Feb 14, 2023

Strategy Bulletin Vol.325

Is the "too convenient truth" covering the U.S. economy false?

- The "Too Good to Be True" (Mystery) of the U.S. Economy and its Basic Contradiction (1)

How should we view the U.S. economy today? There are many convenient mysteries that cannot be explained by common sense interpretations. The labor market continues to boom, despite more than a year of monetary tightening and layoffs at large high-tech firms. Even more curious is the fact that the rate of wage growth has begun to decline in the face of strong labor supply and demand. In the financial markets, despite eight interest rate hikes in the U.S. over the past year, totaling 4.5%, there is still plenty of money to invest, pushing up emerging market equities and lower-rated U.S. credit. Why is this expedient happening so frequently? Is this mystery temporary and will it disappear as the economic downturn becomes more severe, or will it persist and continue to support the U.S. economy?

(1) Labor Market Mystery

The U.S. labor market in great shape

The January employment report was a surprise to all economists. Employment was at an all-time high, with the unemployment rate falling to a 53-year low of 3.4%. Job gains were much stronger than expected at 517,000, a strength that could be seen as an acceleration from the 260,000-350,000 range of gains since August 2022. Employment increased across almost all industries. Gains were also seen in the construction sector, where housing starts have been depressed by rising interest rates. This strength in the labor market is unusual, as the economy is in the midst of eight interest rate hikes over the past year, totaling 4.5%, and layoffs are being announced one after another, mainly by major high-tech firms.

Just to name a few, in the past few months, Alphabet (12,000 employees, 6% reduction), Amazon (over 18,000employees reduction), Dell (6,600 employees, 5%), IBM (3,900 employees, 1.4% reduction), Microsoft (11,000 employees, 5% reduction), Salesforce (10% reduction), Zoom (1,300 jobs, 15% reduction), PayPal (2,000 jobs, 7% reduction), BNY Mellon (1,500 jobs, 3% reduction ), Goldman Sachs (3,200 jobs reduction), Dow (2,000 jobs reduction), 3M (2,500 jobs reduction) ・・・・, almost all the big tech companies.

However, companies are strongly motivated to hire, and employment is increasing in almost all sectors, including the construction sector, where housing starts have been depressed by rising interest rates. Some small and medium-sized companies, which have been pushed out of the job market by large corporations, are seeing this restructuring as an opportunity. The virtuous cycle of strong consumption bringing widespread employment opportunities has been quite different from the BPR (Business Process Reengineering) revolution of the early 1990s, when white-collar workers were replaced by machines, resulting in unemployment and a jobless recovery that left the labor market in a slump. There is a stark difference from those days.

Workers' Bargaining Power Grows, but Wage Growth Slows

The bargaining power of workers is alive and well. The number of workers voluntarily leaving their jobs is high, the percentage of unfilled job openings is high, especially in small and medium-sized companies, and job hopping by workers in search of higher wages is vigorous.

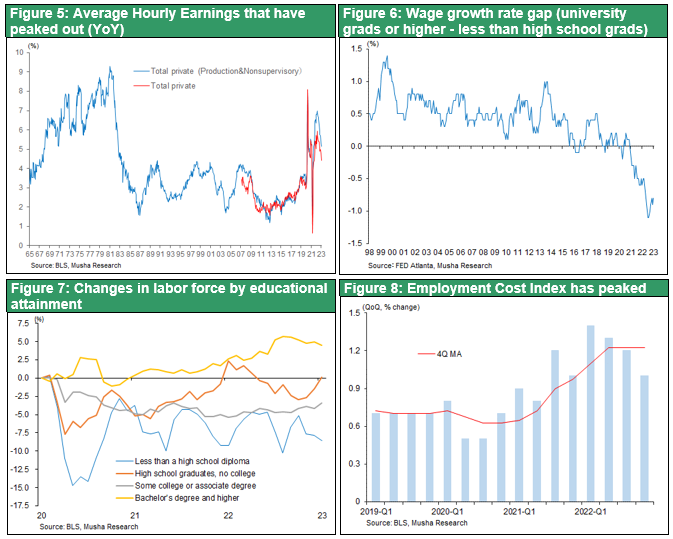

The slowdown in wage growth and the narrowing of the wage gap under this labor supply-demand crunch also defies conventional wisdom: the average hourly wage (AHE) in January was 0.3% month-over-month, down half from 0.7% last January. The labor shortage in the hospitality industry, including truck drivers, waiters, and waitresses, caused by the extraordinary labor supply-demand crunch under the Corona disaster, is easing, and the rate of wage growth in unskilled and low-wage sectors is beginning to slow. Low employment growth in the higher-paying sectors, finance and information, has also pulled down overall wage level growth.

The average workweek in January was 34.7 hours, above the range of the past six months (34.4-34.6 hours). The synergistic effect of the increase in the number of jobs and hours worked suggests a significant increase in production activity in January. On the other hand, the employment cost index is declining. This is due to productivity growth and lower wage growth. This is truly an over-performing labor market, but why is this happening?

Possibly a decline in the NAIRU is occurring

Clearly, the labor market is becoming more elastic and reallocating resources. More specifically, the NAIRU (Non-Accelerating Inflation Rate of Unemployment) may be declining. In the labor market, the Internet has made it possible to instantly match job openings and job seekers. It has also enabled fairer wage determination. Job shifting due to skill development may be causing higher salaries plus higher productivity. If the NAIRU is declining, this could mean a surplus of labor supply, which could kill two birds with one stone: increasing production while suppressing wages.

(2) Mystery of Financial Markets

Surplus of funds under tightening, a replay of Greenspan's enigma

The mystery in financial markets is the existence of ample global investment funds and liquidity. Despite the historic rate hikes, there is still plenty of money to invest, and risk premiums are beginning to fall in emerging market equities and low-rated U.S. credit markets. Most importantly, the yield on the 10-year U.S. Treasury note has fallen to around 3.5% to 3.7%, even though short-term interest rates have been raised to 4.5%. This is half the CPI and nominal GDP growth rate, and based on the Taylor rule, it is still at an accommodative level. It could be said that the money glut is allowing the effects of monetary tightening to slip through the cracks. The financial condition index calculated by the Federal Reserve Bank of Chicago has been improving significantly since the fourth quarter of last year. It seems as if we are witnessing the same situation that former Fed Chairman Greenspan described as a "conundrum.

While some see this decline in long-term interest rates as a sign of future economic downturn , it does not add up with the rising prices of riskier emerging market equities and junk bonds, as well as the increase in U.S. bank lending and the rise in the copper market, which is highly linked to the global economy.

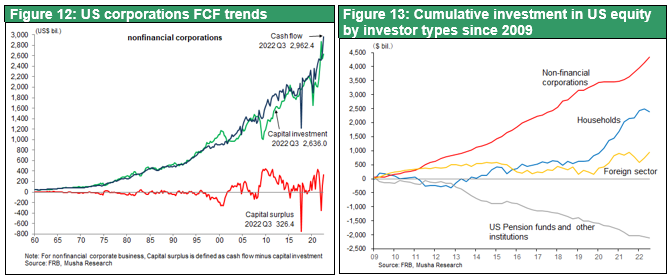

The savings surplus in the corporate sector due to higher capital productivity

Just as the decline in long-term interest rates since 1980 was not a harbinger of an economic downturn, it is possible that the current decline in long-term interest rates is due to other factors. What it may be is that the value generated by the corporate sector is greater than the investment required by the corporate sector, and that a permanent capital surplus is occurring. Behind this is the constant increase in capital productivity. The prices of equipment, machinery, intellectual assets, etc. have fallen significantly, and this has led to lower reacquisition prices for equipment and other assets, thereby reducing the amount of investment required. Also, restructuring is underway in GAFAM, where AI and robotics are replacing labor, and the large productivity gains may be causing a money glut in the corporate sector. The existence of substantial free cash flow in U.S. companies indicates that there is an ample cash surplus in the corporate sector. Companies are returning most of that excess cash to the market in the form of share buybacks.

(3) Clarification of the Mystery and Outlook

Possibility of a Soft Landing, Possibility of the Beginning of a Bull Market

If the NAIRU is declining, there is a surplus (slack) in the U.S. labor market, and a hasty rate hike by the Fed would increase the risk of deflation again. Moreover, if the long- and short-term interest rates remain inverted under a persistent money surplus, it will unnecessarily hurt financial institutions business and cause an unnecessary rise in financial stress, which will also increase the risk of deflation.

In other words, the risk from now on is not inflation but recession and deflation, and both the U.S. market and the U.S. authorities seem to have reached a consensus on this point. Chairman Powell's comments were subtle, pointing to disinflation and not ruled out the possibility of a rate cut before the end of the year.

Possibility that employment is not a lagging indicator

It is possible that a virtuous cycle has already begun to emerge. While the manufacturing PMI is falling, the none-manufacturing PMI is rebounding. New orders are particularly strong in the services sector, which is supported by a strong labor market and consumption. If this is the case, then employment is a leading indicator, not a lagging one, which again is a break with the norm. It is reported that Manhattan rents are continuing to rise even under the tightening of monetary policy, but this is also supported by the strength of the labor market.

The implication of the above for investment would be that eventually the possibility of a repeat of the Goldilocks market will return and asset price increases will be justified. It will be important to discern the will of the policy authorities. The reappointment of Treasury Secretary Yellen, a high-pressure economic theorist who is more concerned with the risks of deflation, is significant.

If the U.S. economy is softening and the stock market is entering a bull market, the hypothesis is that this is because the U.S. capitalist economy is deepening. At the very least, the AI Internet revolution, innovation, and the further effectiveness of the U.S. labor and capital markets are strengthening the resilience of the U.S. economy.