Feb 04, 2014

Strategy Bulletin Vol.113

Investors are worried about inadequate demand in US and China

The steep drop of the Argentine peso has sparked growing concerns about emerging countries. These concerns are even affecting industrialized countries. Stock prices are falling worldwide as a result. One cause may be the movement of investments out of emerging countries now that the widely expected tapering of the US quantitative easing has started. If this is indeed the only cause, the situation is not serious because of the relatively small size of emerging country markets and economies. Nevertheless, the drop in markets is significant. Downturns in the stock markets of Japan and other countries are now more than 10%, which is regarded as the beginning of a bear market. It is too soon to determine whether or not a bear market has started. However, investors need to seriously consider the actual risk factor that is fueling concerns in financial markets.

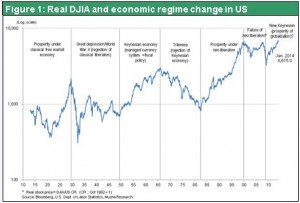

Simply put, this is the risk of a decline in demand in the US and China. The sudden downturn in long-term interest rates could be an evidence of this decline. The IMF has only recently raised its global economic growth forecast for 2014. Revising the forecast made most people think that there is no need to worry about demand in the US and China for the time being. But financial markets may have run out of patience. Or perhaps investors are beginning to ask governments to take more concrete actions. The real Dow Jones Industrial Average appears to be indicating that we are on the verge of a new regime of prosperity. Advancing to this regime, though, will require a mechanism for creating sustainable demand that can raise life styles to a higher level. Time and innovative ideas will be needed to accomplish this. Consequently, governments may be called upon to take on the challenge of enacting new policies.

Figure 1: Real DJIA and economic regime change in US

(1) The record-high real DJIA and warnings by Summers and Shiller

Can QE alone restore jobs and achieve sustained growth?

Unemployment in the US is still the real risk. A US economic recovery has undoubtedly started. But a decline in the labor participation rate is mainly responsible for the slow growth in jobs and decline in unemployment. The cause is obvious. Globalization and an industrial revolution driven by the Internet have raised the productivity of labor and capital. Companies are generating unprecedented earnings with no end in sight to the surplus of workers and money. A severe economic downturn will begin if nothing is done about unemployment. The only solution is to create new demand so that surplus labor and capital can be used to create new value for fueling growth. But can this be accomplished by using nothing except quantitative easing, which is a financial policy?

Figure 2: US labor force participation ratio and employment population ratio in labor force

Figure 3: US labor distribution ratio

QE was very successful at preventing a crisis after the Lehman shock and restoring economic growth. However, QE alone does not have enough energy to drive growth. The problem is the difficulty of utilizing the unprecedented volume of surplus capital to trigger latent demand. Many companies are unable to fully use cash flows from depreciation because of the falling cost of machinery and equipment. Furthermore, funds that companies have accumulated overseas cannot be easily used to create demand in their home countries. Surging stock prices are making rich people even richer, but peripheral demand is still lackluster.

The problem posed by Summers

Lawrence Summers believes that creating demand requires reforms of systems in order to encourage creative monetary policies, tax system reforms and investments. A continuation of easy-money policies would push up asset prices even more. But the ability of these policies to create of demand would steadily decline and there would be an increasing danger of an asset bubble. However, it would be detrimental to enact tight-money policies and stricter lending standards in order to hold down asset prices even though full employment has not been achieved. The consensus was for a prolonged period of economic stagnation after World War II. But since this did not happen, this long-term stagnation was not the fate of the world. Instead, Mr. Summers says, this was an event that could be avoided by using the proper policies.

Shiller’s warning

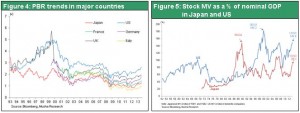

Robert Shiller warns that a stock market bubble will form if nothing is done. As the housing bubble of the past decade demonstrated, demand created by using solely financial policies is highly likely to be temporary. Mr. Shiller points out that the CAPE (cyclically adjusted price/earnings multiple) is currently 25. This is about the same as in 2007 when stocks peaked prior to the collapse of Lehman Brothers and in 1996 when Fed chairman Alan Greenspan made his warning about “irrational exuberance.” A Financial Times editorial stated that CAPE was 21 on January 6, when stocks reached their highest point since the Great Depression, and that any further increase in stock prices would be unhealthy. At the peak of the IT bubble, CAPE had climbed all the way to 44. Therefore, stocks will probably go even higher even though the tapering of QE has started because the widespread availability of cheap assets in a climate of extreme easy-money policies. But Mr. Shiller goes on to say that financial regulatory agencies should be prepared to deal with the associated risks.

Figure 4: PBR trends in major countries

Figure 5: Stock MV as a % of nominal GDP in Japan and US

The US has started to downsize QE prior to the transition to new Fed chairman Janet Yellen. While carefully watching the actions of the new chairman, financial markets will probably start to demand the creation of an effective policy framework that encompasses finances, taxes, systems and many other types of actions.

What the real DJIA tells us

As you can see in Figure 1, the DJIA set a new all-time high in real terms as well late in 2013. Could this record-high be the sign of a new regime of prosperity? After all, the real DJIA’s movements over the years have mirrored the ups and downs of US economic regimes as follows.

1) Increased up to 1929 = Classic free-economy (gold standard) prosperity

2) Decreased during 1930-1940s depression and war = Demise of classic free economy

3) Late 1940s to late 1960s = Keynes-style (managed currencies, fiscal policies) prosperity

4) 1980s and 1990s = New free-economy (paper dollar system, Reagan-Thatcher policies) prosperity

5) 2000 to 2013 = Demise of the new free economy (bursting of the IT and housing bubbles)

This leads to the question of what regime will emerge to resolve the problems created by the end of the new free economy. I think the most likely candidate is prosperity underpinned by “new Keynesian economics.” One example is quantitative easing aimed at creating expectations among investors. This new regime also requires a full array of macroeconomic initiatives that include creative fiscal policies on a global scale. This is precisely what Lawrence Summers has pointed out.

(2) China’s crisis deepens as data become unreliable

Issues with corporate accounting practices in China

In January 2014, a US Securities and Exchange Commission judge suspended the Chinese units of the “Big Four” accounting firms for six months from auditing US-listed companies for six months. The reason is that Chinese auditors refused to submit to the US audit work papers about US-listed Chinese companies. US regulatory authorities are clearly have doubts about the reliability of Chinese accounting systems as well as corporate governance and other aspects of how companies operate. A close examination of accounting in China could reveal a variety of deceit and other behavior that is harmful to the interests of shareholders. According to the Financial Times, the PER of US-listed Chinese companies is a relatively high 18. Furthermore, all overseas-listed Chinese companies are said to have a market capitalization of $870 billion, of which US-listed companies account for $464 billion. Doubts about the reliability of Chinese accounting methods and companies’ financial soundness could create big problems involving fund procurement and market capitalization. Chinese companies may be unable to retain their US stock market listings unless they can find SEC-approved accounting firms to replace the Big Four.

There are suspicions about China’s economic statistics, too. The country reported 2013 GDP growth of 7.7%. But how much can this figure be trusted? For example, adding the GDPs of China’s provinces results in a growth rate far higher than 7.7%. The basis for China’s data is clearly shaky. Consequently, even if investors trust current Chinese economic data for making decisions, there is still a possibility that China will reject numbers that were announced years ago.

Non-performing loans are just the tip of the iceberg

In January, there were reports that a JPY50 billion trust named Credit Equals Gold #1 Collective Trust Product is expected to default. The trust was issued by China Credit Trust Company and marketed by the Industrial and Commercial Bank of China. The Chinese government intervened and financial markets were stabilized for a while. However, the cause of the collapse of this company and resulting default was not resolved. People who invested in this trust will receive their money because of the government’s intervention. But the root causes of this crisis have not been eradicated. With an estimated JPY120 trillion of these so-called “trust products” in China, this default crisis may be nothing more than the tip of the iceberg.

The danger of relying only on real estate investments for growth

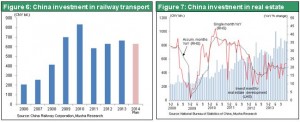

Investments in three major sectors have been driving economic growth in China: (1) factories and machinery; (2) public-works projects and (3) real estate. Capital expenditures, the first sector, cannot be increased anymore because companies in many industries have enormous excess capacity. For railroads and other public-works projects, expenditures have been declining since peaking in 2010. Only real estate investments are still increasing. With growth continuing at an annual pace of 20%, many of these real estate investments may end up as non-performing assets. Moreover, the end of huge inflows of foreign currency, which were the primary source of growth capital in China, is creating instability in financial markets, too.

Figure 6: China investment in railway transport

Figure 7: China investment in real estate

As you can see, the Chinese economy very likely has a broad range of problems that can no longer be hidden. Numerous crises are worsening just below the surface. Even if these crises do not come to the surface, investors will have to pay close attention to events in China. However, there is virtually no chance that a financial crisis in China would create global shockwaves as the panic that followed the collapse of Lehman Brothers did. The reason is that China’s financial markets are extremely insular. If an asset bubble burst in China, the crisis would be very unlikely to trigger a chain-reaction of non-performing loan growth worldwide. On the other hand, a severe economic downturn in China would have a major impact on resource-producing countries and companies that have a significant reliance on demand in China.