Cheap stock price, Strong yen

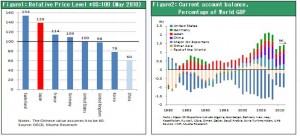

Stock prices in Japan are lagging far behind other countries. Following the start of the Greek debt crisis, stock indexes are down 12% in the United States, 5% in Germany and 1% in South Korea compared with their pre-crisis peaks. But Japan has suffered a drop of 17% during the same period. The peculiar strength of the yen is most likely to blame. Japan is losing its competitive edge against South Korea, Taiwan and other nearby Asian countries. Furthermore, Japan’s trade surplus has decreased significantly. As a result, although the yen’s 2009 purchasing power parity (GDP basis) was \115/dollar, an exchange rate of even \120 can be justified. There are many other reasons as well for a decline in the yen’s value. Most notable are Japan’s many ineffective and short-lived governments, one of the world’s largest budget deficits, and a shrinking population. Nevertheless, the yen alone among major currencies has appreciated in the wake of the crisis in Greece. Today, the yen is the world’s strongest currency. According to OECD statistics, the yen is overvalued by more than 39% in relation to its purchasing power parity. In contrast, the Korean won is undervalued by 22% and the Chinese yuan is thought to be undervalued by more than 40%. The yen’s strength places Japanese companies at an enormous disadvantage.

Why is the currency of a weak country so strong? The most significant reason is most likely that deflation gives Japan high effective interest rates. Nominal short term interest rates are now virtually zero in both Japan and the United States. But the difference in the two countries’ inflation rates gives Japan an effective interest rate that is 2 percentage points higher than in the United States. The result is a negative cycle for Japan in which economic weakness creates deflation that makes the currency stronger, causing the economy to weaken even more.

Deflation strengthen the yen

Foreign exchange rates have a tendency to be self-fulfilling prophecies. Once a rate starts moving, there is always a risk that it will continue spiraling in the same direction. This is why investors must remember that the foreign exchange market often overshoots the proper level. Once the yen begins to move up or down, this movement itself creates a reason for a further increase or decrease in the yen’s value. Appreciation or depreciation gains momentum as a result. Negative cycles emerge in both directions. A stronger yen produces deflation, which boosts effective interest rates and causes the yen to become stronger still. A weaker yen produces inflation, which lowers effective interest rates and causes the yen to become weaker still. These cycles are harmful because they hinder the sustainability of economic growth by exaggerating exchange rate volatility. This explains why a suitable degree of foreign exchange market intervention is needed. Looking at the situation in Japan today, the country would probably welcome a decline in the yen’s value to about the level of purchasing power parity, which was \115/dollar in 2009. The Japanese government should enact foreign exchange and monetary policies aimed at lowering the yen to this point.

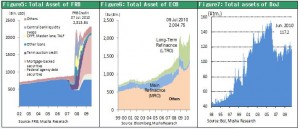

BOJ expected to act

There may be steps that the Bank of Japan can take in this regard. Central banks in Europe and the United States expanded their balance sheets by 50% to 100% by enacting non-traditional monetary policies following the outbreak of the global financial crisis. Purchases of assets with risk accounted for much of this growth. But the Bank of Japan was subdued by comparison. This difference between the stances of the Bank of Japan and other central banks may have reinforced investor sentiment that was pushing the yen higher. Today, the yen is viewed as the world’s strongest safe currency. If the crisis mentality about the global economy grows, we will probably see the yen appreciate even more. As the yen strengthens, Japan will sustain damage to both its economy and stock markets. Japanese government agencies have thus reached the point where they must advance to the next stage of action. For an example to follow, Japan need look no farther than the Swiss central bank, which has been constantly intervening in foreign exchange markets.

Policies that support nations, competitiveness

A fierce policy war is unfolding among countries worldwide in the face of the relentless advance of economic globalization. In the past, international competition meant competition among companies. But now, international competition consists of countries jostling and pushing each other to gain the most advantageous positions. The world has entered the age of mercantilism, where countries are not ashamed to do whatever is needed to establish a position of superiority. Governments offer companies lower taxes and attractive factory sites, guide foreign exchange rates to their advantage, use government-backed exports and take many other actions. Relatively small countries like Hong Kong, Singapore, Dubai and South Korea have used such measures with comparative ease. But the major countries have difficulty in adopting new policies, much like when a large ship changes course. And Japan has dropped the farthest behind among these major countries. The time has probably come for Japan to start thinking about expanding its options for the adoption of new policies without being held back by its actions in the past.