Stock prices bounce back from the crisis

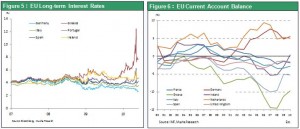

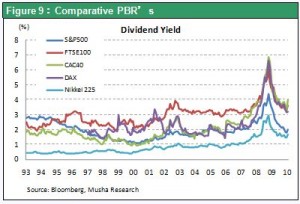

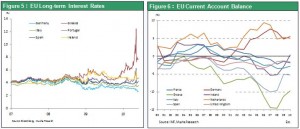

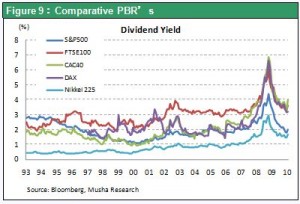

We have very likely seen the bottom of the plunge in stock prices that occurred in May and June. Even Moody’s downgrade of Greek government bonds had little effect on stock markets. At one point, the market was overwhelmed with excessive pessimism. Prices dropped to a level that factored in another Lehman shock and a global liquidity crisis. But this bad news was merely the perfect excuse for a correction following the global stock market rally of more than 80% during the past year. Right now, sovereign risk is not the greatest worry in global financial markets. Instead, investors are concerned about what is going to happen after the sovereign debt crisis. The biggest question is where investment capital will go following the major shift in investments that was triggered by this crisis. Investors rushed to move their money out of southern European countries as the sovereign debt crisis unfolded. Bonds of Greece, Portugal, Spain and other countries were sold off. Much of the proceeds from these sales were channeled to Germany, the United States and Japan. Long-term interest rates in these countries declined as a result. We should therefore turn our attention to the positive effect of lower interest rates on the economies and financial markets of Germany, the United States, Japan and other core industrialized countries. For the time being, we will see a resurgence of risk-taking because of technical factors. This will probably generate a rebound of 7-8% following the recent global downturn of about 14% in stock prices. After this rebound, I expect to see stock prices continue to climb as markets factor in a sustainable recovery in the global economy.

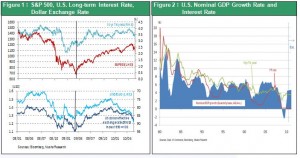

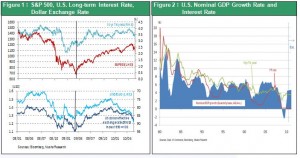

Low interest rates and a strong dollar will revitalize U.S. domestic demand and investments

Inflows of capital will probably revitalize the U.S. and German economies and prevent further declines in asset prices. In particular, falling U.S. interest rates are bringing down interest rates on mortgages and allowing companies to procure funds at a lower cost. This will probably increase the desire of people to buy homes and companies to make capital investments. The U.S. long-term interest rate is at the 3.2% level even though the nominal GDP annualized growth rate was 6.1% in 4Q 2009 and 4.1% in 1Q 2010. Once again, the Greenspan conundrum is emerging. This is an excellent condition for investments. Furthermore, the strong dollar is fueling a recovery in U.S. domestic demand and growth in U.S. imports. I also expect to see a resurgence in foreign investments by U.S. companies. This will further increase the amount of dollars that are spread across the world. These events will return the world to a phase of economic growth that is led by the United States. For proof, we need look no farther than the recovery in exports from China.

The appeal of German assets (stocks and real estate)

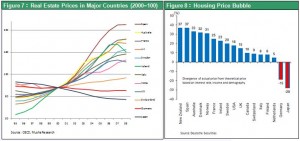

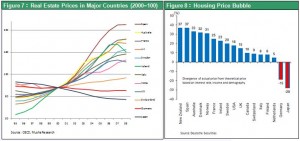

The German economy, which is the strongest in Europe, is benefiting from lower interest rates as well as the weaker euro. This will probably make German companies even more profitable and competitive. The recent strength of German stocks shows that these benefits are already emerging. We will probably see a further increase in Germany’s current account surplus. However, German financial institutions are holding back on foreign investments because of problems involving their investments in southern and eastern Europe. Growth in idle funds in Germany due to this decline in foreign investments is making German assets increasingly attractive. These assets were already attractive because German stocks and real estate have been clearly underpriced relative to other countries for some time. As the figure shows, Germany has a negative real estate bubble just as in Japan.

The increasing likelihood of a return of the yen carry trade

As investors start taking on risk again, we should expect to see the yen weaken against the U.S. dollar in foreign exchange markets. In the wake of the Lehman shock, the dollar carry trade was the primary component of the initial stage of the resumption of risk-taking in 2009. Investors procured dollars at a minimal interest rate and used these funds to make global investments. But the dollar carry trade ended as the U.S. economy recovered and the dollar bottomed out. Rising fear about Greece since early in 2010 temporarily increased investment positions in which the euro was preferred currency for procuring funds. At this point, though, euro-denominated debt has become risky because the euro has stopped falling at least for the time being.

I believe that prospects for sustained global economic growth will improve. But an increasing volume of global speculative positions will probably accompany this growth. The currency that speculators choose to procure funds (which currencies and assets to short) will be a critical point. In this case, the yen is leading candidate to become the currency used to procure funds. One reason is that the yen is overvalued by 30% at the current exchange rate of about \90 to the dollar, because purchasing power parity is \115 to the dollar (OECD GDP basis). No other currency has a purchasing power parity gap this large. Furthermore, interest rates are virtually zero in Japan and the authorities have indicated an intention of further monetary easing. Eventually, we will probably see growth in global speculation lead to an increase in yen carry trade positions that cause the yen to depreciate. If this happens, the resulting end of deflation in Japan would prompt investors to bid up prices of Japanese stocks even more.