Sep 05, 2022

Strategy Bulletin Vol.312

Huge resilience stored in Japanese equities (= 2 price gaps)

Huge driving force (= price gap) set up by the BOJ

We hear accusations that the BOJ is ineffective in the face of rising global inflation and unprecedented yen depreciation, and that the BOJ is the only bank in the world that has left its ultra-easy monetary policy called YCC (Yield Curve Control) in place. However, the BOJ's maintenance of its ultra-easy monetary policy is not inept, but rather has the clear intention of fostering a driving force for economic revival. By "impetus," we mean to keep price differentials as high as possible and to continue to build up pressure for market changes. Thanks to the Bank of Japan's patient maintenance of ultra-easy monetary policy, the Japanese economy is currently experiencing unprecedented price differentials. Just as differences in elevation cause water to flow and water pressure to shape the terrain, price differentials in the economy and financial markets are what stimulate market transactions and economic vitality. Demand and investment flow to places where prices are low, and growth begins there.

Unprecedented undervaluation (i.e., inverse domestic-foreign price differentials)

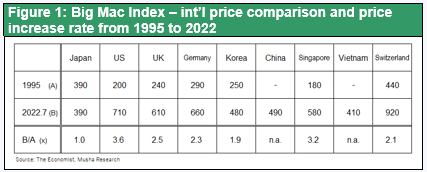

The first price differential facing Japan today is the unprecedented inverse price differential between domestic and foreign prices. In 2022, the price of a McDonald's Big Mac in Japan is 390 yen, half the price of a Big Mac in Switzerland (920 yen) or the United States (710 yen), and cheaper than in Germany, the United Kingdom, South Korea, China, and Vietnam. Looking back to 1995, 27 years ago, the price of a Big Mac in Japan was 390 yen, the highest in the world except for Switzerland, surpassing the price in the United States (200 yen), the United Kingdom (240 yen), and Germany (290 yen). Over the past 30 years, Japan has gone from being the most expensive country in the world to the least expensive country in the world. Looking at the real effective exchange rate of the yen (2010=100), which is a comparison to the world average price, the Japanese yen was 65 in 1972, more than doubled to a peak of 150 in 1995, and dropped to 58 in 2022, less than 40% of its highest level. This was caused by a particularly large swing in the exchange rate from an extraordinarily strong yen to a very weak yen.

Global Demand Concentration in Low-Cost Japan Begins

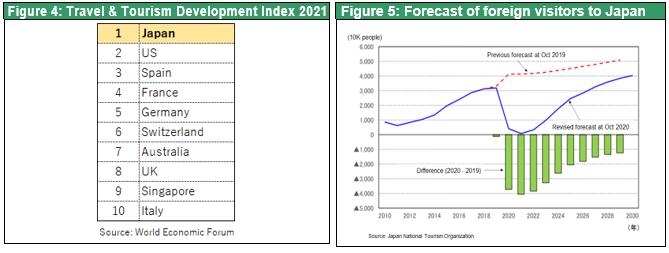

Due to this unprecedented price disparity, global demand is beginning to gravitate toward Japan, a low-cost country. First, export competitiveness will increase, and export volumes will begin to rise. Imported goods will be substituted for domestic products. When the Corona disaster ends, demand for travel to Japan, which has become more affordable, will surge. Cross-border e-commerce is booming, where goods are procured in Japan at lower prices and resold overseas. This concentration of demand in Japan has only just begun, and there is no doubt that it will grow in strength like a torrent. Japan has lost significant market share in smartphones, PCs, and semiconductors, but it has high technological competitiveness in areas that can be black boxed, such as a wide range of materials, components, and equipment. In addition, a survey by the WEF, which presides over the Davos Forum, found that Japan has the world's highest tourism development capacity. The great power of adding price competitiveness to this high quality (non-price competitiveness) should not be underestimated.

Historical high profit, Hight Capex growth for the last 30 years

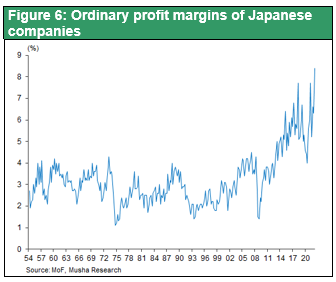

The significant depreciation of the yen has increased foreign exchange gains for export-oriented manufacturers and companies with overseas operations, leading to an increase in corporate profits: corporate ordinary income for the April-June period of 2022 increased by 17%, and the ordinary income margin was 8.4%, both record highs.

There are also signs of a surge in domestic capital investment. According to a survey by the Development Bank of Japan, capital investment plans for FY2022 increased 26.8%, the highest since the burst of the bubble economy. Growth is led by nonferrous metals (mainly silicon wafers), chemicals, electrical machinery, machinery, and other high-tech industries that are benefiting from the yen's depreciation. The construction of TSMC's Kumamoto plant, which will cost a total of 1 trillion yen, has also begun. As the yen's depreciation becomes more pronounced in the future, the return of factories to the domestic market will intensify, and investment growth is expected to increase even further.

Unusually Undervalued Stocks

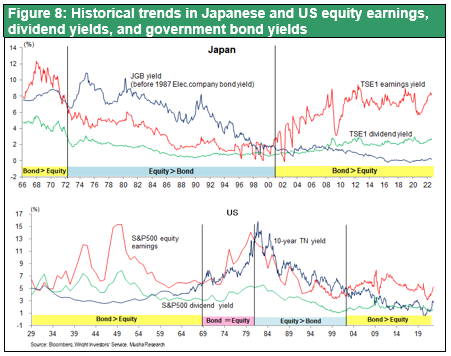

Second, the BOJ's relentless maintenance of low interest rates has resulted in an unprecedented price differential between bonds and stocks. The prices of stocks, bonds, and other financial assets can be analogized from their yields; the prices of the two major financial instruments, bonds and stocks, have historically experienced large swings. Since the yield on 10-year Japanese government bonds is 0.2%, it is calculated to take 500 years to recover the invested capital. On the other hand, stocks have a yield (earnings per share/price) of 8%, which means that it would take 12.5 years to recover the invested capital. This shows that stocks are extremely undervalued compared to bonds, at a ratio of 1:40. This extreme price differential between bonds and stocks is unprecedented in the world or in Japan's history.

Figure 8 shows that Japanese and U.S. bond yields and stock yields have alternately been in an era of overpriced equities (underpriced bonds) and an era of underpriced equities. The current relative prices of Japanese equities are so undervalued as to appear absurd. Looking back five or ten years from now, we will see that this was an era of unprecedented equity investment opportunities.

Conditions for a stock market rally that existed only in Japan

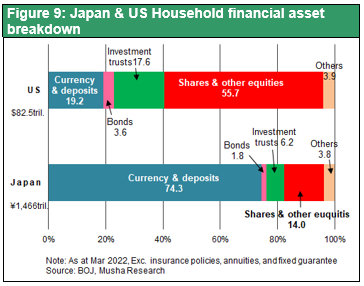

Buying stocks with the money sold from bonds (or withdrawn from deposits) has been a tremendously lucrative investment opportunity. 74%* (1,089 trillion yen) of Japan's household financial assets consist of cash deposits and bonds that pay next to zero interest, and only 20%* (295 trillion yen) of all stocks and investment trusts offer a lucrative return of 8%*. The huge amount of capital stored in significantly overvalued bonds and cash and deposits is about to start flowing toward equity investments (*ratio calculated excluding insurance, annuities, and fixed guarantees).

In the U.S., household financial assets consist of stocks and investment trusts (72%) and cash, deposits, and bonds (25%). In the U.S., government bonds yield 3.2%, so it takes 31 years to recover the principal of bonds. In contrast, stocks yield 6%, so it takes 17 years to recover the principal. The price difference between stocks and bonds is 1:1.8, which is much smaller than in Japan.

In Japan, stocks are undervalued to a degree unmatched by any other country, and this is where the huge water pressure is stored. Foreign investment in Japanese real estate, which has become relatively undervalued like stocks, is booming, and foreign long-term investment funds are beginning to pay attention to the undervaluation of Japanese stock prices, such as Warren Buffett's purchase of trading company stocks with a dividend yield of 4-5% in 2020, financed at a low interest rate of 0.4%.

The number of NISA accounts is increasing rapidly, and the number of purchases from NISA accounts is increasing at an exponential pace. The number of purchases from accumulation NISA accounts continues to grow at a doubling pace and is expected to reach the 2 trillion-yen level by 2023. When combined with purchases from general NISA accounts (¥2.7 trillion per year in 2021 and ¥1.4 trillion from January to March 2021), it is not long before individual stock accumulation investments exceed ¥10 trillion per year and emerge as a major investment entity.

2023 will be the year of Japanese stocks

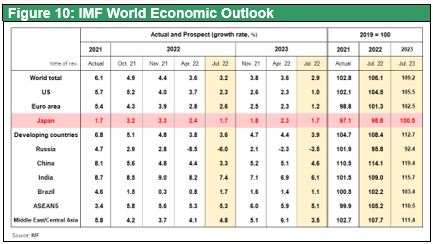

The IMF's July 2023 global economic outlook shows Japan growing at 1.7%, the highest among developed countries, compared with 2.9% for the world, 1.0% for the U.S., and 1.2% for the eurozone. The reasons for this are: 1) Japan is the only advanced economy to continue monetary easing, 2) the elimination of special factors pressuring the economy under the corona disaster (the impact of the consumption tax hike in October 2019 and the economic damage caused by the excessive corona defense of the Japanese people)will disappear , and 3) the economic revitalization caused by the price differentials mentioned above.

Japanese equities are currently in an adjustment phase due to monetary tightening in the U.S., but we believe this is an opportunity to buy at the bottom of the market.