Stocks continue short-term downturn with no end in sight

The bottom fell out of U.S. stocks last week as indexes dropped to new lows for 2010. Many negative signs emerged on stock market charts, including a drop in the 13-week moving average to below the 26-week moving average. Looking only at the stock market, it appears that U.S. investors are becoming seriously concerned about a double-dip recession and another big drop in stock prices . The current economic recovery was fueled by rising stock prices driven by investor sentiment. As improving investor sentiment boosted stock prices, the resulting wealth effect lowered the household saving rate as higher household spending generated economic growth. Now falling stock prices and declining investor sentiment are producing a reverse wealth effect. It is not difficult to envision the start of a negative cycle in which a rising household saving rate brings down the economy, causing stock prices to fall even more and further damaging investor sentiment. Many people have adopted a pessimistic outlook, including economist Paul Krugman who believes that a third depression is coming. Barton Biggs has reversed his stance. Mr. Biggs was one of the best-known optimists, accurately predicting this stock market recovery and making big investments in high-tech stocks. But now he has sold the majority of his stock portfolio. The outlook for the economy has quickly become uncertain.

Worries about the economy will probably increase over the short term, which means we could see a further decline in stock prices. As U.S. stock prices decline and concerns about the U.S. economy grow, investors will become even more averse to risk. The resulting appreciation of the yen will create a new obstacle for the Japanese economy and stock market, which have just started to recover.

A negative bubble may emerge in the stock market

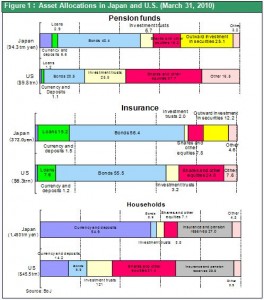

Despite these negative views, there is no change in our outlook from a longer-term perspective. The first reason is that the recent drop in stock markets has made many stocks even more undervalued. In fact, we may see the formation of a negative bubble similar to the one that existed after the Lehman shock. Valuations of stocks are at remarkably low levels as long-term interest rates fall the risk premium climbs. Looking ahead, I think we will see either (1) a sharp economic downturn (and drop in equity values) or (2) an sharp rebound in stock prices. I believe that a stock market rebound is more likely to occur. The second reason is the remarkable progress made by the correction in U.S. economic fundamentals. First, companies have completed all required actions concerning their inventories, workforces, capital equipment and balance sheets. Second, the correction has suppressed U.S. household demand (and thus created substantial pent-up demand). Third, housing prices have fallen to bargain-basement levels. Even if there is a second recession later this year, this enormous progress in improving U.S. economic fundamentals virtually guarantees that the next period of sustained growth will last even longer.

The foundation for long-term growth is in place

In 1981, the second half of a U.S. double-dip recession was the starting point for the powerful stock market rally that took place during the 1980s. The so-called jobless recovery that started in 1991 created a sound base for U.S. prosperity during the remainder of that decade. Therefore, the strength of the foundation for the next period of economic growth will be proportional to the length of this current period of economic stagnation. A longer period of stagnation means that we should see an even longer period of prosperity. This is because U.S. companies, which are the drivers of economic growth, have never been more streamlined and energetic than they are today. Labor productivity is increasing steadily and labor’s share of income is at a record low. Moreover, U.S. companies have an unprecedented volume of liquidity on their balance sheets. Investors must never forget that benefits of globalization and the Internet revolution are constantly supporting financial markets and national economies.

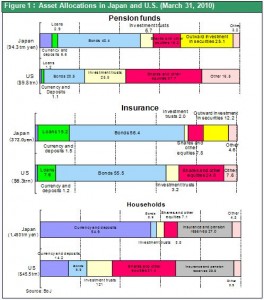

The impact of the amended Insurance Business Law

In the context of the negative bubble, I believe that no financial assets in the world are more undervalued right now than Japanese equities. The average dividend yield of 2% for listed stocks in Japan is almost twice as high as the yield on long-term Japanese government bonds. Moreover, with the dividend payout ratio at about 30%, the total return for shareholders is six times higher than for holders of Japanese government bonds. Valuations of Japanese stocks have plunged to this remarkably low level because Japanese investors have stopped buying stocks. One of the reasons is restrictions on how insurance companies manage their assets. Insurance companies can place no more than 30% of assets in Japanese equities, 30% in foreign assets and 20% in real estate. But late last week, the Nihon Keizai Shimbun reported that Japan’s Insurance Business Law may be amended to eliminate these limits. As Figure 1 shows, we might see a dramatic correction in valuations of Japanese equities if the cause of the current Japanese stock negative bubble is based upon the difference between equity weightings in the portfolios of Japanese and U.S. investors.