Sep 14, 2022

Strategy Bulletin Vol.313

Dollar appreciation under negative real interest rates

~ Two major factors enabling a mild landing in the US

(1) Have Times changed? Premature conclusions are dangerous

Unprecedented environment, Data dependent stance required

The year 2022 began in an environment of unprecedented uncertainty. There were the US-China conflict and protectionism, price rises highest in last40-year , supply chain disruptions, rapid interest rate hikes, changes in the way people work and live due to the Corona pandemic and the transformation of the labor market (= increased bargaining power of workers), and finally, breaking out the war in Ukraine and the energy crisis. As Fed Chairman Jerome Powell has repeatedly stated, we have no choice but to watch the data closely and think about the contours of the coming era in a resilient manner.

The era of promoting risk-taking is not yet over

However, there is a danger of making assumptions. The end of the era of disinflation and the arrival of the inflationary era, the shift from low interest rates to an era of rising interest rates, the abortive globalization (from the development of the international division of labor to an era of international division and conflict), and the shift from small government to big government (from deregulation to tighter regulation) are all spoken of as if they were a given. It is assumed that the era of great moderation, in which market-friendly central banks provided ample liquidity and encouraged risk-taking, is over and that the financial and capital markets will enter an era of higher risk and volatility.

Relatively low interest rates continue and the era of a strong dollar begins

It is important to identify what will change and what will remain constant. First, it is surprising that relative low interest rates remained unchanged. Secondly, it is surprising that the exchange rate has changed so much towards a stronger dollar. The continuation of relatively low interest rates and a strong dollar will be the driving force behind the mild landing of the US economy and the subsequent acceleration of growth. Musha Research believes that the long-term US stock market trend, which was not derailed by the Corona shock, is alive and well.

(2) Relatively low interest rates (G>R: Greenspan's enigma) will not change

A pleasant surprise, the continuation of Greenspan's conundrum

The most relieving aspect of the market developments in 2022 was the continuation of relatively low interest rates in the U.S. Amidst the upheaval of the 8-9% headline inflation (6% even for core CPI), the strong rate hike (factoring in the 0.75% hike at the September FOMC meeting), and the start of QT, the 10-year US Treasury yield has remained below 3.5% without any significant jumps.

Although it depends on what price index is used, if we use the core CPI (6.3% in August), which is usually used, the real interest rate remains significantly negative at just under 3% despite the large interest rate hike. This means that the financial foot is still on the gas pedal, not the brake pedal.

Anchor of Growth and Rising Asset Prices Still Alive and Well

The 10-year U.S. Treasury yield has been well below nominal economic growth since around 2000, and even today, after the Corona and 2022 inflation shocks, the relationship:

"G (economic growth rate) > R (interest rate)"

has persisted. Nominal GDP growth was 10.1% in 2021, 6.6% in the 1Q and 8.4% in the 2Q of 2022, and it is not expected to fall below 4% in 2023 and beyond. In other words, the yield on 10-year government bonds cannot be expected to exceed the nominal growth rate no matter how far it goes.

This is a continuation of what then Fed Chairman Greenspan called "conundrum" in 2005, when he referred to the fact that long-term interest rates did not rise even under conditions of high growth and large interest rate hikes. The fact that G (economic growth rate) > R (interest rates), the Greenspan conundrum that has anchored the U.S. economy and asset prices since the GFC, is alive and well. The fact that it is alive and well is a great reason to be optimistic about the U.S. economy and markets.

Greenspan's conundrum Continues to Give FEB Discretionary Leeway

Friendly monetary policy that does not kill good inflation can be implemented with long-term interest rates kept in check. Productivity growth and asset price increases can be maintained by sustaining the high-pressure economic conditions that Treasury Secretary Yellen advocates. The Fed's assumed inflation target could be shifted to 3% in order to maintain high-pressure economic conditions.

Marked Decline in Expected Inflation

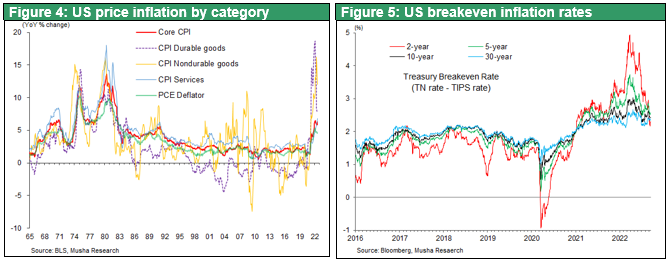

The problem is that the current inflation situation has swung to such an extreme that it is difficult to see the truth. As shown in Figure 4, the current price situation in the U.S. is barely peaking out, and a fierce fight against inflation is required.

However, the TIPS market has already priced in a significant decline in prices. Most of the current price increases have been caused by transitory supply constraints, such as supply chain disruptions, the war in Ukraine, and the lockdown in China due to the Corona disaster. The easing of these supply constraints and the fact that expectations of a slowdown in demand due to Fed rate hikes have been factored in have led to a significant decline in the expected inflation rate calculated backward from TIPS. As shown in Figure 5, the change in the TIPS-based expected inflation rate from its peak in March to the recent has been a sharp decline from 3.0% to 2.3% over 10 years, from 3.7% to 2.7% over 5 years, and from 4.9% to 2.6% over 2 years.

Based on this expected inflation rate, real interest rates are already significantly positive, indicating that monetary policy is acting as a brake on the economy. Raising interest rates excessively in response to temporarily high inflation could overburden the economy in the future when price hikes have already subsided, The fact that the yield on 10-year Treasuries has remained relatively stable at low levels should give the Fed a free hand to avoid overkill.

(3) Major positive surprise dollar appreciation in 2022

The era of long-term dollar appreciation continues

The significant change in 2022 is the appreciation of the dollar. The dollar index, a currency-weighted average of the major currencies, rose 17% over the past year, from 92 to 108. Musha Research has consistently argued for the strength of US innovation and a long-term dollar appreciation trend. ("It is assumed that the temporary dollar weakness during the Corona Pandemic is over and that the long-term dollar appreciation trend that began bottoming in 2011 will continue." Strategy Bulletin 292, 19 October 2021), which has happened.

The strong dollar supports the US economy on multiple levels

The strong dollar has boosted the US economy on multiple levels by (1) reducing US domestic inflation by lowering import prices, (2) increasing the external purchasing power of Americans, and (3) suppressing long-term US interest rates through the inflow of funds into the US. Although under the same inflationary conditions, the economic effects are the exact opposite of those of the US dollar depreciation during the high-inflation period of the 1970s.

Price restrained, with a 10% stronger dollar pushing down CPI by up to 1.3%

A strong dollar is favorable to inflation risk; a strong dollar makes import prices cheaper. The US imports goods worth USD 2.8 trillion (JPY 364 trillion) annually. A 10% year-on-year appreciation of the dollar has the effect of lowering import prices by USD 280 billion (JPY 37 trillion). Even if not all of this is passed on to US importers, since annual US consumption is USD 17 trillion, this alone has the effect of pushing consumer prices down by a maximum of 1.3% (i.e., boosting real purchasing power of US consumer).

On the other hand, the negative effect of a strong dollar is a decline in the price competitiveness of US companies, but at present US companies compete with other countries on price only in a small number of items, such as automobiles. If there are no overseas competitors, such as GAFAM, cost increases due to a strong dollar can be met by higher local sales prices, which would improve the US current account balance. Figure 7 shows the US's huge goods trade deficit and large services and income surpluses, but the strong dollar is likely to significantly reduce the value of goods imports in dollar terms, while service prices are likely to be maintained in dollar terms, which will significantly improve the current account balance.

The dollar, the secret weapon of US hegemony

'...Furthermore, and perhaps most importantly, the dollar may be the secret weapon of US hegemony. The dollar has sometimes been used to achieve US geopolitical objectives. In the past against Japan and in the future, the dollar will be used as a strategic tool in the US-China conflict. A strong dollar is considered essential to the US's urgent priority: building a global supply chain that excludes China’ (Strategy Bulletin 292, 19 October 2021).

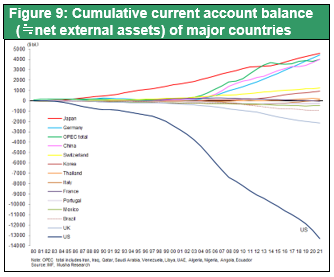

A strong dollar is advantageous and essential for the hegemonic US. The dollar, now the only world currency, is a privilege of the US, which can freely print and issue dollars without the need for any backing. Nothing is better than a strong dollar that can be printed for free. There are two risks: (1) depreciation of the dollar's value = inflation and (2) loss of the dollar's reserve currency status, but there is no fear of this for the time being. Figure 8 shows the accumulated current account balances of the major countries ≈ accumulated foreign claims and debts, and shows that only the US continues to have a huge accumulated debt. The US is the world's largest debtor country and the only huge supplier of world money.

Overwhelming US power advantage, especially in innovation, is evident

The reason why the dollar is strong now is simply that the overwhelming superiority of US power has become clear. The US is the world's largest oil and gas producer and net exporter. It is also the world's largest exporter of grain, and rising energy and grain prices are positive for the US. Although the decline of manufacturing has been emphasized, the competitiveness of advanced industries is overwhelming. Except for China, the five US GAFAM companies dominate the global internet and cyberspace, and their technological innovation power is unmatched by any other country. They also dominate global finance through their reserve currency, the dollar.

The economic and financial gap with China will widen as the dollar appreciates. Figure 9 shows the nominal GDP of major countries time, and it is believed that the US will be overtaken by China, following Japan and the eurozone. However, if the dollar appreciates and the yuan depreciates, China will not be able to catch up with the US any time soon. A stronger dollar and depreciating yuan will favor the US in the Sino-US conflict.

(4) Why a US mild landing is possible

Strong US fundamentals

Inflation has peaked out and the Fed has capped the expanding spiral of inflationary sentiment by decisively raising interest rates.

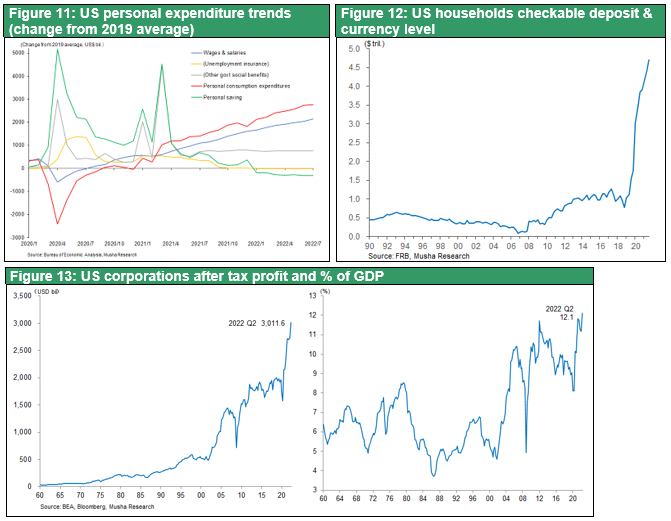

Terminal rate goes above 3%, but even under this, the US economy is robust in terms of employment, investment and corporate profits, with the possibility of a soft landing. Real wages are negative, but consumption will not easily stall due to savings, which have been enriched under the Corona disaster, the favorable employment environment and the contribution of fiscal policy. US companies will continue to increase revenues by nearly 10%, wages will rise but corporate pricing power will remain strong, and profit margins will remain high, with no significant decline in profit margins, except for a reduction in foreign profit conversion gains due to the strong dollar.

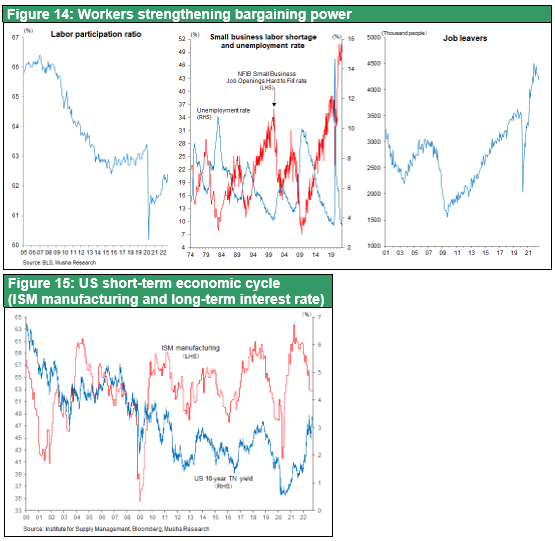

No change in the Fed's market-friendly trend

The key question is whether the Fed's priority to control inflation will avoid overkill, but with long-term interest rates under control, it can use the tools of monetary easing. Treasury Secretary Janet Yellen's strategy of maintaining high-pressure economic conditions may be utilized. The continued relatively tight labor market and the maintenance of strong bargaining power for workers will provide incentives for companies to increase labor productivity.

In that case, the target could shift to a 3% inflation rate, and the Fed's tendency to be market-friendly would not change. Then 2022-2023 may not be a recession year, but a mini-dip year, like 2013 and 2016, which came every three to four years in a long-term economic expansion (Figure 15).

US equities may start to soar in 2023, when rate hike will be over, and a rate cut is on the horizon.

(5) "US decline" theory is wrong - the global democratic liberal order will be rebuilt

Great illusion of Russia and China is a failure of US diplomacy that has created a "power vacuum", not a decline in US power

The US is perceived as a declining superpower, and this is believed to be the case with Putin's invasion of Ukraine and Xi Jinping's attempts to challenge its hegemony, but this is simply not the case. The decline of the US geopolitical presence began when the war on terror was in limbo. Obama's advocacy of nuclear abolition and his declaration that he would cease to be the world's policeman was misinterpreted as an abandonment of 'diplomacy by force'. The subsequent Trump administration reverted to self-centeredness by advocating America First, and last year the Biden administration withdrew from Afghanistan without gaining anything, no doubt creating a major power vacuum in the world. It is clear that both Xi Jinping's South China Sea tyranny and Putin's invasion of Ukraine have taken advantage of this. It is a failure of US diplomacy, but not due to a decline in US power.

The war in Ukraine is a breakthrough in the restructuring of the world liberal democratic order

The war in Ukraine has made it clear to all that the larger threats are obvious and that the conflict between conservatives versus left-wing liberals in the US is a minor one. After the mid-term elections in November this year and other events, US public opinion, which has been skewed towards idealistic liberals, will swing towards realism again. The vectors of the liberal democratic world are also aligned, such as Germany's shift away from pacifism and Finland and Sweden's intention to join NATO. It is inevitable that an unprecedented centripetal force will be raised to rebuild a world order that does not allow the status quo to be changed by force. It is important to emphasize that it is neither correct nor desirable attitude to question the world liberal order or to advocate a theory of US decline, as in the case of China and Russia (Strategy Bulletin 303, 18 April).