The current correction amid skepticism is an excellent opportunity to buy on dips

U.S. stocks staged a quick downward correction that began when the U.S. Securities and Exchange Commission filed a complaint against Goldman Sachs on Friday. The Nikkei Average as well dropped 1% on Friday. Japan’s stock markets have been showing increasing signs of overheating due to a 15% rally in the Nikkei Average since February 9. But there is no reason for disappointment; investors should view this correction as an excellent opportunity to pick up stocks at lower prices. Moreover, this correction is very likely to surprise investors with its speed and small drop in stock prices. This is because everything is in place for a rebound of the crucial U.S. market. Stock prices are always driven by two forces: earnings (the real economy) and liquidity (monetary policy). The U.S. economy today is in a “sweet spot” with respect to both of these forces. Earnings are staging a remarkable rebound. Recent earnings announcements by JPMorgan Chase and Intel (see below) are indicative of this trend. Furthermore, these improvements are probably only the beginning of an even broader upturn in the performance of many other companies. Until now, rising earnings have been driven primarily by the benefits of restructuring and higher prices of troubled assets. From now on, we are going to witness a full-fledged rally that is fueled instead by earnings linked to a powerful surge in demand (which pushes up sales).

Astonishingly upbeat corporate earnings

Jamie Dimon, JPMorgan Chase’s chief executive officer, on Wednesday abandoned his trademark caution and hailed significant improvements in the health of long-suffering U.S. consumers as the harbinger of a strong economic recovery. “There have been clear and broad-based improvements in underlying [economic] trends,” Mr. Dimon told investors. “We believe these improvements will continue and are hopeful they will gain momentum, resulting in an even stronger recovery.” Mr. Dimon said that for the first time in two years, losses in businesses ranging from credit cards to home equity loans were falling. Fears about a second bottom are rapidly dissipating. Commercial lenders will be expected to confirm JPMorgan’s confidence in the consumer recovery. Mr. Dimon’s newly found optimism was compounded by his belief that large U.S. companies were ready to invest and hire again, fueling demand for loans and capital markets services (Financial Times, April 15, 2010)

Intel’s first quarter business results were the best since the company was founded. Revenue rose 44% and earnings nearly quadrupled while the gross profit margin at 63% beat analyst forecasts by a wide margin. “Demand for our new MPUs has been incredible,” said Paul Otellini, Intel's chief executive officer. He added that Intel expects a strong second quarter, even though this is usually a weak-demand period, and higher full-year profit margins. An analyst cited this as the harbinger for favorable earnings in the technology sector (Wall Street Journal, April 15, 2010).

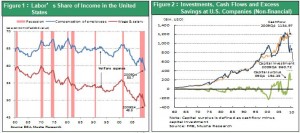

Two factors are supporting this impressive rebound in earnings at U.S. companies. First is a dramatic fall in labor’s share of income at these companies, as shown in Table 1. Second is an unprecedented volume of excess savings at U.S. companies, as shown in Table 2. This is why I believe that the ongoing upturn in earnings has a very strong base.

The Bernanke put

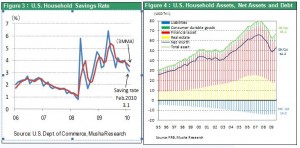

Stock prices have risen not only because of the improvement in the real economy but also due to the Fed’s monetary policy that is friendly to stocks. A broad-based economic recovery cannot occur unless there is a constant increase in the prices of stocks, houses and other assets. The U.S. household saving ratio, which is reversely proportional to negative consumer sentiment, surged from 1.2% in the first quarter of 2008 to 6.4% in May 2009. The ratio has since declined significantly, falling to 3.3% in January 2010 and 3.1% in February. Furthermore, we must not overlook the fact that a significant recovery in asset prices is behind this improvement in consumer sentiment. Net assets of U.S. households peaked at $66 trillion in the second quarter of 2007 and then plunged to $48.5 trillion in the first quarter of 2009. But net assets rebounded to $54.2 trillion in the fourth quarter. Over a period of only nine months, net assets rose by $6 trillion, which is 40% of the U.S. GDP. The result was a big improvement in the willingness of households to make expenditures.

Making asset markets an ally (the Greenspan-Bernanke school of thought)

Fed chairman Ben Bernanke has been consistently optimistic about the economy. At the same time, though, he is fine-tuning markets due to fears about a sharp upturn in long-term interest rates that could happen if investors become overly optimistic. Additionally, just like his predecessor Alan Greenspan, Mr. Bernanke clearly rejects the belief that the Fed should be vigilant about asset bubbles because excessive monetary easing by the Fed was what caused the housing bubble. This stance may or may not be correct. Personally, I support this position. In either case, Mr. Bernanke’s decision not to regard asset prices as the enemy (and to use asset prices as an ally in some respects) at this stage of the economic recovery has produced many benefits. His stance has played a role in creating widespread confidence in asset markets as well as in encouraging risk-taking and improving the liquidity of financial markets.