The 1964 summer Olympics in Tokyo were the dividing line between the eras of reconstruction and rapid economic growth in Japan. This event was also the symbol of the start of strong growth. A major revival of Japan is likely to be sparked by the 2020 Olympics, too. If Japan’s economy in 2020 surpasses the peak of rapid growth that was reached in 1990, the Nikkei Average may approach its all-time high of almost ¥40,000.

Competing for the Olympics brought the people of Japan together

Japan displayed a surprising degree of solidarity during the process of bidding for the 2012 Olympics. This may be the result of the much stronger sense of cohesiveness in the wake of the Great East Japan Earthquake. Public support for the Olympic Games has never been as high as it was this time. In the first place, four years ago Tokyo failed in its bid for the 2016 Olympics because of the lack of public support. For example, in the 2007 election to choose the governor of Tokyo, only Shintaro Ishihara wanted to host the Olympics. The other major candidates were all opposed: Shiro Asano, (supported by the Democratic Party of Japan), Manzo Yoshida (supported by the Communist Party) and Kisho Kurokawa. Support was unanimous this time. No one was opposed. Japan’s solidarity that emerged with earthquake reconstruction activities was seeking a new outlet. What altered public sentiment? The earthquake and Senkaku Islands incident fueled a greater awareness concerning Japan’s security. People feel more strongly about the concept of “one for all and all for one.” Apparently the public’s crisis mentality has come to the surface all at once.

Japan needed faith in the future and a commitment

No country in the world has more idle resources than Japan. In other words, Japan has substantial growth potential. This is evident in Japan’s long-term interest rates, which are the lowest in the world. Having the lowest long-term interest rates means that Japan has the largest amount of unused capital. Japan could improve its economy and standard of living by utilizing these funds, but nothing is being done to accomplish this. The reason is that Japan has been consistently held back by an unjustified and unnecessary mood of pessimism and resignation.

From the standpoint of the global economy, investments in the Olympics by Japan, the country with the most surplus capital, can produce the greatest benefit for the global economy by inducing demand. Consequently, the selection of Japan to host the 2020 Olympics was the most economically rational decision.

Figure 1:Long-term interest rate tends of major countries

Figure 2:Expanding household financial assets in the economic stagnation

Holding the 2020 Olympics will probably completely eliminate Japan’s mood of pessimism and resignation. The following changes are certain to occur.

> Infrastructure construction

> With Japan attracting more attention worldwide, tourism will grow in Japan

> More exposure for Japanese values (consideration of others, public morality, hospitality, cleanliness, safety and other characteristics) and the ability to offer the highest quality services in the world

> Characteristics of Japan’s economy that have been overlooked and ignored will emerge, bringing together the vectors for growth.

> Japan will eliminate its inward-looking mentality as the country increases its interaction with the world over the next seven years. A change will occur in the introspective mindset of young people in Japan (one example is the sharp drop in the number of Japanese students attending Harvard and other overseas universities).

People who had given up on the future now have a reason to think about themselves, business activities, Tokyo, Japan and the world seven years from now. This is a significant change in sentiment.

The Olympics will have an enormous economic benefit and restore Japan’s animal spirits

These events will have an enormous impact on the economy. In 2012, the Tokyo 2020 Bid Committee estimated that the Olympics would generate production of ¥2.96 trillion (¥1.67 trillion just in Tokyo), directly create demand of ¥1.22 trillion (¥0.97 trillion in Tokyo), and produce ¥1.42 trillion of added value (¥0.86 trillion in Tokyo). Growth in demand consists of ¥360 billion for facilities, ¥310 billion for operations and ¥560 billion for other items. All figures are minimum amounts based on narrow definitions.

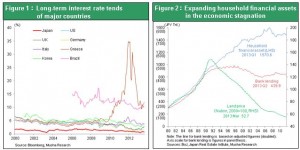

The biggest economic benefit of the Olympics will probably be the restoration of Japan’s animal spirits due to a shift in the thinking of the people of Japan. Simply restoring stock and land prices to normal levels from the drops caused by an excessive aversion to risk would create hundreds of trillions of yen of value. Afterward, Japan would consistently generate new demand along with the end of deflation and resurgence of consumption and investing. Figure 3 shows the market value of assets in Japan (land + stocks). This figure has declined steadily between 1990 and 2012, a period of 23 years. Over only 22 years, Japan lost ¥1,600 trillion as the value of these assets fell from ¥3,140 trillion in 1989 to ¥1,500 trillion in 2011. This translates into an average annual decline of ¥72 trillion, so Japan was losing wealth equivalent to 15% of its GDP every year. Declining asset values produced massive expenses for Japan’s real estate companies and financial institutions during these 22 years. As a result, companies were forced to cut wages and use the savings to meet fund procurement needs and the cost of dealing with non-performing assets. A consistent downturn in asset prices for 22 years had never before occurred anywhere in the world. This was a phenomenon unique to Japan.

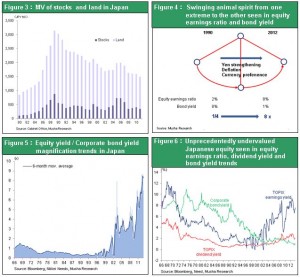

Approximately half of the extended drop in asset prices was a legitimate downturn associated with the preceding bursting of Japan’s asset bubble. But the other half was an excessive drop. Figures 4, 5 and 6 show changes in stock valuations in terms of the return on stocks (earnings) in comparison with the return on bonds (interest). The figures show that stock prices in Japan are extremely undervalued in relation to bonds. This undervaluation applies to Tokyo area real estate, too. The excessive drop in prices of stocks and land led to Japan’s excessive mood of pessimism and resignation (the loss of animal spirits).

The 2020 Olympics in Tokyo will sweep away the extreme pessimism and resignation now affecting Japan and likely push up stock and land prices to fair levels. The economic benefit will be immense.

Figure 3:MV of stocks and land in Japan

Figure 4:Swinging animal spirit from one extreme to the other seen in equity earnings ratio and bond yield

Figure 5:Equity yield / Corporate bond yield magnification trends in Japan

Figure 6:Unprecedentedly undervalued Japanese equity seen in equity earnings ratio, dividend yield and bond yield trends

Prime Minister Shinzo Abe said that he wants to use the selection of Tokyo as a spark to shake off the 15-year period of deflation and an inward-focused economy. I believe there is no doubt that this will be accomplished.

Holding the 2020 Olympics will probably completely eliminate Japan’s mood of pessimism and resignation. The following changes are certain to occur.

> Infrastructure construction

> With Japan attracting more attention worldwide, tourism will grow in Japan

> More exposure for Japanese values (consideration of others, public morality, hospitality, cleanliness, safety and other characteristics) and the ability to offer the highest quality services in the world

> Characteristics of Japan’s economy that have been overlooked and ignored will emerge, bringing together the vectors for growth.

> Japan will eliminate its inward-looking mentality as the country increases its interaction with the world over the next seven years. A change will occur in the introspective mindset of young people in Japan (one example is the sharp drop in the number of Japanese students attending Harvard and other overseas universities).

People who had given up on the future now have a reason to think about themselves, business activities, Tokyo, Japan and the world seven years from now. This is a significant change in sentiment.

Holding the 2020 Olympics will probably completely eliminate Japan’s mood of pessimism and resignation. The following changes are certain to occur.

> Infrastructure construction

> With Japan attracting more attention worldwide, tourism will grow in Japan

> More exposure for Japanese values (consideration of others, public morality, hospitality, cleanliness, safety and other characteristics) and the ability to offer the highest quality services in the world

> Characteristics of Japan’s economy that have been overlooked and ignored will emerge, bringing together the vectors for growth.

> Japan will eliminate its inward-looking mentality as the country increases its interaction with the world over the next seven years. A change will occur in the introspective mindset of young people in Japan (one example is the sharp drop in the number of Japanese students attending Harvard and other overseas universities).

People who had given up on the future now have a reason to think about themselves, business activities, Tokyo, Japan and the world seven years from now. This is a significant change in sentiment.

Prime Minister Shinzo Abe said that he wants to use the selection of Tokyo as a spark to shake off the 15-year period of deflation and an inward-focused economy. I believe there is no doubt that this will be accomplished.

Prime Minister Shinzo Abe said that he wants to use the selection of Tokyo as a spark to shake off the 15-year period of deflation and an inward-focused economy. I believe there is no doubt that this will be accomplished.