savings has been the cause of Japan's stock market weakness, but the TSE's request for a correction of P/B ratios below 1x has increased momentum to redirect excess funds to share buybacks. Share buybacks reached a record high of 8 trillion yen in FY2021, and are expected to rise to the 10 trillion yen level in FY2022. In the U.S., share buybacks are the largest source of equity investment, and there is a strong possibility that this will be the case in Japan as well. The long absence of domestic investors will rapidly improve with the entry of households and the corporate sector.

New Bank of Japan Governor to Follow through on Ultra-Monetary Easing; Public Support a Strength

The "mysterious strength" of Mr. Kishida, as Yoshiko Sakurai describes it, is clearly demonstrated in his nomination of Mr. Ueda to succeed Mr. Kuroda as Bank of Japan Governor. Unlike Kuroda, Ueda is a flexible pragmatist, neither anti- nor pro-reflationary, and has broad support.

Mr. Kuroda's policy of extraordinary monetary easing has been roundly criticized by Bank of Japan alumni, academics, economists, and the media. They were of the firm belief that (1) deflation in Japan was tolerable and (2) traditional monetary policy should be adhered to. This, combined with opposition to the Abe administration's coercive methods of pressuring the BOJ to end deflation, created an irreparable rift between the pro- and anti-Extreme Easing camps. This intense criticism of the policy has created a public opinion that "the extraordinary monetary easing will fail," that overcoming deflation is impossible, and that easy risk-taking should not be undertaken, thus making it difficult to realize the policy objectives in a self-fulfilling manner. Ueda, however, had no such difficulties, and his policy management will proceed smoothly.

The momentum for wage increases has been building through the united efforts of labor, government, and corporate management, and inflation of around 1% is now firmly in place, and the economy is now on its way to the goal of sustained 2% inflation. This is the result of Kuroda's monetary easing, and no one now disputes the broad policy objective of achieving sustained 2% inflation. What is required now are technical and tactical measures , no longer requiring strategic theories on whether deflation is the enemy or not. While the reflationary camp that has supported Kuroda believes that the current monetary easing policy should not be touched until 2% inflation is firmly established, and the anti-reflationary camp believes that the YCC and other unorthodox policies should be stopped as soon as possible, the ultimate goal for both remains the same: the establishment of 2% inflation. The difference is merely a technical argument as to which is more appropriate, and there is no difference in the idea of maintaining an accommodative environment for the time being. The decisive factor in this process is the ability to garner public support, and Ueda and his supporting deputy governor candidates, Himino and Uchida, are ideally suited to win the support of the public and the market.

Evaluation Criteria: Stock Prices and Exchange Rates

The measure of public support is nothing other than stock prices. Kishida does not want to pursue a monetary policy that the stock market is concerned about, and Ueda has no room to adopt one. Nor would a yen appreciation to the 120 yen per dollar level be acceptable from the standpoint of establishing sustainable wage growth. The Ueda-led BOJ administration is destined from the start to mobilize policy tools to promote a strong stock market and maintain a weak yen.

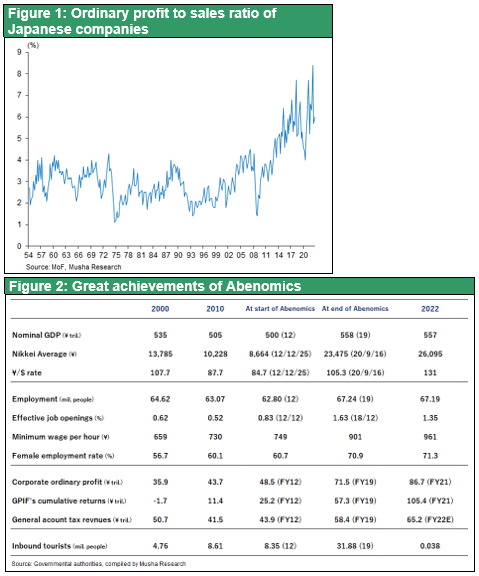

The Abe and Suga administrations have doubled the earning power of Japanese companies. Corporate recuring profit, which hovered in the 40 trillion yen range from FY2000 to FY2012, rose to 86.7 trillion yen in FY2021. It should be noted that this significant increase in earning power is behind the "mysterious strength" of the Kishida administration.