Oct 31, 2022

Strategy Bulletin Vol.317

The Chinese Court Revolution and Its Impact on Japan

~ Why the J-Curve effect is particularly powerful this time around

(1) Xi Jinping's complete dictatorship established

Opposition completely eliminated, making it impossible for liberals to roll back

The 20th Congress of the Communist Party of China (CPC) carried out a palace revolution in China, showing the world that Xi Jinping's dictatorship has been established. The forced exit of former President Hu Jintao at the closing congress (October 22), together with the complete elimination of the opposition (Communist Youth League faction) from the new executive (Politburo Standing Committee members), which was decided the next day, signals that China has moved to a new system of personal dictatorship and that a historic shift has been accomplished. The policy shift by China's liberal forces toward democracy, emphasis on a market economy, and international cooperation is no longer possible.

It is almost certain that China's economy will enter a process of national decline over the long term due to the refraction of economic growth seen in the bursting of the bubble, the declining birthrate and aging population, and the rapid decline of the population. China's ambition to surpass the U.S. in economic power and to become the world's dominant power appears to be a remarkably difficult goal in the normal course of events.

Increasing Likelihood of an Invasion of Taiwan

However, the possibility of an invasion of Taiwan, which has been a matter of concern, is seen as having risen substantially. In his political report at the opening session of the Communist Party Congress, Xi declared that he "will never abandon the use of force (as an option)" for the unification of Taiwan. The rationales of many experts who had previously assumed that there would be no armed invasion, such as (1) domestic governance would not hold, (2) Taiwan's popular sentiment would leave, (3) criticism by the international community would increase, etc., no longer hold. Now he has gained the ultimate power to suppress opposition, it is only a matter of utilizing it.

U.S. defense and diplomatic authorities are becoming even more aware of the danger

History has seen many instances in which dictatorial powers, faced with difficult long-term prospects, have attempted a major reversal of course through military adventurism. Dictatorial powers, not to mention Russian President Vladimir Putin's invasion of Ukraine, have been belligerent. On October 19, U.S. Chief of Naval Operations Mike Gilday attended an online event of a U.S. think tank and expressed his alarm about the Taiwan contingency, saying, "In my mind, it could be in 2022 or2023, much earlier than 2027," and "China has always achieved its goals ahead of schedule over the past 20 years. In 2021 Philips Davidson, then commander of the U.S. Indo-Pacific Command, pointed out the possibility of a Taiwan contingency by 2027, which took the public by surprise. U.S. Secretary of State Antony Blinken also stressed in a debate at Stanford University on October 17 that "China is not content with the status quo and is pursuing the unification of Taiwan on a faster timeline than ever before.

(2) Inevitable Containment of China and Urgent Shift of Production Bases from China

On October 7, the U.S. Department of Commerce significantly tightened restrictions on exports to China of semiconductors and supercomputers. The scope of the restrictions, which had been limited to cutting-edge logic devices, was greatly expanded and added 31 companies and universities on the restrict list s, including Changjiang Memory Corporation (YMTC). In addition, end-use regulations were introduced to block the export of bypassed way using the third country, and the exceptions to the regulations were made stricter. As early as this month, YMTC's first successful negotiations to supply NAND flash memory to Apple for the first time were effectively canceled. In addition, Americans and U.S. companies are prohibited from designing, engineering, or cooperating with YMTC. In the future, more extensive and stricter regulations will be introduced in rapid succession, such as the outbound regulations (considering the introduction of a review system for outbound direct investment and the transfer of important production capacity and supply chains out of the country) in the House bill for the "U.S. Competition Bill," which is being coordinated by the House and Senate as a comprehensive countermeasure bill against China. Apple and Tesla, both of which manufacture in China, will have no choice but to shift their production bases out of China.

The return of high-tech industries to Japan will become clear as a result of the shift away from China

The economy has not kept pace with the rapid increase in geopolitical tensions. In the future, momentum will build in the industrial world to leave China. Recognition of human rights repression, which now applies only to Xinjiang Uighur, Tibet, Hong Kong, and other remote areas, may be extended to the mainland as well. Japan's advantage emerges when one considers where it can be a receptacle for the growing need to flee China.

Although there is talk of a shortage of human resources and a loss of synergies as a result of Japan's former relocation of factories overseas, the country still retains the foundations of much of its industrial strength. Japan has lost ground in cutting-edge semiconductors, but the global share of semiconductor production is 19% if we added the production bases of overseas companies such as Micron Technology (bought from Elpida Memory - Hiroshima Plant) and Western digital (production in cooperation with Kioxia), to Japanese manufacturers such as Kioxia, Sony, and Renesas Electronics.

The country has also a 32% share of global semiconductor production equipment, and a 56% share of semiconductor materials (all according to the 2020 OMDIA survey). In addition, it has so many world-leading companies in the fields of machinery, measuring equipment, components, and materials. Simply bringing these companies back to Japan should result in the rebuilding of significant synergies.

Fujifilm responded to China's forced disclosure and transfer of MFP technology information by closing its local factories. Canon Chairman Mitarai also commented, "We cannot leave (production sites) unattended in countries that may be affected. There are only two ways to go: to move them to safer countries or to bring them back to Japan. The depreciation of the yen, which lowers the cost of production in Japan, is one of the major reasons (for returning to Japan)," he said (October 26), showing his determination to face the turning of the tide.

A number of companies have begun to move their production bases back to Japan

TSMC has begun construction of its Kumamoto plant, which is expected to cost 1 trillion yen in total, and the WSJ reported that TSMC intends to build a second, more advanced plant (October 19, "Taiwan's TSMC Considers Boosting Production in Japan to Reduce Geopolitical Risk"). For TSMC, which has overtaken Intel and Samsung in the semiconductor technology competition and is now in a position to take the lead, production in Taiwan alone is a major risk. Expanding its overseas production system is a pressing issue, and Japan is likely to be the most promising base for such expansion.

Other projects worth tens of billions of yen include the first new EV production building at Subaru's Oizumi plant in 60 years, the restart of Renesas Electronics' Kofupower semiconductor plant, SUMCO's new Imari plant, Sumitomo Metal Mining new Niihama plant for nickel electrode materials, Iris Oyama's partial domestic transfer of plastic production in China, Kyocera's construction of semiconductor Plant in Kagoshima Sendai, Daikin Industries' domestic transfer of its China-dependent supply chain, Canon's construction of exposure system plant at Utsunomiya in 21 years, Yaskawa Electric's return to domestic production of key components and construction of its Fukuoka Yukuhashi plant, and Fujifilm's Toyama plant for the production of biopharmaceuticals on a contract basis. As the yen's depreciation becomes more pronounced, the return of factories to the domestic market will intensify, and investment growth is expected to increase even further.

(3) The current depreciation of the yen will further strengthen the J-curve effect, leading to a Japan-volume economic boom in 2023

The J-curve effect refers to the fact that the yen's depreciation initially increases the unit cost of imports and the trade deficit, at which point the yen's depreciation appears to be negative, but eventually the yen's depreciation will bring about a virtuous cycle of large volume growth. In overseas markets, the increased price competitiveness will increase the market share of Japanese firms and boost domestic production by exporting firms. In the domestic market, there will be a shift from overpriced imports to underpriced domestic products, and production will increase. As a result, factory utilization rates will rise, which will eventually lead to increased capital investment. In this way, the yen's depreciation triggers a virtuous cycle of increased production and investment.

However, the current depreciation of the yen has triggered a record capital investment boom due to a return to domestic production in the wake of the U.S.-China confrontation, even before domestic production volume had increased noticeably. The BOJ's Tankan FY2022 capital investment plan for all industries of all sizes was up 16.4% from the previous year. This is an upward revision from the previous 14.1% increase in June, and is the highest level as of September since the survey began in 1983 (capital investment in the manufacturing sector increased 21.2%, the highest level since 1988).The virtuous circle of the J-curve effect is quickly emerging.

Foreigners to become domestic demand leaders, inbound and cross-border e-commerce

The second factor accelerating the J-Curve effect is the increase in inbound demand. Domestic demand industries, which have not benefited from the yen's depreciation to date, have gained new customers in the form of foreigners, and we are now seeing a virtuous cycle in which the yen's depreciation immediately leads to an increase in the volume of demand.

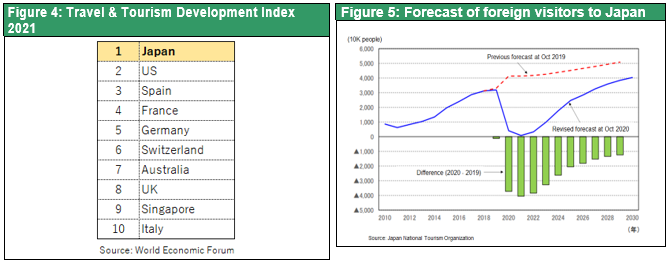

A study by the WEF, which presides over the Davos Forum, found that Japan has the highest tourism development capacity in the world. The number of tourists to Japan increased to 31.9 million in 2019, just before the Corona pandemic, and was expected to reach 40 million in 2020, the year of the Olympics, but dropped to almost zero under the pandemic. However, once the Corona pandemic is over, demand for travel to Japan, which has become incredibly undervalued, is expected to surge. In the medium to long term, Japan, with its hinterland in Asia, home to approximately 1.5 billion middle-income earners, will far surpass France, the world's top tourism destination, with 90 million visitors.

The third factor that will accelerate the J-Curve effect this time is cross-border e-commerce EC in which goods are procured in Japan at a discount and resold overseas.

The Nikkei reported "According to the Ministry of Economy, Trade and Industry, cross-border EC sales to individuals will reach 2,138.2 billion yen to China in 2021 (up 10% from the previous year) and 1,222.4 billion yen to the United States (up 26%), about 10% of the value of exports to the United States and China. According to data from more than 3,000 domestic companies held by BEENOS, Japan's largest provider of cross-border EC support, the sales value index (in yen terms) for the January-June period of 2022 increased 80% over the January-June period of 2020," (October 16).

Extremely Cheap Nippon is a Business Opportunity for All Japanese to Gain

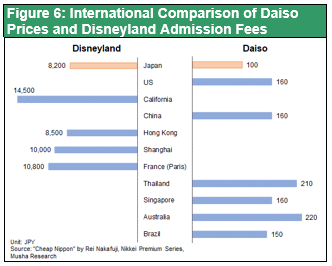

Figure 6 below is an international comparison of Daiso's sales prices as published in Rei Nakafuji's book, "Cheap Nippon," and it is surprising that Daiso's prices remain uniform at 100 yen only in Japan, while prices in other emerging countries such as Thailand, Brazil, and China are significantly higher than those in Japan. Moreover, this price difference is as of January 2021, when the dollar was about 105 yen/dollar , so it can be inferred that the current price difference of 140-150 yen/dollar is much larger (Ms. Nakafuji reported Daiso's explanation that this low price is mainly due to labor costs and low rents). This overwhelming price difference has become a business opportunity that can be captured by anyone, including large corporations, small and medium-sized businesses, and individuals.

This new development of globalization has opened up new sources of demand in the form of overseas customers for many small and medium-sized enterprises and service industries, which previously catered exclusively to domestic demand. The weak yen will immediately trigger an increase in the volume of demand for these industries and the local economies through inbound and cross-border e-commerce. The J-curve effect of the yen's depreciation is expected to have a positive impact beyond imagination. The background to the yen's depreciation is the U.S.-China confrontation.

Musha Research's decade-long assertion that the U.S.-China confrontation would be a tailwind for the Japanese economy (*) has become a reality.

(*) Musha’s published books (only in Japanese)

"The End of the Lost 20 Years: The Japanese Economy Diagnosed by Geopolitics" 2011, Toyo Keizai Inc.

"The U.S. Economy That Will Eventually Win and the Chinese Economy That Will Lose Alone: The Historical Seasonal Wind Blowing in Japan" 2017, Kodansha